KPIT Technologies Ltd

IT - Software Services

KPIT Technologies Ltd

IT - Software Services

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Major Software Services Player in Auto ER&D

KPIT Technologies Limited (formerly KPIT Engineering Limited) was formed by the merger-demerger of Birlasoft (IT services) and KPIT Software. It is a global technology company that specialises in delivering Product Engineering solutions and services to the automotive and mobility industries. The company provides technology solutions to automotive OEMs in areas such as powertrains, communications, autonomous, and diagnostics along with Software IP, software integration, feature creation, and verification and validation services. KPIT Tech has a large customer base with 12 of the top 15 global automotive OEMs as customers. According to Zinnov, the automotive industry is one of the largest in terms of R&D spenders with USD 158 billion in annual investments, of which top 30 global automotive OEMs and tier-1 firms accounting for 80%.

Consolidated Financial Statements

| Rs. in Crores | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY19 | 641.26 | 71.11 | 11.09% | 54.19 | 2.02 | 5.62% | 19.82 | 13.18 |

| FY20 | 2156.17 | 287.31 | 13.33% | 146.59 | 5.43 | 13.95% | 6.47 | 2.16 |

| FY21E | 2035.00 | 300.95 | 14.79% | 135.93 | 4.96 | 11.75% | 36.30 | 15.26 |

| FY22E | 2380.00 | 378.60 | 15.91% | 213.78 | 7.80 | 16.23% | 23.08 | 11.84 |

| FY23E | 2763.00 | 441.32 | 15.97% | 265.46 | 9.68 | 18.74% | 18.59 | 9.90 |

Investment Rationale

Key Customer Focus to Drive Growth

The client base of the company is strong with 12 out of the 15 top automotive OEMs

and 9 tier-I suppliers. Its top 25 (T25) clients account for ~85% of its revenue

and the current revenue run rate has a potential room for the growth with potential

market share gains.

Digitisation and innovative business models, driven by new age industrial players and technology firms venturing into the digital mobility sector, are disrupting the automotive industry. To counter this, traditional automakers have increased their R&D spending to capitalise on modern age technology such as autonomous driving, electrification, and connectivity. Since the customers of the company are multinational automobile market leaders with multibillion-dollar R&D budgets, each of the T25 customers could result in growth opportunities for KPIT. Its top customers are turning their investments into digital projects like connected, electrification, digital cockpit, and autonomous vehicles and KPIT is well positioned in these new areas, with a high chance of gaining market share.

Deals Wins and Pipeline show that Electrification and Automation are being Prioritised

Electric vehicle demand is growing around the world as a result of high carbon emissions

from traditional vehicles, prompting governments around the world to incentivise

electric mobility. Automobile manufacturers are prioritising developments in emerging

technologies such as electric powertrain and autonomous. KPIT is involved in conventional

as well as in electric power train and its capabilities in these areas are aiding

demand recovery. Deal pipeline of the company is healthy and has been improving

from covid-lows and is at ~80% of pre-covid levels with improved decision-making

environment. During Q4FY20 and Q1FY21, the company closed two large deals with the

total contract value of ~USD 110 million:

- KPIT has been chosen as a strategic tech partner by a leading automotive tier I and system supplier for Autonomous Driving and ADAS. The contract is for 5 years, with a transaction value of >USD 60 million.

- A leading automotive tier 1 awarded KPIT a multi-million-dollar strategic deal for an electrification programme. The contract is for more than 5 years, with a transaction value of USD 50+ million.

These deals support the hypothesis that OEMs would maintain high levels of digital R&D spending to combat current and emerging rivalry in the areas of autonomous and electrification. KPIT is likely to benefit from multi-billion-dollar investments (General Motors – USD 27 billion, Ford – USD 29 billion, Volkswagen – 87 billion, BMW – 30 billion and Daimler – 70 billion) planned by some of the world's largest automakers for their electric vehicle strategies in the United States and Europe.

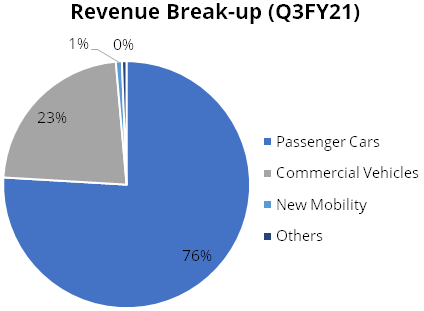

Expansion into Adjacent Segments such as Commercial Vehicles and New Mobility

KPIT is centred on the mobility industry, and has built several strategic partnerships

in the passenger car vertical (76% of revenue). KPIT's passenger car vertical

remains strong, with considerable potential in the areas of electric powertrain,

autonomous driving, digital cockpit, and diagnostics.

Further, the company has identified several adjacent segments within the mobility industry for diversification such as commercial vehicles (CV) and new mobility. For KPIT, commercial vehicle is relatively a new vertical. CV manufacturers are embracing autonomous and connected technology, which presents a strong opportunity for KPIT. New mobility services are transforming urban transportation. App-based mobility services, such as car and ride sharing, as well as Mobility as a Service provide new ways to extend and complement existing mobility. It is also a new vertical for the company where it is creating futuristic solutions which could aid in its growth in the coming years.

Source: Investor Presentation

Financial Performance

In Q3FY21, KPIT posted 6.5% revenue grow on a sequential basis; likely to have been

contributed by its large deal with-in electrification. The company is hopeful about

sales growth in the fourth quarter. Its deal pipeline remains high. On account of

the high growth rate and positive operating leverage, EBITDA margins should continue

to increase. Because of the benefits of operating from home, the company is considering

closing a couple of facilities in India, which will be a margin driver in the future.

Higher usage, higher offshore, and lower depreciation are some of the other margin

levers.

Also, cash generation has been strong on account of better working capital and with expectation of margin expansion, cash generation is expected to grow. KPIT is not expected to invest in large acquisitions; with high cash position coupled with no significant investment, the company might increase shareholders payout, which stood at 18.34% in FY20.

Outlook & valuation

On the back of factors such as: I) The company’s activities are in line with current developments in new age technology, electrification, and autonomous. II) Expansion in adjacent segment such as CV and new mobility III) Healthy deal pipeline and improving decision making IV) strong relationships with top global automotive OEMs and tier 1 suppliers and; V) Increased R&D expense by global auto companies; we believe the future of KPIT is very bright. We expect the company to reap significant benefits from these levers of growth in near-to-medium term. The stock is currently trading at PE of 18.6x of FY23E earnings.

Financial Statement

Profit & Loss statement

| Year End March (Rs. In Crores) | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|

| Net Sales | 641.26 | 2156.17 | 2035.00 | 2380.00 | 2763.00 |

| Growth % | 236.24% | -5.62% | 16.95% | 16.09% | |

| Expenditure | |||||

| Material Cost | 11.55 | 7.82 | - | - | - |

| Employee Cost | 356.75 | 1428.73 | 1335.00 | 1523.00 | 1755.00 |

| Other Expenses | 201.84 | 432.31 | 399.06 | 478.40 | 566.68 |

| EBITDA | 71.11 | 287.31 | 300.95 | 378.60 | 441.32 |

| Growth % | 304.03% | 4.75% | 25.80% | 16.57% | |

| EBITDA Margin | 11.09% | 13.33% | 14.79% | 15.91% | 15.97% |

| Depreciation & Amortization | 18.77 | 108.05 | 133.65 | 129.00 | 132.00 |

| EBIT | 52.34 | 179.26 | 167.30 | 249.60 | 309.32 |

| EBIT Margin % | 8.16% | 8.31% | 8.22% | 10.49% | 11.20% |

| Other Income | 56.09 | 30.68 | 20.00 | 35.00 | 40.00 |

| Interest & Finance Charges | 6.94 | 19.82 | 17.38 | 17.38 | 17.50 |

| Profit Before Tax - Before Exceptional | 101.49 | 190.12 | 169.92 | 267.22 | 331.82 |

| Profit Before Tax | 67.20 | 180.61 | 169.92 | 267.22 | 331.82 |

| Tax Expense | 12.18 | 33.83 | 33.98 | 53.44 | 66.36 |

| Effective Tax rate | 0.12 | 0.18 | 0.20 | 0.20 | 0.20 |

| Exceptional Items | -34.29 | -9.51 | - | - | - |

| Net Profit | 55.02 | 146.77 | 135.93 | 213.78 | 265.46 |

| Growth % | 166.77% | -7.39% | 57.27% | 24.17% | |

| Net Profit Margin | 8.58% | 6.81% | 6.68% | 8.98% | 9.61% |

| Consolidated Net Profit | 54.19 | 146.59 | 135.93 | 213.78 | 265.46 |

| Growth % | 170.53% | -7.27% | 57.27% | 24.17% | |

| Net Profit Margin after MI | 8.45% | 6.80% | 6.68% | 8.98% | 9.61% |

Balance Sheet

| Year End March (Rs. in Crores) | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|

| Share Capital | 268.50 | 268.88 | 268.88 | 268.88 | 268.88 |

| Total Reserves | 691.06 | 773.21 | 879.24 | 1039.57 | 1238.66 |

| Shareholders' Funds | 963.47 | 1050.53 | 1156.99 | 1317.32 | 1516.41 |

| Minority Interest | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 |

| Non Current Liabilities | |||||

| Long Term Burrowing | 37.09 | 2.97 | 31.32 | 16.32 | 1.32 |

| Deferred Tax Assets / Liabilities | -4.35 | -38.73 | -38.73 | -38.73 | -38.73 |

| Long Term Provisions | 28.82 | 12.09 | - | - | - |

| Current Liabilities | |||||

| Short Term Borrowings | 59.97 | 16.61 | 16.61 | 16.61 | 16.61 |

| Trade Payables | 102.74 | 84.67 | 120.57 | 133.05 | 154.99 |

| Other Current Liabilities | 440.12 | 306.84 | 268.50 | 268.50 | 268.50 |

| Short Term Provisions | 38.08 | 46.95 | - | - | - |

| Total Equity & Liabilities | 1669.74 | 1596.33 | 1619.64 | 1777.46 | 1983.49 |

| Assets | |||||

| Net Block | 419.78 | 526.42 | 572.77 | 613.77 | 653.77 |

| Non Current Investments | 1.04 | 1.04 | 1.04 | 1.04 | 1.04 |

| Long Term Loans & Advances | 14.81 | 48.63 | 48.63 | 48.63 | 48.63 |

| Current Assets | |||||

| Currents Investments | 48.71 | 8.22 | 8.22 | 8.22 | 8.22 |

| Inventories | 17.99 | 11.53 | - | - | - |

| Sundry Debtors | 592.00 | 448.68 | 430.60 | 453.60 | 528.39 |

| Cash and Bank | 220.66 | 381.04 | 391.06 | 484.89 | 576.12 |

| Short Term Loans and Advances | 49.20 | 35.21 | 31.74 | 31.74 | 31.74 |

| Total Assets | 1669.74 | 1596.33 | 1619.64 | 1777.46 | 1983.49 |

Cash Flow Statement

| Year End March (Rs. in Crores) | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|

| Profit After Tax | 55.02 | 146.77 | 135.93 | 213.78 | 265.46 |

| Depreciation | 18.77 | 108.05 | 133.65 | 129.00 | 132.00 |

| Others | 588.77 | -1.74 | - | - | - |

| Changes in Working Capital | 81.51 | 129.98 | 65.50 | -10.51 | -52.85 |

| Cash From Operating Activities | 151.14 | 388.74 | 335.08 | 332.27 | 344.60 |

| Purchase of Fixed Assets | -27.03 | -68.62 | -180.00 | -170.00 | -172.00 |

| Free Cash Flows | 124.11 | 320.12 | 155.08 | 162.27 | 172.60 |

| Others | -60.80 | -70.87 | - | - | - |

| Cash Flow from Investing Activities | -87.00 | -138.27 | -180.00 | -170.00 | -172.00 |

| Increase / (Decrease) in Loan Funds | -17.29 | -37.28 | -10.00 | -15.00 | -15.00 |

| Equity Dividend Paid | - | -47.02 | -29.91 | -53.44 | -66.36 |

| Others | 51.06 | -83.19 | - | - | - |

| Cash from Financing Activities | 33.77 | -177.35 | -39.91 | -68.44 | -81.36 |

| Net Cash Inflow / Outflow | 97.91 | 73.13 | 115.18 | 93.82 | 91.24 |

| Opening Cash & Cash Equivalents | 0.10 | 200.87 | 275.89 | 391.06 | 484.89 |

| Closing Cash & Cash Equivalent | 200.87 | 275.89 | 391.06 | 484.89 | 576.12 |

Key Ratios

| Yr End March | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|

| Basic EPS | 2.02 | 5.43 | 4.96 | 7.80 | 9.68 |

| Diluted EPS | 2.02 | 5.43 | 4.96 | 7.80 | 9.68 |

| Cash EPS (Rs) | 2.72 | 9.43 | 9.83 | 12.50 | 14.50 |

| DPS | 0.75 | 1.00 | 1.09 | 1.95 | 2.42 |

| Book value (Rs/share) | 35.88 | 38.89 | 42.20 | 48.05 | 55.31 |

| ROCE (%) Post Tax | 18.00% | 16.20% | 13.17% | 17.82% | 19.38% |

| ROE (%) | 5.62% | 13.95% | 11.75% | 16.23% | 18.74% |

| Inventory Days | 5.12 | 2.50 | 1.03 | - | - |

| Receivable Days | 168.48 | 88.08 | 78.85 | 67.80 | 64.86 |

| Payable Days | 29.24 | 15.86 | 18.41 | 19.45 | 19.03 |

| PE | 19.82 | 6.47 | 36.30 | 23.08 | 18.59 |

| P/BV | 1.11 | 0.91 | 4.27 | 3.75 | 3.25 |

| EV/EBITDA | 13.18 | 2.16 | 15.26 | 11.84 | 9.90 |

| Dividend Yield (%) | 1.88% | 2.84% | 0.61% | 1.08% | 1.34% |

| P/Sales | 1.67 | 0.44 | 2.42 | 2.07 | 1.79 |

| Net debt/Equity | - | - | - | - | - |

| Net Debt/ EBITDA | -1.93 | -1.15 | -1.14 | -1.19 | -1.28 |

| Sales/Net FA (x) | 3.06 | 4.56 | 3.70 | 4.01 | 4.36 |