Infosys Ltd

IT - Software Services

Infosys Ltd

IT - Software Services

Stock Info

Shareholding Pattern

Price performance

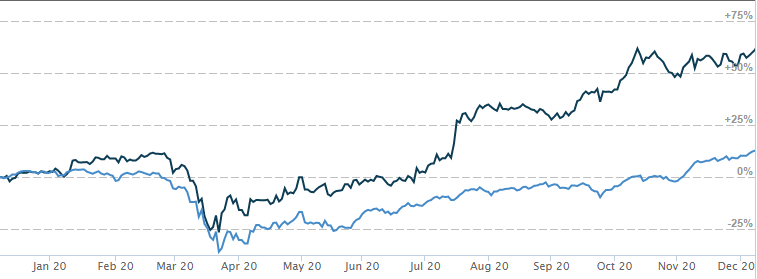

Indexed Stock Performance

Robust growth in Digital service business and leader in technology space

Infosys Ltd. (Infosys) is India’s leading information technology (IT) company. The company provides consulting, technology, outsourcing and next-generation digital services to clients across 46 countries. Infosys has nearly 4 decades of experience in managing the systems and workings of global enterprises. The company facilitates continuous improvement of its clients’ operations through building and transferring digital skills, expertise and ideas from its innovation ecosystem.

Strong revenue growth

Infosys reported revenue growth of 4% QoQ / 2.2% YoY in constant-currency (CC) in

Q2 FY2021. Digital revenues grew by 25.4% YoY in CC terms and now contribute 47.3%

of total revenues. Management expects digital revenue to contribute more than 50%

of total revenues in short period of time. For FY2021, Infosys increased revenue

growth guidance to 2-3% range in CC terms which was earlier at 0-2%. Management

has shown lot of confidence because of strong deal conversions and focused M&A

should also start contributing. Infosys concluded 3 M&A deals in the quarter,

all focused on improving digital capabilities.

Strong momentum in large deal wins

Large deal signings for the Q2 remained strong at US$3.15bn as compared to US$1.74

bn in Q1FY21. Lot of traction is seen in BFSI segment where Banks and Financial

services firms are going digital, while Retail segment is seeing growth towards

e-commerce and improving customer experience. Infosys signed its largest deal in

its history, which could be worth $1.5 billion, involves digital transformation

and migration of record keeping services to cloud-based platform for Vanguard.

Robust margin improvement

EBIT margins for Q2 stood at 25.3%, increase of 364 bps YoY / 268 bps QoQ. Margin

improvement was led by lower discretionary spends like brand building, defferal

of costs like wage hikes & promotions, increased offshore utiliztion and lower

travel because of work from home.

For FY2021, EBIT margin guidance has increased to 23-24% as compared to 21-23% earlier.

Management has guided that H2 will face margin headwinds as there will be salary

hike, one time special incentive to employees and some discrtionery costs are likely

to come back.

Structural changes in the IT industry

We believe that to navigate businesses through the current crisis, digitization

and use of technology will be of prime importance. There is high demand for services

like i) digital transformation, ii) cyber security, iii) cloud. Several sectors

are also seeking technology-based solutions immediately to tackle the health and

economic crises – notably in healthcare, life sciences, banking, telecommunications

and essential retail.

Robust growth in Digital revenue

Infosys has strong digital capabilities and offerings that enable clients to achieve

business transformation by adopting digital technologies. Digital services and solutions

contributed 39% of revenue in FY2020 as compared to 31% in FY2019. For Q2 FY2021,

digital revenue grew by 25% YoY in constant currency (CC) terms and now contributes

47% of total revenue.

Technical

READY FOR NEW 52 WEEK HIGH

Price: INFY is in a secular uptrend making higher highs and higher lows on weekly and monthly charts. The stock is currently placed above all its 21SMA & 50SMA moving averages on all time frames which indicates positive setup. The stock has bounce from the recent swing low of Rs. 1056 with increased in delivery volume, which show bullishness for this stock. The stock has made its new 52 week high of Rs. 1186 made on 15 October 2020. We expect the stock to continue its outperformance in the coming weeks. The Parabolic SAR (Stop & Reverse) is also below the trading price, suggesting northward momentum is likely to remain intact in the counter. The stock has bounced from the support level with increased in volume which indicates the strength in the counter. The stock has been significantly outperforming NIFTY IT over last week on week basis. We expect the stock to continue its outperformance in the coming weeks.

Indicator: The RSI on daily chart is pegged at 60.12, indicating the stock has not been overbought. The signal line also suggests the upward move and more momentum is due in the counter from a near term perspective. The DMI+ is also pointing upwards and is currently placed around 27.54 levels, which shows overall strength is likely to bring in sustained buying from the current levels Further MACD histogram on the monthly chart is trading in positive territory and making higher highs indicating strength in the stock. We expect the stock outperform in near term.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. INFOSYS stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short term. The stock has seen decent deliverable quantity to trade quantity on daily basis, which indicates strong hands are accumulating the stock at currents levels, which enhance the confidence over the stock. As a trader one can accumulate around current level and Rs. 1155 with keeping the stop loss Rs.1010 for target Rs.1450 level for short to medium term.