Indian Bank

Bank - Public

Indian Bank

Bank - Public

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

India Bank is the Seventh-Largest PSB in Terms of Deposits and Advances, With A Strong Presence in The Country's Southern and Eastern Regions

Company Profile

Indian Bank was established in August 1907 as a part of the Swadeshi movement. The

bank’s primary banking operations include fund-based and non-fund-based facilities

for retail, agriculture, MSMEs, and corporates. It is one of the leading PSU banks

in India as Allahabad bank is now been amalgamated into Indian Bank with effect

from April 2020. After amalgamation, the entity enjoys larger balance sheet, optimised

capital utilisation, and wider geographic reach resulting into deeper penetration.

As of June 2021, the Indian bank has a strong domestic branch network including 5,809 branches and 5,238 ATMs & BNA. Additionally, the bank has international presence through three overseas branches. GoI’s ownership in the bank stood at 88.06% as of June, 2020, following issuing of shares under amalgamation to the shareholders of Allahabad Bank which reduced to 79.86% following the QIP in June, 2021.

Investment Rationale

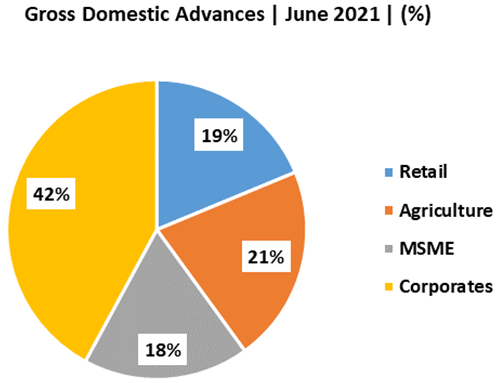

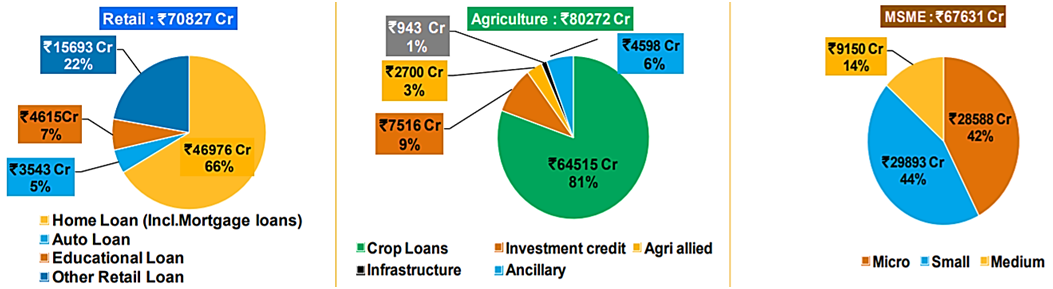

Well-Diversified Loan Book with Higher Focus on Retail, Agriculture, and MSME

(RAM) Sectors

The bank has a well-diversified product mix which caters to customers across urban,

semi-urban, metro, and rural areas. Retail, Agriculture and MSME (RAM) advances

account for more than 58% of overall advances, while corporate portfolio accounts

for 42% of the loan book as of June 2021. The credit portfolio has many products

such as home loan, auto loan, education loan, and others. In agriculture advances,

the bank focuses more on crop loans.

Source: Investors’ Presentation

Source: Investors’ Presentation

To diversify the loan book further, the bank focuses on lending to various sectors such as infrastructure, textile, food processing, trade, agriculture, among others. As of June 2021, no other sectors apart from agriculture (21%) was loaned more than 20% of the gross advances.

The bank’s operations have been directed toward a balanced asset portfolio, with an emphasis on retail operations and selective attention paid to corporate operations. As a result, the bank has been able to limit its exposure to some of India's struggling industries and instead focus on the higher-yielding retail and MSME sectors. This strategically diversified asset portfolio across the RAM sectors is expected to improve risk diversification, revenue, and profitability.

Strong Capital Adequacy

Indian bank is among the well-capitalized banks in public sector. As on June, 2021

its Common Equity Tier I (CET 1) ratio, Tier-I capital adequacy ratio (CAR) and

overall CAR was 11.57%, 12.21% and 15.92%, respectively (10.23%, 10.40% and 13.27%,

respectively, as on April, 2020). Improvement in CAR was driven by capital infusion

by the government and fund raise by the bank. In the current fiscal till date, it

has raised Rs. 1,650 crores of equity capital through QIP and is in the process

of raising additional capital in the upcoming quarters. In FY21, the bank had raised

Additional Tier 1 bonds and Tier 2 bonds of Rs. 2,000 crores each. The capitalisation

provides cushion against asset-side risks. Its net worth coverage for net NPAs was

3.3x as on June, 2021 (2.4x as on April, 2020).

Signs of Recovery in Asset Quality

As of June 2021, the GNPA of the bank stood at 9.7% compared to 10.9% as of June

2020 and Net NPA was at 3.47% vs. 2.76% YoY. Provisioning Coverage Ratio (PCR) (including

Technical Write-off) as of June 2021 was 82% vs. 80.52% as of June 2020. Fresh slippages

are lower by 49.3% to Rs. 4,204 crores vs. Rs. 8,292 crores in March 2021. With

bad asset up-gradation of Rs. 1,647 crores (14.2x the previous quarter) and prudential

write-offs of Rs. 2,713 crores (Rs. 2,489 crores in Q4FY21); the absolute GNPA of

the bank has decreased ~2% sequentially. The management has guided for <2% credit

cost and target slippage ratio of ~3% (4.8% in FY21).

The collection efficiency of corporate has improved on a sequential basis from 94% to 97%. However, the collection efficiency of RAM sectors has decreased, which, we believe is due to the second wave of Covid-19 pandemic. As economy is coming on track and vaccination programme is taking pace, collection efficiency of RAM sectors is expected to improve in the coming quarters.

The loan book of the bank as on June 2021 has high exposure to corporates (42%) and MSME (18%). In corporates, it has high exposure to sectors such as Infrastructure (16%), NBFCs (12%), Basic Metal (2%) and Textiles (2%). Some of these sectors such as textile and infrastructure has started to perform better on the back of various government initiatives recently. Out of the total, almost 81% of the borrowers are above investment grade and almost 19% are BB & below rating category. In the unrated exposure, 85% of the exposure is in investment grade and PSU sector. Rating wise, 94% of standard NBFC exposure is rated A and above.

Healthy Resource Profile

Following its merger with Allahabad Bank, Indian Bank's resource profile has

improved, with the proportion of low-cost CASA deposits at 40.9% as of June 30,

2021. The percentage remains higher than the industry average, allowing Indian Bank

to keep its cost of deposits (CoD) under control. For the quarter ending June, 2021,

CoD was 4.05%, compared to 4.83% in the preceding fiscal quarter. Furthermore, the

resource profile is supported by the significant amount of highly stable retail

deposits (retail term deposits and savings account deposits), which accounted for

roughly 96.3% of total domestic deposits as of June, 2021. The bank's resource

profile is expected to gain from its expanded reach following its merger with a

larger domestic branch network that included 5,809 branches and 5,238 ATMs and Bunch

Note Acceptors (BNAs) as of June, 2021.

Emphasis on Digital Transformation

The bank has identified “Transformation Roadmap” to be implemented in

next 2-3 years. As a part of this, one of the focus areas of the bank is digital

transformation. The bank intends to grow business by digital lending in Retail,

MSME, and Agri products in a phased manner as well as to grow CASA. The bank is

implementing Loan Management System (LMS) to enable it for end-to-end digital lending.

It is digitalizing the documentation to avoid physical presence of the borrower

at the bank branches for documentation/disbursement. These initiatives are expected

to aid in growing advances gradually over the years as people prefer ease of digitization

rather than following the process physically.

Further, the bank is developing new channels and applications and upgrading existing channels for easy customer on-boarding process and ease of doing digital transaction through various channels. It has transitioned branches to banking apps and increased its ATM and internet banking networks, offering a full range of mobile banking, debit and prepaid card services, and payment systems. In order to achieve a more efficient operating model and to support new business models and distribution channels, management has stated that they will continue to focus on increased operational efficiencies by further optimising the operating platform through technology enhancement and process streamlining.

Outlook & valuation

After the amalgamation with Allahabad bank, it is now witnessing synergies and is poised to grow on business and profitability. The bank is focusing on improving is CASA share in deposits while looking at diversified growth in credit/advances. The bank’s ‘transformation roadmap’ for next 2-3 years will be backed by various initiatives focused on digital transformation, transformation in operating models, leadership development plan, and performance management system.

The bank is expected to emerge stronger by the end of this fiscal and initial signs of recovery was seen in Q1FY22. With economy on a recovery track backed by higher pace of vaccination, the bank’s RAM collections are also expected to improve going forward. The healthy capital adequacy will help the momentum to continue. At the current market price of Rs. 160, the stock of Indian bank is trading at 0.44x of FY23E book value.

Peer Comparison

| Particulars | CMP | P/ABV | P/E | FY21 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FY21 | FY22E | FY23E | FY21 | FY22E | FY23E | RoE% | RoA% | NIM% | GNPA% | NNPA% | CASA% | Loan Book (INR. Crores) | ||

| Punjab National Bank | 41.40 | 0.83 | 0.66 | 0.56 | 21.79 | 9.61 | 5.15 | 3.88% | 0.15% | 2.99% | 14.12% | 5.73% | 45.48% | 6,74,230.00 |

| Bank of Baroda | 88.00 | 0.84 | 0.77 | 0.67 | 55.70 | 6.44 | 4.42 | 1.50% | 1.14% | 2.71% | 8.87% | 3.10% | 42.87% | 7,06,300.50 |

| State Bank of India | 482.00 | 2.21 | 1.90 | 1.64 | 21.11 | 13.72 | 11.12 | 9.94% | 0.48% | 3.26% | 4.99% | 1.15% | 46.13% | 24,49,497.79 |

| Indian Bank | 160.00 | 0.53 | 0.51 | 0.44 | 6.01 | 4.74 | 3.70 | 7.82% | 0.48% | 3.53% | 9.85% | 3.37% | 42.30% | 3,64,010.24 |

Source: Annual Reports; Consensus Estimates; StockAxis Research

Financial Statement

Profit & Loss statement

| Particulars (Rs. in Crores) | FY2019 | FY2020 | FY2021 | FY2022E | FY2023E |

|---|---|---|---|---|---|

| Interest Earned | 19184.81 | 21404.97 | 39105.79 | 43787.65 | 48002.35 |

| Interest Expended | 12166.72 | 13798.55 | 23439.84 | 27099.90 | 29659.40 |

| Net Interest Income | 7018.09 | 7606.42 | 15665.95 | 16687.75 | 18342.95 |

| Other Income | 1882.89 | 3312.46 | 6079.25 | 6716.60 | 7151.35 |

| Total Income | 8900.98 | 10918.88 | 21745.20 | 23404.35 | 25494.30 |

| Operating Expense | 4020.37 | 4420.84 | 10349.55 | 10417.00 | 11287.95 |

| Pre-Provisioning Operating Profit | 4880.62 | 6498.04 | 11395.65 | 12987.35 | 14206.35 |

| Provisions and Contingencies | 4596.40 | 5125.31 | 8490.07 | 9195.65 | 9048.70 |

| Taxes | -37.74 | 619.37 | -99.10 | -412.20 | -233.00 |

| Net Profit | 321.95 | 753.36 | 3004.68 | 4203.90 | 5390.65 |

| Earnings Per Share (EPS) | 6.70 | 14.33 | 26.60 | 33.75 | 43.28 |

Balance Sheet

| Particulars (Rs. in Crores.) | FY2019 | FY2020 | FY2021 | FY2022E | FY2023E |

|---|---|---|---|---|---|

| Share Capital | 480.29 | 608.80 | 1129.37 | 1245.44 | 1245.44 |

| Total Reserves | 18908.40 | 21480.47 | 37282.58 | 41486.48 | 46877.13 |

| Shareholders Fund | 19388.69 | 22089.27 | 38411.94 | 42731.92 | 48122.57 |

| Deposits | 242075.95 | 260225.90 | 538071.11 | 585114.60 | 639029.15 |

| Borrowings | 12137.54 | 20830.31 | 26174.60 | 25815.95 | 27414.10 |

| Other Liabilities and Provisions | 6463.09 | 6322.70 | 23347.36 | 28992.20 | 31372.35 |

| Total Liabilities | 280065.27 | 309468.17 | 626005.02 | 682654.67 | 745938.17 |

| Fixed Assets | 3961.40 | 3895.74 | 7376.31 | 7709.75 | 8255.60 |

| Advances | 181261.91 | 197887.01 | 364010.24 | 391311.05 | 430423.95 |

| Investments | 64992.17 | 81241.69 | 176536.97 | 194028.70 | 213178.75 |

| Cash & Bank Balance | 20020.38 | 13924.68 | 54059.88 | 61294.22 | 65453.02 |

| Other Assets | 9829.40 | 12519.05 | 24021.62 | 28310.95 | 28626.85 |

| Total Assets | 280065.27 | 309468.17 | 626005.02 | 682654.67 | 745938.17 |

Key Ratios

| Particulars (Rs. in Crores) | FY2019 | FY2020 | FY2021 | FY2022E | FY2023E |

|---|---|---|---|---|---|

| Earnings Per Share | 6.70 | 14.33 | 26.60 | 33.75 | 43.28 |

| Price/Earnings | 23.87 | 11.17 | 6.01 | 4.74 | 3.70 |

| Book Value Per Share | 339.24 | 313.76 | 289.16 | 343.11 | 386.39 |

| Price/BV | 0.47 | 0.51 | 0.55 | 0.47 | 0.41 |

| Average Book Value (ABV) | 334.39 | 326.50 | 301.46 | 316.13 | 364.75 |

| Price/ABV | 0.48 | 0.49 | 0.53 | 0.51 | 0.44 |

| NIM | 2.64% | 2.72% | 3.53% | 2.69% | 2.71% |

| ROA | 0.11% | 0.24% | 0.48% | 0.62% | 0.72% |

| ROE | 1.66% | 3.41% | 7.82% | 9.84% | 11.20% |

| Cost to Income Ratio | 45.17% | 40.49% | 47.59% | 44.51% | 44.28% |

| GNPA | 7.11% | 6.87% | 9.85% | 8.90% | 7.60% |

| NPA | 3.75% | 3.13% | 3.37% | 2.90% | 2.40% |