ICICI Lombard General Insurance Co Ltd

Insurance - General

ICICI Lombard General Insurance Co Ltd

Insurance - General

Stock Info

Shareholding Pattern

Price performance

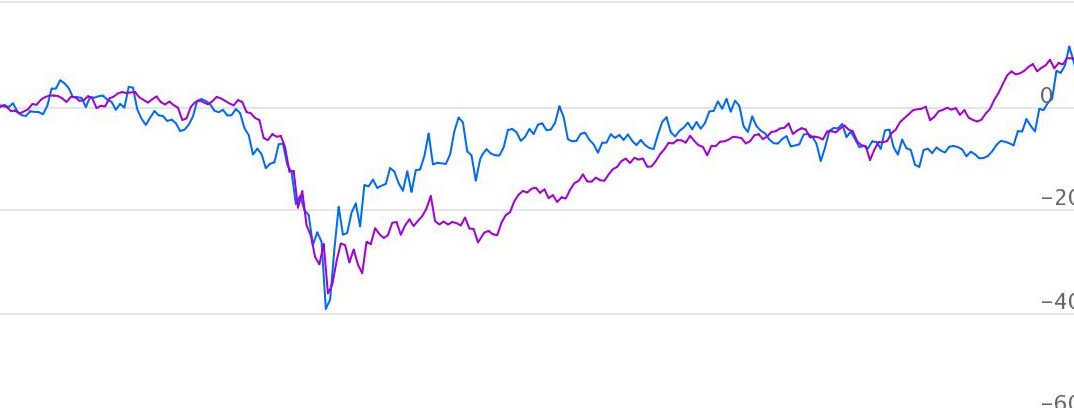

Indexed Stock Performance

A structural growth story of the largest non-life private insurer in the country

Profile

ICICI Lombard General Insurance (ILGI) is the 5th largest player in the general

insurance sector in India as on March 31, 2020 (Source: GI Council Report) and a

leader among private general insurers. Promoted by ICICI Bank, one of India’s

largest private sector banks, ILGI commenced operations in 2002. It offers a range

of products across non-life/general categories, including motor, health, crop/weather,

fire, personal accident, marine, engineering and liability insurance, through multiple

distribution channels.

Investment Rationale

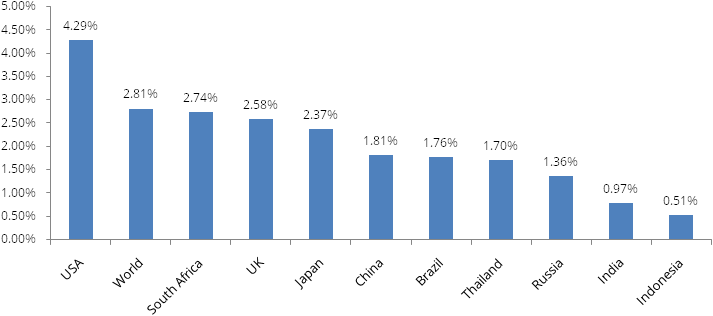

Low Insurance Penetration in India

India’s non-life insurance coverage is significantly lower at 0.97% (premium

as % of GDP) as compared to its peers like Thailand at 1.7%, Singapore at 1.67%

and Malaysia at 1.62%. The reasons for low penetration are low awareness and low

propensity to spend on insurance, which does not deliver immediate benefit. However,

due to aggressive campaigning by insurance companies and online aggregators, government’s

focus on different insurance schemes, deregulation of the sector, easy payment options

and higher incomes have led to increased adoption of non-life insurance.

Industry Tailwind

As India continues to grow, the need for non-life insurance will continue to grow

at a robust pace led by rising penetration and growing awareness. The accessibility

to insurance has increased significantly in the recent past led by aggressive penetration

by private insurers, web-based aggregators and government’s efforts to ensure

insurance cover to those who cannot afford it.

Acquisition of Bharti AXA General Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) on November

27 gave an in-principle approval to the acquisition of General Insurance business

of Bharti AXA General Insurance Company Limited by ICICI Lombard General Insurance

Company Limited. The stock exchanges and the Competition Commission of India (CCI)

had already approved the proposed acquisition by ILGI. The consolidated entity will

have a market share of 8.7% in the non-life business.

Market Leader with a Strong Brand

ILGI’s market share stood at 12% among private players and overall industry

share stood at 7% in FY20. The leadership position has been strengthened by its

strong brand and partnerships, robust and diversified product profile, strong promoter

pedigree and decent underwriting track record.

Diverse Product Portfolio with robust Distribution Network

Strong distribution across India has helped the company reach a diverse set of customers,

including large and mid-sized corporates, SMEs, central and state governments, and

individuals.

Technological Edge

During FY2020, around 96.5% of the policies were processed electronically. It uses

technology extensively from providing quotes for policies to settling claims. It

also uses various mobile applications, chatbots, and telematics interfaces to help

customers and channel partners.

Outlook & Valuation

We believe the sector will continue to witness high growth going forward led by

a number of factors such as huge under penetration, high economic growth, higher

disposable incomes, increased awareness, digital penetration and favourable regulations.

We believe the current pandemic will lead to increased penetration of health insurance

segment. At the current market price of Rs. 1470, the stock trades at 35x/30x

FY22/23 E EPS.

Consolidated Financial Statements

| Rs. in cr. | NPE | Total Revenue | Operating Profit | PAT | EPS | Expense Ratio | ROE |

|---|---|---|---|---|---|---|---|

| FY18 | 6912.00 | 8481.00 | 1338.00 | 862.00 | 18.98 | 103.30% | 20.80% |

| FY19 | 8375.35 | 10226.54 | 1705.73 | 1049.27 | 23.11 | 101.70% | 21.30% |

| FY20 | 9404.00 | 11533.24 | 2024.24 | 1194.24 | 26.30 | 101.10% | 20.80% |

| FY21E | 9534.56 | 11805.30 | 2175.39 | 1417.39 | 31.22 | 101.00% | 21.30% |

| FY22E | 10411.82 | 13121.87 | 2710.05 | 1869.14 | 41.17 | 100.00% | 23.70% |

| FY23E | 11973.59 | 15114.86 | 3141.27 | 2175.89 | 47.93 | 100.00% | 23.10% |

Investment Rationale

Low Insurance Penetration in India

India’s non-life insurance coverage is significantly lower at 0.97% (premium

as % of GDP) as compared to its peers like Thailand at 1.7%, Singapore at 1.67%

and Malaysia at 1.62%. The reasons for low penetration are low awareness and low

propensity to spend on insurance, which does not deliver immediate benefit. However,

due to aggressive campaigning by insurance companies and online aggregators, government’s

focus on different insurance schemes, deregulation of the sector, easy payment options

and higher incomes have led to increased adoption of non-life insurance. With only

10% of the economic losses being insured in India, we believe that the sector will

continue to grow at double digit growth rates going forward led by the structural

changes like rapid urbanization, high GDP growth, favourable dynamics, rising incomes

and higher loss aversion. Private insurers are expected to grow at a faster rate

than public insurance, and thereby gain market share.

Non-life Insurance Penetration across the Globe

Motor Insurance:

Despite being more advanced than other forms of non-life insurance in India, motor

insurance remains underpenetrated relative to global levels. According to CRISIL

Research, only 60% of cars older than three years are insured in India as against

the global benchmark of 90%, and only around 25% of two wheelers are insured as

against a global benchmark of over 90%. This leaves enough headroom for growth in

the Motor Insurance category. The growth will be led by renewal premiums of old

vehicles due to awareness of regulatory requirements and increase in sales of new

vehicles. The segment will also get a boost from the government as the cumbersome

third-party motor insurance rules are simplified.

Health Insurance:

Health insurance in India is also expected to pick up pace going forward driven

by growing proportion of ageing population, rise in incidence of lifestyle related

diseases/critical illness/pandemic, higher income levels and higher awareness. Currently

health insurance is at an inflection point, as covid-19 pandemic has accelerated

the need for health insurance. Till FY18, only 35% of the Indian population had

some or the other form of health insurance as against 90% in some of the advanced

economies.

Industry Tailwind

As India continues to grow, the need for non-life insurance will continue to grow

at a robust pace led by rising penetration and growing awareness. The accessibility

to insurance has increased significantly in the recent past led by aggressive penetration

by private insurers, web-based aggregators and government’s efforts to ensure

insurance cover to those who cannot afford it.

The insurance industry is going through structural changes which will continue for the longterm. The industry will gain from both new policies and renewals. While the industry will grow at an accelerating pace, insurers which have an established brand and right underwriting skills like ILGI will benefit and grow faster than the industry.

Acquisition of Bharti AXA General Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) on November

27 gave an in-principle approval to the acquisition of General Insurance business

of Bharti AXA General Insurance Company Limited by ICICI Lombard General Insurance

Company Limited. The stock exchanges and the Competition Commission of India (CCI)

had already approved the proposed acquisition by ILGI. The consolidated entity will

have a market share of 8.7% in the non-life business.

We believe a lot of synergistic benefits will be visible over 1-2 year period as Bharti AXA is a strong franchise and the merger will benefit the policyholders through deeper customer connect touch points and an enhanced product suite.

Market Leader with a Strong Brand

ILGI’s market share stood at 12% among private players and overall industry

share stood at 7% in FY20. The leadership position has been strengthened by its

strong brand and partnerships, robust and diversified product profile, strong promoter

pedigree and decent underwriting track record.

Diverse Product Portfolio with robust Distribution Network

Strong distribution across India has helped the company reach a diverse set of customers,

including large and mid-sized corporates, SMEs, central and state governments, and

individuals. With its distribution strength, the company can reach out to a diverse

mix of prospective customers in urban as well as rural India. Key distribution channels

are direct sales, individual agents, corporate agents - banks, other corporate agents,

Motor Insurance service providers (MISPs), brokers and digital.

Strong risk management framework

The insurer, helped by its huge data, has managed its risk in an efficient manner

over the past decade and a half. This data has helped the company get into profitable

segments and close down or avoid loss-making segments. It also has a high-quality

panel of reinsurers including GIC Re, Scor Re, Munich Re, Hannover Re, Swiss Re,

Lloyds, Fm Global, and XLCatlin, which it uses to comply with the reinsurance requirements

and also transfer risk to maintain product-wise retention limits on a per-risk and

per-event basis.

Technological Edge

During FY2020, around 96.5% of the policies were processed electronically. It uses

technology extensively from providing quotes for policies to settling claims. It

also uses various mobile applications, chatbots, and telematics interfaces to help

customers and channel partners. The company engages millennial customers through

its digital platforms and third-party platforms and helps them speed up the process

of price discovery, issue of policy, support and claims settlement.

Business Model

Understanding the Insurance Business

The insurance business is primarily a risk transfer business, which involves pooling

risk from individuals (the insured) and redistributing it across a larger portfolio.

Insurance companies generate revenue in two ways: 1) Charging premiums in exchange

of insurance coverage and 2) reinvesting those premiums into other interest/income

generating assets. These companies then manage their administrative costs to be

profitable.

The most important part of the insurance business is good underwriting. The insurer needs to price the risk and charge a premium for assuming the risk. An insurer that is consistently paying out higher amount in claims and expenses as compared to its earnings in premiums will continually dip into its investment assets to sustain business. This will reduce its solvency position and increase the risk to its capital. Good underwriting ensures that the company, most times, pays lower in claims and expenses than it earns in premium.

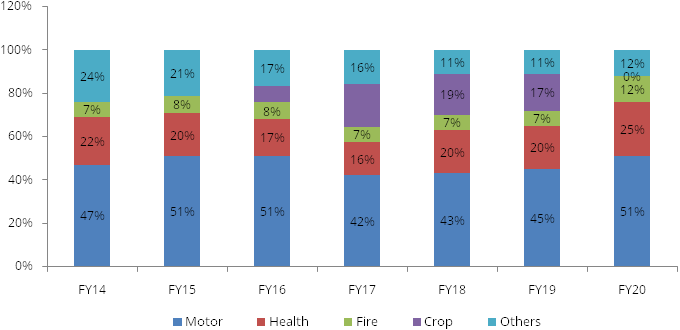

Product Offerings

Motor Insurance: Motor insurance is the biggest product category for ILGI

constituting 51% of Gross Direct Premium Income (GDPI) in FY20. Under motor insurance,

the company insures third party liabilities (i.e. injury or loss of life of a third

party in the event of an accident) and own damages for private cars, 2-wheelers

and commercial vehicles (CVs). Private cars and 2-wheelers formed 56.7% and 28.5%

respectively of the total motor insurance premiums in FY20, while CVs formed 14.8%.

Health and Personal Accident (PA): ILGI is one of the country’s leading health insurers providing a range of benefit-based and indemnity-based policies. Under benefit-based policies, the insurer pays a fixed amount (irrespective of the actual amount of losses/expesnes) when the event occurs. Under indemnity-based policies, the insurer pays the actual expenses incurred (limited to sum assured) by the insured. Most of the health policies fall under the indemnity category. Health, Travel and PA formed 25% of the company’s GDPI in FY20.

Corporate health: This segment consists of policies purchased by corporations to cover the medical health of their employees. These policies are further categorized based on the size of the corporate. Premiums are charged differently to small, mid and large sized corporates.

Mass Health: Under this segment, the company participates in government health programmes. These plans are not very remunerative and hence, are not the focus area of the company.

Corporate Insurance: Corporate insurance includes fire, marine, engineering, group health and liability insurance. IGLI derived 22% of its GDPI from corporate insurance in FY20.

Government Business Group: The company serves rural India under this category and includes various government programmes such as Rashtriya Swasthya Bima Yojana (health insurance).

Revenue Break-up

Industry

India is the 11th largest non-life insurance market in the world and 4thlargest market in Asia in terms of gross premiums. Non-life insurers include general insurers, standalone health insurers and specialized insurers. The industry received gross direct premiums (GDP) of Rs. 1.8 lakh crores, of which 38% and 26% came from Motor and Health, respectively. Private players accounted for more than 50% of GDPs generated in the non-life insurance sector in FY20. Major private players in the industry are ICICI Lombard, Bajaj Allianz, IFFCO Tokio, HDFC Ergo, Tata-AIG, Reliance, Cholamandalam, Royal Sundaram and other regional insurers. There are also specialized insurers like AIC, STAR Health, Apollo Munich, with single line of focus such as agriculture and health.

The industry has grown at a CAGR of 17% in the past 17 years due to higher penetration and increased awareness. The growth was also because of the proliferation of private players in the space after deregulation of the sector. The number of companies in the sector increased from 15 in 2004 to 33 in 2020.

Risks & Concerns

Market Risks: As ILGI derives almost all its profits from investment income, factors that affect the financial markets may impact the company’s profitability.

Regulatory Risks: Any adverse change in regulations affecting the industry as a whole or the company in particular, may impact the company’s performance.

Catastrophic Events: including natural disasters increase ILGI’s liabilities for claims and could have a significant adverse effect on its business and financial condition.

Increase in claims: A second wave of Covid-19 may result in significant increase in claims.

Outlook & valuation

We believe the sector will continue to witness high growth going forward led by a number of factors such as huge under penetration, high economic growth, higher disposable incomes, increased awareness, digital penetration and favourable regulations. We believe the current pandemic will lead to increased penetration of health insurance segment. We expect improvement in ILGI’s combined ratio over the years driven by business efficiencies and better underwriting. We expect the profit before tax (PBT) to be solely driven by investment returns in the coming 1-2 years before the combined ratio improves consistently below 100%. At the current market price of Rs. 1470, the stock trades at 35x/30x FY22/23 E EPS.

Financial Statement

Profit & Loss statement

| Income statement (Rs. Crore) | FY17 | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|---|

| Gross Premium Written (GPW) | 10961.00 | 12600.00 | 14789.00 | 13592.00 | 14136.00 | 16256.00 | 18695.00 |

| YoY Growth (%) | 32.10% | 15.00% | 17.40% | -8.10% | 4.00% | 15.00% | 15.00% |

| Reinsurance Ceded | 4366.00 | 4755.00 | 5251.00 | 3942.00 | 4099.00 | 5121.00 | 5889.00 |

| Net premium written (NPW) | 6595.00 | 7845.00 | 9539.00 | 9641.00 | 10037.00 | 11136.00 | 12806.00 |

| % of GPW | 60.20% | 62.30% | 64.50% | 70.90% | 71.00% | 68.50% | 68.50% |

| Change in Provisions | (431) | (933) | (1,163) | (237) | (502.00) | (724) | (832) |

| % of NPW | 6.50% | 11.90% | 12.20% | 7.50% | 6.50% | 6.50% | 6.50% |

| Premium Earned (NPE) | 6164.00 | 6912.00 | 8375.00 | 9404.00 | 9535.00 | 10412.00 | 11974.00 |

| Income from Investments (net) | 1001.00 | 1127.00 | 1336.00 | 1542.50 | 1666.00 | 1923.00 | 2237.00 |

| % of Policyholder's Account Investments | 9.90% | 9.20% | 9.30% | 8.60% | 7.80% | 8.00% | 8.00% |

| Other Income | 46.00 | 36.00 | 41.00 | 107.00 | 107.00 | 112.00 | 118.00 |

| Core Business revenue | 7211.00 | 8075.00 | 9752.00 | 11053.00 | 11307.00 | 12446.00 | 14329.00 |

| Income from Investments (net) | 309.00 | 406.00 | 474.00 | 480.00 | 498.00 | 675.00 | 786.00 |

| % of Shareholder's Account Investments | 9.70% | 9.30% | 9.40% | 8.60% | 7.30% | 8.00% | 8.00% |

| Total Revenue | 7520.00 | 8481.00 | 10227.00 | 11533.00 | 11805.00 | 13122.00 | 15115.00 |

| Total Expenses (Including Claims) | 6502.00 | 7143.00 | 8521.00 | 9509.00 | 9630.00 | 10412.00 | 11974.00 |

| Expense Ratio (%) | 105.50% | 103.30% | 101.70% | 101.10% | 101.00% | 100.00% | 100.00% |

| Operating Profit | 1018.00 | 1338.00 | 1706.00 | 2024.00 | 2175.00 | 2710.00 | 3141.00 |

| Provision and other expenses | (108) | (142) | (107) | (327) | (192) | (211) | (232) |

| Profit before tax | 910.00 | 1196.00 | 1598.00 | 1697.00 | 1983.00 | 2499.00 | 2909.00 |

| Tax | 208.00 | 334.00 | 549.00 | 503.00 | 566.00 | 630.00 | 733.00 |

| Tax Rate (%) | 22.90% | 27.90% | 34.40% | 29.60% | 28.50% | 25.20% | 25.20% |

| Profit after tax | 702.00 | 862.00 | 1049.00 | 1194.00 | 1417.00 | 1869.00 | 2176.00 |

| Growth (%) | 39.30% | 22.80% | 21.70% | 13.80% | 18.70% | 31.90% | 16.40% |

| EPS | 15.60 | 19.00 | 23.10 | 26.30 | 31.20 | 41.20 | 47.90 |

Balance Sheet

| Balance Sheet | FY16 | FY17 | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|---|---|

| Cash and bank balances | 195.00 | 194.00 | 592.00 | 592.00 | 33.00 | 33.00 | 33.00 | 33.00 |

| Other assets | 4850.00 | 7608.00 | 10348.00 | 10348.00 | 9700.00 | 10185.00 | 10694.00 | 11229.00 |

| DTA | 144.00 | 87.00 | 211.00 | 211.00 | 306.00 | 306.00 | 306.00 | 306.00 |

| Investments | 11563.00 | 15079.00 | 18193.00 | 20614.00 | 26327.00 | 30110.00 | 34839.00 | 40750.00 |

| Policy holder's account | 9174.00 | 11096.00 | 13465.00 | 15255.00 | 20467.00 | 22282.00 | 25781.00 | 30155.00 |

| % of Total Investments | 79.30% | 73.60% | 74.00% | 74.00% | 77.70% | 74.00% | 74.00% | 74.00% |

| Shareholder's account | 2389.00 | 3983.00 | 4728.00 | 5360.00 | 5860.00 | 7829.00 | 9058.00 | 10595.00 |

| Fixed assets | 383.00 | 383.00 | 406.00 | 418.00 | 677.00 | 697.00 | 718.00 | 740.00 |

| Total assets | 17134.00 | 23351.00 | 29750.00 | 32183.00 | 37043.00 | 41331.00 | 46590.00 | 53058.00 |

| Share capital | 448.00 | 451.00 | 454.00 | 454.00 | 454.00 | 454.00 | 454.00 | 454.00 |

| Reserves and surplus | 2808.00 | 3274.00 | 4088.00 | 4875.00 | 5680.00 | 6743.00 | 8145.00 | 9777.00 |

| Share application money-pending allotment | - | 1.00 | - | - | - | - | - | - |

| Shareholders' equity | 3255.00 | 3727.00 | 4542.00 | 5329.00 | 6134.00 | 7197.00 | 8599.00 | 10231.00 |

| Loss and LAE Reserves | 3110.00 | 3549.00 | 4478.00 | 4926.00 | 5872.00 | 6459.00 | 7105.00 | 7816.00 |

| Fair value change account | 309.00 | 677.00 | 734.00 | 734.00 | (429) | 734.00 | 734.00 | 734.00 |

| Borrowings | - | 485.00 | 485.00 | 485.00 | 485.00 | 485.00 | 485.00 | 485.00 |

| Current liabilities | 10460.00 | 14914.00 | 19511.00 | 20710.00 | 24980.00 | 26456.00 | 29667.00 | 33793.00 |

| Total liabilities | 17134.00 | 23351.00 | 29750.00 | 32183.00 | 37042.00 | 41331.00 | 46590.00 | 53058.00 |