ICICI Bank Ltd

Bank - Private

ICICI Bank Ltd

Bank - Private

Stock Info

Shareholding Pattern

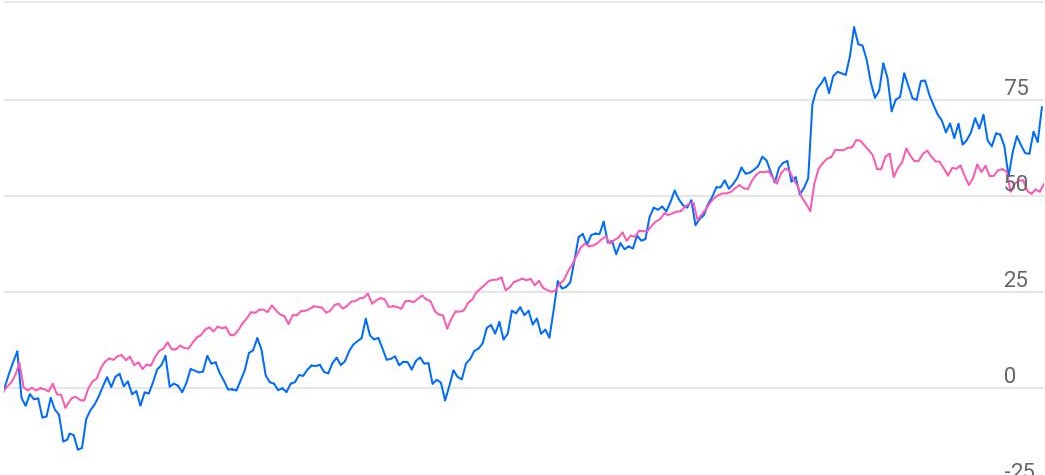

Price performance

Indexed Stock Performance

Well Positioned for Growth

Profile

ICICI Bank is a leading private sector bank in India. ICICI Bank was promoted in

1994 by ICICI Limited, an Indian financial institution. The Bank’s consolidated

total assets stood at Rs. 15.73 trillion as at March 31, 2021. ICICI Bank

offers a wide range of banking products and financial services to corporate and

retail customers through a variety of delivery channels and through its group companies.

ICICI Bank has a network of 5,266 branches and 14,136 ATMs at March 31, 2021.

Consolidated Financial Statements

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Net Interest Income (NII) | 23026.00 | 27015.00 | 33267.00 | 38989.00 | 42006.00 | 46008.00 |

| Total Income | 40446.00 | 41527.00 | 49716.00 | 57958.00 | 62770.00 | 69372.00 |

| Pre-Provisioning Operating Profit (PPOP) | 24742.00 | 23438.00 | 28100.00 | 36397.00 | 39231.00 | 43705.00 |

| Profit after Tax (PAT) | 6778.00 | 3364.00 | 7930.00 | 16193.00 | 22009.00 | 24518.00 |

| Earnings Per Share (EPS) | 10.00 | 5.00 | 12.00 | 24.00 | 32.00 | 36.00 |

| Average Book Value (ABV) (Rs) | 162.00 | 164.00 | 172.00 | 195.00 | 227.00 | 258.00 |

Investment Rationale

Strong and resilient retail banking portfolio – major growth driver

ICICI bank’s retail portfolio has been a major growth driver, which constitute

66.7% of outstanding advances as on March 31, 2021. Focus on retail loans led to

increased in its share as a % of total mix from 39% in 2014 to 63% in March 2020.

The household credit to GDP ratio stands at 12% for India v/s 68% for the US and

61% for China, which shows multi-decade opportunity size. Retail portfolio is largely

secured and built on proprietary data and analytics in addition to bureau checks

and well-priced in relation to risk. Retail portfolio constitutes mainly mortgage

loans (50%), auto loans (13%), business banking (7.6%), rural loans (14.7%), credit

cards (3.5%) and personal loans (10.1%). ICICI Bank has faced virtually no outages

in its digital platforms unlike its large peers that have recently faced regulatory

pressure. This is because the bank has made adequate investments in digital platforms,

leading to better customer wallet share.

Business Banking and SME - huge growth opportunity

SME portfolio includes borrowers with turnover less than Rs. 2.50 billion. Credit

opportunity for business banking stands at Rs. 12.5 trillion, which shows significant

growth opportunities. SME portfolio has grown consistently over the years and currently

constitutes ~4.2% of total advances as on March 31, 2021, from 3% as on 30th

June 2019, it has increased its overall portfolio weight by ~120bps in 7 quarters.

The bank focuses on well diversified portfolio across sectors and geographies along

with parameter based lending, digital channels, granularity, collateral and robust

monitoring. Business banking and SME book has shown very robust growth of 19.9%

and 32.5% for Q4FY21 as compared to Q4 FY20, while QoQ book grew by 6.6% and 11.8%

respectively.

Rural Business – Reimagined focus

ICICI Bank rural business has become a focus area, given significant potential for

growth. The bank is targeting entire rural ecosystem on the back of its ‘phygital’

infrastructure. The bank has segmented the addressable opportunity into 6 micro-markets

i.e. agri, dealers, self-employed, institutions, corporates and micro entrepreneurs.

This diversification aids risk reduction as risk is uncontrollable due to the monsoons.

Rural economy presents strong opportunity; therefore bank is focused on building

unique solutions in this segment.

Corporate – focus on Return of Capital (portfolio quality) and Return on

Capital (earning quality)

In corporate banking, objective remains on maximizing risk calibrated core operating

profit through portfolio quality and earning quality. The bank focuses on granular

exposures and higher rated corporates and provides full suite of banking products

to corporate clients and their ecosystems. Pick-up in economic activity, growth

focused budget, push towards infrastructure spending, consolidation in corporate

credit market towards large lenders, and revival in capex cycle has renewed a sense

of optimism around the growth possibilities within the corporate banking space.

The bank’s corporate book showed strong resilient during covid and grew 10.1%

YoY and 3.9% QoQ for Q4FY21, it currently stands at Rs. 1.76 lakh crore, which is

24% of bank’s total loan portfolio.

Strong digital capabilities

ICICI Bank is using technology to accelerate growth across business verticals. The

management is focused to build a strong bank with best in class digital capabilities.

The bank has launched video KYC in June 2020, to onboard new savings account, salary

accounts, personal loans and credit cards. As on March 31, 2021, ~45% of the credit

card customers were onboarded using video KYC and over 90% of savings account transactions

are through digital channels which includes internet banking, mobile banking, POS,

touch banking, and debit cards.

Best in class Asset Quality

ICICI Bank has almost completed its clean-up process as reflected in gross NPA and

net NPA which have been consistently reducing year after year and quarter after

quarter, even after absorbing covid-19 shock. Gross NPA and net NPA stood at 8.84%

and 4.77% at 31st March 2018, which has drastically come down to 4.96%

and 1.14% respectively as at March 31, 2021. Provision coverage ratio (PCR) was

77.7% at March 31, 2021; in addition to PCR, the bank holds additional provision

buffer of ~Rs. 14144 cr. (1.9%), of which ~Rs. 7,475 cr. is covid-19 related, these

provision buffers will help in keeing credit cost under check.

Outlook & valuation

ICICI Bank has built a strong and resilient retail banking portfolio with strong digital capabilities to provide customized cutting edge digital solutions, which is helping the bank gain market share across business segments. ICICI Bank resilience and strength is seen from the way bank managed covid related issues and is well prepared to face any future challenges with highest PCR among its peers, highest covid-19 related provisions and higher home loan portfolio. We expect credit cost to reduce from here with stable asset quality and high provisioning buffer. The stock currently trades at valuation of 2.8x FY22E and 2.5x FY23E P/ABV.

Financial Statement

Profit & Loss statement

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Interest Earned | 54966.00 | 63401.00 | 74798.00 | 79118.00 | 82993.00 | 91385.00 |

| Interest Expended | 31940.00 | 36386.00 | 41531.00 | 40129.00 | 40987.00 | 45376.00 |

| Net Interest Income | 23026.00 | 27015.00 | 33267.00 | 38989.00 | 42006.00 | 46008.00 |

| Other Income | 17420.00 | 14512.00 | 16449.00 | 18969.00 | 20764.00 | 23364.00 |

| Total Income | 40446.00 | 41527.00 | 49716.00 | 57958.00 | 62770.00 | 69372.00 |

| Employee Expense | 5914.00 | 6808.00 | 8271.00 | 8092.00 | 8577.00 | 9006.00 |

| Other Operating Expense | 9790.00 | 11281.00 | 13344.00 | 13469.00 | 14962.00 | 16662.00 |

| Total Operating Expense | 15704.00 | 18089.00 | 21615.00 | 21561.00 | 23539.00 | 25668.00 |

| Pre-Provisioning Operating Profit | 24742.00 | 23438.00 | 28100.00 | 36397.00 | 39231.00 | 43705.00 |

| Provisions | 17307.00 | 19661.00 | 14053.00 | 16214.00 | 9808.00 | 10926.00 |

| Profit before Tax | 7435.00 | 3777.00 | 14047.00 | 20183.00 | 29424.00 | 32778.00 |

| Tax | 657.00 | 413.00 | 6117.00 | 3990.00 | 7415.00 | 8260.00 |

| Profit after Tax | 6778.00 | 3364.00 | 7930.00 | 16193.00 | 22009.00 | 24518.00 |

| Earnings Per Share (EPS) | 10.00 | 5.00 | 12.00 | 24.00 | 32.00 | 36.00 |

Balance Sheet

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Share Capital | 1286.00 | 1289.00 | 1295.00 | 1383.00 | 1383.00 | 1383.00 |

| Reserves | 103873.00 | 107080.00 | 115211.00 | 146123.00 | 166405.00 | 188852.00 |

| Shareholders Fund | 105159.00 | 108369.00 | 116505.00 | 147506.00 | 167789.00 | 190236.00 |

| Deposits | 560975.00 | 652920.00 | 770969.00 | 932522.00 | 1045720.00 | 1202578.00 |

| Borrowings | 182859.00 | 165320.00 | 162897.00 | 91631.00 | 90403.00 | 81362.00 |

| Other Liabilities and Provisions | 30196.00 | 37851.00 | 47995.00 | 58770.00 | 76700.00 | 88260.00 |

| Total Liabilities | 879189.00 | 964460.00 | 1098366.00 | 1230433.00 | 1380611.00 | 1562435.00 |

| Fixed Assets | 7904.00 | 7931.00 | 8410.00 | 8878.00 | 9321.00 | 9881.00 |

| Advances | 512395.00 | 586647.00 | 645291.00 | 733729.00 | 860588.00 | 1008528.00 |

| Investments | 202994.00 | 207733.00 | 249531.00 | 281287.00 | 253570.00 | 240892.00 |

| Cash & Bank Balance | 84169.00 | 80296.00 | 119156.00 | 133128.00 | 172914.00 | 209389.00 |

| Other Assets | 71727.00 | 81852.00 | 75978.00 | 73411.00 | 84217.00 | 93746.00 |

| Total Assets | 879189.00 | 964460.00 | 1098366.00 | 1230433.00 | 1380611.00 | 1562435.00 |