ICICI Bank Ltd

Bank - Private

ICICI Bank Ltd

Bank - Private

Stock Info

Shareholding Pattern

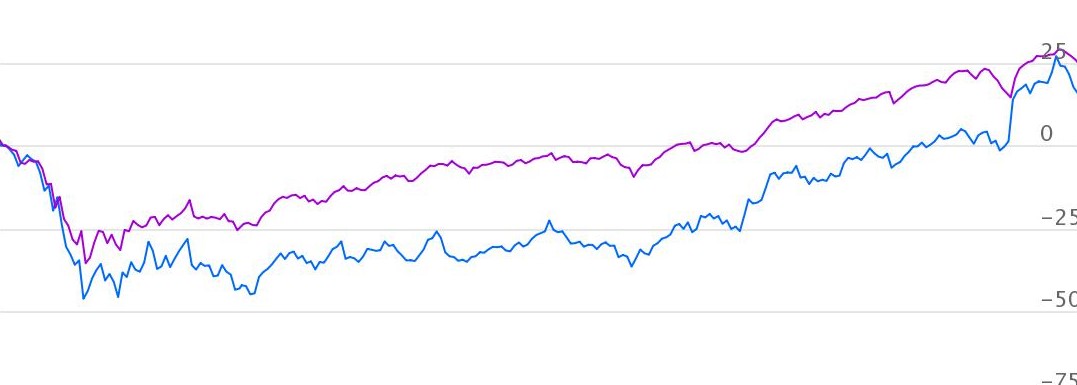

Price performance

Indexed Stock Performance

Well Positioned for Growth

Profile

ICICI Bank is a leading private sector bank in India. ICICI Bank was promoted in

1994 by ICICI Limited, an Indian financial institution. The Bank’s consolidated

total assets stood at Rs. 15.19 trillion as at December 31, 2020. ICICI Bank offers

a wide range of banking products and financial services to corporate and retail

customers through a variety of delivery channels and through its group companies.

ICICI Bank has a network of 5,267 branches and 14,655 ATMs at December 31, 2020.

Investment Rationale

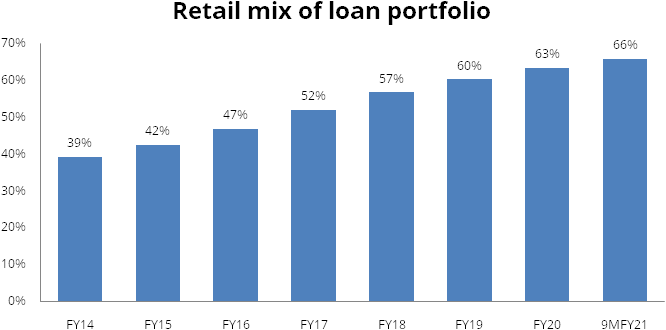

Strong and resilient retail banking portfolio – major growth driver

ICICI bank’s retail portfolio has been a major growth driver, which constitute

65.6% of outstanding advances as on 31st December 2020. Focus on retail loans led

to increased in its share as a % of total mix from 39% in 2014 to 63% in March 2020.

The household credit to GDP ratio stands at 12% for India v/s 68% for the US and

61% for China, which shows multi-decade opportunity size. Retail portfolio is largely

secured and built on proprietary data and analytics in addition to bureau checks

and well-priced in relation to risk. Retail portfolio constitutes mainly mortgage

loans (49%), auto loans (14%), business banking (7.6%), rural loans (14.7%), credit

cards (4%) and personal loans (10%). ICICI Bank has faced virtually no outages in

its digital platforms unlike its large peers that have recently faced regulatory

pressure. This is because the bank has made adequate investments in digital platforms,

leading to better customer wallet share.

Business Banking and SME - huge growth opportunity

SME portfolio includes borrowers with turnover less than Rs. 2.50 billion. Credit

opportunity for business banking stands at Rs. 12.5 trillion, which shows significant

growth opportunities. SME portfolio has grown consistently over the years and currently

constitutes ~3.9% of total advances as on 31st December 2020, from 3%

as on 30th June 2019, it has increased its overall portfolio weight by

~90bps in 6 quarters. The bank focuses on well diversified portfolio across sectors

and geographies along with parameter based lending, digital channels, granularity,

collateral and robust monitoring. Business banking and SME book has shown very robust

growth of 39.4% and 24.6% for Q3FY21 as compared to Q3 FY20, while QoQ book grew

by 12.4% and 16.1% respectively.

Rural Business – Reimagined focus

ICICI Bank rural business has become a focus area, given significant potential for

growth. The bank is targeting entire rural ecosystem on the back of its ‘phygital’

infrastructure. The bank has segmented the addressable opportunity into 6 micro-markets

i.e. agri, dealers, self-employed, institutions, corporates and micro entrepreneurs.

This diversification aids risk reduction as risk is uncontrollable due to the monsoons.

Rural economy presents strong opportunity; therefore bank is focused on building

unique solutions in this segment.

Corporate – focus on Return of Capital (portfolio quality) and Return on

Capital (earning quality)

In corporate banking, objective remains on maximizing risk calibrated core operating

profit through portfolio quality and earning quality. The bank focuses on granular

exposures and higher rated corporates and provides full suite of banking products

to corporate clients and their ecosystems. Pick-up in economic activity, growth

focused budget, push towards infrastructure spending, consolidation in corporate

credit market towards large lenders, and revival in capex cycle has renewed a sense

of optimism around the growth possibilities within the corporate banking space.

The bank’s corporate book showed strong resilient during covid and grew 6.5%

YoY and 8.1% QoQ for Q3FY21, it currently stands at Rs. 1.7 lakh crore, which is

24.3% of bank’s total loan portfolio.

Strong digital capabilities

ICICI Bank is using technology to accelerate growth across business verticals. The

management is focused to build a strong bank with best in class digital capabilities.

The bank has launched video KYC in June 2020, to onboard new savings account, salary

accounts, personal loans and credit cards. As on December 2020, ~41% of salary account

customers and ~46% of the credit card customers were onboarded using video KYC and

over 90% of savings account transactions are through digital channels which includes

internet banking, mobile banking, POS, touch banking, and debit cards.

Best in class Asset Quality

ICICI Bank has almost completed its clean-up process as reflected in gross NPA and

net NPA which have been consistently reducing year after year and quarter after

quarter, even after absorbing covid-19 shock. Gross NPA and net NPA stood at 8.84%

and 4.77% at 31st March 2018, which has drastically come down to 4.38%

and 0.63% respectively as at 31st December 2020. Provision coverage ratio

(PCR) on a proforma basis was 77.6% at December 31, 2020; in addition to PCR, the

bank holds additional provision buffer of ~Rs. 16,400 cr. (2.3%), of which ~Rs.

9,984 cr. is covid-19 related, these provision buffers will help in keeing credit

cost under check. Restructing was in control at ~Rs. 2,550 cr. (0.4% of loans) which

provides comfort on overall impact of covid-19.

Outlook & Valuation

ICICI Bank has built a strong and resilient retail banking portfolio with strong digital capabilities to provide customized cutting edge digital solutions, which is helping the bank gain market share across business segments. ICICI Bank resilience and strength is seen from the way bank managed covid related issues and is well prepared to face any future challenges with highest PCR among its peers, highest covid-19 related provisions and higher home loan portfolio. We expect credit cost to reduce from here with stable asset quality and high provisioning buffer. The stock trades at valuation of 2.7x FY22E and 2.4x FY23E P/ABV. We initiate on ICICI Bank with a BUY rating with a SOTP based target price of Rs.730, valuing core banking business at Rs.618 (2.4x P/ABV FY23E) and rest for the subsidiaries.

Consolidated Financial Statements

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Net Interest Income (NII) | 23026.00 | 27015.00 | 33267.00 | 38408.00 | 42028.00 | 46014.00 |

| Total Income | 40446.00 | 41527.00 | 49716.00 | 58110.00 | 62792.00 | 69378.00 |

| Pre-Provisioning Operating Profit (PPOP) | 24742.00 | 23438.00 | 28100.00 | 36601.00 | 39245.00 | 43708.00 |

| Profit after Tax (PAT) | 6778.00 | 3364.00 | 7930.00 | 16826.00 | 22016.00 | 24520.00 |

| Earnings Per Share (EPS) | 10.50 | 5.20 | 12.10 | 24.40 | 31.90 | 35.50 |

| Average Book Value (ABV) (Rs) | 161.60 | 163.80 | 172.00 | 195.00 | 226.80 | 257.70 |

Investment Rationale

Strong and resilient retail banking portfolio – major growth driver

ICICI bank’s retail portfolio has been a major growth driver, which constitute

65.6% of outstanding advances as on 31st December 2020. Focus on retail

loans led to increased in its share as a % of total mix from 39% in 2014 to 63%

in March 2020.

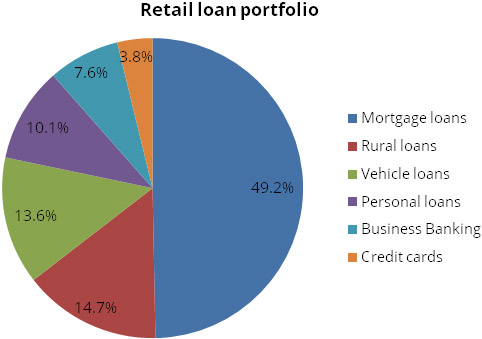

The household credit to GDP ratio stands at 12% for India v/s 68% for the US and 61% for China, which shows multi-decade opportunity size. Retail portfolio is largely secured and built on proprietary data and analytics in addition to bureau checks and well-priced in relation to risk.

Retail portfolio constitutes mainly mortgage loans (49%), auto loans (14%), business banking (7.6%), rural loans (14.7%), credit cards (4%) and personal loans (10%). Total mortgage portfolio includes home loans at 70%, top up loans given to existing home loan customers at 6%, office premises loans at 5% and loan against property at 19%. ICICI Bank has reported best mortgage disbursements in recent months, driven by digitization of entire underwriting process with instant loan approvals and expansion of footprint outside tier1 cities. All other segments have reported strong growth in Q3FY21, in most of the segments; growth has surpassed pre-covid levels.

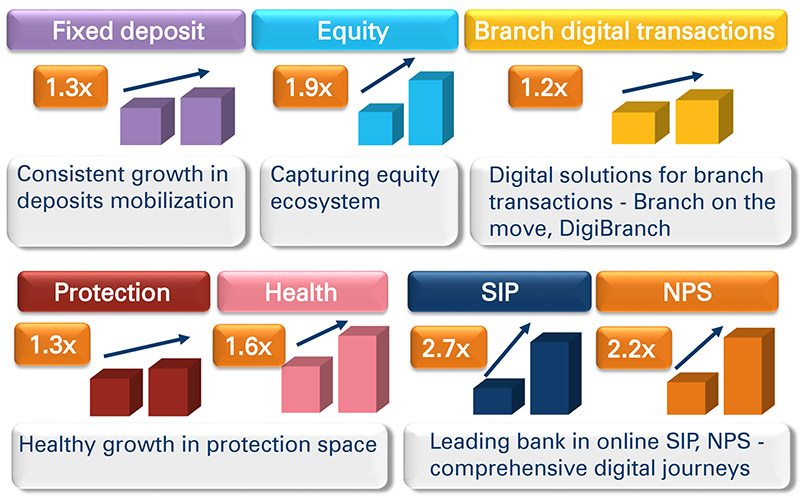

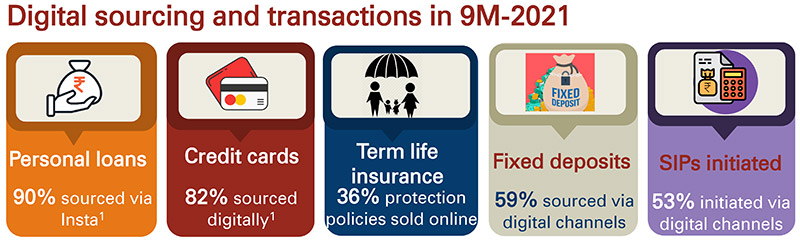

After covid-19, digital adoption has increased and ICICI Bank with its full digital stack has been able to service and onboard new customers digitally. The share of digital origination at the bank has increased significantly. Digital transactions too have increased significantly, surpassing pre-COVID-19 levels. The volume of mobile banking transactions increased by 59.5% YoY in Q3 FY21. The bank has recently launched products like WhatsApp banking and has expanded its mobile banking app iMobile to non-ICICI Bank customer. The bank received very encouraging response from non-ICICI Bank customers with ~0.5 mn activations since its launch just 3 months back.

Source: Company Presentation, Stockaxis Research

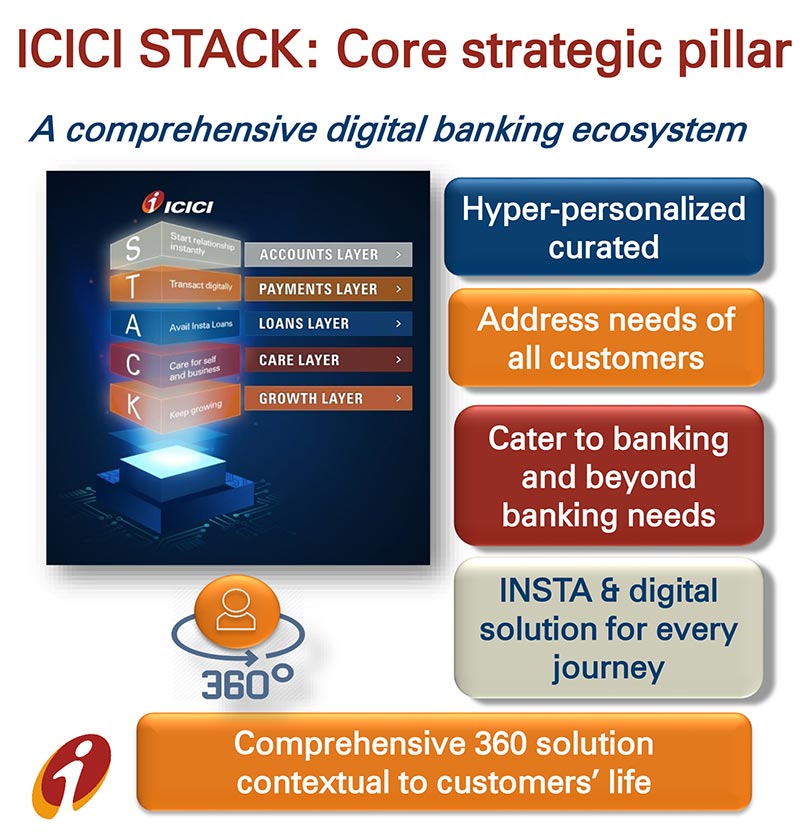

ICICI Bank has faced virtually no outages in its digital platforms unlike its large peers that have recently faced regulatory pressure. This is because the bank has made adequate investments in digital platforms, leading to better customer wallet share. The bank has introduced ICICI STACK, a comprehensive strategy, as a core strategic pillar. The bank plans to use digital tools such as Customer 360 degree view/ iGenome for customer profiling, cross-selling products and services across the customer life cycle, thereby reducing cost of customer acquisition and improving profitability.

Source: Company Presentation, Stockaxis Research

ICICI Bank focuses on providing the right & full bouquet of product offering such as Equity, SIP, Protection, PPF, NPS, etc and enabling opportunities for cross-selling. The focus on retail will help to create a low-cost deposit franchise. Overall, the bank’s focus is on building a retail franchise with a strong digital edge.

Source: Company Presentation, Stockaxis Research

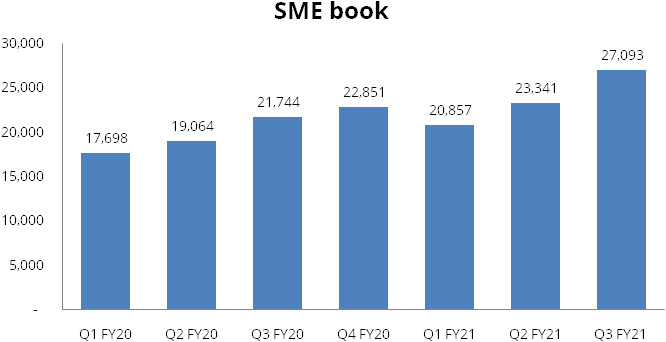

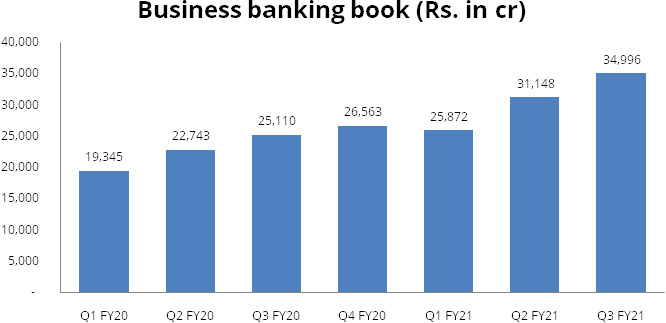

Business Banking and SME - huge growth opportunity

SME portfolio includes borrowers with turnover less than Rs. 2.50 billion. Credit

opportunity for business banking stands at Rs. 12.5 trillion, which shows significant

growth opportunities. SME portfolio has grown consistently over the years and currently

constitutes ~3.9% of total advances as on 31st December 2020, from 3%

as on 30th June 2019, it has increased its overall portfolio weight by

~90bps in 6 quarters. The bank focuses on well diversified portfolio across sectors

and geographies along with parameter based lending, digital channels, granularity,

collateral and robust monitoring. Primary collateral in the business banking portfolio

in the form of charge on current assets and backed by self-occupied residential

or commercial or industrial property. Over 90% of business banking book is fully

collateralized with a collateral cover of >100%.

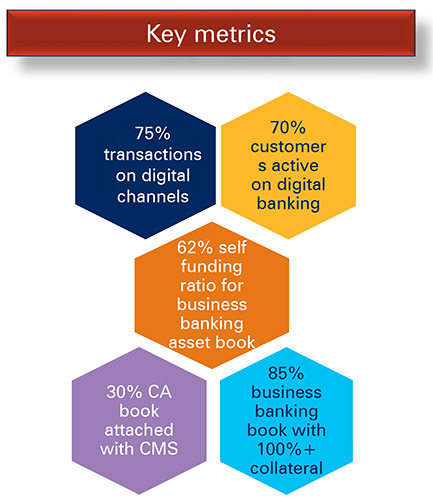

Business banking and SME customers have become far more digitzed than ever before. The bank launched BIZCIRCLE a networking app, which is AI powered platform to digitize, connect and serve SMEs. 75% of transactions are on digital channels, with 70% of customers active on digital banking. Business banking book has 62% self-funding ratio and 85% of the Business banking book has collateral of 100%.

Source: Company Presentation, Stockaxis Research

Business banking and SME book has shown very robust growth of 39.4% and 24.6% for Q3FY21 as compared to Q3 FY20, while QoQ book grew by 12.4% and 16.1% respectively.

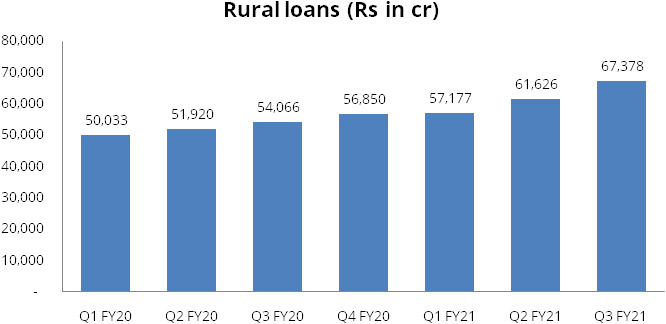

Rural Business – Reimagined focus

ICICI Bank rural business has become a focus area, given significant potential for

growth. The bank is targeting entire rural ecosystem on the back of its ‘phygital’

infrastructure. The bank has segmented the addressable opportunity into 6 micro-markets

i.e. agri, dealers, self-employed, institutions, corporates and micro entrepreneurs.

This diversification aids risk reduction as risk is uncontrollable due to the monsoons.

This portfolio stands at Rs 67,378 cr. as at 31st December 2020, which is 10.3%

of domestic loan book and 14.7% of retail loan book. Rural portfolio is diversified

across 26 states and is 96% secured backed by liquid asset like gold, FD, agri commodity.

Gold loans and kisan credit cards comprise 3% each of the total loan book; overall

the book has grown 1.8x over the last 3 years by catering to almost 19.5mn customers

of which 15mn are under-banked. Rural economy presents strong opportunity; therefore

bank is focused on building unique solutions in this segment.

Corporate – focus on Return of Capital (portfolio quality) and Return on

Capital (earning quality)

In corporate banking, objective remains on maximizing risk calibrated core operating

profit through portfolio quality and earning quality. The bank focuses on granular

exposures and higher rated corporates and provides full suite of banking products

to corporate clients and their ecosystems.

Pick-up in economic activity, growth focused budget, push towards infrastructure spending, consolidation in corporate credit market towards large lenders, and revival in capex cycle has renewed a sense of optimism around the growth possibilities within the corporate banking space. The bank’s corporate book showed strong resilient during covid and grew 6.5% YoY and 8.1% QoQ for Q3FY21, it currently stands at Rs. 1.7 lakh crore, which is 24.3% of bank’s total loan portfolio. ICICI Bank corporate book growth has been subdued and lagged its large peers. Slow growth is because of the bank’s conscious effort to reduce exposure to certain sectors like power, construction etc. Power sector exposure as a % of the banks total exposure came down from 5.1% during March 2017 to 2.6% in December 2020.

Risk calibrated approach has led to substantial improvement in portfolio quality which is visble from reduction in gross additions to corporate NPAs from Rs. 2473 cr. in Q3FY20 and Rs. 1268 cr. in Q2FY21 to Rs. 77 cr. in Q3 FY21, while BB and below book saw a huge decline from 9.2% as at 31st March 2017 to 1.6% as at 31st December 2020, similarly A- and above book witnessed huge upside from 56.2% as at 31st March 2017 to 72% as at 31st December 2020. This has helped in reducing concentration risk, as exposure to top 10 groups as a % of total exposure reduced from 16.8% at 31st March 2017 to 12.2% at 31st December 2020.

Strong digital capabilities

ICICI Bank is using technology to accelerate growth across business verticals. The

management is focused to build a strong bank with best in class digital capabilities.

The bank has launched video KYC in June 2020, to onboard new savings account, salary

accounts, personal loans and credit cards. As on December 2020, ~41% of salary account

customers and ~46% of the credit card customers were onboarded using video KYC and

over 90% of savings account transactions are through digital channels which includes

internet banking, mobile banking, POS, touch banking, and debit cards.

Source: Company Presentation, Stockaxis Research

ICICI Bank has launched BizPay360, a smart bulk payment solution on corporate internet banking. It provides instant digital activation, one click single & multiple payments, detailed reports, planning for future payments etc.

Source: Company Presentation, Stockaxis Research

ICICI bank has recently launched ‘Infinite India’ an online platform for foreign companies setting up operations in India. The platform provides quick and easy incorporation and integrated banking operations.

Source: Company Presentation, Stockaxis Research

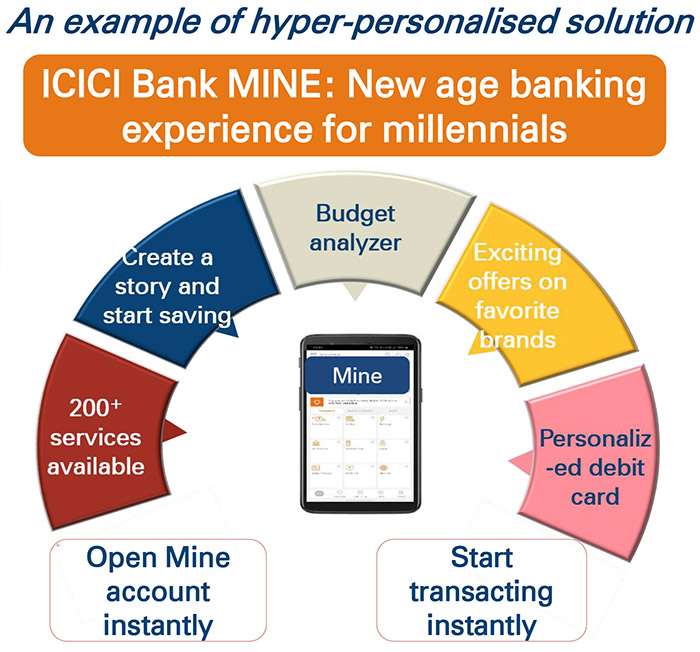

ICICI bank has launched ‘ICICI Bank MINE’ a new-age banking experience for millennials with 200+ banking and informational services for daily banking and investments right from the smartphone. It’s a personalised experience where customer can set their own options and limits on debit card with personalised debit card image and recommendation on offers and much more.

Source: Company Presentation, Stockaxis Research

The Bank incroduced a facility called ‘ICICI Bank Cardless EMI’ which enables pre-approved customers to buy their favourite gadgets or home appliances using their mobile phone and Permanent Account Number (PAN) instead of physical wallet or cards.

All the above digital intiatives showed results as Digital channels like internet, mobile banking, PoS and others accounted for over 90% of the savings account transactions in 9M-2021.

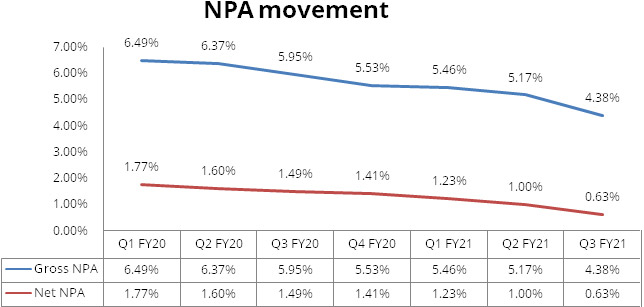

Best in class Asset Quality

ICICI Bank has almost completed its clean-up process as reflected in gross NPA and

net NPA which have been consistently reducing year after year and quarter after

quarter, even after absorbing covid-19 shock. Gross NPA and net NPA stood at 8.84%

and 4.77% at 31st March 2018, which has drastically come down to 4.38%

and 0.63% respectively as at 31st December 2020.

Improving asset quality is also visible from improving rating profile of overall loan book. Rating profile wise A- and above book stood at 56.2% as at 31st March 2017, which has increased to 72% at 31st December 2020. The improvement has been consistent year after year. Similarly, BB and below book saw substantial improvement from 9.2% at 31st March 2017 to 1.6% at 31st December 2020.

Rating profile of total loan book

| Rating category | Mar 31, 2017 | Mar 31, 2018 | Mar 31, 2019 | Mar 31, 2020 | Sep 30, 2020 | Dec 31, 2020 |

|---|---|---|---|---|---|---|

| AA- and above | 37.2% | 42.4% | 45.1% | 44.4% | 47.3% | 49.2% |

| A+, A, A- | 19.0% | 20.1% | 22.0% | 25.8% | 24.3% | 22.8% |

| A- and above | 56.2% | 62.5% | 67.1% | 70.2% | 71.6% | 72.0% |

| BBB+,BBB, BBB- | 28.7% | 27.5% | 28.2% | 26.6% | 25.6% | 24.3% |

| BB and below | 9.2% | 4.0% | 2.2% | 1.4% | 1.5% | 1.6% |

| Non-performing loans | 5.4% | 5.4% | 2.3% | 1.5% | 1.1% | 1.9% |

| Unrated | 0.5% | 0.6% | 0.2% | 0.3% | 0.2% | 0.2% |

| Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

ICICI Bank’s Q3FY21 results witnessed best in class asset quality with net NPA ratio was 0.63% at December 31, 2020; on a proforma basis, including loans not classified as non-performing pursuant to the Supreme Court’s interim order and contingency provisions for the same, the net NPA ratio would have been 1.26% compared to 1.12% at September 30, 2020 and 1.41% at March 31, 2020. Provision coverage ratio (PCR) on a proforma basis was 77.6% at December 31, 2020; in addition to PCR, the bank holds additional provision buffer of ~Rs. 16,400 cr. (2.3%), of which ~Rs. 9,984 cr. is covid-19 related, these provision buffers will help in keeing credit cost under check.

Restructing was in control at ~Rs. 2,550 cr. (0.4% of loans) which provides comfort on overall impact of covid-19. The bank is carrying provisions of ~Rs. 385 cr. on the same.

The bank has adopted conservative aproach towards it provisioning policy to prevent balance sheet from any future shock. During Q3FY21, the Bank has changed its provisioning policy on non-performing assets to make it more conservative. The contingency provision made on a prudent basis for loans overdue for more than 90 days at December 31, 2020 but not classified as non-performing pursuant to the Supreme Court’s interim order, also reflects the revised policy. The change in policy resulted in higher provision on advances amounting to Rs. 2,096 crore during Q3FY21 for aligning provisions on the outstanding loans to the revised policy.

Subsidiaries gaining momentom

ICICI group is the fastest growing financial service conglomerate in the country.

ICICI group has strong presence across entire financial service spectrum including

Life Insurance, General Insurance, Broking, Asset management.

ICICI Lombard General Insurance

ICICI Lombard General Insurance is the 5th largest player in the general insurance

sector in India as on March 31, 2020 (Source: GI Council Report) and a leader among

private general insurers. It offers a range of products across non-life/general

categories, including motor, health, crop/weather, fire, personal accident, marine,

engineering and liability insurance, through multiple distribution channels.

ICICI Lombard reported strong 9MFY21 results where GDPI growth and combined ratio was much better than industry. Management is rightly focused on sustained profitability, prudent risk management and multi-channel distribution mix. We believe pandemic will lead to increased penetration of health insurance segment. ICICI Lombard is currently trading at 36x / 31x FY22E / FY23E earnings.

ICICI Prudential Life Insurance

ICICI Prudential Life has consistently been amongst the top companies in the Indian

life insurance sector. In FY2015 ICICI Prudential Life became the first private

life insurer to attain assets under management of Rs. 1 trillion, while the AUM

as on 31st December 2020 stood at Rs. 2.1 trillion. The company offers long term

savings and protection products to meet different life stage requirements of the

customers. The company have developed and implemented various initiatives to provide

cost-effective products, superior quality services, consistent fund performance

and a hassle-free claim settlement experience to the customers.

We believe that the company has strong growth potential in protection business and annuity business, supported by improved persistency, reduction in cost and robust solvency ratio. Covid-19 has improved the need for protection and provided growth opportunities in the medium to long term. Currently, the stock is trading at 1.9x FY23E embedded value.

ICICI Securities

ICICI Securities (I-Sec) is India's leading retail led equity franchise, distributor

of financial products, and investment banker. I-Sec is a technology-based firm offering

a wide range of financial services including institutional broking, retail broking,

investment banking, private wealth management, and financial product distribution.

I-Sec operates www.icicidirect.com, India's leading virtual financial supermarket,

meeting the three need sets of its clients- investments, protection, and borrowing.

Through its three lines of businesses - broking, distribution of financial products,

and investment banking, I-Sec serves customers ranging from the retail and institutional

investors, corporate, high net-worth individuals and government.

ICICI securities delivered strong 9MFY21 led by growth in retail equities. With strong rally in equity markets, higher ADTVs & market volatility, higher market share across equity segment and increased demand for insurance products, we expect robust growth in earnings to continue. We like the business model as there is low credit risk with almost zero inventories. Currently, stock is trading at 11.3x / 10.3x FY22 / FY23 E earnings.

ICICI Prudential Asset Management

ICICI Prudential Asset Management Company Ltd. is a leading asset management company

in the country focused on bridging the gap between saving & investments and

creating long term wealth for investors through a range of simple and relevant investment

solutions. ICICI Pru AMC is one of India’s largest and most profitable mutual

fund houses with ~Rs. 4 trillion in assets under management.

Financials

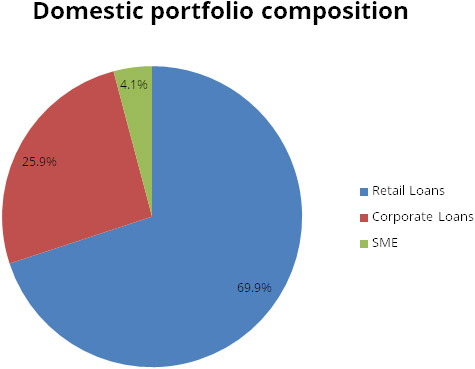

Diversified and granular loan book

Domestic loan book comprises of 88.6% of total consolidated advances, while balance

11.4% is international book as on 31st December 2020. Management have

decided to exit exposures that are not linked to India in a planned manner.

Domestic book comprises ~70% of retail loans, while coporate loan is at ~26%. Corporate loans include SME borrowers with turnover of Rs. 2.50 billion and above. SME book stands at ~4% and it includes borrowers with turnover less than Rs. 2.50 billion.

Retail loans are diversified across mortgage loans, vehicle loans, rural loans, personal loans, and credit cards etc. Mortgage loans have highest weightage at ~49%, followed by rural loans at ~15%.

Strong capital position

The Bank’s total capital adequacy at December 31, 2020, including profits

for 9M-2021, was 19.51% and Tier-1 capital adequacy was 18.12% compared to the minimum

regulatory requirements of 11.08% and 9.08% respectively.

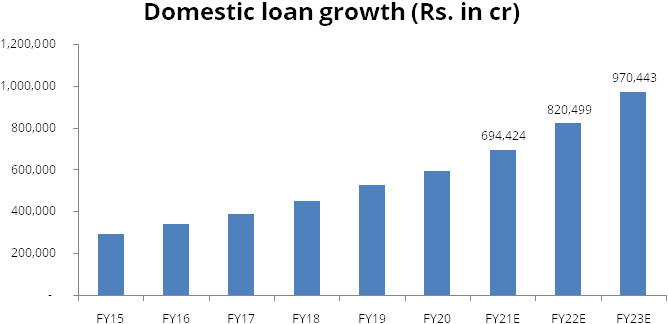

Robust growth in domestic advances

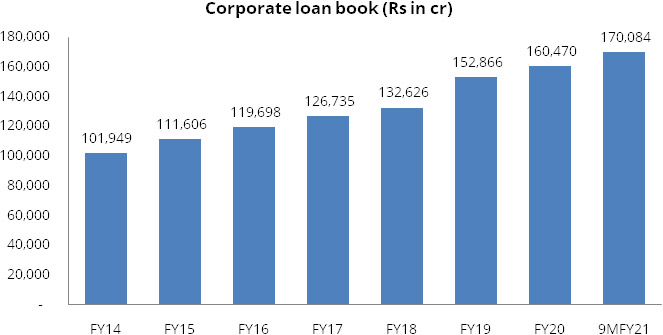

Domestic loan book has grown at 15% CAGR from FY15-20, led by growth in retail as

retail loan book grew at 19.9% CAGR whereas corporate loan book grew at 7.5% CAGR

between FY15-20. We believe corporate book clean up is complete and management is

focusing on growth, which is visble from strong sequencial growth of 8% in Q3FY21,

led by increase in exposure to PSUs and highly rated entities. We expect retail

book to continue its growth momentum and corporate book to start gaining pace. We

expect retail and corporate book to grow at 19.7% and 11.8% CAGR from FY20-23E.

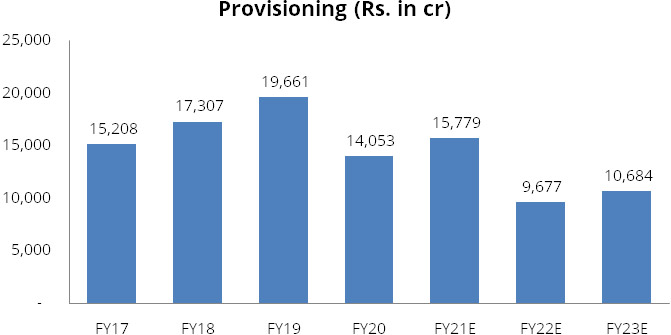

Credit costs to normalise from FY22

Conservative provisioning (PCR at 77% including pro-forma NPAs), excess provisions

in hand over and above regulatory requirement, and minimal restructuring requirement

at 0.4% of loan book makes us believe that worst is behind with respect to slippages.

Management has guided that credit cost to normalise and provision to restrict upto

25% of pre-provisioning operating profit.

Healthy funding profile

ICICI Bank has maintained healthy funding profile led by growth in CASA and term

deposits. We believe big banks like ICICI Bank are going to capture CASA market

share as after what happened with Yes Bank, Lakshmi Villas Bank and other co-operative

banks where RBI had cancelled their liscence (Karad Janata Sahakari Bank and Vasantdada

Nagari Sahakari Bank). We believe big banks are set to become even stronger, with

ongoing consolidation happening in banking industry.

ICICI Bank’s average CASA ratio for Q3FY21 stands at 41.8%. The bank witnessed 26.5% y-o-y growth in average CA and 15.9% y-o-y growth in average SA in Q3FY21. Costs of deposits have drastically come down from 4.92% in Q3FY20, 4.22% in Q2FY21 to 3.97% in Q3FY21.

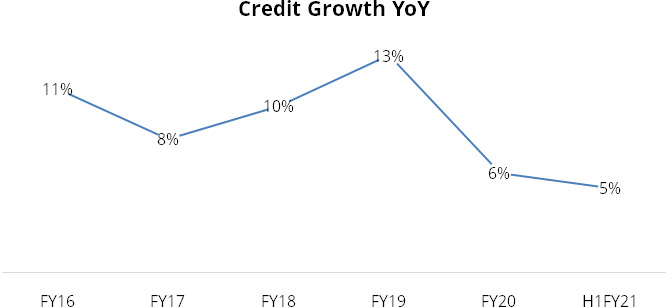

Industry

In FY20, banks’ credit registered a slowest growth of 6% in a decade on account of subdued economic activity, deleveraging of corporate balance sheets and muted business sentiment. Further, risk aversion amongst the banks due to all-time high NPAs in the system has restricted the flow of credit in the system.

Source: RBI

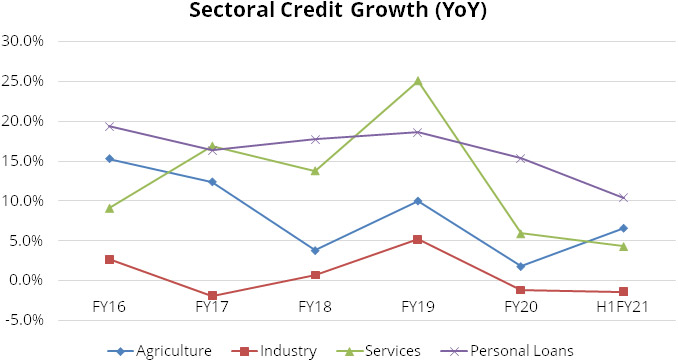

The slowing down in credit growth during FY20 and H1FY21 was spread across sectors but was pronounced in the case of service and industry on account of a subdued business environment and partly reflecting elevated levels of sectoral NPAs.The credit growth in industry and services sector is expected to remain subdued in FY21. On the other hand, due to good monsoon, strong demand and less effect of the pandemic, credit growth in the agricultural sector will remain in a bright spot. Further, the retail side of the business has seen an aggressive growth compared to industry and service loans. However, due to disruptions caused by covid-19 pandemic and subsequent effect in job losses and pay cuts even retail could witness subdued credit demand.

Source: RBI

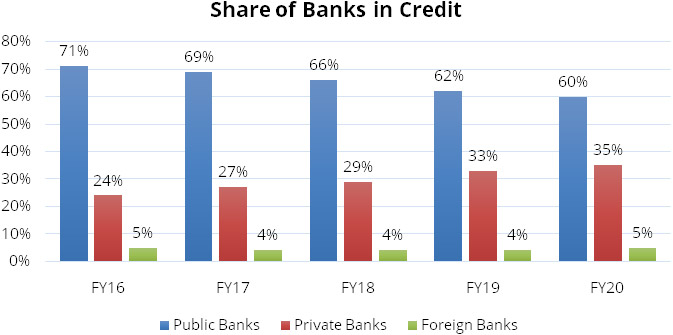

Over the years, the share of private banks in the overall outstanding credit has witnessed a sharp increase on account of clean-up of bad assets along with low capitalization levels in PSBs, which resulted in cautious lending as well as halt in lending by by some PSBs that have been put under a prompt corrective action framework. It is expected that the growth momentum of private lending to continue going forward.

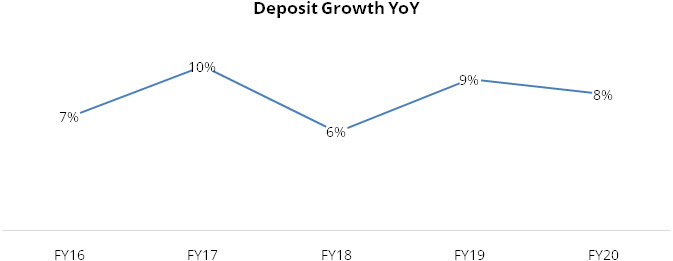

In FY17, the country witnessed a sudden surge in deposits due to demonetization and therefore due to higher base effect, FY18 witnessed a lower growth of 6.1%. Further, deposit growth in FY20 struggled due to overall slowdown in the economy. Currency with public surged due to Covid-19 induced dash for cash while solvency issues related to a private sector bank also brought about some reassignment of deposits.

Source: RBI

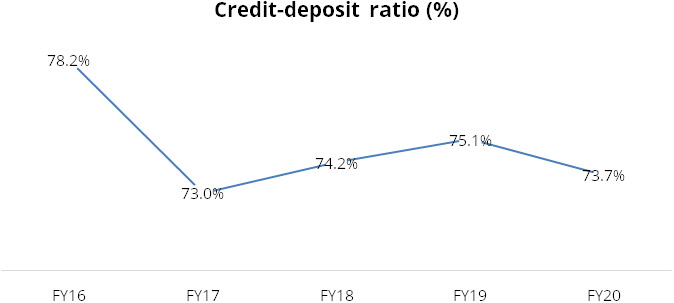

The increasing Credit-deposit ratio till FY19 was due to faster growth of credit compared to growth in deposits, therefore putting pressure on banks resources for lending. However, credit growth has taken a hit in recent times and is expected to remain subdued in FY21, thereby a declining the credit-deposit ratio.

Source: RBI

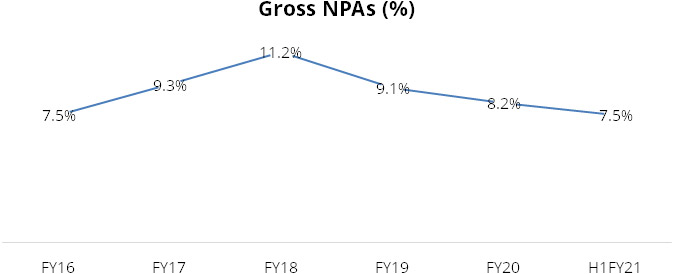

FY18 saw a peak in Gross NPAs and after that, there was a moderation which continued till H1F21; the improvement was on the back of lower slippagesdeclining to 0.74% in September 2020 and resolution of a few large accounts through the Insolvency and Bankruptcy Code. As per IRAC norms, the accretion to NPAs would have been higher in the absence of the asset quality standstill provided as a Covid-19 relief measure. Going forward, due to uncertainties induced by the pandemic and its impact on real economic, the asset quality may deteriorate sharply. The RBI’s financial stability reported of December 2020, suggests that GNPAs may rise sharply by September 2021 to 13.5% in a baseline scenario and to 14.8% under severe stress scenario.

Source: RBI

Under Basel III guidelines, banks have to maintain capital adequacy ratios above the minimum regulatory requirement. To achieve this requirement, a timeframe was set for the period of 5 years from March 2015 to March 2019.However, as of September 2020, the regulator has extended this deadline twice to achieve completion. The first extension was by a year from March 2019 to March 2020 and the second extension was due to the current Covid-19 pandemic situation so as to achieve the completion of the regulatory capital adequacy requirement. While most private banks have maintained their capital adequacy ratios with adequate buffer capital above the requirement, PSBs have remained vulnerable to maintain capital adequacy ratios with supportive buffers.

In Value terms, large value credit transfers (RTGS) aredominating the overall digital payments landscape over the years and in FY20it accounts for 80.8% of the total value of digital transactions. However, in volume terms, credit transfers via multiple channels such as the UPI, NEFT and IMPS were the leaders. In case of card payments, the value of debit card transactions registered a growth of 35.6% compared to 21.1% for credit cards.During the pandemic, the social distancing requirements has led to the digital mode of transactions being preferred over cash. The trajectory of growth in UPI-based transactions as well as overall retail digital transactions has been impressive both in value and volume terms.

Peer comparison

HDFC Bank is the best bank in terms of growth, asset quality, return ratios etc. and the same is reflected in its valuation. We belive ICICI Bank is next best placed to capture growth opportunities and improve asset quality, along with that there is high possiblity of multiple re-rating.

| Particulars | ICICI Bank | Kotak Mah. Bank | Axis Bank | HDFC Bank |

|---|---|---|---|---|

| Market Cap. (Rs. Crores) | 4,23,886.78 | 3,92,728.93 | 2,20,425.48 | 8,80,123.57 |

| P/BV | 2.79 | 4.81 | 2.23 | 4.51 |

| Return on Equity | 14.6% | 13.7% | 4.9% | 18.4% |

| Return on Assets | 1.7% | 2.4% | 0.5% | 1.9% |

| Opearting Profit Margin | 60.0% | 61.5% | 59.0% | 63.2% |

| Revenue Growth (5 Years) | 9.1% | 20.2% | 12.3% | 19.3% |

| Profit Growth (5 Years) | -4.8% | 23.1% | -24.3% | 20.6% |

| Revenue Growth (3 Years) | 11.7% | 14.5% | 12.2% | 18.6% |

| Profit Growth (3 Years) | -2.1% | 20.3% | -22.3% | 21.3% |

| Advances 5 Year CAGR | 10.00% | 23.03% | 15.42% | 22.17% |

| Advances 3 Year CAGR | 11.08% | 14.35% | 15.21% | 21.25% |

| Net Interest Income | 72.9% | 72.9% | 70.9% | 72.1% |

| Net Interest Margin | 3.7% | 4.5% | 3.6% | 4.2% |

| Cost to Income Ratio | 40.5% | 38.5% | 41.0% | 37.9% |

| CASA Ratio | 41.8% | 58.9% | 42.0% | 43.0% |

| Gross NPA | 4.38% | 2.26% | 3.44% | 0.80% |

| Net NPA | 0.63% | 0.50% | 0.74% | 0.10% |

| Provision Coverage Ratio | 86.0% | 78.4% | 75.0% | 88.0% |

| Capital Adaquecy Ratio | 19.5% | 23.6% | 19.3% | 18.9% |

| No. of Branches | 5,267 | 1,603 | 4,586 | 5,416 |

In below table, we can see that ICICI bank has underperformed other banks with respect to growth in advances, mainly because of sluggishness in corporate loans. We believe that this will change with focus on growth, system and processes in place, stable management and clean up almost done.

| Advances (Rs. Cr.) | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 5 Yr-CAGR | 3 Yr-CAGR |

|---|---|---|---|---|---|---|---|---|

| ICICI Bank | 4,38,490 | 4,93,729 | 5,15,317 | 5,66,854 | 6,46,962 | 7,06,246 | 10.00% | 11.08% |

| HDFC Bank | 3,83,408 | 4,87,290 | 5,85,481 | 7,00,034 | 8,69,223 | 10,43,671 | 22.17% | 21.25% |

| Kotak Bank | 88,632 | 1,44,793 | 1,67,125 | 2,05,997 | 2,43,462 | 2,49,879 | 23.03% | 14.35% |

| Axis Bank | 2,84,449 | 3,44,663 | 3,81,165 | 4,49,844 | 5,06,656 | 5,82,959 | 15.43% | 15.21% |

Risks & Concerns

- Interest rate risk - With increase in interest rates there can be pressure on CASA and thereby on NIMs.

- Deterioration in Asset quality – any disruption in retail or corporate portfolio can result in lower balance sheet growth and higher than estimated slippages.

- High risk customers – bank has exposure to high risk sectors and customers like power sector, contruction sector etc. The bank also has strong presence in rural India, which is dependant on monsoon.

Outlook & valuation

ICICI Bank has built a strong and resilient retail banking portfolio with strong digital capabilities to provide customized cutting edge digital solutions, which is helping the bank gain market share across business segments. ICICI Bank resilience and strength is seen from the way bank managed covid related issues and is well prepared to face any future challenges with highest PCR among its peers, highest covid-19 related provisions and higher home loan portfolio. We expect credit cost to reduce from here with stable asset quality and high provisioning buffer. Further, strong liability franchise and consolidation in banking industry will help the bank to gain market share. The management continues to highlight its clear focus on maximising risk-optimised core operating profit growth. We expect RoA / RoE to improve to 1.7% / 13.8% for FY23E from 0.8% / 7.1% in FY20.

The stock trades at valuation of 2.7x FY22E and 2.4x FY23E P/ABV. We initiate on ICICI Bank with a BUY rating with a SOTP based target price of Rs.730, valuing core banking business at Rs.618 (2.4x P/ABV FY23E) and rest for the subsidiaries.

| Particulars | Rationale | Stake % | Value per share (Rs.) |

|---|---|---|---|

| ICICI Bank | 2.4x FY23 ABV | 100% | 618 |

| ICICI Pru Life Insurance | Market cap | 51% | 52 |

| ICICI Lombard General Insurance | Market cap | 52% | 51 |

| ICICI Pru AMC | 5% of FY23E AAUM | 51% | 18 |

| ICICI Securities | Market cap | 75% | 15 |

| ICICI Bank UK | 0.5x FY20 net worth | 100% | 3 |

| ICICI Bank Canada | 0.5x FY20 net worth | 100% | 3 |

| ICICI Securities Primary Dealership | 10x FY23E PAT | 100% | 6 |

| Total value of subsidiaries | 148 | ||

| Less: 25% holding co. discount | 37 | ||

| Value of subs. (post hold. co. disc.) | 111 | ||

| Target Price | 730 |

Financial Statement

Profit & Loss statement

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Interest Earned | 54966.00 | 63401.00 | 74798.00 | 78855.00 | 83015.00 | 91390.00 |

| Interest Expended | 31940.00 | 36386.00 | 41531.00 | 40447.00 | 40987.00 | 45376.00 |

| Net Interest Income | 23026.00 | 27015.00 | 33267.00 | 38408.00 | 42028.00 | 46014.00 |

| Other Income | 17420.00 | 14512.00 | 16449.00 | 19702.00 | 20764.00 | 23364.00 |

| Total Income | 40446.00 | 41527.00 | 49716.00 | 58110.00 | 62792.00 | 69378.00 |

| Employee Expense | 5914.00 | 6808.00 | 8271.00 | 8092.00 | 8577.00 | 9006.00 |

| Other Operating Expense | 9790.00 | 11281.00 | 13344.00 | 13418.00 | 14970.00 | 16664.00 |

| Total Operating Expense | 15704.00 | 18089.00 | 21615.00 | 21510.00 | 23547.00 | 25670.00 |

| Pre-Provisioning Operating Profit | 24742.00 | 23438.00 | 28100.00 | 36601.00 | 39245.00 | 43708.00 |

| Provisions | 17307.00 | 19661.00 | 14053.00 | 15779.00 | 9811.00 | 10927.00 |

| Profit before Tax | 7435.00 | 3777.00 | 14047.00 | 20822.00 | 29434.00 | 32781.00 |

| Tax | 657.00 | 413.00 | 6117.00 | 3995.00 | 7417.00 | 8261.00 |

| Profit after Tax | 6778.00 | 3364.00 | 7930.00 | 16826.00 | 22016.00 | 24520.00 |

| Earnings Per Share (EPS) | 10.00 | 5.00 | 12.00 | 24.00 | 32.00 | 36.00 |

Balance Sheet

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Share Capital | 1286.00 | 1289.00 | 1295.00 | 1381.00 | 1381.00 | 1381.00 |

| Reserves | 103873.00 | 107080.00 | 115211.00 | 146424.00 | 166714.00 | 189163.00 |

| Shareholders Fund | 105159.00 | 108369.00 | 116505.00 | 147805.00 | 168095.00 | 190544.00 |

| Deposits | 560975.00 | 652920.00 | 770969.00 | 909321.00 | 1045720.00 | 1202578.00 |

| Borrowings | 182859.00 | 165320.00 | 162897.00 | 100447.00 | 90403.00 | 81362.00 |

| Other Liabilities and Provisions | 30196.00 | 37851.00 | 47995.00 | 70880.00 | 76700.00 | 88260.00 |

| Total Liabilities | 879189.00 | 964460.00 | 1098366.00 | 1228453.00 | 1380917.00 | 1562744.00 |

| Fixed Assers | 7904.00 | 7931.00 | 8410.00 | 8747.00 | 9184.00 | 9735.00 |

| Advances | 512395.00 | 586647.00 | 645291.00 | 736624.00 | 860588.00 | 1008528.00 |

| Investments | 202994.00 | 207733.00 | 249531.00 | 269755.00 | 253570.00 | 240892.00 |

| Cash & Bank Balance | 84169.00 | 80296.00 | 119156.00 | 135935.00 | 173339.00 | 209825.00 |

| Other Assets | 71727.00 | 81852.00 | 75978.00 | 77393.00 | 84236.00 | 93765.00 |

| Total Assets | 879189.00 | 964460.00 | 1098366.00 | 1228453.00 | 1380917.00 | 1562744.00 |

Key Ratios

| Particulars (Rs. in cr.) | FY18 | FY19 | FY20 | FY21E | FY22E | FY23E |

|---|---|---|---|---|---|---|

| Earnings Per Share (Rs) | 10.50 | 5.20 | 12.10 | 24.40 | 31.90 | 35.50 |

| Adj DPS (Rs) | 2.50 | 1.50 | 1.00 | 2.00 | 2.50 | 3.00 |

| Book Value (BV) (Rs) | 161.60 | 166.10 | 178.00 | 212.10 | 241.40 | 274.00 |

| Price / BV | 1.70 | 2.40 | 1.80 | 2.90 | 2.50 | 2.20 |

| Average Book Value (ABV) (Rs) | 161.60 | 163.80 | 172.00 | 195.00 | 226.80 | 257.70 |

| Price / ABV | 1.70 | 2.40 | 1.90 | 3.20 | 2.70 | 2.40 |

| NIIM (%) | 3.10% | 3.50% | 3.80% | 3.70% | 3.60% | 3.40% |

| ROA (%) | 0.80% | 0.40% | 0.80% | 1.40% | 1.70% | 1.70% |

| ROE (%) | 6.40% | 3.20% | 7.10% | 12.90% | 14.10% | 13.80% |

| Cost to Income Ratio | 38.80% | 43.60% | 43.50% | 37.00% | 37.50% | 37.00% |

| Total Debt/Equity(x) | 7.10 | 7.60 | 8.00 | 6.80 | 6.80 | 6.70 |

| GNPA (%) | 8.80% | 6.70% | 5.50% | 4.20% | 3.50% | 3.10% |

| NPA (%) | 4.80% | 2.10% | 1.40% | 0.60% | 0.50% | 0.40% |

| Cost of Funds | 4.60% | 4.70% | 4.70% | 4.20% | 3.80% | 3.80% |