Hawkins Cookers Ltd

Consumer Durables - Domestic Appliances

Stock Info

Shareholding Pattern

Price performance

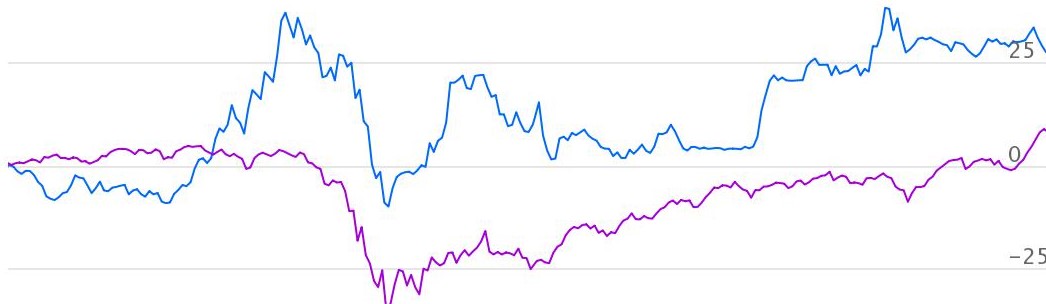

Indexed Stock Performance

Muhurat pick

Profile

Hawkins Cookers Ltd incorporated in 1959, operates in two segments i.e. Pressure

Cookers and Cookware. The pressure cookers are marketed under the flagship brand

Hawkins, Futura and Miss Mary; cookware is sold under the Futura brand. It offers

~73 different pressure cooker models in twelve different varieties.

Investment Rationale

Shift from unorganised to organised sector: The organized players like Hawkins Cookers

will grow faster compared to unorganized players owing to narrowing price gap, strong

brand positioning and superior quality of products.

Historically, Hawkins Cookers has outperformed TTK Prestige: Over the last 6-7 years, Hawkin cookers has continuously outperformed market leader TTK Prestige in terms of sales growth mainly due to strong brand, higher ad spends, new product launches and wide distribution network.

Ujjwala Yojana Scheme: We believe the Ujjwala scheme is one of the factors that has helped in the growth of pressure cookers segment in the rural region as more rural consumers got access to LPG cylinder. Growing awareness and aspirations in the rural regions will contribute more growth.

Established Brand image and Distribution network: Hawkins is second largest branded player in the pressure cooker segment with strong brand equity in the domestic market. Hawkins has a PAN India distribution network with dealers across the country.

Outlook & Valuation

We believe Hawkins cookers will perform well on the back of government initiatives,

new product launches, strong brand name, wide distribution network, increased penetration

of cooking gas,. Currently Hawkins cookers trades at 33.1 X on the basis of FY22E

earnings.