Graphite India Ltd

Electrodes & Welding Equipment

Graphite India Ltd

Electrodes & Welding Equipment

Stock Info

Shareholding Pattern

Price performance

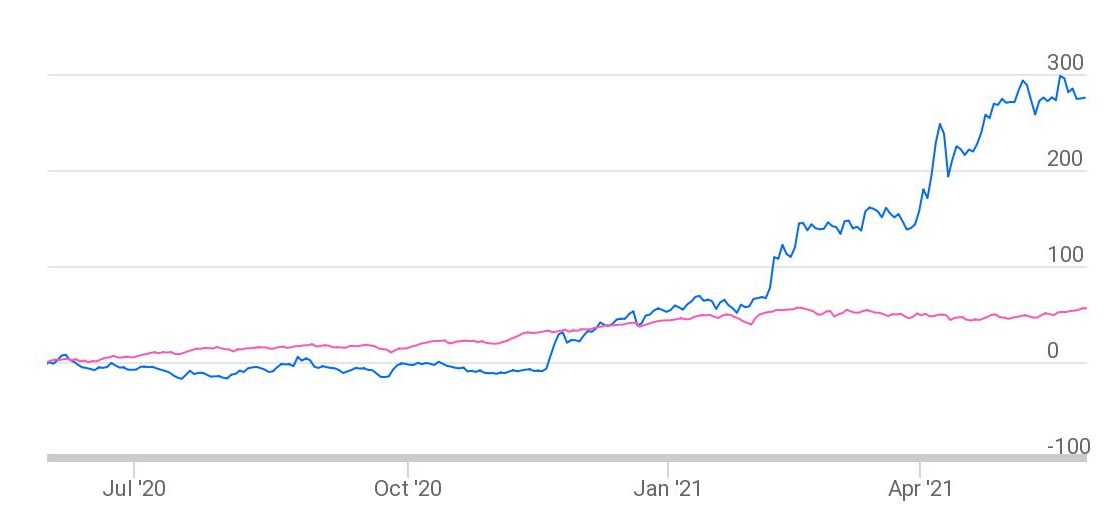

Indexed Stock Performance

Strong Demand for Steel to Benefit Graphite India

Company Profile

Graphite India is mainly engaged in the business of manufacturing and selling of

graphite electrodes, carbon, and other products. The company started graphite electrodes

(GE) production in1967 in a collaboration with Great lake Carbon Corporation, USA.

It has three manufacturing plants in India which are strategically placed in close

vicinity of steel mills & three main ports of India which enables them to transport

materials to the domestic & international clients easily. The company has manufacturing

capacity of 98,000 TPA & power generation of 33MV. Out of the total capacity,

ultra-high-power graphite electrodes constitute 80-85% and rest is high power.

Investment Rationale

Increase in Steel Prices to Benefits Graphite Electrode Sector

In line with global steel prices, domestic steel prices have witnessed strong traction

over the last 8-9 months, registering a healthy increase in the aforementioned period.

Currently, domestic hot rolled coil (HRC) prices (ex-Mumbai) are at Rs 57,500/tonne,

up 58% from July 2020 low of Rs 36,500/tonne. Healthy demand both on the global

as well as domestic front has aided steel prices to remain firm at higher levels.

The strength in steel prices both in the global and domestic market augurs well

for graphite electrode companies.

Graphite Electrodes Prices Started Increasing

Graphite electrodes are used in steel manufacturing via the Electric arc furnace

(EAF) route (~1.7-1.8kg of electrodes produce ~1 ton of steel). The uptick in steel

production has led to a pick-up in graphite electrodes demand. Going forward, steel

industry production growth trend is likely to continue with a healthy recovery in

major steel consuming industries like construction and automobiles. The domestic

steel industry is also poised to grow with the announcement of increased government

spending on infrastructure. The combination of these factors is expected to drive

demand for graphite electrodes and would also have a positive impact on graphite

electrode prices. Graphite electrode prices have already started to move northwards

auguring well for graphite electrode companies.

Opening of Scrap Imports in China a Way to Reduce Iron Ore Imports

Chinese government has lifted their ferrous scrap imports ban and is planning to

restart imports with some specific guidelines from the beginning of 2021 which would

improve economics for electric arc furnace resulting in demand for graphite electrodes.

China Carbon Neutrality Target has to Move the EAF Route

China’s crude steel capacity reached 1.21btpa in 2019, of which around 155mtpa

was electric arc furnace steelmaking capacity. Net crude steel capacity expansion

reached 42mtpa in the year, but is set to slow to 14mtpa in 2020. In CY20, china

has produced an estimated 108-110mn tonnes of steel through the electric arc furnace

(EAF), as it restricted scrap imports through a policy measure in 2019. Given China’s

objective to reduce CO2 emissions & be carbon neutral by 2050, the recent measures

announced by the government freeing scrap imports will result in enhanced electric

arc furnace (EAF) production, thereby reducing China’s dependence on iron

ore imports. China Metallurgical industry planning & Research institute expects

developing Electric arc furnace (EAFs), will become one of the key policy incentives

for the steel industry during the next 5-year period. Electric arc furnace steelmaking,

which consumes scrap steel is as an effective way to reduce emissions compared to

blast furnaces, which use iron ore & coking coal as raw materials.

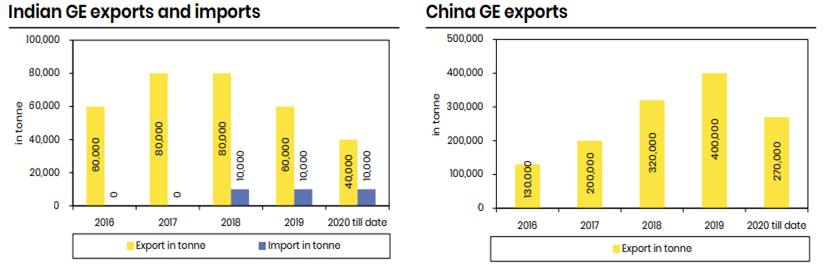

Ability & Opportunity to produce High Quality Graphite Electrodes

Needle coke is the raw material used for graphite electrodes production. Though

china has been ramping up its needle coke capacity, production technologies are

way behind the key suppliers in the trade. China’s low-quality electrodes

are sold at ~25-30% discount to domestic electrodes, despite import duty being scrapped

on graphite electrodes. We expect import of high-quality needle coke will restrict

a major increase in high quality Graphite electrodes production in China, and is

a key underpinning for the company, as they have the capacity to produce~83,000

tonne of ultra-high power graphite electrodes out of their total capacity of 98,000

tonne. Also due to the political tensions between India & China, the latter

has substantially reduced exporting High power grade electrodes to India. This will

help India induction-based furnaces to opt for domestic electrodes, thus providing

support to high power grade electrodes prices in India.

Source - Steelmint

Outlook & valuation

We are bullish on graphite India due to resurgence on Chinese scrap imports, increasing demand and price due to increases in steel demand. Currently the stock is trading at the EV/EBITDA of 5.5x on the basis of FY23E.

Technical

Price: GRAPHITE has gained 8.20% over last one month after finding bottom at Rs.535 made on 05 April 2021, which also ended medium term down trend, indicating its long-term secular uptrend has resumed after its cyclical correction. The stock has been significantly outperforming NIFTY over last month. We expect the stock to continue its outperformance in the coming weeks. The stock has bounced from the support level with increased volume which indicates the strength in the counter.

Indicator: The stock is trading above important moving average 21SMA, 50SMA & 200SMA on daily charts as well as weekly chart. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. RSI on daily chart is pegged at sub 67.32 levels, indicating the stock has not yet been over bought. Even the MACD line on weekly charts is in buy mode, indicating bullish momentum is likely to continue which supports to our bullish view on the stock.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. GRAPHITE stock has seen the increase in delivery volume, which shows the movement of this stock is on bullish side.

Conclusion: Considering all the above data facts, we recommend buying for medium term. Investor may go long on the stock around Rs.760 levels keeping a stop loss below Rs.675 for the targets of Rs.920 levels.