Emami Ltd

Household & Personal Products

Emami Ltd

Household & Personal Products

Stock Info

Shareholding Pattern

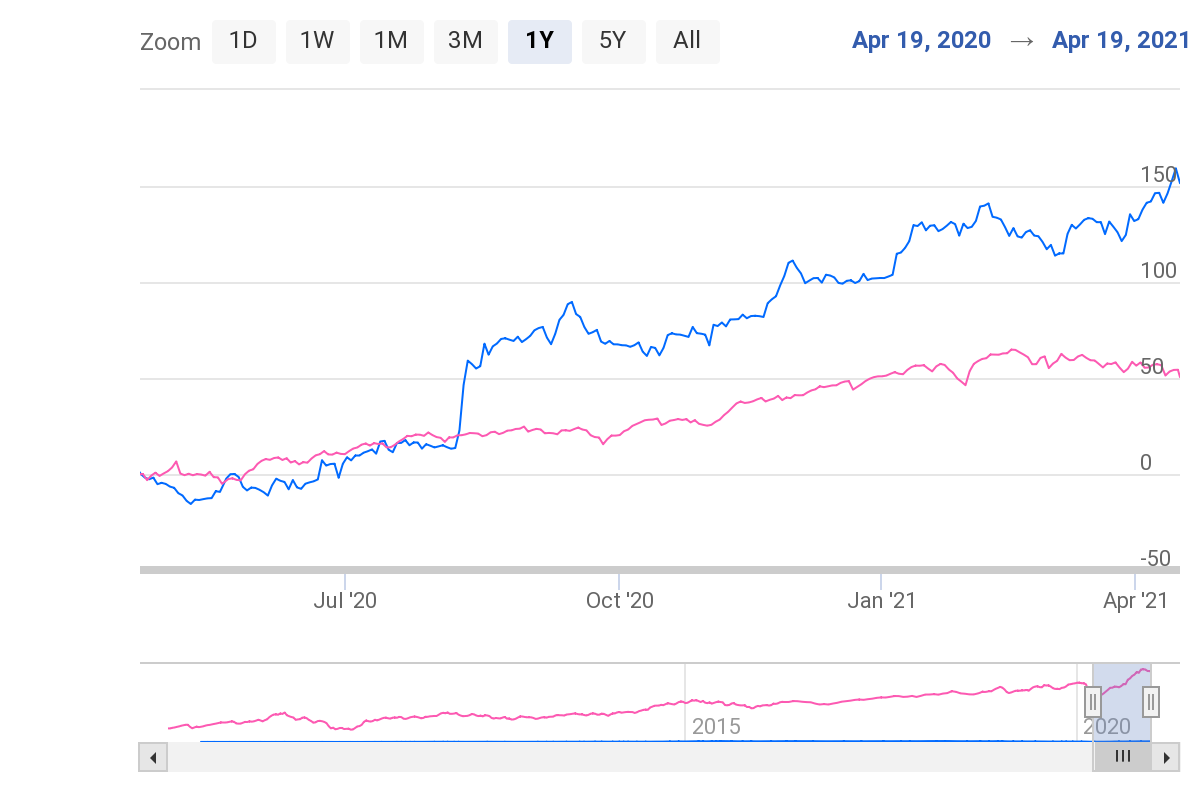

Price performance

Indexed Stock Performance

Margins at life time high!!!

Profile:

Emami is a leading FMCG player in India, operating in certain attractive segments

such as skin care and hair oil. The company was founded by Radhe Shyam Agarwal and

Radheshyam Goenka in 1974 and is headquartered in Kolkata, India. The company has

been operating in health, beauty and personal care products for the past 30+ years

and has sustained a prominent position in therapeutic and Ayurvedic based products,

ensuring strong entry barriers for competition. Emami Ltd. engages in the marketing

and sale of medicinal, cosmetics, and toiletries products. The firm offers brands

such as Boroplus, Navratna, Zandu Balm, Fair and Handsome, Mentho Plus Balm, Fast

Relief, Sona Chandi, Kesari Jivan, Vasocare, and Zandu.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 2530.50 | 642.80 | 25.40% | 307.10 | 6.80 | 15.20% | 79.00 | 37.90 |

| FY19 | 2694.60 | 727.20 | 27.00% | 303.20 | 6.70 | 14.60% | 59.90 | 24.80 |

| FY20 | 2654.90 | 690.60 | 26.00% | 302.90 | 6.70 | 16.60% | 25.40 | 11.20 |

| FY21E | 2814.20 | 765.50 | 27.20% | 331.70 | 7.50 | 17.30% | 71.70 | 31.10 |

| FY22E | 3039.30 | 854.00 | 28.10% | 394.60 | 8.90 | 19.40% | 60.50 | 27.50 |

| FY23E | 3434.40 | 989.10 | 28.80% | 470.90 | 10.70 | 22.60% | 50.80 | 23.30 |

Investment Rationale

Focus on niche segments:

The company has been operating in health, beauty and personal care products for

the past 30+ years and has sustained a prominent position in therapeutic and Ayurvedic

based products, ensuring strong entry barriers for competition. Company is a leading

player in the niche cool oil & Talc segment. We believe being niche, the Company

is relatively protected from competition. Emami’s products are in niche categories

for mass consumers, a rare interplay of volume and value. Apart from this company

has De-seasonalised its product portfolio by launching Navratna Garam Tel in winter

(headache, numbness and lethargy).

Exhibit No 1: Niche products

Source: Company, Stockaxis research

Strong brand portfolio:

Emami offers consumer portfolio of more than 9 brands and 13 sub-brands. Over the

decades, Emami focused on creating brands from scratch - distinctive, niche and

potential leaders across categories. These Emami brands have successfully fused

age-old ayurveda and modern science. Emami has prioritized brand building and has

spent around Rs. 3,200 Cr. over past decade on the same which has helped it achieve

sustained leadership of the core brands. Emami derives virtually all its revenues

from proprietary brands. Emami’s brands have been respected for their pioneering

features, distinctiveness, and associations with popular brand ambassadors.

Exhibit No 2: Strong product portfolio

Source: Company, Stockaxis research

Robust set of numbers:

Emami’s Q3FY21 results delivered a constructive surprise on all fronts with

14.9% revenue growth led by Health, Hygiene and winter care portfolio. Benign input

prices and stringent cost control measures helped all time high gross margin at

70.4%(+220bps), while EBITDA grew 28.9% despite 12.4% growth in ad-spends. EBITDA

margin stood at 36.4%. Emami reported all time high Gross/EBITDA margins at 70.4%/

36.4%. We expect the company will continue to sustain its high margin looking at

the new product portfolio and continuous cost reduction.

Health and Hygiene segment to act as a key catalyst for growth in near term:

In recent quarter its key segment Health had delivered robust growth of 38% yoy.

We expect health to continue high growth momentum on the back of 1)strong

growth in Pancharishta, key brand (up 19% yoy) 2) new launches in Zandu portfolio

and 3) 2.5x growth see in Zandu Honey, benefitting from recent controversy related

to purity of competitors brand 4) continued traction in Chyawanprash business (up

24% YoY). Moreover, Emami has recently entered into Ortho oil segment (market

size of Rs 2.5 bn) capitalizing brand equity of Zandu, given there is less competitive

intensity (presence of few regional players such as SBS biotech - Dr Ortho brand,

from whom Emami acquired Kesh King brand).

Outlook & valuation

Emami Limited is one of the leading and fastest growing personal and healthcare businesses. The company’s performance was subdued in the past few years due to number of factors such as demonetisation and GST, heightened competition in key categories and seasonality. However, with the timely interventions by the management in addition to demand boost to ayurvedic products in wake of Covid-19 has provided tailwinds. We believe Emami is a market leader in several categories and with low penetration of key categories. We Initiate a Buy on Emami limited for long term perspective on the back of wider distribution, new product launches(30+ product launches in 9mFY21), improving financials and margins, and enhanced rural demand. At CMP the stock trades at PE of 59x and 49x of our FY22E and FY23E earnings estimates.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 2530.50 | 2694.60 | 2654.90 | 2814.20 | 3039.30 | 3434.40 |

| Growth % | 1.70% | 6.50% | -1.50% | 6.00% | 8.00% | 13.00% |

| Expenditure | ||||||

| Material Cost | 809.80 | 968.70 | 934.60 | 979.30 | 1051.60 | 1174.60 |

| Employee Cost | 254.60 | 279.70 | 299.50 | 309.60 | 328.20 | 370.90 |

| Other Expenses | 823.20 | 719.00 | 730.20 | 759.80 | 805.40 | 899.80 |

| EBITDA | 642.80 | 727.20 | 690.60 | 765.50 | 854.00 | 989.10 |

| Growth % | -8.30% | 13.10% | -5.00% | 10.80% | 11.60% | 15.80% |

| EBITDA Margin | 25.40% | 27.00% | 26.00% | 27.20% | 28.10% | 28.80% |

| Depreciation & Amortization | 310.90 | 325.30 | 336.30 | 350.70 | 362.50 | 384.20 |

| EBIT | 332.00 | 401.90 | 354.20 | 414.80 | 491.50 | 604.90 |

| EBIT Margin % | 13.10% | 14.90% | 13.30% | 14.70% | 16.20% | 17.60% |

| Other Income | 96.10 | 34.90 | 57.10 | 57.10 | 57.10 | 57.10 |

| Interest & Finance Charges | 34.30 | 21.40 | 21.00 | 21.30 | 14.10 | 17.30 |

| Profit Before Tax - Before Exceptional | 393.80 | 415.40 | 390.30 | 450.50 | 534.60 | 638.60 |

| Profit Before Tax | 393.80 | 405.60 | 379.60 | 450.50 | 534.60 | 638.60 |

| Tax Expense | 86.30 | 100.90 | 71.30 | 113.40 | 134.50 | 162.30 |

| Effective Tax rate | 21.90% | 24.30% | 18.30% | 25.20% | 25.20% | 25.40% |

| Exceptional Items | - | -9.80 | -10.70 | - | - | - |

| Net Profit | 307.50 | 304.70 | 308.30 | 337.10 | 400.00 | 476.40 |

| Growth % | -9.60% | -0.90% | 1.20% | 9.30% | 18.70% | 19.10% |

| Net Profit Margin | 12.20% | 11.30% | 11.60% | 12.00% | 13.20% | 13.90% |

| Consolidated Net Profit | 307.10 | 303.20 | 302.90 | 331.70 | 394.60 | 470.90 |

| Growth % | -9.80% | -1.30% | -0.10% | 9.50% | 19.00% | 19.30% |

| Net Profit Margin after MI | 12.10% | 11.30% | 11.40% | 11.80% | 13.00% | 13.70% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 22.70 | 45.40 | 45.30 | 45.30 | 45.30 | 45.30 |

| Total Reserves | 1990.90 | 2030.70 | 1778.40 | 1875.70 | 1991.10 | 2130.00 |

| Shareholders' Funds | 2014.20 | 2075.90 | 1822.90 | 1920.10 | 2035.50 | 2174.50 |

| Minority Interest | 0.60 | -0.20 | -0.90 | -0.90 | -0.90 | -0.90 |

| Non Current Liabilities | ||||||

| Long Term Burrowing | - | - | - | - | - | - |

| Deferred Tax Assets / Liabilities | 11.80 | 12.20 | 3.50 | 3.50 | 3.50 | 3.50 |

| Long Term Provisions | 23.80 | 20.00 | 23.10 | 23.10 | 23.10 | 23.10 |

| Current Liabilities | ||||||

| Short Term Borrowings | 325.90 | 109.90 | 210.20 | 145.20 | 110.20 | 210.20 |

| Trade Payables | 242.00 | 291.40 | 324.50 | 299.70 | 280.60 | 310.40 |

| Other Current Liabilities | 82.00 | 157.10 | 100.60 | 100.60 | 100.60 | 100.60 |

| Short Term Provisions | 64.00 | 121.60 | 156.70 | 156.70 | 156.70 | 156.70 |

| Total Equity & Liabilities | 2797.80 | 2818.50 | 2678.50 | 2685.90 | 2747.30 | 3016.00 |

| Assets | ||||||

| Net Block | 1746.20 | 1625.30 | 1404.70 | 1139.00 | 891.50 | 652.30 |

| Non Current Investments | 241.40 | 233.90 | 142.50 | 142.50 | 142.50 | 142.50 |

| Long Term Loans & Advances | 51.80 | 44.30 | 47.80 | 47.80 | 47.80 | 47.80 |

| Current Assets | ||||||

| Currents Investments | 128.10 | 7.90 | 68.30 | 68.30 | 68.30 | 68.30 |

| Inventories | 194.00 | 221.70 | 244.60 | 232.20 | 224.50 | 248.30 |

| Sundry Debtors | 155.90 | 216.40 | 308.00 | 224.80 | 224.50 | 248.30 |

| Cash and Bank | 79.50 | 203.40 | 119.10 | 487.90 | 804.70 | 1265.00 |

| Short Term Loans and Advances | 82.80 | 144.40 | 196.20 | 196.20 | 196.20 | 196.20 |

| Total Assets | 2797.80 | 2818.50 | 2678.50 | 2685.90 | 2747.30 | 3016.00 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 307.50 | 304.70 | 308.30 | 337.10 | 400.00 | 476.40 |

| Depreciation | 310.90 | 325.30 | 336.30 | 350.70 | 362.50 | 384.20 |

| Others | -44.90 | -35.00 | 1.40 | - | - | - |

| Changes in Working Capital | -61.20 | -73.90 | -80.00 | 70.90 | -11.10 | -17.80 |

| Cash From Operating Activities | 587.80 | 553.70 | 530.70 | 758.70 | 751.50 | 842.80 |

| Purchase of Fixed Assets | -123.70 | -139.20 | -159.10 | -85.00 | -115.00 | -145.00 |

| Free Cash Flows | 464.10 | 414.50 | 371.70 | 673.70 | 636.50 | 697.80 |

| Others | -155.90 | 109.50 | -79.60 | - | - | - |

| Cash Flow from Investing Activities | -279.10 | -23.40 | -227.70 | -85.00 | -115.00 | -145.00 |

| Increase / (Decrease) in Loan Funds | -183.70 | -218.90 | 14.00 | -65.00 | -35.00 | 100.00 |

| Equity Dividend Paid | -119.40 | -158.90 | -363.10 | -198.90 | -236.00 | -279.80 |

| Others | 47.00 | 2.00 | 18.00 | - | - | - |

| Cash from Financing Activities | -279.00 | -407.10 | -387.10 | -304.90 | -319.60 | -237.40 |

| Net Cash Inflow / Outflow | 29.70 | 123.20 | -84.10 | 368.80 | 316.80 | 460.30 |

| Opening Cash & Cash Equivalents | 50.40 | 80.10 | 203.10 | 119.10 | 487.90 | 804.70 |

| Closing Cash & Cash Equivalent | 80.10 | 203.10 | 119.10 | 487.90 | 804.70 | 1265.00 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 6.80 | 6.70 | 6.70 | 7.50 | 8.90 | 10.70 |

| Diluted EPS | 6.80 | 6.70 | 6.70 | 7.50 | 8.90 | 10.70 |

| Cash EPS (Rs) | 13.60 | 13.80 | 14.10 | 15.40 | 17.00 | 19.40 |

| DPS | 7.00 | 4.00 | 4.00 | 4.50 | 5.30 | 6.30 |

| Book value (Rs/share) | 44.40 | 45.70 | 40.20 | 43.20 | 45.80 | 48.90 |

| ROCE (%) Post Tax | 15.70% | 14.60% | 15.90% | 17.20% | 19.50% | 21.80% |

| ROE (%) | 15.20% | 14.60% | 16.60% | 17.30% | 19.40% | 22.60% |

| Inventory Days | 26.90 | 28.20 | 32.10 | 30.90 | 27.40 | 25.10 |

| Receivable Days | 18.20 | 25.20 | 36.00 | 34.50 | 27.00 | 25.10 |

| Payable Days | 30.80 | 36.10 | 42.30 | 40.50 | 34.80 | 31.40 |

| PE | 79.00 | 59.90 | 25.40 | 71.70 | 60.50 | 50.80 |

| P/BV | 12.00 | 8.70 | 4.20 | 12.60 | 11.90 | 11.10 |

| EV/EBITDA | 37.90 | 24.80 | 11.20 | 31.10 | 27.50 | 23.30 |

| Dividend Yield (%) | 1.30% | 1.00% | 2.40% | 0.80% | 1.00% | 1.20% |

| P/Sales | 9.60 | 6.70 | 2.90 | 8.60 | 8.00 | 7.00 |

| Net debt/Equity | 0.10 | - | 0.00 | - | - | - |

| Net Debt/ EBITDA | 0.20 | -0.10 | 0.00 | -0.40 | -0.80 | -1.10 |

| Sales/Net FA (x) | 1.40 | 1.60 | 1.80 | 2.20 | 3.00 | 4.40 |