DFM Foods Ltd

Consumer Food

DFM Foods Ltd

Consumer Food

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Pioneer of packaged snack foods in India looking to expand to the next level of growth.

DFM Foods Ltd. is an India-based company incorporated in 1993. The company is engaged in the manufacturing and marketing of processed foods, which includes snack foods. The company pioneered the entry of packaged snacks in the Indian market with the introduction of its Crax Corn Rings product.

Corn Rings and Wheat Puffs are marketed under the CRAX and NATKHAT brand names respectively. Both these products have become extremely popular snacks, especially among children. In the namkeens category, the company offers a complete range of products consisting of 13 distinct product variants that include Bhujiyas, Daals, Mixtures, and Nut-Mixes. These are sold in several pack sizes to cater to both casual/impulse consumption as well as consumption at home.

Extensive product portfolio:

DFM Foods is the pioneer of packaged snack foods in the Indian market. The company

is engaged in the business of manufacturing and selling packaged foods for more

than 3 decades. Over the years, the company has launched various brands and products.

The company markets its products under the brand names of “Crax”, “Curls”,

“Natkhat” and “Fritts”. The product portfolio comprises

of corn rings, corn puffs, wheat puffs, cheese balls, corn and potato sticks, and

traditional namkeens in 13 distinct variants.

Increased consumption of snacks and packaged foods:

We have observed a massive change in the snack foods market. Demand for packaged

foods has risen over the last several years due to urbanisation, increase in purchasing

power, growth in female working population and busier lifestyles among Indian consumers.

Packaged foods offer Indian consumers traditional snacks such as Farsan, Bhujia

and other namkeens.

New leadership and new strategy will drive future growth:

The new promoter, Advent International holds 73.91% of the company’s total

equity. Post the acquisition, the company appointed a new managing director, Mr

Lagan Shastri. Mr Shastri has worked in senior marketing positions in Hindustan

Coco Cola beverages for more than 20 years. The focus of the new leadership team

is to drive the next phase of expansion and business growth. This will be achieved

by strengthening distribution, marketing, innovation and creating a strong product

portfolio.

Splendid strategy well in place:

DFM foods focus remains on branding of the products. In order to leverage the strong

brand power of Crax, the company has launched products in “sub-segmentation

strategy”. The sub-segmentation strategy gives the benefit of umbrella advertising

as the other products are launched under the main brand “Crax”. Sub-segmentation

strategy also helps in to reduce the costs as there is no requirement of re-branding

or separate branding of the new products.

Foray into namkeens will be the subsequent growth driver:

DFM Foods has pioneered the Indian packed snacks market. The company has entered

the namkeens (Crax namkeens) segment under their flagship brand Crax. Munching on

namkeen and snacks is an ancient practice in India. DFM Foods is focusing on tapping

an opportunity by launching snacks meant for specific occasions, like to uplift

the mood, fasting and provide some fun. With consumers snacking for various reasons,

DFM foods is highlighting events or value proposition/benefits offered on the snack

pack.

Sound & improving financials:

DFM foods is expected to deliver ~26% net profit CAGR over FY20-22E. On the back

of ramp-up in sales and increasing margins from operating leverage and improved

product mix. We expect improving product mix to reflect in DFM foods financials

from FY22. Given low penetration, share gain from unorganised market, better distribution

and high operational efficiency, we believe there is sound reason to be bullish

on DFM foods.

Niche operator in snacks:

Crax has a strong positioning as a snack, especially for kids. Apart from niche

positioning, Crax is the most preferred snack and less expensive than most other

snacks. To maintain its leadership position, Crax has remained unique through its

strategy of giving a free gift (toy) in each pack.

Outlook & valuation

DFM Foods has strong brand presence across the country. The company is well known

for its Crax brand which dominates the market (65% market share) and hearts of children.

We believe Indians (especially children) have an emotional connect with eating snacks

and this will continue to drive the future growth of the company. We expect the

recent capacity addition of 5,000 MTPA will enhance revenues and profitability for

the company. Further, the new promoter and management will drive high operational

efficiency, which, in turn, will increase profitability. We initiate “Buy”

on DFM Foods Limited on the back of strong brand presence, new product launches,

continuous innovation in existing products, and rising customer reach. At CMP of

Rs. 339, the company trades at PE of 55x/ 36x our FY21E/ FY22E EPS estimates.

Consolidated Financial Statements

| (In Rs Cr) | Sales | EBITDA | EBITDA % | PAT | EPS | ROE % | EV/EBITDA | P/BV |

|---|---|---|---|---|---|---|---|---|

| FY18 | 425.00 | 51.00 | 12.00% | 23.00 | 5.00 | 24.90% | 28.60 | 13.80 |

| FY19 | 484.00 | 63.00 | 13.10% | 33.00 | 7.00 | 28.30% | 17.20 | 8.40 |

| FY20 | 508.00 | 42.00 | 8.20% | 24.00 | 5.00 | 17.80% | 21.00 | 6.00 |

| FY21E | 549.00 | 59.00 | 10.80% | 32.00 | 6.00 | 20.20% | 29.90 | 10.40 |

| FY22E | 631.00 | 83.00 | 13.10% | 49.00 | 10.00 | 25.90% | 21.00 | 8.60 |

Investment Rationale

Extensive product portfolio:

DFM Foods is the pioneer of packaged snack foods in the Indian market. The company

is engaged in the business of manufacturing and selling packaged foods for more

than 3 decades. Over the years, the company has launched various brands and products.

The company markets its products under the brand names of “Crax”, “Curls”,

“Natkhat” and “Fritts”. The product portfolio comprises

of corn rings, corn puffs, wheat puffs, cheese balls, corn and potato sticks, and

traditional namkeens in 13 distinct variants.

Product portfolio:

Crax:

Launched in 1984, this was the first product of its kind to hit Indian retail shelves

and it was instantly successful. In no time, it became quite the favourite especially

among children. Its unique ring shape has captured the hearts and fingers of children.

Crax Curls:

This latest innovation in the Crax portfolio has a unique, melt-in-mouth texture

and is available in 3 lip smacking flavours - Chatpata Masala, Tomato Treat and

Spicy Delight. With a large pack-fill, this product offers great value to the consumer

at Rs. 5.

Crax namkeens:

A range of ethnic snacks made from the finest ingredients, Crax Namkeens comprise

of a wide range of Bhujias, Mixtures and Nut-Mixes. A total of 12 different product

variants are available in pack sizes of Rs. 5, Rs. 10 and Rs. 20.

Crax pasta crunch:

Pasta crunch is a mouth-watering crunchy snack that comes in pasta shape. It blends

the best of Chinese and Indian spices in its "Chinese Tadka" flavour and

is priced at Rs. 5 per pack.

Natkhat:

Natkhat is light and crunchy delicious wheat puffs with a lower fat content. It

is available in classic and masala flavours. It comes in two package sizes priced

at Rs. 2 and Rs. 5.

Exhibit No 1: DFM Foods’ product portfolio

Source: Company, StockAxis Research

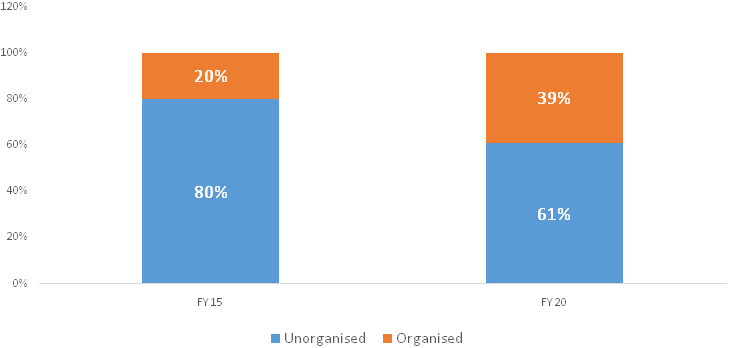

Increase in consumption of snacks and packaged foods:

We have observed a massive change in the snack foods market. Demand for packaged

foods has increased over the last several years due to urbanisation, increase in

purchasing power, growth in female working population and busier lifestyles among

Indian consumers. Packaged foods offer Indian consumers traditional snacks such

as farsans, bhujia and other namkeens. We observe a shift from loose packaging namkeens

to standard and packaged namkeens (such as Crax namkeens, Haldiram, Bikaji and Balaji).

Packaged snacks and namkeens have a deeper impact on customers as they are easily

available in local stores, hygienically processed and packed, and are more popular

due to brand awareness and celebrity endorsements. Customers know that packaged

foods use the best ingredients and are always fresh. Currently, the organised players

have market share of around 39% as compared to 20% in 2015. Organised players’

market share is expected to grow in double digit.

Exhibit No 2: Industry Trends (In %)

Source: Company, StockAxis Research

New management and new strategy will drive future growth: In

November 2019, buyout firm Advent International acquired a little more than 13 million

equity shares at Rs 249.50 per share, representing 26% of the expanded voting share

capital of the company. Prior to that, in September 2019, Advent International entered

into agreements to acquire (i) promoter shares constituting 38.27% of the paid up

share capital and 38.14% of the expanded voting share capital; (ii) WestBridge’s

shares constituting 24.87% of the paid up share capital and 24.79% of the expanded

voting share capital; and (iii) other shareholders’ shares constituting 4.99%

of the paid up share capital and 4.97% of the expanded voting share capital. This

indicates increased interest and confidence of the acquirer in the performance of

the company. Post these acquisitions, Advent International holds 73.91% of the company’s

total equity. Post the acquisition, a new managing director, Mr Lagan Shastri has

been appointed. Mr Shastri has worked in senior marketing positions in Hindustan

Coco Cola beverages for more than 20 years. The focus of the new leadership team

is to drive the next phase of expansion and business growth. This will be achieved

by strengthening, distribution, marketing, innovation and creating a strong product

portfolio.

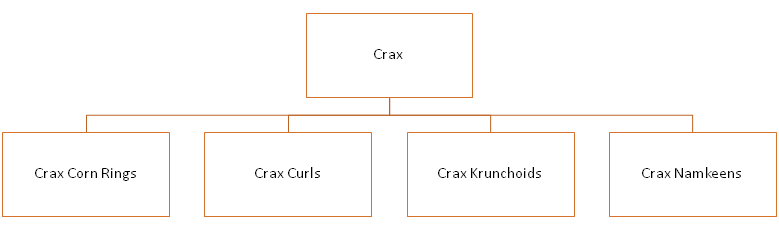

Splendid strategy well in place:

DFM foods focus remains on branding of the products. In order to leverage the strong

brand power of Crax, the company has launched products in “sub-segmentation

strategy”. The sub-segmentation strategy gives the benefit of umbrella advertising

as the other products are launched under the main brand “Crax”. Sub-segmentation

strategy also helps in to reduce the costs as there is no requirement of re-branding

or separate branding of the new products. Over the years the company has launched

4 different products under the main brand Crax.

Exhibit No 3: Brand Structure

Source: Company, Stockaxis Research

Foray into namkeens will be the subsequent growth driver:

DFM Foods has pioneered the Indian packed snacks market. The company has entered

the namkeens (Crax namkeens) segment under their flagship brand Crax. Munching on

namkeen and snacks is an ancient practice in India. DFM Foods is focusing on tapping

an opportunity by launching snacks meant for specific occasions, like to uplift

the mood, fasting and provide some fun. With consumers snacking for various reasons,

DFM foods is highlighting events or value proposition/benefits offered on the snack

pack. We believe the company can replicate the success of Crax corn rings in its

new products too. We expect Crax namkeens to grow in double digit in upcoming years.

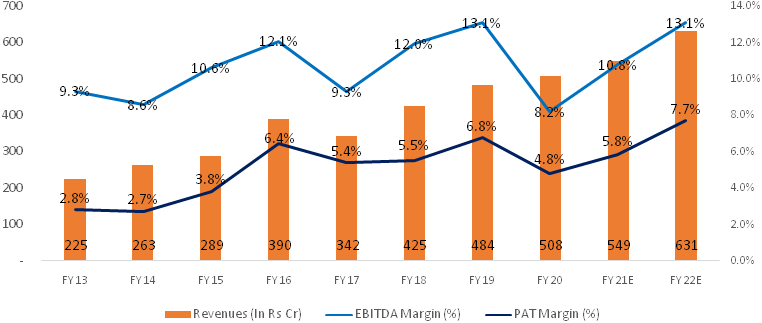

Sound & improving financials:

DFM foods is expected to deliver ~26% net profit CAGR over FY20-22E. On the back

of ramp-up in sales and increasing margins from operating leverage and improved

product mix. We expect improving product mix to reflect in DFM foods financials

from FY22. Given low penetration, share gain from unorganised market, better distribution

and high operational efficiency, we believe there is sound reason to be bullish

on DFM foods. We expect DFM foods to increase sales at ~7% CAGR, EBITDA at ~26%

CAGR and PAT at ~26% CAGR over FY20-22E.

Exhibit No 4: Improving margin trend

Source: Company Stockaxis Research

Niche operator in snacks:

Crax has strong positioning as a snack, especially for kids. Apart from niche positioning,

Crax is the most preferred snack and less expensive than most other snacks. To maintain

its leadership position, Crax has remained unique by its strategy of giving a free

gift (toy) in each pack.

Exhibit No 5: Strategy of free toy in each pack

Source: Company, StockAxis Research

Financials

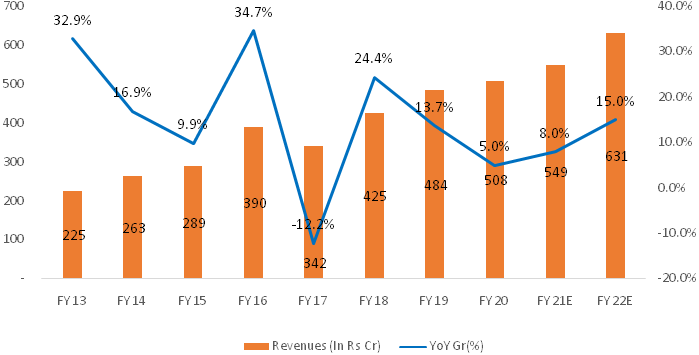

Revenue is expected to grow @~7% CAGR over FY20-FY22E

We expect DFM Foods’ revenue to grow at 7% CAGR over FY20-FY22E to Rs. 631

crores by FY22 on the back of new capacity addition of 5,000 MTPA and entry in new

geographies. The company has grown its revenues by 6% CAGR during FY18-FY20. We

expect revenue to grow in single digit for FY21 by 8% yoy to Rs. 549 crores, mainly

due to impact of Covid-19 in Q1 FY21. Due to the pandemic, the company faced logistics

challenges in Q1 FY21, and due to unavailability of branded products, consumers

tended to choose un-branded products.

Exhibit no 6: Revenue trends (In Rs Cr)

Source: Ace equity, StockAxis Research

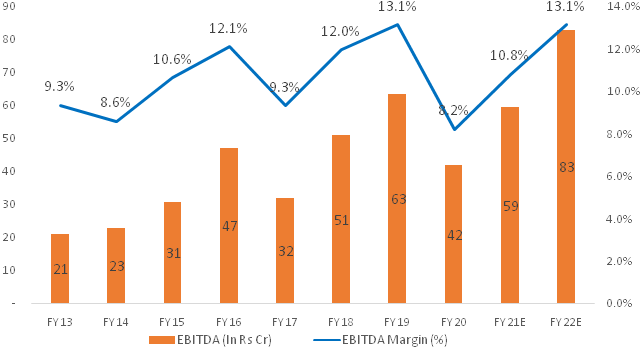

EBITDA margins are expected to expand by ~490 bps over FY20-FY22E

We expect EBITDA to grow at CAGR of ~26% over FY20-FY22E, and EBITDA margins to

expand by ~490 bps over FY20-FY23E due to higher capacity utilisation and lower

operating costs. Given strong sales and high operating leverage and improved product

mix will aid margin expansion in future. We expect EBITDA margins to expand by ~260

bps yoy to 10.8% in FY21E.

Exhibit No 7: EBITDA and EBITDA margin trend (In Rs Cr)

Source: Ace equity, StockAxis Research

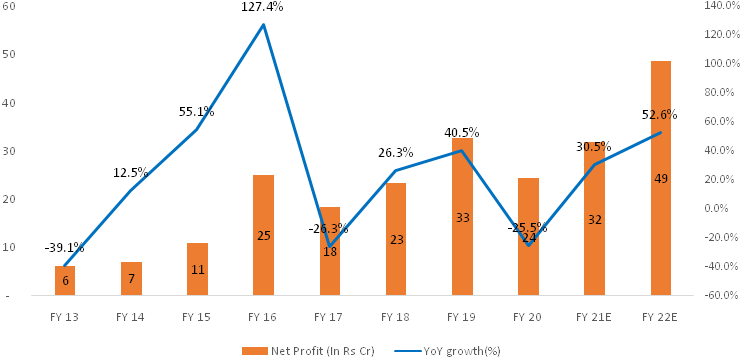

Net profit is expected to grow at ~26% CAGR

We expect net profit to grow @ ~26% CAGR over FY20-22E on the back of high operational

efficiency and lower tax rates. The company grew its net profit by 2% CAGR during

FY18-FY20. In the past company’s profits remained very inconsistent due to

inferior product mix, volatile RM costs and higher ad spends. We believe with the

help of new management the company will enjoy higher operating leverage. We see

tapering advertisement costs and sales promotions through cartoon characters and

toys is likely to continue. We expect push-advertising costs are unlikely to grow

in-line with sales.

Exhibit No 8: Net profit trend (In Rs Cr)

Source: Ace equity, StockAxis Research

Industry

The Indian snack food industry is a promising and growing arm of the Fast-Moving Consumer Goods (FMCG) category. The snacks industry has been on the rise for several years, but the last few years have been marked by notable growth. Today, consumers want a variety of easy-to-carry, price-effective snacks that do not compromise on taste and nutrition. The industry has seen transition from freshly made snacks to packaged, instant and ready-to-cook snacking food items.

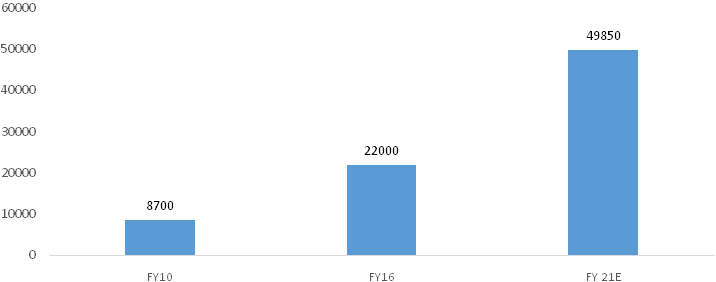

The Indian traditional and namkeen organised snack food market is estimated to be around Rs. ~49,850 crores for the year FY 2020-21. The market is divided into 4 segments - namkeen and traditional snacks, extruded snacks, chips and others. Around 39% of the market is captured by organized players; the organized market is expected to grow by about 15% per annum, whereas the entire market is expected to grow by 7-8% per annum. Today, around 1,000 snack items are sold in India spanning various tastes, forms, textures, aromas, bases, sizes, shapes and fillings. Besides, some 300 types of savouries are sold in our country today. The extruded snacks market is influenced by the growth of retail food industry and the extruded snack market is projected to grow at a CAGR of 15% from 2019-2024.

Exhibit No 9: Organised market (In Rs Cr)

Source: Company, McKinsey, Stockaxis Research

Growth Drivers of the Industry

Increasing per capita Income:

Increasing per capita incomes of people living in urban, semi-urban and rural regions

of the country is one of the major factors driving consumption of the snacks industry.

The snacks market is also expected to be positively influenced by anticipated growth

in the country’s retail food market in the coming years.

Growing Young Population:

A growing young population with a strong preference for packaged snack foods is

driving growth for this market. Children are a major target segment of the snacks

market which include chips and extruded snack segment.

Smaller and affordable pack sizes:

With growing urbanisation, the industry has introduced smaller and affordable pack

sizes at competitive pricing, which has contributed to the growth of the snacks

market in India.

Evolving consumer habits:

Consumers demand a range of natural products that deliver health benefits in convenient

formats. They are more attuned to healthy eating habits with focus on ingredients

used to prepare the food. The industry is responding to this demand by focusing

efforts on developing snacks that contain healthy ingredients while satisfying cravings.

This growing innovation has led to rapid shifts in the category and brand portfolios.

Source: McKinsey, Company, IBEF, Stockaxis research.

Overview of the Indian packed foods

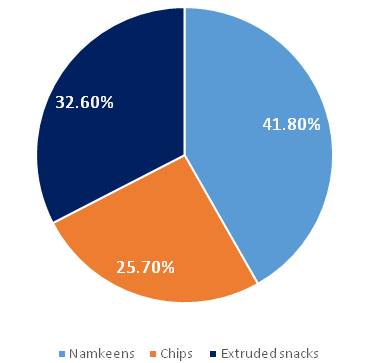

Indian packed snack food industry is mainly divided into three segments:

- Namkeen & traditional snacks category contributes 41% of the total organised market and is pegged at `7,848cr, dominated by Haldirams (48% market share). It is expected to grow at a CAGR of 18% over FY16-21E to `17,782cr category.

- Extruded snacks are the second largest contributors in the industry at 32%, dominated by PepsiCo. It is expected to grow at a CAGR of 15% over FY16-21E to `13,988cr category.

- Chips contribute 25% to the overall organised market, dominated by PepsiCo’s Lays. It is expected to grow at 10% CAGR over FY16-21E to `10,619cr market.

Exhibit no 10: Diversification of packed snacks as on FY20 (In %)

Source: Mckinsey, Stockaxis Research

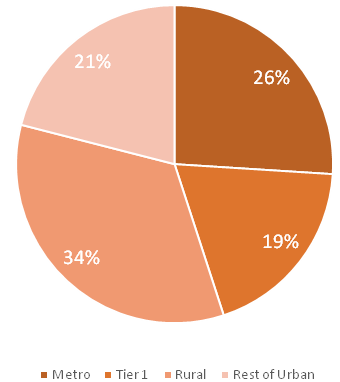

Exhibit no 11: Region wise revenues for packed foods as on FY20 (In %)

Source: Mckinsey, Stockaxis Research

Key players in domestic organised snacks market:

DFM Foods:

DFM was one of the first few players to aggressively enter the extruded snacks market

and it was the pioneer in bundling toys with snacks and targeting kids to drive

growth. It sells its products under the CRAX brand. We believe, on account

of new promoters’ the company can expand its distribution reach and launch

new products. We expect high corporate governance and operational efficiency kicking

in which will aid operating margin expansion.

PepsiCo:

The company employed multi-pronged strategy to grow the India business. It entered

the Indian market with a homogenous product chips and followed it with another homogenous

category of extruded snacks (by launching Kurkure); both categories and

products have national acceptance. Despite having strong R&D capabilities, parent’s

support and deep pockets, it has not being able to crack the Indian namkeen market

owing to high level of regional preference and taste.

Haldiram (North + West):

Haldiram as a brand rules India’s snacks market with an overall market share

of 20%. This is driven by strong understanding of regional taste and preferences.

Long-term presence through local operations in various parts of the country has

enabled Haldiram to understand local tastes, develop products to cater to these

and thereby establish strong brand equity. However, despite strong regional connect,

the company has not succeeded at the national level in categories like chips and

extruded snacks.

ITC (Bingo+ No rulz):

ITC relied on extruded and chips/nachos products which have national and followed

it up with national level media campaigns to establish national brand. Its existing

distribution strength, riding other FMCG businesses, also helped it expand its reach

nationally. However, despite being a player with deep pockets, innovation in the

category has been weak and the company has been largely a follower in the space.

Moreover, it has failed to enter the regional namkeen market, which entails better

margins and is a high growing category.

Balaji Wafers:

The company started as a chips player, with strong value-for-money proposition in

Gujarat and Rajasthan markets. After attaining critical mass in the segment, it

ventured in to the namkeen category. Despite improving its product mix, the company

has not been able to expand itself beyond western India. This is largely due to

its strategy of directly dealing with distributors /running own logistics to cover

a distance of 100-200 km of each of its factories. While till date this strategy

has worked for the company both in terms of growth as well as margins, beyond a

time we believe in order to grow and penetrate it will face challenges as it spreads

its wings beyond its home market.

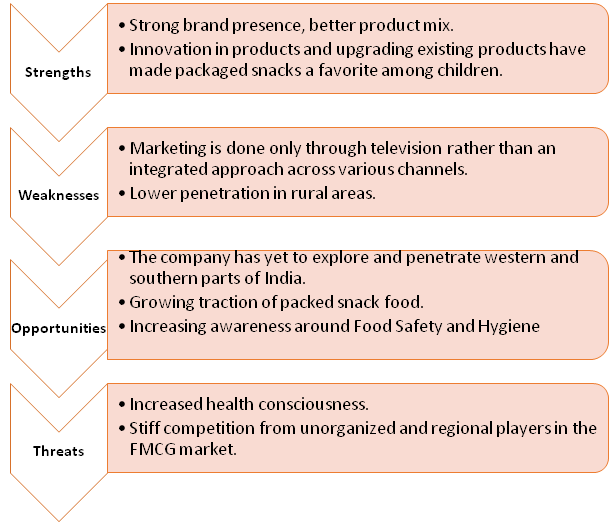

Swot Analysis of DFM Foods Limited

Peer Comparison:

| Company | EBITDA Margin | PAT margin | RoCE | RoE | Debt to Equity(x) | PE Ratio (x) | EV/EBITDA(x) |

|---|---|---|---|---|---|---|---|

| DFM | 8.20% | 4.80% | 15.00% | 17.80% | 0.60 | 69.50 | 36.90 |

| Prataap Snacks | 6.79% | 2.40% | 7.78% | 5.37% | 0.01 | 45.00 | 17.10 |

Risks & Concerns

Raw material risk: Lower agricultural production and any adverse effects on commodities can cause volatility in the prices of raw materials (maize and oil) which may result in increased cost of materials for the company.

Rise in competition: The company faces intense competition from recognised organised and unorganised players in the market. Rising competition can result in reduced margins and may affect profitability.

Revenue concentration risk: Concentration on particular geographic areas for revenue generation may result in limited growth.

Outlook & valuation

DFM Foods has strong brand presence across the country. The company is well known for its Crax brand which dominates the market (65% market share) and hearts of children. We believe Indians (especially children) have an emotional connect with eating snacks and this will continue to drive the future growth of the company. We expect the recent capacity addition of 5,000 MTPA will enhance revenues and profitability for the company. Further, the new promoter and management will drive high operational efficiency, which, in turn, will increase profitability. We initiate “Buy” on DFM Foods Limited on the back of strong brand presence, new product launches, continuous innovation in existing products, and rising customer reach. At CMP of Rs. 339, the company trades at PE of 55x/ 36x our FY21E/ FY22E EPS estimates.

Financial Statement

Profit & Loss statement

| Year End March (In Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E |

|---|---|---|---|---|---|

| Net Sales | 425.00 | 484.00 | 508.00 | 549.00 | 631.00 |

| % Growth | 24.40% | 13.70% | 5.00% | 8.00% | 15.00% |

| Expenditure | 374.00 | 420.00 | 466.00 | 489.00 | 548.00 |

| Material Cost | 256.00 | 284.00 | 305.00 | 329.00 | 369.00 |

| Employee Cost | 42.00 | 46.00 | 55.00 | 52.00 | 60.00 |

| Other expenses | 77.00 | 90.00 | 106.00 | 108.00 | 119.00 |

| EBITDA | 51.00 | 63.00 | 42.00 | 59.00 | 83.00 |

| EBITDA Margin | 12.00% | 13.10% | 8.20% | 10.80% | 13.10% |

| Growth (%) | 59.70% | 24.80% | -34.30% | 42.10% | 39.50% |

| Depreciation & Amortization | 10.00 | 11.00 | 11.00 | 14.00 | 15.00 |

| EBIT | 40.86 | 52.94 | 30.35 | 45.54 | 67.72 |

| Other Income | 4.00 | 7.00 | 7.00 | 7.00 | 7.00 |

| Interest & Finance Charges | 10.00 | 11.00 | 10.00 | 10.00 | 9.00 |

| Share of Associates | - | - | - | - | - |

| Exceptional Items | - | -2.00 | - | - | - |

| Profit Before Tax | 35.00 | 47.00 | 27.00 | 43.00 | 65.00 |

| Tax Expense | 12.00 | 15.00 | 3.00 | 11.00 | 16.00 |

| Net Profit | 23.00 | 33.00 | 24.00 | 32.00 | 49.00 |

| Net Profit Margin | 5.50% | 6.80% | 4.80% | 5.80% | 7.70% |

| Growth | 26.30% | 40.50% | -25.50% | 30.50% | 52.60% |

| Adjusted EPS | 5.00 | 7.00 | 5.00 | 6.00 | 10.00 |

Balance Sheet

| Year End March (In Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E |

|---|---|---|---|---|---|

| Share Capital | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| Total Reserves | 91.00 | 118.00 | 133.00 | 157.00 | 194.00 |

| Share Warrants & Outstandings | 1.00 | 1.00 | 3.00 | 3.00 | 3.00 |

| Shareholders' Funds | 102.00 | 129.00 | 145.00 | 170.00 | 207.00 |

| Minority Interest | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Non-current Liabilities | 103.00 | 110.00 | 129.00 | 135.00 | 133.00 |

| Deferred Tax Assets / Liabilities | 16.00 | 20.00 | 15.00 | 15.00 | 15.00 |

| Long Term Burrowing | 81.00 | 83.00 | 78.00 | 84.00 | 82.00 |

| Other Long Term Liabilities | 4.00 | 4.00 | 31.00 | 31.00 | 31.00 |

| Long Term Provisions | 3.00 | 3.00 | 4.00 | 4.00 | 4.00 |

| Total Current Liabilities | 84.00 | 103.00 | 132.00 | 116.00 | 118.00 |

| Trade Payables | 35.00 | 43.00 | 55.00 | 46.00 | 48.00 |

| Other Current Liabilities | 22.00 | 23.00 | 29.00 | 21.00 | 21.00 |

| Short Term Borrowings | 6.00 | 4.00 | 5.00 | 5.00 | 5.00 |

| Short Term Provisions | 22.00 | 33.00 | 44.00 | 44.00 | 44.00 |

| Total Equity & Liabilities | 290.00 | 343.00 | 406.00 | 420.00 | 457.00 |

| ASSETS | |||||

| Total Non-Current Assets | 190.00 | 194.00 | 244.00 | 263.00 | 263.00 |

| Net Block | 155.00 | 166.00 | 218.00 | 237.00 | 237.00 |

| Capital Work in Progress | 4.00 | 6.00 | 13.00 | 13.00 | 13.00 |

| Long Term Loans & Advances | 3.00 | 2.00 | 3.00 | 3.00 | 3.00 |

| Other Non Current Assets | 28.00 | 21.00 | 10.00 | 10.00 | 10.00 |

| Total Current Assets | 101.00 | 148.00 | 163.00 | 157.00 | 194.00 |

| Currents Investments | 52.00 | 55.00 | 58.00 | 58.00 | 58.00 |

| Inventories | 24.00 | 22.00 | 24.00 | 22.00 | 24.00 |

| Sundry Debtors | 0.00 | - | 0.00 | - | - |

| Cash and Bank | 2.00 | 37.00 | 34.00 | 31.00 | 65.00 |

| Other Current Assets | 1.00 | 2.00 | 4.00 | 4.00 | 4.00 |

| Short Term Loans and Advances | 21.00 | 32.00 | 43.00 | 43.00 | 43.00 |

| Total Assets | 290.00 | 343.00 | 406.00 | 420.00 | 457.00 |

Cash Flow Statement

| Year End March (In Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E |

|---|---|---|---|---|---|

| Profit After Tax | 23.00 | 33.00 | 24.00 | 32.00 | 49.00 |

| Depreciation | 10.00 | 11.00 | 11.00 | 14.00 | 15.00 |

| Changes In working Capital | -11.00 | 11.00 | 10.00 | -6.00 | 0.00 |

| Cash Flow after changes in Working Capital | 22.00 | 54.00 | 45.00 | 39.00 | 63.00 |

| Other Items | 12.00 | 9.00 | -3.00 | - | - |

| Cash From Operating Activities | 34.00 | 63.00 | 43.00 | 39.00 | 63.00 |

| Cash Flow from Investing Activities | -13.00 | -48.00 | -14.00 | -33.00 | -15.00 |

| Purchase of Fixed Assets | -13.00 | -23.00 | -24.00 | -33.00 | -15.00 |

| Sale of Fixed Assets | 1.00 | 0.00 | 4.00 | - | - |

| Others | 0.00 | -25.00 | 6.00 | - | - |

| Free Cash Flows | 21.00 | 40.00 | 18.00 | 6.00 | 48.00 |

| Cash Flow from Financing Activities | -21.00 | -13.00 | -21.00 | -10.00 | -14.00 |

| Proceeds from Long Term Borrowings | 14.00 | 15.00 | 1.00 | ||

| Repayment of Long Term Borrowings | -14.00 | -14.00 | -5.00 | ||

| Short Term Loans | -5.00 | -2.00 | 1.00 | ||

| Increase / (Decrease) in Loan Funds | -5.00 | 0.00 | -3.00 | -2.00 | -2.00 |

| Equity Dividend Paid | -5.00 | -5.00 | -6.00 | -6.00 | -10.00 |

| Income tax on dividend paid | -1.00 | -1.00 | -1.00 | -1.00 | -2.00 |

| Others | -11.00 | -7.00 | -10.00 | - | - |

| Net Cash Inflow / Outflow | 0.00 | 2.00 | 8.00 | -3.00 | 34.00 |

| Opening Cash & Cash Equivalents | 1.00 | 1.00 | 4.00 | 11.00 | 8.00 |

| Closing Cash & Cash Equivalent | 1.00 | 4.00 | 11.00 | 8.00 | 42.00 |

Key Ratios

| Year End March | 2018 | 2019 | 2020 | 2021E | 2022E |

|---|---|---|---|---|---|

| Per Share | |||||

| Basic EPS | 4.60 | 6.50 | 4.80 | 6.20 | 9.50 |

| Diluted EPS | 4.60 | 6.50 | 4.80 | 6.20 | 9.50 |

| Book value (Rs/share) | 20.30 | 25.60 | 28.50 | 33.30 | 40.50 |

| DPS | 1.00 | 1.30 | 0.00 | 1.20 | 1.90 |

| ROE (%) | 24.90% | 28.30% | 17.80% | 20.20% | 25.90% |

| ROCE (%) Post Tax | 16.70% | 20.60% | 15.00% | 16.10% | 20.20% |

| Receivable Days | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Inventory Days | 18.00 | 17.00 | 16.00 | 15.00 | 13.00 |

| Payable Days | 32.00 | 29.00 | 35.00 | 34.00 | 27.00 |

| Working Capital (days) | -14.00 | -12.00 | -19.00 | -18.00 | -14.00 |

| Liquidity Ratio | |||||

| Total debt/Equity | 0.91 | 0.72 | 0.63 | 0.52 | 0.42 |

| Net debt/Equity | 0.38 | 0.01 | 0.00 | 0.00 | 0.00 |

| EV/EBITDA | 28.60 | 17.20 | 21.00 | 29.90 | 21.00 |

| P/BV | 13.80 | 8.40 | 6.00 | 10.40 | 8.60 |

| P/Sales | 3.30 | 2.30 | 1.70 | 3.20 | 2.80 |

| Operating Cash Flow/PAT | 1.50 | 1.90 | 1.70 | 1.20 | 1.30 |