Cera Sanitaryware Ltd

Ceramics / Marble / Granite / Sanitaryware

Stock Info

Shareholding Pattern

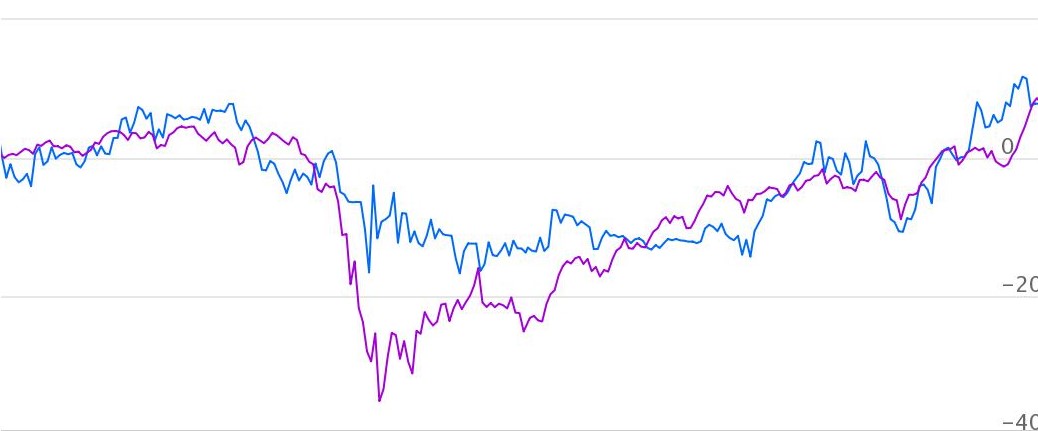

Price performance

Indexed Stock Performance

Muhurat pick

Profile

Cera sanitaryware Ltd is engaged in manufacturing, marketing and distribution of

sanitaryware, faucetware and trading in tiles and other bathroom products. CERA

is positioned amongst Top-3 organized players in sanitaryware market owing to its

presence across product segments at various price points and unique designs. The

Company has more than 3,600 dealers and 12000+ retailtouchpoints.

Investment Rationale

Right outsourcing mix: CERA has been able to strike a prudent balance between

in-house manufacturing and outsourcing. This strategy helps company to be asset

light and improves overall return ratios like ROE/ROCE.

Use of high tech in manufacturing: Cera has been an innovator in the use of technology and automation in design and process. The company has indigenously developed robotic glazing machines which results in better spread of glaze while reducing wastage and dependence on labour. It has also developed 3D printing which allows reduction in SKUs since the mould is designed very fast and focus is on production on faster selling products.

Recovery in Real Estate: Cera is best-positioned to ride on real estate recovery due to focus on product positioning, brand-building. Recently housing demand has surged, resulting in growth opportunities for the Cera.

Outlook & Valuation

Cera is likely to see the healthy traction in the coming times due to strong product

portfolio at a varied price points, robust distribution network, rising brand awareness

in Tier-II and Tier-III cities, Imminent recovery in individual house building and

thrust on low-cost housing projects, cost savings initiatives and strong balance

sheet with consistent free cashflow generation