Central Depository Services (India) Ltd

Depository Services

Central Depository Services (India) Ltd

Depository Services

Stock Info

Shareholding Pattern

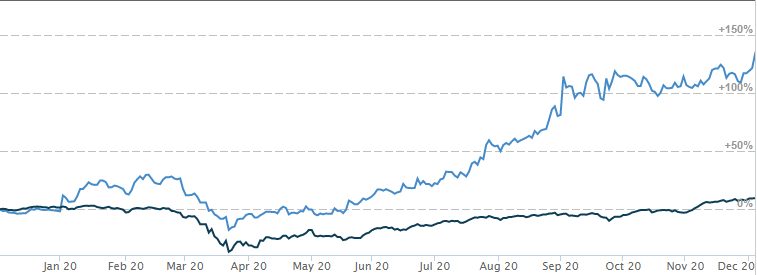

Indexed Stock Performance

Proxy on the capital markets growth story

Central Depository Services (India) Limited (CDSL) is India’s leading and only listed depository, with an objective of providing convenient, dependable and secure depository services at affordable cost to all market participants. CDSL maintains and services over 2.4 crore demat accounts of Investors or Beneficial Owners (BOs) spread across India. These BOs are serviced by CDSL’s 597 Depository Participants (DPs) from over 19,500 locations.

Investment Rationale

- Increase in trading volumes and retail participation: CDSL has experienced a substantial growth in the number of companies / Issuers admitted in demat from 541 in FY 1999-00 to 14,018 in FY 2019-20, a growth of 18% CAGR. Retail investors have been increasingly investing in equities, which is evident from the rise in number of investor’s accounts.

- Gaining market share from NSDL: In terms of cumulative market share of active demat accounts, CDSL has experienced a growth in market share from 40% in FY 2013-14 to 51% in FY 2019-20. As on 30th September, CDSL’s aggregate market share was 54% of investors’ accounts. CDSL opened 11.2 lakh investors’ accounts in the month of September 2020, the highest in the history of CDSL.

- Duopoly business with high entry barrier: CDSL (promoted by BSE) and NSDL (promoted by NSE) are the only 2 depositories present in India. Because of their strong parentage, these depositories have clear advantage and duopoly nature has resulted in healthy competition.

RANGE BREAKOUT

Price: CDSL is consolidating above all its important moving average, 21SMA & 50SMA on daily and weekly chart. We expect the stock to continue its outperformance in the coming weeks. The stock was trading in range as show on daily chart, before the stock break out from this range on higher side. The stock has bounced from the support level with increased in volume which indicates the strength in the counter. The stock is making higher low on daily chart, which is giving bullish stance.

Indicator: The stock is trading above keen moving average (21SMA & 50SMA) on daily chart, which indicates bullishness for this stock. The RSI on daily chart is pegged at 67.28, indicating the stock has not been overbought. The signal line also suggests the upward move and more momentum is due in the counter from a near term perspective. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. MACD line on daily charts is in buy mode, indicating bullish momentum is likely to continue which supports to our bullish view on the stock. Whereas ADX trading at 28.49, well trading above 25, which shows overall strength is likely to bring in sustained buying from the current levels.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. CDSL stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Trader may go long around current level Rs.515 with keeping the stop loss Rs.450 for target Rs.650.