Ceat Ltd

Tyres & Allied

Stock Info

Shareholding Pattern

Price performance

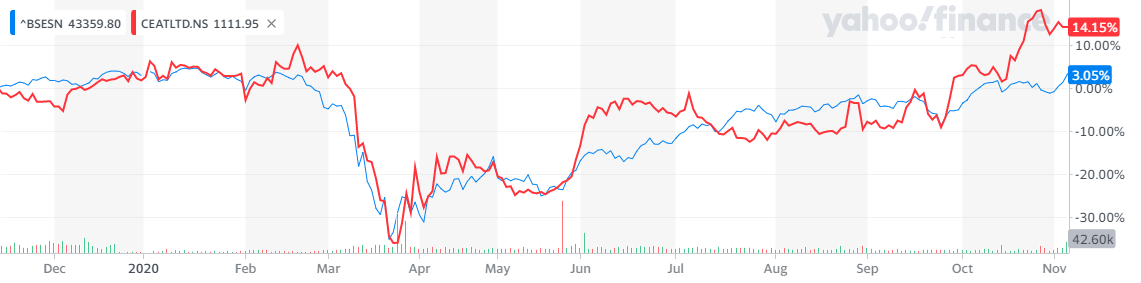

Indexed Stock Performance

Muhurat pick

Profile

CEAT Ltd. engages in the manufacture and sale of automotive tyres, tubes, and flaps.

It offers tyres to all user segments and manufacturers for all vehicles including

heavy-duty trucks and buses, light commercial vehicles, earthmovers, forklifts,

tractors, trailers, cars, auto-rickshaws, motorcycles and scooters,. The company

was founded on March 10, 1958 and is headquartered in Mumbai, India.

Investment Rationale

Strong OEM relationships: To expand revenues from non-trucking segments,

CEAT entered into niche categories like 2Ws and UVs in the early years of this decade.

It started working closely with OEMs to understand their requirements in terms of

product quality and backed this up with new products catering to every segment.

Over past few years, CEAT has added marquee clients to its OEM portfolio in both

2Ws and 4Ws, showcasing its R&D capabilities. The company is consistently investing

in upgrading its technological capabilities and R&D to deliver high-quality,

innovative and specialized products across categories.

Capex to fuel growth: Company has expanded its production capacity in key focus categories of Two-wheeler, Passenger Vehicle and Truck & Bus Radial (TBR). During FY20, production commenced at its greenfield capacity plant in Chennai for Passenger Vehicle tyres and has expanded 2W tyre and TBR facilities in Nagpur and Halol, respectively. On consolidated basis, INR ~4000 crore has been earmarked for capacity expansion projects out of which INR 2200 crores has already been spent. The remaining investments will be made in a staggered manner. These projects are being funded through internal accruals and external borrowings. These additional capacity enhancement projects with ram-up of new plants coming on stream will uplift the total volumes on an overall basis.

Extensive distribution reach: CEAT has been consistently strengthening its distribution network and looking for innovative ways to widen its reach. The company has a three-pronged approach to reach customers: 1) dealers, 2) distributors and 3) branded/exclusive franchises.

Outlook & Valuation:

CEAT has laid strong emphasis on effective marketing and branding of products. To

position its products competitively, the company has developed creative ad campaigns

based on extensive research/consumer insights. Since the 2W/PV segments are consumer-facing,

we believe factors such as brand loyalty, visibility and recall go a long way in

creating replacement market demand and improving market share. We expect reversal

in margins in upcoming quarters led by increased share of OEM’s in sales mix

and volume recovery across verticals. Currently the stock trades at PE of 18x/11x

of FY21/FY22E estimates. We remain positive on the stock for long term.