Carborundum Universal Ltd

Abrasives

Carborundum Universal Ltd

Abrasives

Stock Info

Shareholding Pattern

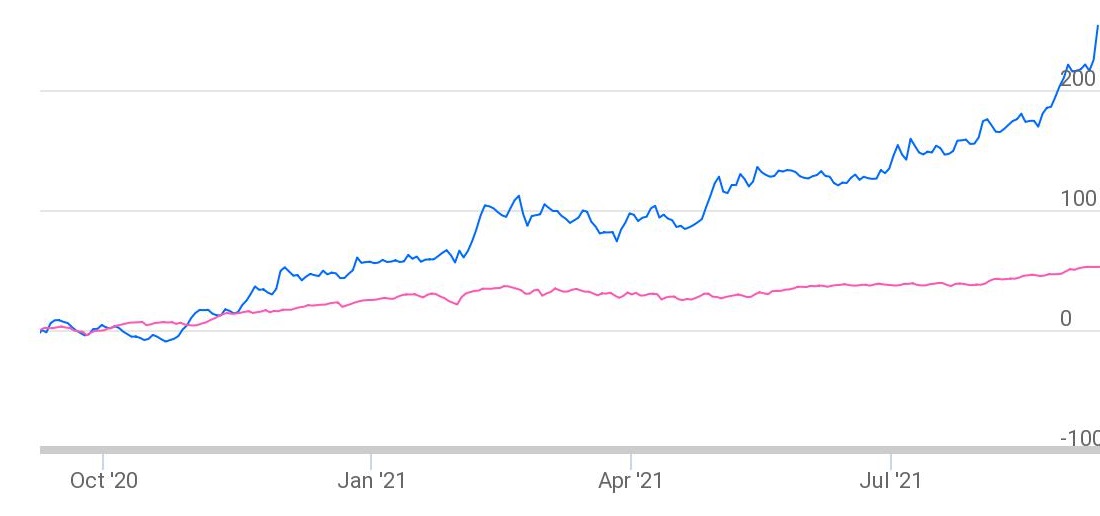

Price performance

Indexed Stock Performance

Engaged in Manufactures and Selling of Abrasives, Electrominerals, and Ceramics

Company Profile

Carborundum Universal Limited (CUMI) was incorporated in 1954 as a joint venture

between India’s Murugappa group, Carborundum company (USA) and Universal Grinding

Wheel company (UK). CUMI has broadly four business segments: Abrasives, Electro

Minerals, Ceramics, and Composites. The company has several manufacturing plants

across Russia, South Africa and Australia, and marketing operations in China, Middle

East, and North America. CUMI exports its products to 40+ countries. It has five

subsidiaries and its wholly-owned subsidiary CUMI International Ltd has

six subsidiaries. Of the total 11 subsidiaries, three are situated in India and

eight overseas.

Segment Overview

Abrasives (36% to Consolidated Revenue) – This segment is in the business

of engineering surfaces. It manufactures and distributes rigid and flexible abrasives.

Basically, abrasives are used to finish or shape a work piece by rubbing. The key

product segments are bonded abrasives, coated abrasives, metal working fluid, super

abrasives, and allied products. The products are used in several end-user industries

such as automobiles, auto ancillary, metalworking, building and construction, wood

working, railways, aerospace, and general engineering.

Electro Minerals (40% to Consolidated Revenue) – The mineral business of the company spans across India, Russia, and South Africa with eight manufacturing facilities covering product groups – fused alumina, silicon carbide, and alumina zirconia. For niche markets, the company also manufactures semi friable alumina, surface, and thermally treated grains, solgel derived alumina, specialty alumina, and ceramic fine powders.

Ceramics (23% to Consolidated Revenue) – The ceramics business comprises of the industrial ceramics and the refractories. The key user industries for ceramics business are power generation and distribution, mining & ore processing, cement, ferrous and non-ferrous industries, automotive, battery, glass, paper, food grain handling, petrochemicals, and ceramic tiles. The company’s ceramics business is largely a global business and majority of the sales volumes are through exports. It is one of the major players in India, Australia, and Europe and in specific product groups in Japan and China.

Investment Rationale

Strong Market Position, Diversified Revenue Base, and Integrated Operations

The company's revenue streams are well-diversified. The electro minerals business

(39.7% of consolidated revenue in FY21) surpassed the abrasives business (36.1%)

as the company's largest revenue contributor in FY21. The business of ceramics

contributed for 22.8% of total sales. With a dominant market share in the domestic

abrasives sector, the company is also improving its market position in the global

electro minerals market.

It also has a highly diversified customer base in terms of end-user industries, with revenue contribution from international markets such as Russia, Australia, China, North America, and Europe. CUMI caters to a diverse set of end-user industries including auto OEMs, auto ancillaries, general engineering, fabrication, foundry, industrial projects, construction, and metal working. We believe, having a diversified business and customer base provides a downside cushion to the company. CUMI has also seen cost savings as a result of its backward integration into silicon carbide, zirconia, and brown/white fused alumina, which are key inputs for its abrasives and ceramics businesses.

Dominant Position in Indian Abrasives Market and Well Poised to Take Advantage

of Increased Demand

With a 25%-30% market share, CUMI is one of the major participants in the domestic

abrasives industry. It serves a diverse set of end-user industries and its distribution

network includes over 600 main dealers across India. This segment manufactures and

distributes rigid and flexible abrasives. The products are used in several end-user

industries such as automobiles, auto ancillary, metalworking, building and construction,

wood working, railways, aerospace, and general engineering.

Automotive and related areas provide 25%-30% of CUMI's abrasives business and offers both, precision and ordinary abrasives. Steelmaking, roll grinding, medical equipment, and pharmaceuticals are among the other markets. CUMI also serves the mass market in the areas of woodworking and home renovations. Except for the automotive industry, most of the other end sectors account for less than ten percent of the entire abrasive business.

The company is backward integrated for critical raw materials and was able to gain the competence as a result of acquisitions. The business's main goal is cost competitiveness, while ensuring that supply requirements and evolving market needs are satisfied. India imports a lot of coated abrasives, and CUMI endeavours to get a piece of that market. The company commissioned a new coated maker plant at the close of FY20 with the goal of increasing market share against imported supply. Given its exposure to a diverse range of sectors, we believe the company would benefit from India's economic recovery and resurgence of industrial capex. Capex rebound in India would be positive development for CUMI, as domestic sales accounts for 55%-60% of its revenue.

Growth Opportunities in Electro Minerals

The Business focusses on aggressive growth in the domestic and export market. The

segment continues to focus on new and emerging areas of opportunities like Graphene,

battery materials and related areas through tie-ups for technology and by commissioning

pilot scale plants. Key user industries for this business are abrasives, refractories,

steel, brake linings, nuclear energy, wooden laminates, friction composites, diesel

particulate filter, semiconductor, and others.

Increased focus of the Government in infrastructure spending, growth in domestic auto segment, and the revival of steel industry has pushed the demand for abrasives and refractory products in the domestic market. The segment has seen a growth in White Fused Alumina mainly due to the better performance of user industries like Steel during last year. The fine powder business has also seen an improved performance due to higher offtake by industries. CUMI plans to increase its mix of specialty products from the current 20% to 35% of electro mineral segment sales, which can improve the overall margin profile by diversifying into new products like Azure-S, Nebulox, graphene, etc. Global players looking to reduce sourcing dependence on China is expected to present opportunities for the minerals segment.

Focus on Exports and Supply of Value-added Products to Aid Ceramics Segment

CUMI caters to prominent local and international companies through its industrial

ceramics sector, which provides solutions for thermal, electrical, and wear and

tear resistance. CUMI's business is mostly B2B, with some of its goods co-created

with clients. It caters to a variety of global and domestic majors. Given the complexity

of products, this segment is relatively more profitable. With the addition of a

new capacity, the company will be able to take advantage of new export potential

in the field of ceramics. It has identified several high-potential markets to which

it will gradually boost its supplies.

Under engineered ceramics, Metz cylinders is the most important product area, which finds application in power transmission and distribution. CUMI also provides to specialised injection moulding segments such as spark plugs, 3D printing, and base materials used in fuel cells. It's also working on items for electric vehicles and to meet the newest advances in energy, electronics, aerospace, and other industrial uses. Engineered ceramics is expected to drive margins in the future.

Government Initiatives to Support Growth

The company’s business operations are highly dependent of two core industries

viz. construction and automotive. India, which began its financial year amid the

lockdown, recorded one of the steepest contractions in GDP. However, with the gradual

easing of the lockdown restrictions, pent-up demand within some sections of the

economy, came back strongly. Particularly, construction and home renovations outperformed

expectations. Further, the preference for personal modes of transportation increased,

and festive season gave push demand to some extent.

The Union Budget’s heavy focus on infrastructure and the PLI scheme are expected to keep investment sentiments positive. The government's focus on capex is expected to increase demand for industrial consumables. Growth in Nominal GDP expected to rebound in FY22, thereby giving some demand boost for construction and industrial goods as well as automobiles and auto parts. Though automotive industry is facing supply side issues related to semiconductors, the overall scenario is expected to start recovering in near future. Further, the government's policy of discouraging Chinese imports and encouraging domestic manufacture may help organised players gain market share.

Acquisition of PLUSS Advanced Technologies

On 26th August, 2021, the company has signed formal agreements to purchase

a majority share in PLUSS Advanced Technologies Private Limited for Rs. 115 crores

(72% stake). Existing shareholders, including the promoters and Tata Capital Innovations

Fund will sell their shares to CUMI. The transaction is scheduled to conclude by

October, 2021. The transaction will be funded by CUMI's internal accruals. As

per the company’s filings, PLUSS’ turnover in FY19, FY20, and FY21 was

Rs. 28.65 crores, Rs. 27.04 crores, and Rs. 36.31 crores, respectively.

PLUSS is active in phase change materials (PCM) for thermal energy storage and specialty polymeric additives for polymer recycling and mechanical property enhancement, and it plays a major part in Sputnik V COVID vaccine cold chain logistics. PLUSS was the first company to create leak-proof PCMs, and it is a global leader in hydrated salt-based PCMs, with patents covering Europe, North and South America, and Asia. It holds more than 20 patents and trademarks. PLUSS products are finding new applications in the pharmaceutical cold chain, refrigeration and food supply chain, medical devices, buildings, and HVAC in India and throughout the world.

Outlook & valuation

Indian abrasives market is highly concentrated with two dominant players (CUMI & Grindwell Norton). CUMI is larger of the two players with 25%-30% market share. Both the players combined had a share of ~USD 13 billion in global abrasives market of ~USD 40 billion in CY20. Further, the global abrasives market is expected to reach ~USD 56.6 billion in CY27 and this is expected to aid CUMI’s growth as the company is targeting higher exports. The company is focusing on increasing share of specialities in electro minerals to 35% in medium term and this is expected to aid in margin growth. Further, the government’s focus on infrastructure and initiatives such as PLI schemes, NIP, etc. is expected to keep investment sentiments positive and CUMI see this as a good opportunity for abrasives. At the current market price of Rs. 816, the stock is trading at 32.9x of FY23E consensus estimates.

Technical

Price: CARBORUNDUM UNIVERSAL chart structure suggests formation of cycles of higher highs and higher low on daily charts, even on weekly chart its trading in parabolic curve, this clearly suggests that the stock is consolidating ahead of gaining momentum to resume its upwards journey. The stock trading above its short-term moving averages like 21SMA at Rs.740 and it 50SMA at Rs.686. We expect the stock to continue its outperformance in the coming weeks. The stock has bounced from the support level with increased volumes which indicates the strength in the counter.

Indicator: The RSI 14 on daily chart is pegged at 76.28 and positive crossover & trading comfortably above signal line on daily charts. The Parabolic SAR is trading below its price action on daily charts reflecting up trend in the stock in near term. Even the MACD signal line on weekly chart is trading in positive territory, which indicates bullish view on the stock.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. CARBORUNDUM UNIVERSAL stock has seen buying with increases in volume, which shows the movement of the stock is on bullish side.

Conclusion: The recent price action suggests that strong hands are accumulating the stock at lower levels. Considering all the above data facts, we recommend entering the stock at the current levels for the potential targets of RS.1155 levels. Any correction towards Rs.827 levels can be utilized to average the stock keeping strict stop loss at Rs.800 levels.