Blue Dart Express Ltd

Courier Services

Blue Dart Express Ltd

Courier Services

Stock Info

Shareholding Pattern

Price performance

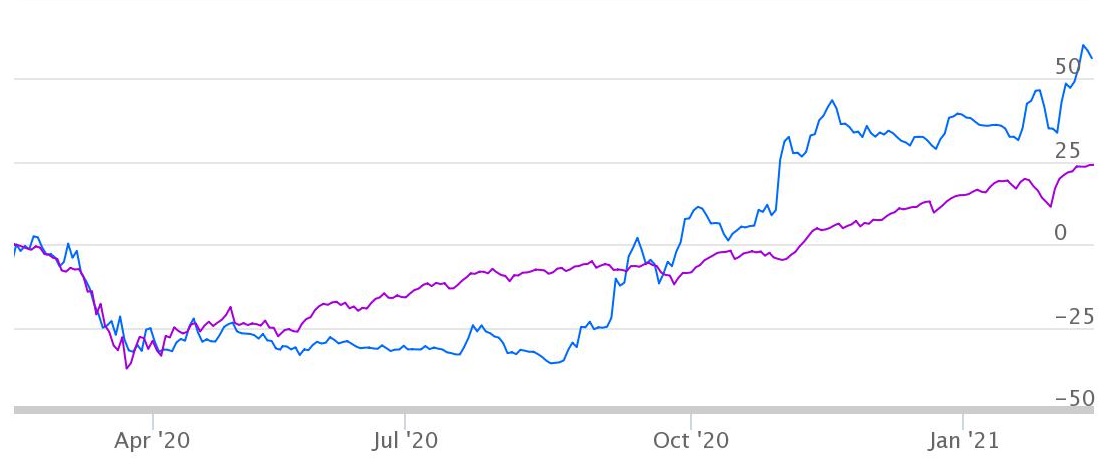

Indexed Stock Performance

Blue Dart Express Limited (Blue Dart) is engaged in transportation and distribution of time-sensitive shipments, through a network of integrated ground and air transportation. The company commands a leadership position in Indian courier industry, facilitated by an extensive network of over 35,000 locations in India and servicing 220+ countries and territories worldwide through a sales alliance with Deutsche Post DHL Group (DP DHL), one of the world’s largest international air express companies. Through the alliance, Blue Dart benefits from DP DHL’s global reach, cross border specialisation and larger network. Blue Dart operates its own fleet of aircraft. As on date, the company operates with its fleet of six Boeing 757-200 freighter aircrafts, a flotilla of 22,336 vehicles as well as 2173 facilities and hubs. Since inception, Blue Dart has maintained its technology leadership and continues to invest in its technology infrastructure to create differentiated delivery capabilities, products and solutions for its customers.

South Asia's Premier Express Air and Integrated Transportation & Distribution Company

Undisputed Leader in Organized Air Express

Blue Dart is the undisputed leader in organized air express business with the market

share of 48-49%. The company benefits from first mover advantage together with an

owned fleet of aircraft, high service standards, pan-India presence and long-term

tie-ups with corporates. It has been ahead of its competitors in deploying advanced

technology, which help its clients to track their cargo with great preciseness.

Its competitive edge over existing domestic players and new entrants is its fleet

of six aircraft, flotilla of 22,336 vehicles as well as 2173 facilities/hubs covers

more than 35,000 locations. It remains unmatched in terms of the first mile and

last mile connectivity in India.

Price Hike to Improve Profitability

Q3FY21 witnessed ~20% YoY revenue growth on account of volume growth and improved

mix. Blue Dart adjusts its prices annually, taking into account inflation, currency

dynamics, fluctuations in fuel costs and other rising regulatory and mandatory costs.

Effective January 2021, Blue Dart has increased average shipment price by 9.6% which

increased our expectation of further profitability in Q4FY21 and FY22E. The higher

yield along with conversion of two leased aircrafts to owned ones is expected to

aid in margin improvement.

Acceleration in E-commerce to Drive Growth

E-commerce is evolving as a major growth driver for the entire logistics industry

in India. On Account of growing number of smartphone users, higher internet penetration,

preference for shopping online over in-store purchase, etc. have boosted the growth

in e-commerce industry. The customers of e-commerce players demand on-time delivery,

real-time tracking, reverse pickup/exchanges, different types of payments, among

others. Blue Dart provides the most efficient solutions with its Dart Plus &

Speed trucking, 24x7 shipment visibility, same day and next day delivery options,

open and closed reverse pick-ups, 15+ payment options, among others to its e-commerce

clients. Due to covid-19 pandemic, there is a shift towards online purchase and

digital payment and we believe that this trend will aid Blue Dart to grow its business

and contribute towards its growth.

Technical

Price: BLUEDART has gained 9.06% over weekly basis after finding bottom at Rs.3709 made on 21 December 2020, which also ended short term down trend in the stock from its previous swing high of Rs.4299.80 made on 19 November 2020 indicating its long-term secular uptrend has resumed. The stock has been significantly outperforming NIFTY over week on week basis. We expect the stock to continue its outperformance in the coming weeks. The stock has bounced from the support level with increased in volume which indicates the strength in the counter.

Indicator: The stock is trading above important moving average 21SMA, 50SMA & 200SMA on daily charts as well as weekly chart. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. RSI (14) on daily chart is pegged at sub 69 levels, indicating the stock has not yet been over bought. The Parabolic SAR is trading below its price action on daily charts reflect up trend in the stock will remain intact in near term. The MACD is trading above the signal in buy territory on daily chart, indicating positive momentum in the stock in the near term.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. BLUEDART stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for medium term. The stock has seen volume break out on daily basis, which indicates strong hands are accumulating the stock at currents levels, which enhance the confidence over the stock. The stock is trading with bullish bias and all set to make new 52 week high in coming days. Traders may go long on the stock around Rs.4645 levels keeping a stop loss below Rs.5300 for target of Rs.7300 level.