Bajaj Finserv Ltd

Finance - NBFC

Bajaj Finserv Ltd

Finance - NBFC

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Established business with strong track record

Company profile

Bajaj Finserv Ltd is a diversified financial services group with a Pan-India presence

in life insurance, general insurance, and lending. It is the holding company for

Bajaj Finance Ltd (BFL) with 52.74% stake in the company. It also holds 74% each

in Bajaj Allianz General Insurance (BAGIC) and Bajaj Allianz Life Insurance (BALIC,

among top 5 private sector life insurers in India on new business in FY20). Incorporated

in 1987, Bajaj Finance Ltd has a diversified product suite comprising of key businesses

such as vehicle loans, consumer durable loans, personal loans, mortgage loans, small

business loans etc. Established in 2001, BAGIC is the 2nd largest private general

insurer in India in terms of gross premium and has consistently performed amongst

the private players. BALIC, established in 2001 has a deep, Pan-India distribution

reach.

Consolidated Financial Statements

| Rs in Cr | NII | PPOP | PAT | EPS | BV |

|---|---|---|---|---|---|

| FY19 | 36064.00 | 9842.00 | 5372.00 | 202.00 | 1492.00 |

| FY20 | 45008.00 | 12422.00 | 5994.00 | 212.00 | 1967.00 |

| FY21 | 51450.00 | 15831.00 | 7367.00 | 281.00 | 2251.00 |

| FY22E | 58521.00 | 18859.00 | 10607.00 | 347.00 | 2586.00 |

| FY23E | 68955.00 | 20705.00 | 12095.00 | 516.00 | 3173.00 |

Rationale for Investment

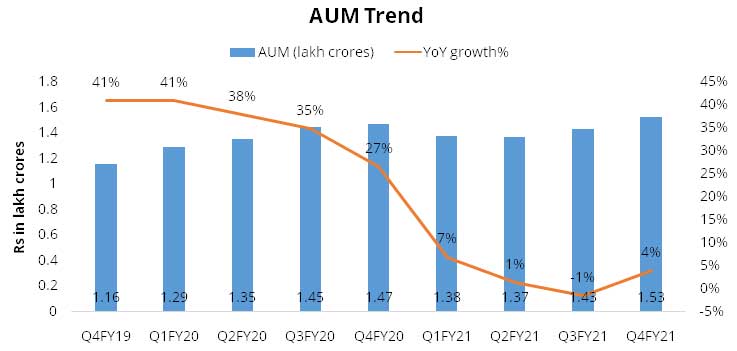

Bajaj Finance has strong market presence in the Indian retail finance operations

Bajaj Finance has emerged as one of the largest retail asset financing NBFCs in

India and continues with its two-pronged strategy of building scale and maximising

profit. The company has demonstrated track record of profitable growth with segments

such as mortgages, small business loans, and commercial lending through building

scale, while consumer durable loans, personal loans, and 2- and 3-wheeler financing

are focused on maximising profit. The company will capitalize on growth opportunities

led by proposed launch of marketplace apps & innovative new digital initiatives,

structurally higher profitability driven by better margins and lower credit costs,

majority of stressed loans are written-off, restructured or provided for and continuous

improvement in liability profile.

General insurance – healthy & profitable retail franchise

BAGIC has established a profitable franchise in the non-life insurance sector with

a persistent market credibility since inception. BAGIC has a strong focus on growing

its retail business which includes motor insurance, health insurance for individuals,

other personal insurances, insurance for commercial entities like shops, SMEs etc.

BAGIC also participates in annual tender-driven businesses like crop insurance and

government health schemes. BAGIC has delivered superior financial performance led

by i) robust and prudent underwriting practices & higher operating efficiency

ii) generation of cash flows through strong retention of premium and judicious investments

of the proceeds; and iii) focus on high quality customer service. BAGIC is experiencing

strong growth in motor segments as well as it is doing better in crop & engineering

insurance. BAGIC’s superior underwriting capability has led to industry leading

combined ratio consistently over time; which stood at 96.9%.

Life insurance – fastest growing amongst peers

BALIC is third largest agency amongst private players and remains prudent by focusing

on a balanced product mix and investment in retail growth engines. BALIC focus is

to maximize customer benefits while gaining market share in retail space and increasing

New Business Value (NBV). It has diverse suite of products across various need segments

namely i) Guaranteed Pension Goal (Annuity), Smart Wealth Goal (ULIP), Flexi Income

Goal (Par), Smart Protect Goal (Term), Guaranteed Income Goal (Non Par) have witnessed

strong response from the customers. Despite the impact of COVID-19, BALIC consistently

reported industry beating growth & improvement in quality parameters (including

balanced product mix, NBV, persistency, etc). The second wave of spread of Covid-19

might lead to increased demand for guarantees, protection and retirement products

due to risk aversion and resultant market volatility. BALIC was fastest growing

among the top 10 private players in FY21 and its market share increased from 4.6%

to 5.5% among private players.

Focus on digital initiatives & technology modernisation

The company has invested deeply in data analytics, machine learning models and artificial

intelligence (AI) to better service customers and drive the business. Some of the

initiatives taken by the company are as follows: i) BAGIC launched “Digi Sampark

Programme” to stay connected with customers thereby enabling extended reach

to customers, hence BAGIC’s digital policy issuance increased to 96.7% in

FY21 from 85.6% in FY20 ii) BALIC’s “Smart Assist” along with

voice calling feature; implementation of CRM (iAhead) with 360 degree view of customers

at all digital touch points; iii) Integrating the fragmented healthcare delivery

ecosystem with technology and financial services on a digital platform to bring

quality healthcare closer to consumers' reach through launch of “Aarogya

Care”.

Outlook & valuation

We expect the company to capitalize on growth opportunities supported by healthy capitalization, surplus liquidity on its balance sheet and resilient asset quality. Further due to BFL’s prudent provisioning, we expect it to enter FY22 with a clean slate and much stronger balance sheet. BALIC and BAGIC have healthy solvency ratios and robust operating metrics coupled with strong structural tailwinds which shall provide impetus to growth going forward. The long term tailwinds such as a large protection gap and expanding per capita income are key growth drivers for the life insurance sector thus we expect strong players like Bajaj Finserv to gain disproportionally from this opportunity supported with the right mix of products and services. The stock is currently trading at 4.1x FY23E P/BV and we initiate our Buy rating on Bajaj FInserv.

Financial Statement

Profit & Loss statement

| DESCRIPTION | Mar-19 | Mar-20 | Mar-21 | Mar-22E | Mar-23E |

|---|---|---|---|---|---|

| Revenue from operations | 42604.00 | 54347.00 | 60591.00 | 67895.00 | 79203.00 |

| Interest Expense | 6540.00 | 9339.00 | 9141.00 | 9374.00 | 10248.00 |

| Net Interest Income | 36064.00 | 45008.00 | 51450.00 | 58521.00 | 68955.00 |

| Growth% | 28.00% | 25.00% | 14.00% | 14.00% | 18.00% |

| Other Income | 2.00 | 5.00 | 0.00 | 1.00 | 3.00 |

| Operating Income | 36066.00 | 45013.00 | 51450.00 | 58522.00 | 68958.00 |

| Employee Expenses | 3802.00 | 4755.00 | 4698.00 | 4743.00 | 4798.00 |

| Operating expenses | 22422.00 | 27836.00 | 30921.00 | 34920.00 | 43455.00 |

| Total Operating Expenses | 26224.00 | 32591.00 | 35619.00 | 39663.00 | 48253.00 |

| PPOP | 9842.00 | 12422.00 | 15831.00 | 18859.00 | 20705.00 |

| Provisions and Contingencies | 1689.00 | 4120.00 | 5969.00 | 4717.00 | 4579.00 |

| Profit Before Tax | 8153.00 | 8302.00 | 9862.00 | 14142.00 | 16126.00 |

| Provision for Tax | 2781.00 | 2308.00 | 2495.00 | 3536.00 | 4031.50 |

| Tax Rate% | 34.00% | 28.00% | 25.00% | 25.00% | 25.00% |

| Profit After Tax | 5372.00 | 5994.00 | 7367.00 | 10607.00 | 12095.00 |

Balance Sheet

| DESCRIPTION | Mar-19 | Mar-20 | Mar-21 | Mar-22E | Mar-23E |

|---|---|---|---|---|---|

| Share Capital | 80.00 | 80.00 | 80.00 | 80.00 | 80.00 |

| Reserves & Surplus | 23661.00 | 31222.00 | 35750.00 | 41064.00 | 50401.00 |

| Networth | 23741.00 | 31302.00 | 35830.00 | 41144.00 | 50481.00 |

| Minority interest | 12808.00 | 19560.00 | 22464.00 | 27555.00 | 31449.00 |

| Total Equity | 36549.00 | 50862.00 | 58294.00 | 68699.00 | 81930.00 |

| Borrowings | 37574.00 | 54700.00 | 47441.00 | 49950.00 | 68684.00 |

| Other Liabilities | 134400.00 | 146272.00 | 174429.00 | 241549.00 | 307213.00 |

| Total Liabilities | 208523.00 | 251834.00 | 280164.00 | 360198.00 | 457827.00 |

| ASSETS | |||||

| Net Block | 1203.00 | 2201.00 | 2182.00 | 2735.00 | 3290.00 |

| Receivables & Advances | 115213.00 | 144558.00 | 149853.00 | 179641.00 | 223876.00 |

| Net Investments | 81679.00 | 91821.00 | 113654.00 | 137295.00 | 167609.00 |

| Cash and Bank | 1589.00 | 2525.00 | 3410.00 | 26029.00 | 44563.00 |

| Other Current Assets | 8839.00 | 10729.00 | 11065.00 | 14498.00 | 18489.00 |

| Total Assets | 208523.00 | 251834.00 | 280164.00 | 360198.00 | 457827.00 |