Bajaj Finance Ltd

Finance - NBFC

Bajaj Finance Ltd

Finance - NBFC

Stock Info

Shareholding Pattern

Price performance

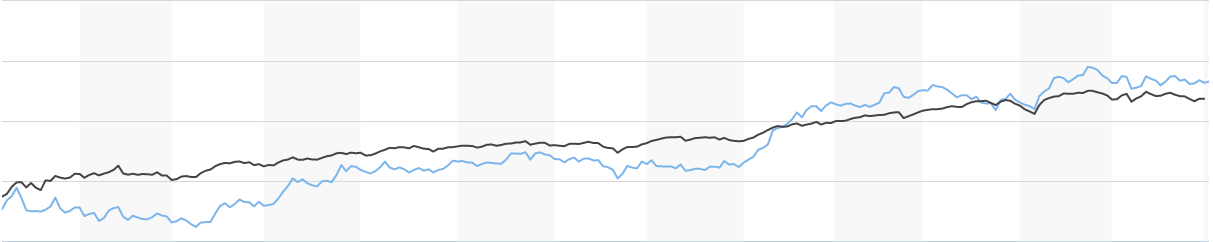

Indexed Stock Performance

Long term growth story intact backed by strong fundamentals

Company Profile

Set up in 1987, Bajaj Finance Limited (BFL) is a subsidiary of Bajaj Finserv (52.7%

ownership), the financial services arm of the Bajaj group. Bajaj Finance has a diversified

product suite comprising of key businesses such as vehicle loans, consumer durable

loans, personal loans, mortgage loans, small business loans, loans against securities,

commercial finance, and rural finance. Bajaj Finance is the largest financier of

2-wheelers and consumer durables in India.

BFL is present in 2988 locations across the country, including 1690 locations in rural/smaller towns and villages as on March 31,2021. It has two 100% subsidiaries: (i) Bajaj Housing Finance Ltd. (‘BHFL’), which is registered with National Housing Bank as a Housing Finance Company (HFC); and (ii) Bajaj Financial Securities Ltd. (‘Bfinsec’), which is registered with the Securities and Exchange Board of India (SEBI).

Investment Rationale

Strong market presence in the Indian retail finance operations

Bajaj Finance has emerged as one of the largest retail asset financing NBFCs in

India and continues with its two-pronged strategy of building scale and maximising

profit. The company has demonstrated track record of profitable growth with segments

such as mortgages, small business loans, and commercial lending through building

scale, while consumer durable loans, personal loans, and 2- and 3-wheeler financing

are focused on maximising profit.

Consistent Growth in Consumer Finance Business

The company is amongst the largest personal loan lenders in India and continued

to be the dominant lender for consumer electronics, furniture and digital products.

Consumer financing business constitutes 36% of the Loan book as on March 2021. The

company’s growth has been sustained by an expanding distribution reach, innovative

credit outreach and cross-selling opportunities. The company also extended its loan

offerings in the healthcare segment by introducing a ‘Healthcare EMI Card’

SME financing form sustainable scale builders while partnerships drive granular

fee income

SME financing and commercial lending now comprise 13% and 9% of consolidated AUM

respectively as on March 2021. It launched used-car financing and small-ticket secured

SME loans in FY19. The Company’s co-branded credit cards business in partnership

with RBL Bank continued to grow in a robust manner and its co-branded credit cards

stood at 2.05 million cards-in-force (CIF). The company’s co-branded wallet

business in partnership with Mobikwik continued to grow by offering EMI cards in

digital format and it had 19.8 million users as on March 2021. Both partnerships

augur well to generate granular and sticky fee income.

Focus on Analytics & technology modernisation

Productivity has increased due to the effective use of technology and analytics.

The company has invested deeply in data analytics, machine learning models and artificial

intelligence (AI) to better service customers and drive the business. Facial recognition

technology has been deployed in offices and some branches on pilot basis, with the

aim of providing a differentiated and frictionless customer service experience.

Outlook & valuation

We expect the company to capitalize on growth opportunities supported by healthy capitalization, surplus liquidity on its balance sheet and resilient asset quality. Further we expect the company to invest in distribution & expand its geographic footprint and it has multiple levers to reduce cost, given its multiple product lines. Further disbursements have been picking up gradually month on month which will enable stable earnings growth going forward. The stock is currently trading at 6.4x FY23E P/BV and we initiate our coverage on Bajaj Finance with a Buy Rating.

Financial Statement

Profit & Loss statement

| DESCRIPTION | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22E | Mar-23E |

|---|---|---|---|---|---|---|

| Interest income | 11586.00 | 16349.00 | 22970.00 | 23303.00 | 29291.00 | 36782.00 |

| Interest Expense | 4696.00 | 6723.00 | 9608.00 | 9414.00 | 12570.00 | 16207.00 |

| Net Interest Income | 6889.00 | 9626.00 | 13363.00 | 13889.00 | 16722.00 | 20575.00 |

| Growth% | 34.00% | 40.00% | 39.00% | 4.00% | 20.00% | 23.00% |

| Other Income | 1213.00 | 2151.00 | 3415.00 | 3380.00 | 4109.00 | 5106.00 |

| Total Income | 8102.00 | 11778.00 | 16778.00 | 17269.00 | 20831.00 | 25681.00 |

| Total Operating Expenses | 3228.00 | 4097.00 | 5526.00 | 5308.00 | 6288.00 | 7955.00 |

| PPOP | 4874.00 | 7681.00 | 11252.00 | 11961.00 | 14543.00 | 17726.00 |

| Provisions and Contingencies | 1030.00 | 1501.00 | 3929.00 | 5969.00 | 4043.00 | 4741.00 |

| Profit Before Tax | 3843.00 | 6179.00 | 7322.00 | 5992.00 | 10500.00 | 12985.00 |

| Provision for Tax | 1347.00 | 2184.00 | 2058.00 | 1572.00 | 2646.00 | 3272.00 |

| Tax Rate% | 35.00% | 35.00% | 28.00% | 26.00% | 25.00% | 25.00% |

| Profit After Tax | 2496.00 | 3995.00 | 5264.00 | 4420.00 | 7854.00 | 9712.00 |

| Earnings Per Share | 43.00 | 69.00 | 88.00 | 73.00 | 130.00 | 161.00 |

Balance Sheet

| DESCRIPTION | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22E | Mar-23E |

|---|---|---|---|---|---|---|

| EQUITY AND LIABILITIES | ||||||

| Share Capital | 115.00 | 115.00 | 120.00 | 120.00 | 120.00 | 120.00 |

| Reserves & Surplus | 15733.00 | 19582.00 | 32208.00 | 36798.00 | 43259.00 | 52671.00 |

| Borrowings | 66109.00 | 101588.00 | 129806.00 | 131783.00 | 160073.00 | 183839.00 |

| Current Liabilities | 2074.00 | 2948.00 | 2257.00 | 2825.00 | 2879.00 | 3591.00 |

| Total Liabilities | 84031.00 | 123563.00 | 164391.00 | 171526.00 | 205418.00 | 239222.00 |

| ASSETS | ||||||

| Non-Current Assets | ||||||

| Net Advances | 79103.00 | 112513.00 | 141376.00 | 146687.00 | 180876.00 | 210475.00 |

| Net Block | 470.00 | 695.00 | 1321.00 | 1367.00 | 1629.00 | 2038.00 |

| Investments | 3139.00 | 8599.00 | 17544.00 | 18397.00 | 18684.00 | 21401.00 |

| Sundry Debtors | 639.00 | 809.00 | 952.00 | 1107.00 | 1279.00 | 1701.00 |

| Cash and Bank | 340.00 | 349.00 | 1383.00 | 2176.00 | 1702.00 | 2209.00 |

| Other Current Assets | 340.00 | 599.00 | 1815.00 | 1792.00 | 1249.00 | 1397.00 |

| Total Assets | 84031.00 | 123563.00 | 164391.00 | 171526.00 | 205418.00 | 239222.00 |