Avenue Supermarts Ltd

Retailing - Supermarts

Avenue Supermarts Ltd

Retailing - Supermarts

Stock Info

Shareholding Pattern

Price performance

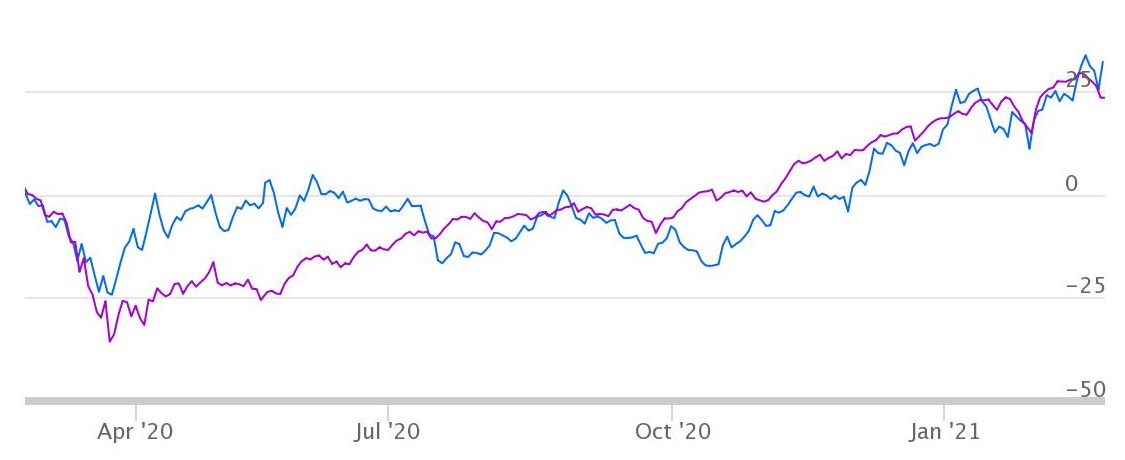

Indexed Stock Performance

Strong Retail Player

Profile:

Avenue Supermarts Limited (DMart) is a national supermarket chain, with a focus

on value-retailing. The Company offers a wide range of products with a focus on

Foods, Non-Foods (FMCG) and General Merchandise & Apparel product categories.

As of December 31, 2020, the Company had 221 operating stores with Retail Business

Area of 8.17 million sq. ft. across Maharashtra, Gujarat, Daman, Andhra Pradesh,

Karnataka, Telangana, Tamil Nadu, Madhya Pradesh, Rajasthan, NCR, Chhattisgarh and

Punjab.

Value retailing to a well-defined target consumer base

D-Mart follows Everyday low cost - Everyday low price (EDLC-EDLP) strategy which

aims at procuring goods at competitive price, using operational and distribution

efficiency and thereby delivering value for money to customers by selling at competitive

prices on daily basis. The company strategy is to target lower-middle, middle and

aspiring upper-middle income consumers as getting value for money is the most compelling

factor in daily shopping decision-making for these income groups. The majority of

the products stocked by the company are essential products forming part of basic

lifestyle rather than discretionary products. This allows to maintain consistency

in footfalls throughout the year and are least affected by seasonality or remain

temporarily depressed due to macroeconomic conditions.

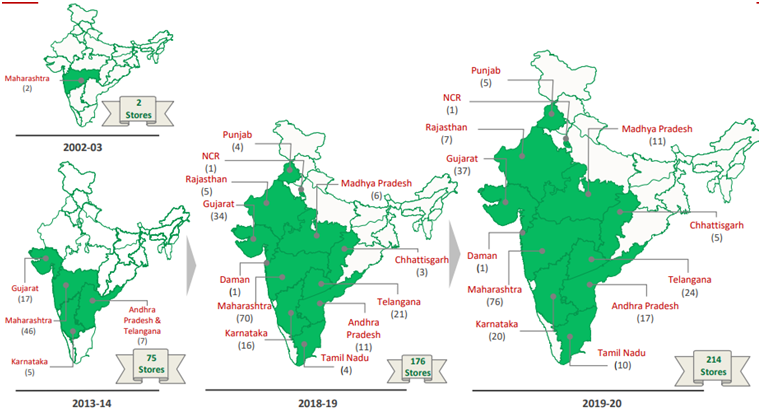

Cluster based store expansions to continue

DMart follows a cluster-based approach. It has deepened store network in southern

and western India and is gradually expanding network in other parts of India. This

approach allows the company to create store clusters within a region and helps better

to understand local needs and preferences and tailor its offerings according to

the demand. Such clusters have also led to increased penetration and presence in

under-served markets with higher cost efficiency due to economies of scale achieved

through supply chain and inventory management with concentrated brand visibility

due to focused implementation of marketing and advertising initiatives.

Owning Stores helps to reduce operating cost

DMART pre-dominantly operates on an ownership model or on a long-term lease arrangement

model rather than a rental model. The company takes a particular property on lease

for a period of more than 20-30 years which allows them to minimize operating costs

thus offering long term competitive advantages like avoiding escalation in rental

expenses thus keeping fixed cost low. DMART’s rental costs are just 0.4% (negligible)

vs average 5-6% of net revenues for other retail players like Future Retail/Spencer

Retail. Despite having lower gross margins in comparison with its peers, Company

has higher EBITDA margins than its peers due to tight control on operating costs.

Over the last 2-3 years however, company has shown an interest towards adding stores

on the long-term lease basis to accelerate the pace of store expansion. DMART’s

Fixed asset turnover has remained consistently higher than peers at ~4x given its

lower operating cost due to negligible rental expenses and higher discounts. Also

inventory turnover ratio has been ~14x from FY16-20. The company has maintained

a higher ROCE and ROE at an average of ~23%/ 17% respectively over FY16-20.

DMART Ready is next growth opportunity

Dmart is addressing e-retail business (DMart Ready) through its subsidiary, Avenue

E-Commerce Ltd through which it offers customers the choice to self-pick-up their

online orders from any of the designated pickup points or get them delivered at

their residence (for a nominal delivery charge). DMART Ready provides its consumers

agility and convenience on a day-to-day purchase, widen its reach in regions where

it doesn’t have presence through Brick & Mortar format owing to high real

estate and other costs. Unlike other online players, DMART wants to expand its e-commerce

business gradually analysing every aspect of the online business model so as to

get a deeper understanding of the store economics as, in grocery e-retailing attaining

breakeven is difficult due to higher revenues from lower margin products, higher

cost of technology and administration and delivery expenses. In Q3FY21, DMART has

launched DMart Ready in select pin codes of Ahmedabad, Bangalore and Hyderabad.

In addition, at some of its brick-and-mortar stores, company has leased some part

of the space to Avenue E-Commerce Limited (AEL) to commence E-Commerce operations

in those cities. Post Covid-19 environment is creating opportunities to launch DMart

Ready in more cities. However, DMART will continue with their approach of small

trials, reviews and controlled acceleration for DMart Ready.

Outlook & Valuation

We believe DMART is well placed in the domestic retail industry given its strong execution capabilities, disciplined EDLP/EDLC strategy, adding new stores, penetrating into new market. At the CMP of 3,123, Avenue supermarket ltd is trading at the PE multiple of 211.2 on the basis of TTM EPS.

Consolidated Financials

| Particulars (in cr) | 2016 | 2017 | 2018 | 2019 | 2020 | 9MNFY21 |

|---|---|---|---|---|---|---|

| Revenues | 8,661 | 12,758 | 15,033 | 20,005 | 24,870 | 16,731 |

| EBITDA | 664 | 981 | 1,353 | 1,633 | 2,128 | 1,131 |

| EBITDAM | 7.66% | 7.69% | 9.00% | 8.16% | 8.56% | 6.76% |

| Profit Before Tax | 492 | 760 | 1,204 | 1,422 | 1,745 | 940 |

| Net Profit | 320 | 479 | 806 | 903 | 1,301 | 686 |

| PATM | 3.70% | 3.75% | 5.36% | 4.51% | 5.23% | 4.10% |

| Adj EPS Priority | 5.70 | 7.67 | 12.92 | 14.46 | 20.09 | 10.58 |

Key Ratios - Consolidated

| Particulars | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| ROE (%) | 23.56 | 18.34 | 18.57 | 17.71 | 15.67 |

| ROCE (%) | 24.22 | 21.91 | 24.18 | 25.78 | 20.84 |

| Fixed Asset Turnover | 4.0 | 4.4 | 4.4 | 4.3 | 4.1 |

| Inventory Turnover(x) | 14.4 | 14.9 | 14.4 | 14.6 | 14.2 |

Technical

Price: Avenue Supermarts has gained 2.83% and got close on intraday high. The stock after finding bottom at Rs.2610 made on 29 January 2021, which also ended short term to medium term down trend in the stock. The stock has been significantly outperforming NIFTY over month on month basis. We expect the stock to continue its outperformance in the coming weeks. The stock has bounced from the support level with increased in volume which indicates the strength in the counter.

Indicator: The stock is trading above important moving average 21SMA & 50SMA on daily charts as well as weekly chart. Bollinger Band (20, 2, S) set up on daily chart has started to slightly expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. RSI (14) on daily chart is pegged at sub 66.90 levels, indicating the stock has not yet been over bought. The Parabolic SAR is trading below its price action on daily charts reflect up trend in the stock will remain intact in near term. The DMI+ (26.73) on the daily timeframe is also currently trading near the 25-mark suggesting that the stock is likely to witness more momentum in coming days.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. AVENU SUPERMART stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for medium term. Trader may go long around current level Rs.3123 with keeping the stop loss Rs.3100 for target Rs.4250.