Atul Ltd

Chemicals

Atul Ltd

Chemicals

Stock Info

Shareholding Pattern

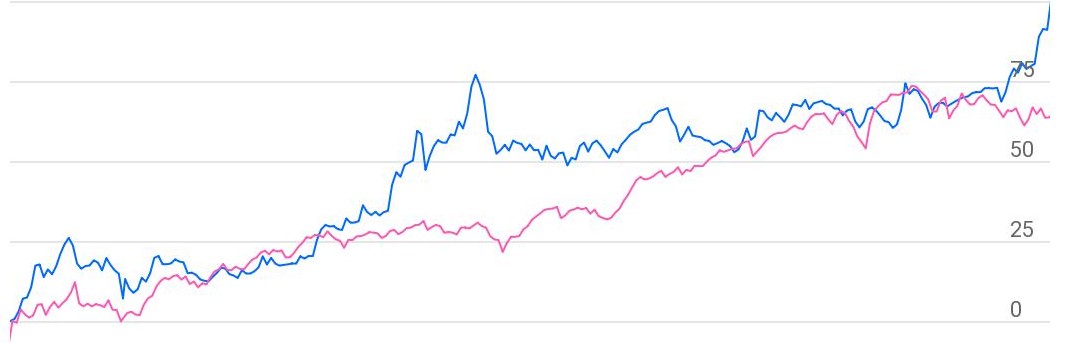

Price performance

Indexed Stock Performance

Chemistry at work

Profile

Atul Ltd, one of the oldest and largest integrated chemical manufacturers in India

is in the business of Life science chemicals (LCS) & Performance & other

chemicals (POC), catering to the requirement of diversified industries like textile,

paints & coatings, adhesives, dyestuff, agriculture, fragrance & flavours,

cosmetic, personal care, tyre, paper, plastic, pharmaceutical, aerospace, composites,

construction, glass, etc. Its life science business consists of three sub segments,

namely, crop protection, Pharmaceuticals & Intermediates & Aromatics - I.

Its POC business consists of four sub segments, namely, Aromatics-II, Bulk chemicals

& intermediates, colors & Polymers. As on FY20, LCS & POC contributed

31% & 69% of the total revenue respectively. The company has 400 formulations

& 900 products in FY20 across all segments and is focussed in adding more value-added

products to the portfolio. The company has ~4,000 customers across 90 countries.

The company works with 2,250 distributors & operates through a network of 38,000

retail outlets in India.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 3295.77 | 505.19 | 15.33% | 276.48 | 93.22 | 12.32% | 28.04 | 15.27 |

| FY19 | 4037.81 | 766.78 | 18.99% | 432.23 | 145.73 | 15.97% | 24.61 | 13.60 |

| FY20 | 4093.06 | 902.01 | 22.04% | 666.46 | 224.70 | 21.12% | 17.75 | 12.47 |

| FY21E | 3683.75 | 909.89 | 24.70% | 637.51 | 214.79 | 17.16% | 37.21 | 24.65 |

| FY22E | 4604.69 | 1059.08 | 23.00% | 753.60 | 253.91 | 17.21% | 31.44 | 20.61 |

| FY23E | 5341.44 | 1239.21 | 23.20% | 902.21 | 302.30 | 18.78% | 26.23 | 17.12 |

Investment Rationale

Strong growth from multiple JV’s

Joint venture (JV) with Anaven

The objective of this JV is to produce mono chloro acetic acid (MCA) which will

use chlorine and hydrogen manufactured at Atul taking advantage of Atul’s

existing infrastructure and Anaven’s leading hydrogenation technology. MCA

is used in agrochemicals, adhesives, pharmaceuticals, surfactants, thermo stabilisers

and cosmetics in addition to being a key raw material for 2,4D. The plant has capacity

to produce 32,000 tonnes per year with expansion potential of upto 60,000 tonnes

per year. The main goal is to meet the entire demand of MCA in India.

Joint venture (JV) with Rudolf

This is one of the fastest growing JV’s of Atul with a CAGR of 38% from FY12-20.

This JV offers a complete range of textile products in Indian market and contributes

2% of the total company revenue.

Strong performance from key subsidiary

Atul Bioscience is wholly owned subsidiary of Atul Ltd. The business of this subsidiary

is to manufacture and market API’s and their intermediaries clocking 3% of

total company revenue. The facility at Ambernath is expected to generate revenue

north of Rs 270 crore with the plan to ramp it up to 450-500 crore by planning a

capex of 25-35 crore at the same site.

Strong R&D focus

Atul’s R&D expense has increased from 0.54% of sales in FY10 to 0.82%

of sales in FY20. However, it still remains below industry average of ~2%. We believe

Atul’s R&D team is more focussed on process improvement instead of product

development. With the help of R&D, company increased yield of 18 products, decreased

consumption of raw materials in five products, decreased consumption charge of two

solvents, recovered ten products from pollutants and introduced 40 new products

and formulation. The company is investing further in people and equipment so as

to strengthen its R&D and thereby enhance its capability.

Key Product Portfolio

| Segment | Life Science Chemical | Performance & Others Chemicals | ||||

|---|---|---|---|---|---|---|

| Sub Segment | Crop Protection | Pharmaceuticals & Intermediates | Aromatics -II | Bulk chemical & Intermediates | Colors | Polymers |

| FY20 Revenues (cr) | 703 | 462 | 694 | 286 | 626 | 1,041 |

| Contribution of the total revenue (%) | 18% | 12% | 18% | 8% | 16% | 27% |

| Product Group | Herbicides, Insecticides, Fungicides | API intermediates, Active Pharmaceutical Ingredients, Others | Intermediates, Perfumery, Others | Bulk chemicals, Adhesion promoters, Others | Dyestuffs, Pigments, Dye-intermediates, Textile chemicals, Others | Epoxy resins, curing agents, Reactive diluents, Sulfones, Protective paints and Adhesives based on Epoxy, Synthetic rubber, Polyurethane, Cyanoacrylate, PVC and PVA |

| Products & Formulation |

Products -20 Formulations -70 |

Products -76 | Products -31 | Products -23 | Products -620 |

Products - 96 Formulation – 300 |

| Key Products | 2,4-D, Indoxacarb and Isoprothiolane |

For Active pharmaceutical ingredients - Dapsone, fluconazole and metoprolol salts. For API intermediates. - carbonates, chloroformates and amino acid derivatives. |

para Cresol and its downstream products like Para Anisyl Alcohol,para Anisic aldehyde and para Cresidine. |

Resorcinol, Resorcinol formaldehyde resin and 1,3–Cyclohexanedione | Pigment Red 168, Sulphur Black 1 and Vat Green 1 | Lapox, Epoxy Resins, Hardeners |

| Market Share of key products |

2,4-D- 16% (Global) Indoxacarb - 7% (Global) |

Dapsone -50% (Global) | Para Cresol -42% (Global) | Resorcinol - Significant market share (only manufacturer in India) | NA | Epoxy: 32% (India) |

| Key User Industries | Agriculture industry |

Used in Pharmaceutical industry for various therapeutic categories, such as anti-depressant, anti-diabetic, anti-infective, anti-fungal, anti-retroviral and cardiovascular |

Fragrance and Personal Care industries |

Cosmetic, Dyestuff, Pharmaceutical and Tyre industries. |

Textile, Paint and Coatings and Paper industries | Aerospace, Automobile, Composites, Construction, Defence, Electrical and Electronics, Footwear, Paint and Coatings, Paper, Sport and Leisure and Wind Energy industries |

Industry Size of key products

| Segment | Sub Segment | Industry Size |

|---|---|---|

| Life Science Chemical | Crop Protection | Global market of crop protection - US$ 59.5 bn, growing at 2.4% P.a |

| Pharmaceuticals & Intermediates | Global market of API - US$160bn | |

| Performance & Others Chemicals | Aromatics -II |

Global market of Para Cresol - 66,300MT, growing at 2%. Global Size of fragrance industry -US$ 13.5bn, growing at 4%. Global Size of Personal Care Industry -US$ 431bn of which personal care ingredients segment is US$ 25 bn and is growing at about 4% |

| Bulk chemical & Intermediates |

Global market of Resorcino -US$ 564 mn, growing at 2.5%. Global market of Tyre Industry - US$ 237bn, growing at 3.7% |

|

| Colors |

Global size of Dyestuff industry is estimated at US$ 6.1 bn and is growing at ~2%. Global market of pigment is ~5bn and is expected to grow at 4%. |

|

| Polymers | Global market for epoxy resins and curing agents is estimated at US$ 7.6 bn and is growing at about 2% and Indian market is estimated at US$ 285 mn and is growing at about 6% |

Outlook & valuation

We believe the chemicals space would continue to grow driven by china plus one & import substitution theme resulting into sustainable earnings growth. We believe Atul is best poised to take the benefit as it is in leader in multiple products, has well-built infrastructure with lot of emphasis on environment which puts it at a significant advantage against most Indian players, backward integrated and focus on downstream products, established distribution network & strong balance sheet. At the price of 7,930, stock is trading at the PE of 26.23X on the basis of FY23E earnings.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 3295.77 | 4037.81 | 4093.06 | 3683.75 | 4604.69 | 5341.44 |

| Growth | 16.30% | 22.51% | 1.37% | -10.00% | 25.00% | 16.00% |

| Expenditure | ||||||

| Material Cost | 1803.47 | 2106.08 | 1970.03 | 1694.53 | 2205.65 | 2563.89 |

| Employee Cost | 213.38 | 259.84 | 300.90 | 298.38 | 331.54 | 373.90 |

| Other Expenses | 773.73 | 905.11 | 920.12 | 780.96 | 1008.43 | 1164.43 |

| EBITDA | 505.19 | 766.78 | 902.01 | 909.89 | 1059.08 | 1239.21 |

| Growth | -0.84% | 51.78% | 17.64% | 0.87% | 16.40% | 17.01% |

| EBITDA Margin | 15.33% | 18.99% | 22.04% | 24.70% | 23.00% | 23.20% |

| Depreciation & Amortization | 110.38 | 118.91 | 130.21 | 148.10 | 165.20 | 181.70 |

| EBIT | 394.81 | 647.87 | 771.80 | 761.79 | 893.88 | 1057.51 |

| EBIT Margin | 11.98% | 16.05% | 18.86% | 20.68% | 19.41% | 19.80% |

| Other Income | 25.91 | 34.86 | 78.04 | 93.35 | 114.40 | 140.70 |

| Interest & Finance Charges | 12.74 | 7.41 | 9.40 | 9.85 | 7.85 | 5.85 |

| Profit Before Tax - Before Exceptional | 407.98 | 675.32 | 840.44 | 845.29 | 1000.43 | 1197.34 |

| Profit Before Tax | 407.98 | 675.32 | 840.44 | 845.29 | 1000.43 | 1197.34 |

| Tax Expense | 130.97 | 244.32 | 174.51 | 212.76 | 251.81 | 300.12 |

| Effective Tax rate | 32.10% | 36.18% | 20.76% | 25.17% | 25.17% | 25.17% |

| Net Profit | 277.01 | 431.00 | 665.93 | 632.53 | 748.62 | 897.23 |

| Growth | -13.08% | 55.59% | 54.51% | -5.02% | 18.35% | 19.85% |

| Net Profit Margin | 8.41% | 10.67% | 16.27% | 17.17% | 16.26% | 16.80% |

| Consolidated Net Profit | 276.48 | 432.23 | 666.46 | 637.51 | 753.60 | 902.21 |

| Growth | -14.39% | 56.33% | 54.19% | -4.34% | 18.21% | 19.72% |

| Net Profit Margin after MI | 8.39% | 10.70% | 16.28% | 17.31% | 16.37% | 16.89% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 29.68 | 29.68 | 29.68 | 29.68 | 29.68 | 29.68 |

| Total Reserves | 2214.24 | 2676.03 | 3125.22 | 3686.23 | 4349.40 | 5143.94 |

| Shareholders' Funds | 2243.92 | 2705.71 | 3154.90 | 3715.91 | 4379.08 | 5173.62 |

| Minority Interest | 20.01 | 23.80 | 26.37 | 26.37 | 26.37 | 26.37 |

| Non Current Liabilities | ||||||

| Long Term Burrowing | - | 43.14 | 86.58 | 78.08 | 58.08 | 38.08 |

| Deferred Tax Assets / Liabilities | 124.54 | 138.96 | 107.84 | 98.66 | 98.66 | 98.66 |

| Long Term Provisions | 17.84 | 19.13 | 20.06 | 20.06 | 20.06 | 20.06 |

| Current Liabilities | ||||||

| Short Term Borrowings | 15.91 | 9.32 | 10.39 | 10.39 | 10.39 | 10.39 |

| Trade Payables | 459.02 | 379.63 | 477.63 | 426.13 | 454.16 | 544.99 |

| Other Current Liabilities | 74.81 | 157.74 | 205.36 | 193.86 | 193.86 | 193.86 |

| Short Term Provisions | 122.42 | 281.62 | 251.24 | 251.24 | 251.24 | 251.24 |

| Total Equity & Liabilities | 3112.00 | 3794.53 | 4356.42 | 4836.75 | 5507.95 | 6373.32 |

| Assets | ||||||

| Net Block | 1035.56 | 1114.22 | 1121.66 | 1148.56 | 1158.36 | 1176.65 |

| Non Current Investments | 467.36 | 546.42 | 488.84 | 493.82 | 498.80 | 503.78 |

| Long Term Loans & Advances | 15.32 | 41.77 | 63.78 | 63.78 | 63.78 | 63.78 |

| Current Assets | ||||||

| Currents Investments | 5.70 | 208.81 | 651.69 | 651.69 | 651.69 | 651.69 |

| Inventories | 411.43 | 511.82 | 503.37 | 479.39 | 510.93 | 613.12 |

| Sundry Debtors | 723.40 | 698.47 | 719.73 | 681.80 | 726.66 | 871.99 |

| Cash and Bank | 49.39 | 54.50 | 35.37 | 545.72 | 1125.75 | 1720.33 |

| Short Term Loans and Advances | 104.04 | 252.74 | 214.24 | 214.24 | 214.24 | 214.24 |

| Total Assets | 3112.00 | 3794.53 | 4356.42 | 4836.75 | 5507.95 | 6373.32 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 277.01 | 431.00 | 665.93 | 632.53 | 748.62 | 897.23 |

| Depreciation | 110.38 | 118.91 | 130.21 | 148.10 | 165.20 | 181.70 |

| Others | 15.67 | 12.15 | 81.55 | - | - | - |

| Changes in Working Capital | -59.43 | -142.70 | 166.74 | 10.40 | -48.36 | -156.69 |

| Cash From Operating Activities | 355.71 | 403.58 | 881.38 | 791.03 | 865.46 | 922.24 |

| Purchase of Fixed Assets | -143.04 | -208.35 | -373.99 | -175.00 | -175.00 | -200.00 |

| Free Cash Flows | 212.67 | 195.23 | 507.39 | 616.03 | 690.46 | 722.24 |

| Others | 12.91 | -199.11 | -412.24 | - | - | - |

| Cash Flow from Investing Activities | -130.13 | -407.46 | -785.66 | -175.00 | -175.00 | -200.00 |

| Increase / (Decrease) in Loan Funds | -151.78 | 38.85 | 53.70 | -20.00 | -20.00 | -20.00 |

| Equity Dividend Paid | -37.88 | -41.04 | -150.41 | -76.50 | -90.43 | -107.67 |

| Others | -17.74 | 1.11 | -10.88 | - | - | - |

| Cash from Financing Activities | -207.40 | -1.08 | -107.59 | -96.50 | -110.43 | -127.67 |

| Net Cash Inflow / Outflow | 18.18 | -4.96 | -11.87 | 519.53 | 580.03 | 594.58 |

| Opening Cash & Cash Equivalents | 23.44 | 42.67 | 37.59 | 26.19 | 545.72 | 1125.75 |

| Closing Cash & Cash Equivalent | 42.67 | 37.59 | 26.19 | 545.72 | 1125.75 | 1720.33 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 93.22 | 145.73 | 224.70 | 214.79 | 253.91 | 302.30 |

| Diluted EPS | 93.22 | 145.73 | 224.70 | 214.79 | 253.91 | 302.30 |

| Cash EPS | 130.43 | 185.82 | 268.60 | 264.69 | 309.57 | 363.52 |

| DPS | 12.00 | 15.00 | 27.50 | 25.78 | 30.47 | 36.28 |

| Book value (Rs/share) | 756.54 | 912.24 | 1063.68 | 1251.99 | 1475.43 | 1743.13 |

| ROCE Post Tax | 13.07% | 17.37% | 22.41% | 18.14% | 18.29% | 18.55% |

| ROE | 12.32% | 15.97% | 21.12% | 17.16% | 17.21% | 18.78% |

| Inventory Days | 46.00 | 41.73 | 45.26 | 45.00 | 45.00 | 45.00 |

| Receivable Days | 68.79 | 64.27 | 63.23 | 64.00 | 64.00 | 64.00 |

| Payable Days | 44.11 | 37.91 | 38.22 | 40.00 | 40.00 | 40.00 |

| PE (x) | 28.04 | 24.61 | 17.75 | 37.21 | 31.44 | 26.23 |

| P/BV (x) | 3.45 | 3.93 | 3.75 | 6.33 | 5.37 | 4.55 |

| EV/EBITDA (x) | 15.27 | 13.60 | 12.47 | 24.65 | 20.61 | 17.12 |

| Dividend Yield | 0.46% | 0.42% | 0.69% | 0.33% | 0.38% | 0.46% |

| P/Sales (x) | 2.35 | 2.63 | 2.89 | 6.39 | 5.11 | 4.41 |

| Sales/Net FA (x) | 3.19 | 3.76 | 3.66 | 3.25 | 3.99 | 4.58 |