Astec Lifesciences Ltd

Pesticides & Agrochemicals

Astec Lifesciences Ltd

Pesticides & Agrochemicals

Stock Info

Shareholding Pattern

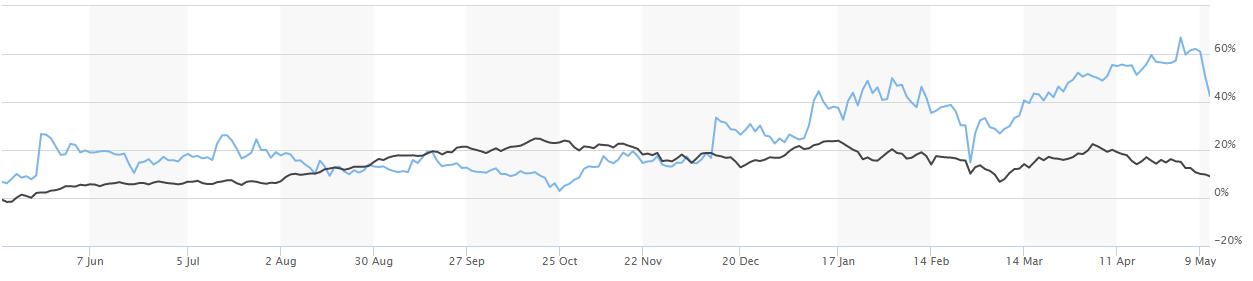

Price performance

Indexed Stock Performance

New Capacity Addition to Drive Growth

Established in 1994, Astec Life sciences is engaged in the production & sale of intermediates, active ingredients and formulations in the off patent–proprietary category with a focus on agrochemical and pharmaceutical sectors. With over two decades of experience in development and production of selected chemicals, the company has forged enduring relationships with large and small companies all over the world. This is evident from the fact that more than half of its business comes from export sales, to more than 25 countries. The company exports its products to East Asia, Europe, Middle East and USA. Some of the key products in agrochemical segment which contributes to majority of the company sales are Hexaconazole, Tebuconazole, Metalaxyl and Propiconazole are. Astec is one of the largest producers of Triazole Fungicides.

Investment Rationale

Robust expansion plan with promising growth in coming years:

Company plans to go heavy on capex as they have committed Rs. 300-400 crores total

capex. Break up would be as follows, i) Rs. 100-150 crores towards new R&D centre,

ii) Rs. 35-50 crores towards further expansion of herbicide plant, iii) Rs. 70-80

crores for safety & plant modernization along with digitization of company’s

facilities to bring it in line with global standards at Mahad facility, iv) Rs.

150 crores for green field multi-purpose plant. This greenfield multipurpose plant

will take 3-4 years to commercialise but company will lay the foundation in FY23.

Along with this, the new Herbicide plant which is a very high potent facility is

currently running at 30% utilization and should reach at 70% utilization by end

of FY23. In next 2-3 years, plant is expected to reach full utilization and management

expects 1.5x to 1.7x asset turns leading to additional ~Rs. 230-270 crores revenues.

For FY22, the plant contributed Rs 25 crores to the topline (operational for 5 months).

Also, the company introduced a new herbicide intermediate for an innovator company

which promises to contribute significantly to sales growth in the years ahead. The

addition of new products and diversification in products will help the company to

achieve higher margins. All these key drivers are expected to contribute 15%-20%

annualized growth for the company.

Many levers for sustainable margins – 1) Inventory stocking, 2) alternate

vendors for RM supplies 3) backward integration to reduce dependence on China &

4) increased contribution of CMO business:

The consumption of raw materials was higher which impacted gross margins in H1FY22.

However, raw material prices have started declining which is reflecting in the gross

margins of the company. Company’s reliance for import of raw materials from

China accounted to 65% which now has been de-risked by arranging vendors in India

and from other parts of the world. Company has stocked up on inventories to mitigate

price volatility. Besides this backward integration plays a key role in minimising

the cost for the company by strengthening the supply chain. Large backward integration

project has been completed in the FY21 (another three are in pipeline), which will

further lower Astec’s dependence on external raw material supplies. Astec

has increased price of final product and customers are accepting increased price

pass on. Astec is also paying its suppliers faster than usual so as to guarantee

supply of raw materials on a timely basis. EBITDA margins shall remain sustainable

going forward (target of ~23-24%) as contribution from CMO business to revenue increase.

In FY22 the CMO business contributed 13% approximately on an aggregate basis. CMO

margins are expected to grow by 5%-7% better than enterprise level . CMO is expected

to deliver 50% revenue CAGR in the next three years.

Geographical diversification cushions pricing pressure in commodity chemicals

One of the major reasons for stable margin growth is the company operates in off-

patent and commodity chemicals markets where pricing pressures are there but its

diverse geographical coverage compensates these pressures on an aggregate basis.

This is evident from the fact that in June 2019 Propiconazole was banned in European

markets, but the share of Propiconazole continued to increase in the revenues of

the company following 9 months FY22 because its demand is high in other parts of

the world, which eventually balances the impact of ban in European markets.

Strong demand for its products, new combinations to drive growth further:

The company expects 3-4% growth over the next 5-10 years in Triazole fungicide,

which is a major contributor to current revenues. However to further drive growth,

the company is launching various combinations of this molecule with new chemistries.

The company has long term relationship with few US and Japanese customers who are driving demand in the contract manufacturing segment. The company is also working on enhancing its product offering and developing a robust pipeline for contract manufacturing business.

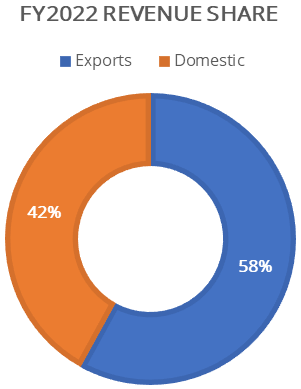

Exports to continue to grow & aid further growth

Exports of the company account for 58% in FY22 as compared to 49% in FY21, while

the domestic business accounts for 42% of revenue in FY22. Rising demand for Astec’s

products globally is the key factor in higher topline this year. During Q4 FY22

the share of domestic business declined as company allocated its capacity for export

market commitments. Strong demand in Exports business was maintained throughout

FY22 which helped to grow highest ever margins incomparison to previous years.

Strong industry tailwinds:

The opportunity for Indian agrochemical players remains high, both in the domestic

and the international markets. Increasing usage of agrochemicals is needed in India,

given the focus on increasing the yield per hectare, limited arable land & rising

labour costs. Globally, disruption of Chinese agrochemical supply chain has shifted

the focus on India, thereby increasing the opportunity for contract manufacturing

business for Indian players. Also, further opportunity will come up from large number

of molecules that will go off-patent in the next 3 to 5 years. China plus one is

a major theme going forward for all chemical companies in India as global players

look for alternate manufacturing locations outside China. Organizations with deep

technical capabilities of technical or intermediate chemistries are likely to gain

from this shift. Astec is one of the leading players in triazoles fungicide and

is well placed to capitalize on these upcoming opportunities in the domestic and

the international markets. Further, with new herbicide plant becoming operational,

the company is also looking to tap more opportunities in CMO segment.

Strong Parentage of Godrej Group

Astec Lifesciences is backed by strong parentage of Godrej Group which has a wider

presence on PAN India basis. The support of giant group like Godrej assures financial

smoothness into the business. By Dec 31st 2021 the Godrej Agrovet group

has been gradually increasing its stake in Astec Lifesciences and has acquired 63.31%

stake in it. Apart from financial support company also enjoys the privilege of strong

managerial support from the Godrej Group, which helps the company in making strong

decisions significant for its upcoming growth. The company has an extensive track

record spanning more than two decades and it enjoys an established position in the

manufacturing of technical grade fungicides. The company has long term relationship

with its clients and is one of the preferred suppliers of technical grade fungicides

to a reputed clientele, comprising large MNCs and supported by its technical competency.

Financials

Financial Highlights FY22

Company has achieved highest ever growth in FY22. Revenue of the company stood at

Rs 677 Crores an increase of 22% from FY22, backed by 44% Y-O-Y growth in exports.

The profit after tax increased by 38%, while the EBITDA margins stood at 24% as

compared to EBITDA margin of 23% in FY21. The ROCE of the company stood at 22%.

The company is on the verge of completion of backward integration projects which

will further enhance or stabilize margins. Higher realisations in topline were due

to increased exports, product mix and higher sales price realisation. Currently

in FY22 company is incurring capex of Rs 100 crores and further capex of Rs 300

crores is planned for FY23-24.

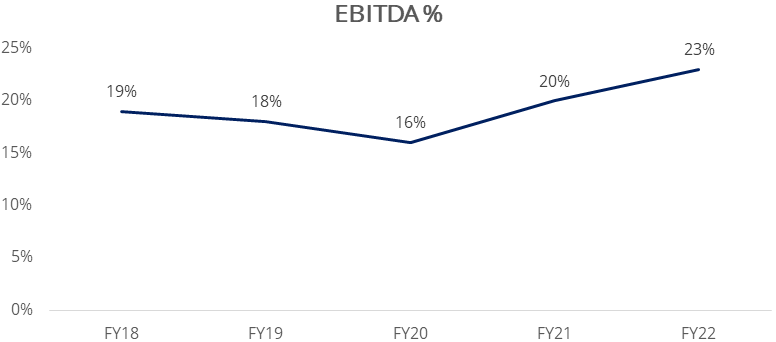

Financial analysis past 5 years

In past 5 years the company has maintained its EBITDA margins in the band of 16%

to 23%. The lowest 16% was due to pandemic in FY20, which was an abnormal year for

the businesses worldwide. In times of Russia-Ukraine crisis there is so much of

pricing pressure on fuel prices. Despite these tough times company has managed to

achieve highest ever EBITDA margins of 23% in FY22. Inventory days of the company

stood at 176 days in FY22 as compared to 122 days in FY18, an increase of 44% in

past 5 years.m Company’s EPS stood at Rs 46/ share in FY22 as compared to

Rs 18/ share in FY18, an increase of 155% in past 5 years. Company has been growing

its topline continuously from past 5 years at a revenue CAGR stood of 16%.

Risks & Concerns

Delay in commissioning of new projects:

Any delay in commissioning of new projects can hamper future growth potential.

Fluctuation in prices of raw material:

Company is still dependent on China as source of for its raw material requirements,

though it has taken significant steps to reduce this dependence. Any wild fluctuations

in prices of RM, can lead to margin erosion.

Outlook & valuation

For coming years the company’s focus is on expansion of CMO business and diversification of chemistries. Further, investments in the new R&D centre to provide stable growth going forward. The company is developing new products to diversify its product portfolio, supported by deep technical capabilities. The company will be key beneficiary of China plus one strategy.

At CMP of Rs 1662 the stock is trading at 23.7x, its earnings of FY24E. We initiate a ‘BUY’ recommendation for the stock.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E |

|---|---|---|---|---|---|---|---|

| Net Sales | 367.60 | 430.90 | 522.60 | 554.90 | 676.60 | 840.00 | 1020.00 |

| Growth % | 21.30% | 17.20% | 21.30% | 6.20% | 21.90% | 24.20% | 21.40% |

| Expenditure | |||||||

| Material Cost | 235.00 | 279.50 | 338.50 | 342.10 | 386.80 | 478.80 | 576.30 |

| Employee Cost | 21.70 | 25.10 | 29.90 | 38.30 | 50.30 | 62.50 | 75.90 |

| Other Expenses | 97.70 | 132.80 | 75.00 | 142.30 | 207.00 | 236.30 | 125.50 |

| EBITDA | 68.80 | 76.50 | 85.20 | 111.50 | 153.80 | 195.80 | 242.40 |

| Growth % | 11.40% | 11.20% | 11.40% | 30.80% | 38.00% | 27.30% | 23.80% |

| EBITDA Margin | 18.70% | 17.70% | 16.30% | 20.10% | 22.70% | 23.30% | 23.80% |

| Depreciation & Amortization | 14.70 | 19.30 | 23.20 | 25.70 | 34.40 | 45.80 | 58.60 |

| EBIT | 54.10 | 57.10 | 62.00 | 85.80 | 119.50 | 150.10 | 183.80 |

| EBIT Margin % | 14.70% | 13.30% | 11.90% | 15.50% | 17.70% | 17.90% | 18.00% |

| Other Income | 8.10 | 11.20 | 11.90 | 8.00 | 10.70 | 10.70 | 10.70 |

| Interest & Finance Charges | 10.70 | 12.40 | 12.60 | 4.80 | 9.10 | 10.80 | 10.80 |

| Profit Before Tax - Before Exceptional | 51.60 | 55.90 | 61.40 | 89.10 | 121.10 | 149.90 | 183.70 |

| Profit Before Tax | 55.70 | 55.90 | 61.40 | 89.10 | 121.10 | 149.90 | 183.70 |

| Tax Expense | 20.70 | 20.10 | 13.80 | 24.00 | 31.20 | 37.80 | 46.30 |

| Effective Tax rate | 40.10% | 36.00% | 22.50% | 26.90% | 25.80% | 25.20% | 25.20% |

| Exceptional Items | 4.20 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Profit | 35.00 | 35.80 | 47.50 | 65.10 | 89.90 | 112.10 | 137.40 |

| Growth % | 32.90% | 2.10% | 32.90% | 36.90% | 38.10% | 24.80% | 22.50% |

| Net Profit Margin | 9.50% | 8.30% | 9.10% | 11.70% | 13.30% | 13.40% | 13.50% |

| Consolidated Net Profit | 34.90 | 35.70 | 47.50 | 65.00 | 89.90 | 112.10 | 137.40 |

| Growth % | 32.90% | 2.40% | 32.90% | 36.90% | 38.10% | 24.80% | 22.50% |

| Net Profit Margin after MI | 9.50% | 8.30% | 9.10% | 11.70% | 13.30% | 13.40% | 13.50% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E |

|---|---|---|---|---|---|---|---|

| Share Capital | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 |

| Total Reserves | 149.00 | 182.00 | 226.00 | 289.00 | 377.00 | 485.00 | 618.00 |

| Shareholders' Funds | 170.00 | 203.00 | 247.00 | 309.00 | 397.00 | 505.00 | 638.00 |

| Minority Interest | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Non Current Liabilities | |||||||

| Long Term Burrowing | 0.00 | 0.00 | 0.00 | 40.00 | 0.00 | 0.00 | 0.00 |

| Deferred Tax Assets / Liabilities | 4.00 | 9.00 | 6.00 | 5.00 | 8.00 | 8.00 | 8.00 |

| Long Term Provisions | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 1.00 | 1.00 |

| Current Liabilities | |||||||

| Short Term Borrowings | 124.00 | 176.00 | 99.00 | 147.00 | 239.00 | 239.00 | 239.00 |

| Trade Payables | 100.00 | 63.00 | 202.00 | 128.00 | 190.00 | 208.00 | 229.00 |

| Other Current Liabilities | 14.00 | 10.00 | 17.00 | 46.00 | 61.00 | 61.00 | 61.00 |

| Short Term Provisions | 0.00 | 0.00 | 1.00 | 1.00 | 0.00 | 0.00 | 0.00 |

| Total Equity & Liabilities | 413.00 | 461.00 | 572.00 | 678.00 | 897.00 | 1023.00 | 1179.00 |

| Assets | |||||||

| Net Block | 115.00 | 167.00 | 194.00 | 213.00 | 340.00 | 484.00 | 556.00 |

| Non Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Long Term Loans & Advances | 25.00 | 27.00 | 22.00 | 19.00 | 18.00 | 18.00 | 18.00 |

| Current Assets | |||||||

| Currents Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Inventories | 78.00 | 93.00 | 121.00 | 106.00 | 187.00 | 202.00 | 239.00 |

| Sundry Debtors | 123.00 | 122.00 | 161.00 | 187.00 | 274.00 | 235.00 | 273.00 |

| Cash and Bank | 1.00 | 1.00 | 1.00 | 2.00 | 2.00 | 7.00 | 15.00 |

| Short Term Loans and Advances | 27.00 | 30.00 | 42.00 | 31.00 | 43.00 | 45.00 | 45.00 |

| Total Assets | 413.00 | 461.00 | 572.00 | 678.00 | 897.00 | 1023.00 | 1179.00 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E |

|---|---|---|---|---|---|---|---|

| Profit After Tax | 35.00 | 35.80 | 47.50 | 65.10 | 89.90 | 112.10 | 137.40 |

| Depreciation | 14.70 | 19.30 | 23.20 | 25.70 | 34.40 | 45.80 | 58.60 |

| Others | -11.10 | -4.80 | 16.00 | -17.90 | -4.40 | 0.00 | 0.00 |

| Changes in Working Capital | 6.40 | -54.50 | 87.80 | -103.30 | -110.10 | 42.20 | -54.00 |

| Cash From Operating Activities | 64.70 | 15.30 | 168.40 | -8.20 | 23.60 | 200.10 | 142.00 |

| Purchase of Fixed Assets | -49.70 | -52.80 | -45.30 | -102.50 | -104.00 | -190.00 | -130.00 |

| Free Cash Flows | 15.00 | -37.50 | 123.10 | -110.70 | -80.40 | 10.10 | 12.00 |

| Others | 0.80 | 0.30 | -28.70 | 29.40 | 0.00 | 0.00 | 0.00 |

| Cash Flow from Investing Activities | -48.90 | -52.50 | -73.80 | -73.10 | -103.90 | -190.00 | -130.00 |

| Increase / (Decrease) in Loan Funds | -4.30 | 52.70 | -78.30 | 88.40 | 92.00 | 0.00 | 0.00 |

| Equity Dividend Paid | -2.90 | -2.90 | -2.90 | -2.90 | -2.90 | -3.90 | -3.90 |

| Others | -10.50 | -12.10 | -12.70 | -4.10 | -8.60 | 0.00 | 0.00 |

| Cash from Financing Activities | -18.20 | 37.10 | -94.50 | 81.30 | 80.50 | -3.90 | -3.90 |

| Net Cash Inflow / Outflow | -2.50 | -0.10 | 0.10 | 0.10 | 0.20 | 6.20 | 8.10 |

| Opening Cash & Cash Equivalents | 2.80 | 0.30 | 0.20 | 0.30 | 0.30 | 0.60 | 6.80 |

| Closing Cash & Cash Equivalent | 0.30 | 0.20 | 0.30 | 0.30 | 0.60 | 6.80 | 14.80 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E |

|---|---|---|---|---|---|---|---|

| Basic EPS | 17.80 | 18.20 | 24.20 | 33.20 | 45.80 | 57.20 | 70.10 |

| Diluted EPS | 17.80 | 18.20 | 24.20 | 33.20 | 45.80 | 57.20 | 70.10 |

| Cash EPS (Rs) | 25.30 | 28.10 | 36.00 | 46.20 | 63.30 | 80.60 | 100.00 |

| DPS | 1.50 | 1.50 | 1.50 | 1.50 | 1.50 | 2.00 | 2.00 |

| Book value (Rs/share) | 86.60 | 103.30 | 125.80 | 157.70 | 202.30 | 257.60 | 325.70 |

| ROCE (%) Post Tax | 13.30% | 13.00% | 15.80% | 16.30% | 17.10% | 17.40% | 17.90% |

| ROE (%) | 20.50% | 17.60% | 19.20% | 21.00% | 22.70% | 22.20% | 21.50% |

| Inventory Days | 72.00 | 73.00 | 75.00 | 75.00 | 79.00 | 97.00 | 82.00 |

| Receivable Days | 116.00 | 104.00 | 99.00 | 114.00 | 124.00 | 113.00 | 102.00 |

| Payable Days | 78.00 | 69.00 | 93.00 | 109.00 | 86.00 | 100.00 | 90.00 |

| PE | 32.50 | 29.40 | 16.00 | 30.20 | 38.30 | 29.00 | 23.70 |

| P/BV | 6.70 | 5.20 | 3.10 | 6.40 | 8.70 | 6.50 | 5.10 |

| EV/EBITDA | 18.40 | 16.10 | 10.10 | 19.30 | 24.20 | 17.80 | 14.40 |

| Dividend Yield (%) | 0.30% | 0.30% | 0.40% | 0.10% | 0.10% | 0.10% | 0.10% |

| P/Sales | 3.10 | 2.50 | 1.50 | 3.50 | 5.10 | 3.90 | 3.20 |

| Net debt/Equity | 0.70 | 0.90 | 0.40 | 0.60 | 0.70 | 0.50 | 0.40 |

| Net Debt/ EBITDA | 1.80 | 2.30 | 1.10 | 1.70 | 1.80 | 1.20 | 0.90 |

| Sales/Net FA (x) | 3.40 | 3.10 | 2.90 | 2.70 | 2.40 | 2.00 | 2.00 |