Amber Enterprises India Ltd

Air Conditioners

Amber Enterprises India Ltd

Air Conditioners

Stock Info

Shareholding Pattern

Price performance

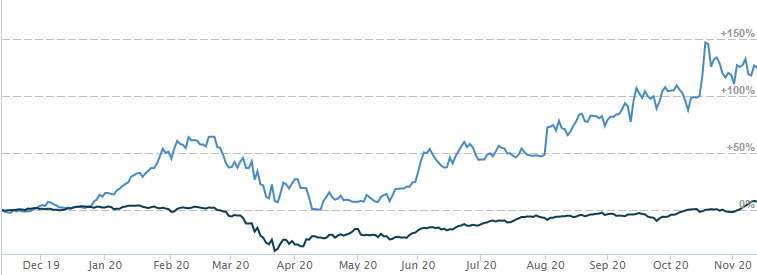

Indexed Stock Performance

Beneficiary of Atmanirbhar movement and China +1 strategy

Amber Enterprises India Ltd. (Amber) is a market leader and one-stop solutions provider of room air conditioning original equipment manufacturer / original design manufacture (OEM/ODM) industry. Amber has a diversified product portfolio, which includes room air conditioners (RAC) and critical components like heat exchangers, sheet metal components, injection moulding components, system tubing, PCBs and electric motors. The company also caters to air conditioning solutions for railways, metros, defence and buses. The company has 15 manufacturing facilities across 6 locations in India, strategically located close to customers enabling faster turnaround.

‘China +1’ strategy has opened up export opportunities

Disruptions in supply chain due to covid-19 and geopolitical concerns have made

global players realise the importance of having a reliable supplier other than China.

India is best placed to capture this opportunity and become a part of the global

supply chain leading to attractive exports opportunities. Amber has already started

receiving enquiries for room air conditioners and various components from companies

across the globe. Amber has started exporting components to Sri Lanka, Bangladesh

and the USA.

Aatmanirbhar Bharat (Self-reliant India) mission to provide regulatory boost to

domestic manufacturers like Amber

Air conditioning is one of the 12 champion sectors identified by the government,

for which India has the opportunity to become a global manufacturing hub. The management

is confident of strong policy interventions from the government to support local

manufacturing, in the form of i) implementation of phased manufacturing programme

to increase localization of air conditioners, ii) Production linked incentive (PLI)

scheme, iii) Non-tariff barriers such as Quality Control Order (QCO) and Compulsory

Registration Order (CRO), or iv) Licencing system for import of air conditioners.

Market leader in highly under penetrated room air-conditioner sector

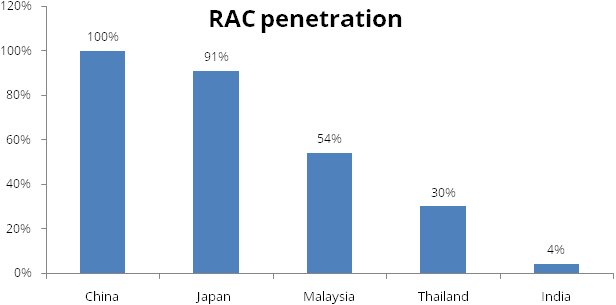

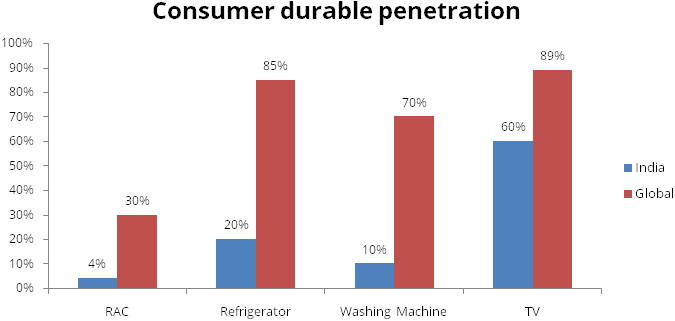

Penetration of room air-conditioners is significantly low in India at 4%, as compared

to the global level at 30%. Room air conditioners are under-penetrated as compared

to other consumer durables like refrigerators, washing machines or televisions.

Due to this low penetration level, there is significant headroom for growth. We

believe, global warming has made air conditioners a necessity. Other key growth

drivers are improving standard of living because of higher disposable income, urbanization

and adequacy of power. Amber being a market leader is well positioned to capture

the growth opportunities provided by the sector.

Strong performance from mobility solutions business

Amber acquired Sidwal Refrigeration Industries Pvt. Ltd. (Sidwal) in May 2019. Sidwal

is engaged in the business of manufacturing and sale of Heating, Ventilation and

Air Conditioning (HVAC) equipment for railways, metros, defence, buses and telecom.

Sidwal is a market leader in HVAC solutions for railways, metros and defence. Despite

the lockdown, Sidwal delivered resilient performance and has strong outlook led

by order wins during the quarter.

Price: AMBER ENT has gained 6.97% over last one month after finding bottom at Rs.2080 made on 26 October 2020, which also ended short term down trend in the stock. The stock has been significantly outperforming NIFTY over last month. We expect the stock to continue its outperformance in the coming weeks. The stock has high of Rs.1695 made on February 2020 and move low till Rs.1154.60 made on April 2020. Drawing Fibonacci Retracement stock is well trading above 100% retracement Rs. 1695.The stock has bounced from the support level with increased in volume which indicates the strength in the counter.

Indicator: The stock is trading above important moving average 21SMA, 50SMA & 200SMA on daily charts as well as weekly chart. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. RSI (14) on daily chart is pegged at sub 57.59 levels, indicating the stock has not yet been over bought. The DMI+ (23.86) on the daily timeframe is also currently trading near the 20-mark suggesting that the stock is likely to witness more momentum in coming days.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. AMBER ENT stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for long term. Trader may go long around current level Rs.2290 for target Rs.3450.