Amara Raja Batteries Ltd

Batteries

Stock Info

Shareholding Pattern

Price performance

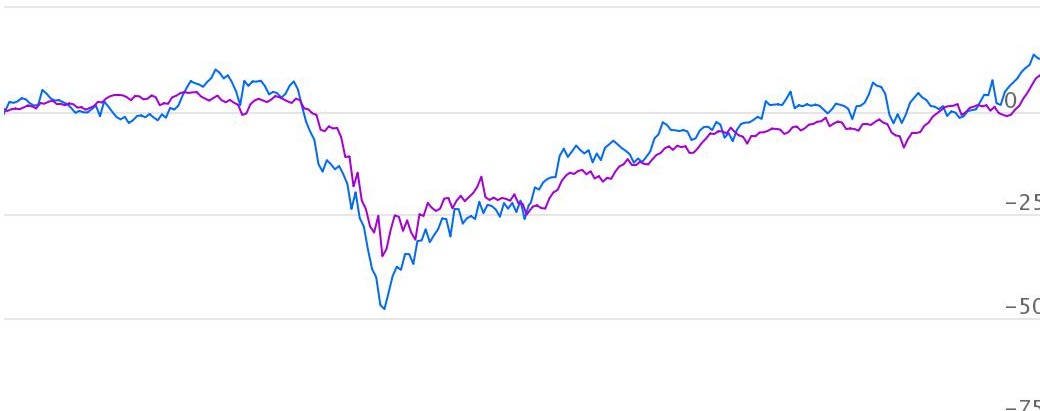

Indexed Stock Performance

Muhurat pick

Profile

Amara Raja Batteries Limited is the technology leader and one of the largest manufacturers

of lead acid batteries for both industrial and automotive applications in the Indian

storage battery industry.

Investment Rationale

- Recovery in demand Post the lifting of lockdown, there has been sharp recovery in demand across segments. In Q2FY21, all segments saw growth – 4W OEM (3-4%), 4W Aftermarket (10%), 2W OEM (110%), 2W Aftermarket (15%), and Home Inverter (35%). The Industrial segment grew by 5–6% – Telecom (10%) and UPS (8%).

- Beneficiary of the shift towards the organised segment We believe that larger players will continue to gain a share as the share of unorganised players is high at 30-40%, particularly in the replacement market.

- Focus on Exports Currently exports contribute 10% of revenues, the company plans to expand into newer markets in India ocean rim, middle-east and Africa to consolidate its overseas presence.

- Expanding product offerings The company is focusing on emerging applications in E- Rickshaws and E- Autos. New technology and new partnerships will drive growth in 2W segment We believe as punch-grid technology gains acceptance, the company will continue to gain market share in 2W batteries.

Outlook & Valuation

We believe that Amara Raja would continue to gain market share in both OEMs and

replacement businesses led by newer technologies and shift towards organised player.

New revenue streams like tower-monitoring systems with demand rebound in telecom

and commercial market segments will lead to strong growth in industrial business.

The stock is currently trading at 19x FY22E earnings.