Acrysil Ltd

Plastic Products

Acrysil Ltd

Plastic Products

Stock Info

Shareholding Pattern

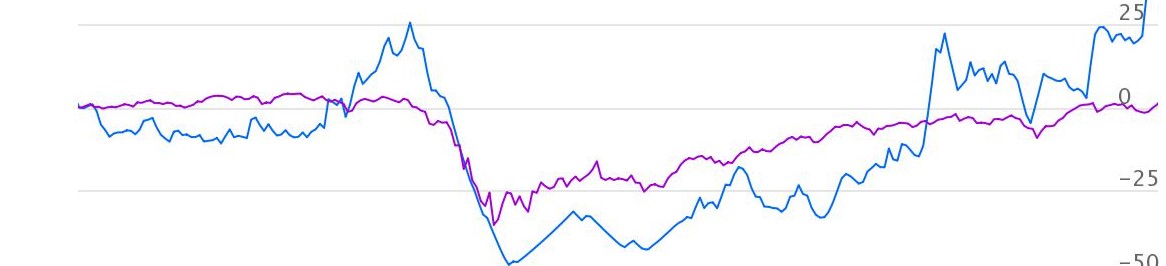

Price performance

Indexed Stock Performance

Building strong brand for future

Profile

Acrysil Limited (Acrysil), is one of the world leaders in manufacturing and marketing of composite quartz kitchen sinks engineered with German technology. Over the years, Acrysil has diversified into stainless steel kitchen sinks, faucets, food waste disposers and built-in kitchen appliances such as chimneys, cook-tops, wine chillers, etc. Acrysil is rapidly moving ahead towards becoming a complete player in Kitchen and Bath segments while establishing brands such as ‘Carysil’ and ‘Sternhagen’. Sternhagen is a popular German luxury brand, wholly owned via the company’s subsidiary, Acrysil GmbH. The range of products in this portfolio includes premium bathware fittings, sanitaryware, and highlighter tiles.

Investment Rationale

Sole manufacturer of quartz sinks in Asia:

Globally, quartz sink manufacturers are limited to only four players, namely, Blanco,

Franke, Acrysil, and Schock. The company is the sole manufacturer in India and Asia

with a global standard of quality, durability and visual appeal. The technology

and know-how acts as a strong moat for the company and remains an entry barrier

in quartz sinks in the domestic as well as in international markets.

Strategic partnerships:

In November 2018, the company entered into an agreement with German brand, GROHE

for the supply of quartz kitchen sinks. GROHE has a global presence in more than

130 countries and is a dominant player in Bathroom Solutions and Kitchen Fittings.

Further, in August 2020, the company entered into a strategic partnership with IKEA

Supply AG (Switzerland) for manufacturing and supply of composite quartz kitchen

sinks globally. This partnership will be a game-changer for the company as IKEA

has 400+ stores in 52 countries. This will accelerate the growth of the company

by leveraging its strong product offerings to a wider geography.

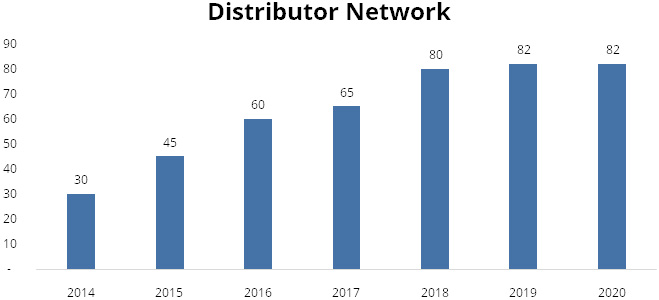

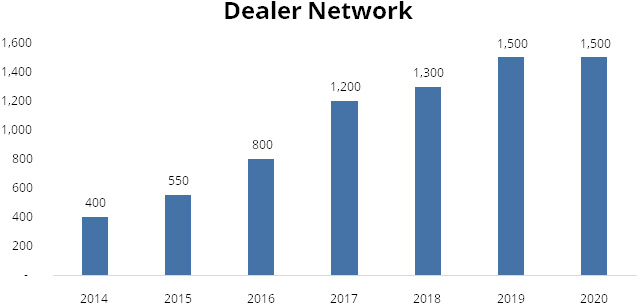

Strong distribution network:

The company has market presence in 55 countries across the world. It has a foothold

in major countries such as Germany, the United States, the United Kingdom, South

Africa, and Australia. The company strives to spread its wings to 70 countries over

the next three years by exploring uncatered geographies. In order to strengthen

its brand in the domestic market, the company has increased its dealer network from

400 to 1,500 and distributor network from 30 to 82 from FY2013 to FY2020. It also

has ~80 franchise galleries. Further, it plans to add ~100 new galleries and ~34

distributors.

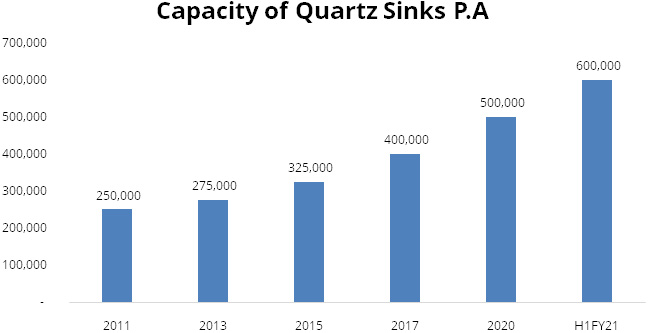

Capacity expansion:

Over the years, the company has expanded the capacity of quartz sinks to service

the growing demand and to benefit from economies of scale. In order to meet incremental

demand from the export and domestic markets, the company has invested ~Rs. 15 crores

from internal accruals to expand its quartz sinks manufacturing capacity by 20%,

from 5 lakh units to 6 lakhs units p.a. by March 2021. The company also has enough

land bank to increase capacity from 6 lakh units p.a to 8–9 lakh units p.a.

Strong Brand Image:

The company has been continuously investing in brand promotion on TV and in print,

along with exposure through sponsorship of events like Times Food and MasterChef

Australia. To strengthen the “STERNHAGEN” Brand, Acrysil has signed

an agreement with Farah Ali Khan, a well-known jewellery designer and Indian gemmologist.

Outlook and Valuation:

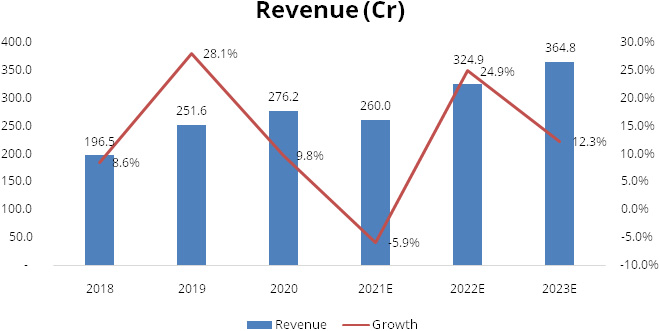

We expect revenue / earnings to grow at CAGR of 9.7% / 18.6% respectively from FY20

to FY23E on the account of partnerships with IKEA and GROHE. These partnerships

have the potential to be a game changer for the company as it is well positioned

to capture a larger pie of the home improvement market. Additionally, Acrysil’s

strong brand image, wide distribution network, expanded capacity in quartz sinks

and stainless-steel sinks, and revamped product portfolio in the bathroom segment

through its brand Sternhagen have the potential to result in strong growth for the

company. At the CMP of Rs.150, the stock is trading at PE multiple of 12.5x/10.9x

on the basis of FY2022E/FY2023E earnings.

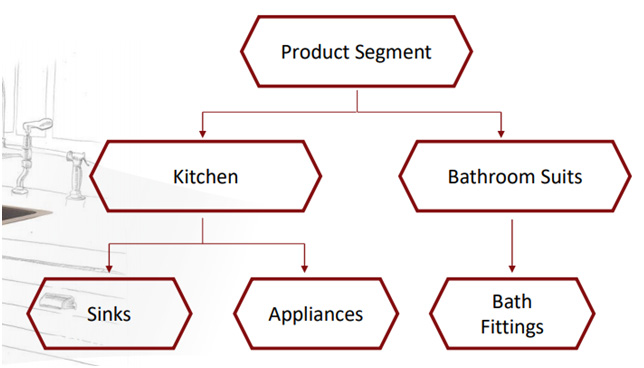

Business Products Overview

Quartz sinks

Acrysil is the only company in Asia and among a few companies worldwide that manufactures

quartz kitchen sinks with global standards of quality, durability and visual appeal.

There has been an increase in demand for quartz sinks which are now preferred over

their stainless-steel counterparts due to their high durability. This trend has

been observed in America, Germany, UK and France. This trend is also expected to

be witnessed in other parts of the world. Currently, stainless steel sinks hold

90-95% of the market with quartz sinks making up only 5-10%. This provides significant

growth opportunity for Acrysil as it has developed more than 120+ models to cater

to various segments and markets. The company has also increased its manufacturing

capacity from 5 lakh units p.a to 6 lakh units p.a to meet the growing export and

domestic demand. Acrysil’s quartz sinks are available in more than 1,500 outlets

in India and are trusted by builders and various modular kitchen studios for their

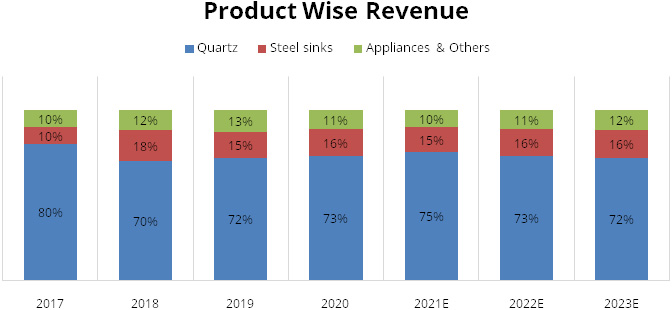

premium quality. Quartz sinks remain a major contributor to the company’s

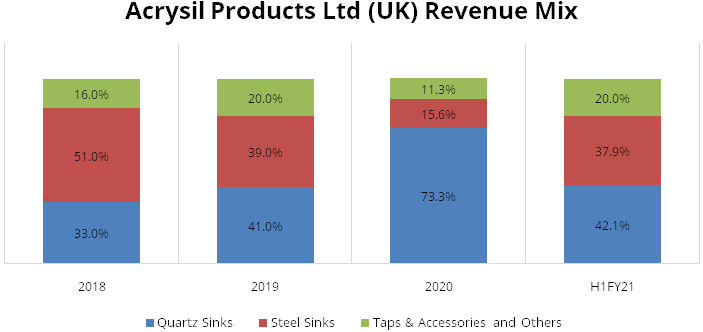

revenue with a share of 73% and 78% in FY20 and H1FY21 respectively. We expect this

segment to grow at 9.2% CAGR from FY20-23E.

Stainless steel kitchen sinks

In this segment, the company continuously innovates its products to enrich the lives

of numerous households and offer an unmatched lifestyle with its premium kitchen

sinks. Last year, the company introduced a new range of innovative products like

square sinks and micro radius sinks. The manufacturing capacity of steel sinks stands

at 90,000 sinks p.a. out of which Press sink capacity stands at 60,000 sinks p.a

and quadro sink capacity at 30,000 sinks p.a. Target Market for Quadro (Designer)

Sinks caters to high end segment that are willing to pay a premium for superior

quality, design and finish. The stainless-steel kitchen sinks contribute 16% in

FY20 &13% H1FY21 respectively to the top line of the company. We expect this

segment to grow at 9.7% CAGR from FY20-23E.

Kitchen appliances & Bathroom fittings

Acrysil is well-placed to become a major player in the overall kitchen industry.

The company has a variety of products including dishwashers, ovens, hoods, etc.

The company is continuously working on innovation, research and development, and

designs to attract customers and stand out in the market. The company plans to increase

its global footprint in the kitchen appliances segment. The company’s wholly

owned subsidiary, Acrysil GmbH, offers the Sternhagen brand range of quartz wash

basins, premium bathware fittings, sanitaryware, and highlighter tiles. Sternhagen

washbasins are made from Sani-Q and designed by EMAMIDESIGN. The Sternhagen bathroom

suites are designed to elevate the bathroom experience by combining style with technology.

These products have received a good response from consumers. The company currently

has more than 60 showrooms and SIS for displaying its high-quality products. The

Kitchen appliances & Bathroom Fittings contribute 11% in FY20 & 8% H1FY21

respectively to the top line of the company. We expect this segment to grow at 12.9%

CAGR from FY20-23E.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 196.47 | 27.00 | 13.74% | 11.95 | 4.61 | 10.10% | 22.53 | 12.72 |

| FY19 | 251.60 | 42.39 | 16.85% | 17.25 | 6.55 | 12.79% | 16.68 | 8.85 |

| FY20 | 276.23 | 47.61 | 17.23% | 22.08 | 8.27 | 13.99% | 6.77 | 4.87 |

| FY21E | 260.00 | 50.11 | 19.27% | 23.84 | 8.93 | 13.48% | 16.80 | 9.12 |

| FY22E | 324.86 | 60.10 | 18.50% | 32.17 | 12.05 | 15.88% | 12.45 | 7.28 |

| FY23E | 364.79 | 66.39 | 18.20% | 36.86 | 13.80 | 17.32% | 10.87 | 6.42 |

Investment Rationale

Sole manufacturer of quartz sinks in Asia:

Globally, quartz sink manufacturers are limited to only four players, namely, Blanco,

Franke, Acrysil, and Schock. The company is the sole manufacturer in India and Asia

with global standard of quality, durability and visual appeal. The technology and

know-how acts as a strong moat for the company and remains an entry barrier for

other players to participate in the growing demand for quartz sinks in the domestic

as well as in international markets. The company is well poised to leverage its

position in the global quartz sink market and meet the growing demand in various

countries around the globe.

Strategic partnerships:

In November 2018, the company entered into an agreement with German brand, GROHE

for the supply of quartz kitchen sinks. GROHE has a global presence in more than

130 countries and is a dominant player in Bathroom Solutions and Kitchen Fittings.

The supply agreement with Acrysil will mark GROHE’s foray into the quartz

kitchen sinks segment. GROHE has been part of the Japanese LIXIL Group Corporation

since 2014. As per the management commentary, the agreement has the potential to

bring in additional revenues to the tune of Rs. 50-60 crores over the next three

years.

Further, in August 2020, the company entered into a strategic partnership with IKEA Supply AG (Switzerland) for manufacturing and supply of composite quartz kitchen sinks globally. This partnership will be a game-changer for the company as IKEA has 400+ stores in 52 countries. This will accelerate growth for the company by leveraging its strong product offerings to a wider geography. The management is hopeful of more such tie-ups in the future as it looks to expand its international presence in the core business of quartz sinks.

Premium product portfolio in building materials space:

Acrysil prides itself in being the custodian of renowned brands – Carysil,

TekCarysil and Sternhagen. Presently, 90-95% of sinks industry is dominated by stainless-steel

sinks and approximately 5-10% uses quartz sinks. With improvement in lifestyles

manifesting in luxury apartments, there is a strong possibility of growing demand

for quartz sinks. However, stainless steel sinks are still a dominant market and

hence, Acrysil has extended its product range to include stainless steel sinks as

well. Acrysil envisages to be a premium category player in stainless steel sinks,

kitchen appliances, bathroom fittings, etc. The company manufactures two kinds of

steel sinks - press sinks and quadro sinks - which are designer sinks catering to

the high-end segment. During the previous year, the company introduced quartz antibacterial

sinks and stainless-steel integrated worktops. It has set up Special Purpose Machines

(SPM) to ensure seamless installation of stainless-steel countertops which will

boost the market in India and overseas. Further, the newly commissioned Physical

Vapour Deposition (PVD) plant provides a metallic finish to stainless steel kitchen

sinks enhancing the styling of these sinks.

In the bathroom suites segment, the company offers quartz wash basins and 3D tiles under the brand Sternhagen. The company has launched a range of products from Sternhagen luxury brand for bathroom interiors, for both domestic as well as international markets. Apart from these, Acrysil offers kitchen appliances like chimneys, hobs, microwave ovens, cook tops, wine chillers, barbeque grillers etc. These products are mainly traded goods sold under the brand name ‘Carysil’ except for certain models of chimneys that the company manufactures.

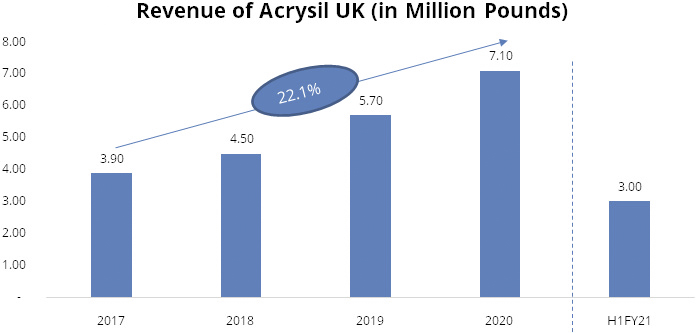

Strong distribution network:

The company has a market presence in 55 countries across the world. It has a foothold

in major countries such as Germany, the United States, the United Kingdom, South

Africa, and Australia. The company strives to spread its wings to 70 countries in

the next three years by exploring uncatered geographies.

The company is present in the UK market through Acrysil Products ltd (formerly known as Homestyle Products Ltd). In Acrysil Products Ltd, Acrysil owns 100% through Wholly owned subsidiary Acrysil UK Limited. The company sells products like quartz sinks, steel sinks, taps and accessories, and other traded products

To increase penetration in USA, the company has incorporated a wholly-owned subsidiary, Acrysil USA Inc. to deal in kitchen, bathroom, and tile products. It would look to leverage its existing customers, develop new customers, and extend market penetration in the USA.

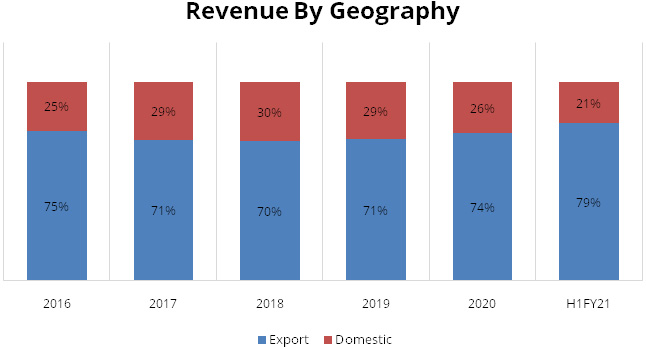

Until FY 2012, the company was largely focused on exports. However, the management saw huge potential in the domestic market and introduced premium products under the brand ‘CARYSIL’. In order to strengthen its brands in the domestic market, the company increased its dealer network from 400 to 1,500 and distributor network from 30 to 82 from FY 2013 to FY 2020. It also has ~80 franchise galleries. Further, it plans to add ~100 new galleries and ~34 distributors

Capacity expansion:

Over the years, the company has expanded the capacity of quartz sinks to meet the

growing demand of consumers and to benefit from economies of scale. As a result,

in March 2020, the company’s capacity stood at 5 lakh sinks p.a. Further,

in order to meet incremental demand from the export and domestic markets, the company

has invested ~Rs. 15 crores from internal accruals to expand its quartz sinks manufacturing

capacity by 20% (1 lakh units p.a.) to 6 lakh units p.a. by March 2021. The company

also has enough land bank to scale capacity from 6 lakh units p.a to 8-9 lakh units

p.a.

Strong brand image:

The company has been continuously investing in brand promotion on TV and in print,

along with exposure through sponsorship of events like Times Food and MasterChef

Australia. To strengthen the “STERNHAGEN” Brand, Acrysil has signed

an agreement with Farah Ali Khan a well-known jewellery designer and Indian Gemmologist.

Business dynamic improving:

Acrysil’s business has not been impacted much by Covid-19 as work-from-home

has led to increased demand for home improvement products like sinks, chimneys,

etc. Further, there is an interesting transition in customer behaviour towards e-commerce

sales leading to a surge in online sales. In this backdrop, Acrysil is targeting

to make ‘Carysil’ a prominent brand by increasing its presence in major

markets like the US, UK, and Europe as it forms the majority of the company’s

export sales.

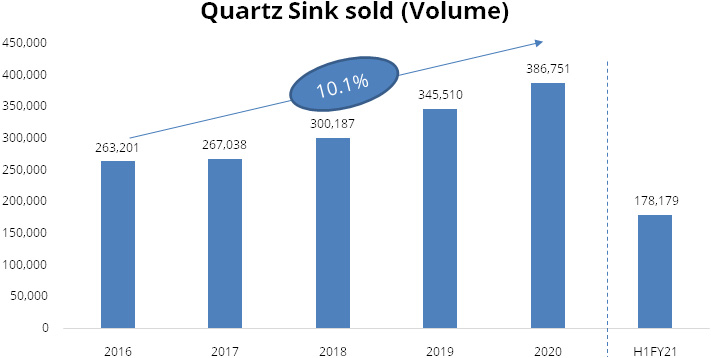

Financials

Revenue analysis

We expect revenue to grow at 9.7% CAGR from FY20-23E due to strategic partnerships,

premium product portfolio and capacity expansion to meet the growing demand in export

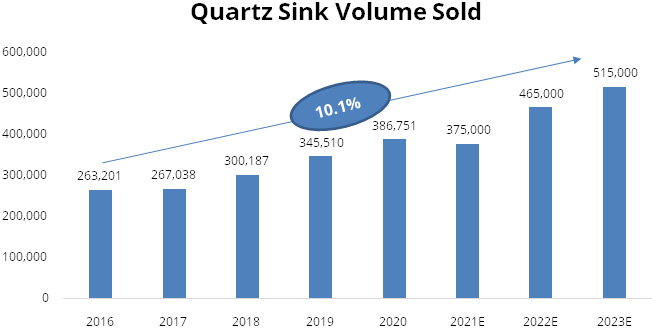

and domestic markets. We expect quartz sink volumes to grow at 10% CAGR from FY20-23E

led by housing growth in US and Europe market and market shift towards quartz sink

from stainless steel sink.

Revenue

Revenue by geography

Quartz Volume Sink

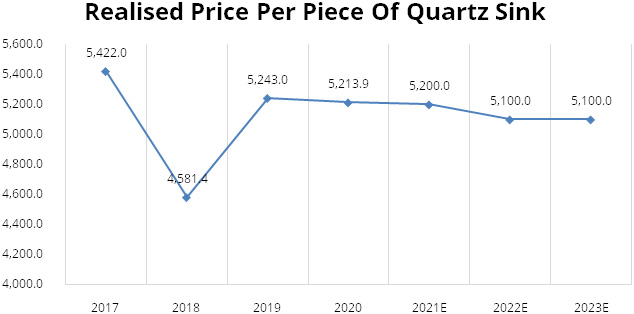

Realised Price Per piece of Quartz Sink

Product wise Revenue

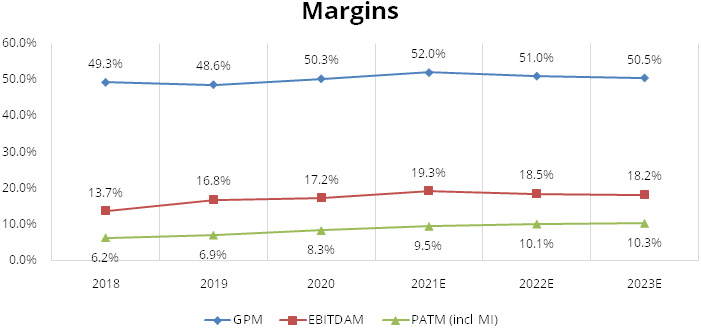

Margins

We expect EBITDA margins to increase from 17.2% in FY20 to 19.3% in FY21E driven

by strong improvement in gross margins due to stable raw material prices and cost

efficiency measures. We expect EBITDA margins to stabilise from FY22 and be in the

range of 18.5%-18%.

Sensitivity analysis

| 2023E | ||||||

|---|---|---|---|---|---|---|

| Sales | EPS | Cost of Raw Materials Consumed | ||||

| 13.8 | 49.00% | 49.50% | 50% | 50.50% | 51% | |

| 364.8 | 14.3 | 13.8 | 13.3 | 12.8 | 12.3 | |

| Change in EPS | 3.7% | -3.7% | -7.4% | -11.1% | ||

| PATM | 10.5% | 10.1% | 9.7% | 9.4% | 9.0% | |

| Stock Price | 150 | 150 | 150 | 150 | 150 | |

| P/E | 10.5 | 10.9 | 11.3 | 11.7 | 12.2 | |

In our model, we have assumed raw materials to sales at 49.5%; however, due to uncertainty on raw materials prices and assuming other factors being the same, we have calculated how increase in RM to Sales will impact the EPS. The table above indicates that for every 1% change in RM cost, EPS changes by -7.4%. from our base model assumption.

Industry

Kitchen sinks

A sink is the basic requirement in any kitchen, whether it is the home kitchen or

in the restaurant. Region-wise, the global sink market has been segmented into Europe,

North America, Asia Pacific, Middle East and Africa, and South America. Majority

of the population in Europe and North America prefer advanced and modern kitchens

in their homes thereby creating a demand for elegant-looking kitchen products. Further,

the pandemic and rising concerns over health have forced majority of world population

to cook food at home. This, in turn, has increased demand for a well-equipped kitchen.

As per the UN, the world needs to build more than two billion new homes over the

next 80 years. Such huge growth in terms of household infrastructure will ultimately

increase the need for water sinks during the construction phase, thereby boosting

the growth of this market.

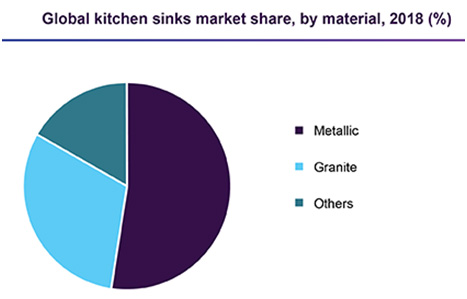

On the basis of material, the kitchen sinks market is further segmented into metallic, granite, and others. The metallic sink is the most preferred material type and it accounted for 52.4% share of the overall revenue in 2018. Due to the scratching property of stainless steel, granite sinks are gaining popularity among consumers. They are the most luxurious and attractive option available in the market. Consumers prefer this if they are looking for some elegant look for their kitchens. Granite sinks are available in various types including 100% marble, 100% granite, granite composite (85% quartz granite 15% resin), and cultured marble (marble dust, stone, and resin).

The global kitchen sink market is expected to be valued at USD 3.06 billion by 2025 with a CAGR of 3.8%. North America dominated the kitchen sinks market with a share of 42.2% in 2019. This is attributable to rising number of households and consumer preference to have an elegant look for their kitchens, which attracts the installations of various innovative sinks in the houses. Europe is the second-largest regional market owing to the growing consumer preference for advanced and modern kitchens in the houses. The majority of the population in Europe prefer to have an elegant look for their kitchens, which attracts the installations of various innovative sinks in the houses and hence increase the demand for sinks in the region. Key factors that are driving the market growth include surge in the number of households in various countries, increasing hotels and restaurants across the globe, and rising consumer expenditures on home care and decor. The growing trend of renovation of old conventional kitchen with modern equipment and facilities is fuelling the growth in this market. Other factors such as growth in number of construction projects, increased access to clean water and improved sanitisation in developing economies, better standard of living, online shopping, and growing Internet of Things (IoT), among others will help to boost the demand for kitchen sinks and appliances.

Ruvati USA, Kohler, Blanco,Franke, Schock, Zuhne, Frigidaire, Swanstone, Acrysil, AGA, Duravit, Dombracht Kitchen, Roca are some of the major market players in the industry. The market presents moderate to high entry barriers due to the presence of leading market players and the requirement of high advertising costs. The market is further driven by the design and automation of products, mergers and acquisitions, and joint ventures.

source: Grandview Research

Kitchen appliances

The kitchen solutions industry is witnessing a shift from local carpenters and interior

designers towards modular kitchen solutions as this option is considered to be smart

and sustainable. A shift is also seen in the industry with a large number of real

estate companies in metros and Tier I cities offering modular kitchens as standard

amenities in recent times. Innovation and adoption of technology has supported the

progress of the global kitchen appliances industry. With change in lifestyle and

increasing disposable income, consumers are becoming increasingly design centric,

which has created the demand for new and premium designs along with preference for

premium kitchen appliances.

The segment is expected to grow at a CAGR of 8.6% between 2019-2025 on the back of growing urbanisation, rise in number of nuclear families, innovation, increased penetration of online distribution channels in tier II+ cities, demand for large kitchen appliances (hobs, chimneys, microwaves, etc.), among others. The growth prospects of the Indian economy remain positive due to its favourable demographics, increase in savings, integration with the global economy, etc.

source: Annual Report

Risks & Concerns

- Slowdown in real estate: The slowdown in the real estate market can impact Acrysil as it is primarily a building materials provider.

- Adverse movement in raw material price: Acrysil’s profitability remains vulnerable to adverse movement in the price of key raw materials i.e., resins because of its inability to pass on any increase in prices for ongoing orders.

- Currency fluctuation: Fluctuation in forex exchange value will impact the profitability of the company as it caters to the export market.

Outlook & valuation

We expect Revenue / Earnings to grow at CAGR of 9.7 %/18.6% respectively from FY20 to FY23E on the account of partnerships with IKEA and GROHE. These partnerships have the potential to be a game changer for the company as it is well positioned to capture a larger pie of the home improvement market. Additionally, Acrysil’s strong brand image, wide distribution network, expanded capacity in quartz sinks and stainless-steel sinks, and revamped product portfolio in the bathroom segment through its brand Sternhagen have the potential to result in strong growth for the company.

At the current price of Rs.150, the stock is trading at PE multiple of 12.5x/10.9x on the basis of FY2022E / FY2023E earnings, which is at discount as compared to 3 year & 5-year average PE of 17.3x & 22.7x respectively. We believe this valuation discount to narrow as growth picks up with margin expansion

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 196.47 | 251.60 | 276.23 | 260.00 | 324.86 | 364.79 |

| Growth % | 8.55% | 28.06% | 9.79% | -5.88% | 24.95% | 12.29% |

| Expenditure | ||||||

| Material Cost | 99.66 | 129.28 | 137.37 | 124.80 | 159.18 | 180.57 |

| Employee Cost | 14.36 | 16.98 | 19.40 | 19.37 | 23.72 | 26.63 |

| Other Expenses | 55.45 | 62.96 | 71.85 | 65.72 | 81.87 | 91.20 |

| EBITDA | 27.00 | 42.39 | 47.61 | 50.11 | 60.10 | 66.39 |

| Growth % | 0.19% | 57.01% | 12.32% | 5.26% | 19.92% | 10.47% |

| EBITDA Margin | 13.74% | 16.85% | 17.23% | 19.27% | 18.50% | 18.20% |

| Depreciation & Amortization | 7.14 | 8.64 | 11.93 | 11.85 | 11.38 | 11.85 |

| EBIT | 19.85 | 33.75 | 35.68 | 38.26 | 48.72 | 54.54 |

| EBIT Margin % | 10.10% | 13.41% | 12.92% | 14.72% | 15.00% | 14.95% |

| Other Income | 4.61 | 2.13 | 4.73 | 4.58 | 5.50 | 6.79 |

| Interest & Finance Charges | 7.58 | 11.67 | 9.93 | 9.93 | 10.18 | 11.03 |

| Profit Before Tax - Before Exceptional | 16.88 | 24.21 | 30.48 | 32.91 | 44.04 | 50.30 |

| Profit Before Tax | 16.88 | 24.21 | 30.48 | 32.91 | 44.04 | 50.30 |

| Tax Expense | 4.65 | 6.72 | 7.62 | 8.28 | 11.08 | 12.66 |

| Effective Tax rate | 27.52% | 27.78% | 25.00% | 25.17% | 25.17% | 25.17% |

| Exceptional Items | - | - | - | - | - | - |

| Net Profit | 12.24 | 17.48 | 22.86 | 24.63 | 32.95 | 37.64 |

| Growth % | 53.49% | 42.86% | 30.77% | 7.73% | 33.79% | 14.23% |

| Net Profit Margin | 6.23% | 6.95% | 8.28% | 9.47% | 10.14% | 10.32% |

| Net Profit after MI | 11.95 | 17.25 | 22.08 | 23.84 | 32.17 | 36.86 |

| Growth % | 64.63% | 44.33% | 27.99% | 8.01% | 34.91% | 14.58% |

| Net Profit Margin after MI | 6.08% | 6.86% | 7.99% | 9.17% | 9.90% | 10.10% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 5.19 | 5.19 | 5.34 | 5.34 | 5.34 | 5.34 |

| Total Reserves | 113.11 | 127.65 | 152.47 | 171.55 | 197.28 | 226.77 |

| Shareholders' Funds | 118.30 | 134.90 | 157.81 | 176.89 | 202.62 | 232.10 |

| Minority Interest | 1.34 | 1.58 | 2.36 | 2.36 | 2.36 | 2.36 |

| Non Current Liabilities | ||||||

| Long Term Burrowing | 18.62 | 16.57 | 21.21 | 21.00 | 21.00 | 21.00 |

| Deferred Tax Assets / Liabilities | 2.28 | 2.49 | 1.99 | 1.61 | 2.40 | 3.18 |

| Long Term Provisions | 0.42 | 0.42 | 0.57 | 0.57 | 0.57 | 0.57 |

| Current Liabilities | ||||||

| Short Term Borrowings | 62.42 | 68.20 | 68.36 | 63.36 | 73.36 | 80.36 |

| Trade Payables | 37.89 | 31.23 | 29.01 | 29.38 | 32.05 | 37.79 |

| Other Current Liabilities | 15.33 | 18.04 | 18.53 | 6.30 | 6.30 | 6.30 |

| Short Term Provisions | 3.19 | 17.20 | 24.20 | 24.20 | 24.20 | 24.20 |

| Total Equity & Liabilities | 259.79 | 290.63 | 324.53 | 326.16 | 365.34 | 408.35 |

| Assets | ||||||

| Net Block | 111.20 | 119.48 | 124.84 | 129.99 | 130.61 | 133.76 |

| Non Current Investments | - | - | - | - | - | - |

| Long Term Loans & Advances | 4.16 | 3.71 | 4.88 | 4.88 | 4.88 | 4.88 |

| Current Assets | ||||||

| Currents Investments | - | - | - | - | - | - |

| Inventories | 48.17 | 53.70 | 59.74 | 55.09 | 60.09 | 70.85 |

| Sundry Debtors | 48.15 | 54.32 | 62.27 | 55.09 | 59.29 | 69.91 |

| Cash and Bank | 17.45 | 13.99 | 19.53 | 27.83 | 57.21 | 75.68 |

| Short Term Loans and Advances | 4.15 | 21.84 | 25.86 | 25.86 | 25.86 | 25.86 |

| Total Assets | 259.79 | 290.63 | 324.53 | 326.16 | 365.34 | 408.35 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 12.24 | 17.48 | 22.86 | 24.63 | 32.95 | 37.64 |

| Depreciation | 7.14 | 8.64 | 11.93 | 11.85 | 11.38 | 11.85 |

| Others | -0.25 | 9.78 | 1.85 | - | - | - |

| Changes in Working Capital | -5.74 | -8.58 | -14.37 | 12.20 | -6.53 | -15.65 |

| Cash From Operating Activities | 15.59 | 23.68 | 30.12 | 48.68 | 37.81 | 33.84 |

| Purchase of Fixed Assets | -19.52 | -18.36 | -19.51 | -17.00 | -12.00 | -15.00 |

| Free Cash Flows | -3.93 | 5.32 | 10.61 | 31.68 | 25.81 | 18.84 |

| Others | -0.50 | 1.07 | 0.04 | - | - | - |

| Cash Flow from Investing Activities | -19.98 | -17.22 | -19.47 | -17.00 | -12.00 | -15.00 |

| Increase / (Decrease) in Loan Funds | 8.58 | 3.72 | -2.74 | -5.00 | 10.00 | 7.00 |

| Equity Dividend Paid | -2.59 | -2.59 | -3.08 | -4.77 | -6.43 | -7.37 |

| Others | -6.38 | -5.40 | -4.05 | - | - | - |

| Cash from Financing Activities | -0.39 | -4.27 | -9.87 | -9.77 | 3.57 | -0.37 |

| Net Cash Inflow / Outflow | -4.79 | 2.19 | 0.78 | 21.91 | 29.37 | 18.47 |

| Opening Cash & Cash Equivalents | 21.83 | 2.95 | 5.14 | 5.92 | 27.83 | 57.21 |

| Closing Cash & Cash Equivalent | 17.05 | 5.14 | 5.92 | 27.83 | 57.21 | 75.68 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 4.61 | 6.55 | 8.27 | 8.93 | 12.05 | 13.80 |

| Diluted EPS | 4.61 | 6.55 | 8.27 | 8.93 | 12.05 | 13.80 |

| Cash EPS (Rs) | 7.36 | 9.83 | 12.74 | 13.37 | 16.31 | 18.24 |

| DPS | 1.00 | 1.20 | 1.20 | 1.79 | 2.41 | 2.76 |

| Book value (Rs/share) | 45.60 | 51.20 | 59.12 | 66.25 | 75.89 | 86.93 |

| ROCE (%) Post Tax | 9.25% | 12.37% | 12.98% | 12.61% | 14.54% | 14.56% |

| ROE (%) | 10.10% | 12.79% | 13.99% | 13.48% | 15.88% | 17.32% |

| Inventory Days | 82.87 | 73.89 | 74.95 | 75.00 | 75.00 | 75.00 |

| Receivable Days | 80.19 | 74.33 | 77.03 | 75.00 | 74.00 | 74.00 |

| Payable Days | 59.61 | 50.14 | 39.80 | 40.00 | 40.00 | 40.00 |

| PE | 22.53 | 16.68 | 6.77 | 16.80 | 12.45 | 10.87 |

| P/BV | 2.28 | 2.17 | 0.95 | 2.26 | 1.98 | 1.73 |

| EV/EBITDA | 12.72 | 8.85 | 4.87 | 9.12 | 7.28 | 6.42 |

| Dividend Yield (%) | 1.00% | 1.10% | 2.10% | 1.20% | 1.60% | 1.80% |

| P/Sales | 1.37 | 1.16 | 0.54 | 1.54 | 1.23 | 1.10 |

| Net debt/Equity | 0.63 | 0.61 | 0.52 | 0.32 | 0.18 | 0.11 |

| Net Debt/EBITDA | 2.75 | 1.96 | 1.73 | 1.13 | 0.62 | 0.39 |

| Sales/Net FA (x) | 1.88 | 2.18 | 2.26 | 2.04 | 2.49 | 2.76 |