1

1

MILARS®

An equity investment Strategy

Powered by

WHY

MILARS?

Does the ‘Buy and Hold’ strategy really work?

Opportunity Cost

When you stay invested in a particular security regardless of its trend, you lose out on the possible gains which you could have generated by investing in securities which are actually moving up.

Churning your portfolio according to the prevailing market circumstances is the only way of making consistent profits in the stock markets.

After all, what good are unrealised profits if you fail to book them at the right time?

Emotions: Dead Or Alive Portfolio

Simply put, Emotions are the enemy of an investor. ‘Buy and hold’ strategy implies being invested throughout both, Bull and Bear markets.

It is effortless to stay invested during the Bull markets when all the portfolios are green and alive, However, during bear markets or abrupt crashes, Investors make decisions based on emotions and sentiments.

If market has repeatedly rallied after every crash, then why have investors practicing ‘Buy and Hold’ booked losses?

So what works?

MILARS®

An Award winning strategy

based on Six guiding principles.

M

- Market Direction

- Invest only when the market is in an uptrend.

- Take defensive action when the market begins to weaken.

Markets everywhere, have moved in Directions, Namely Bull & Bear. It is of utmost importance to identify whether one is dealing in the bull market or the bear market. Just like one cannot fly a kite high up in the east when the winds are moving towards the west, one cannot expect their stocks to go high up in a bear market. Even the strongest winners end up giving average returns if the market direction is not in their favour. Simply put,

Your portfolio will soar high up only if it flies in accordance with the winds of MARKET DIRECTION.

Although one might initiate buying during the corrections in a bear market, it carries more risk as the markets continue to move in the general downtrend eventually. The goal of MILARS is to perform the quintessential task of protecting your profits while cutting your losses.

I

- Industry Ranking

Studies show that 37% of a stock’s price movement is directly tied to the performance of the industry group the stock is in. Another 12% is due to strength in its overall sector.

It is important to understand which industries or sectors will flourish in certain market circumstances and which sectors have lived past their best days.

MILARS has exclusively designed Proprietary systems to be ahead of the curve in identifying the leading industries and ranking it according to their growth performance.

Seasonality, business cycles, changing technology & changing preferences are just the tip of the iceberg in the list of factors which impact industry ranking.

The leading industries will most likely be the industries which are experiencing a structural change which will last for some time to come.

L

- Leading Company

Investors have often sought comfort in familiar stocks which they have heard about over the yea₹The reason they might be familiar with the stock may be because of their previous performances in the preceding Bull runs. However, these previous leaders may not be leaders anymore.

As the saying goes, Past performance does not guarantee future returns. These sentimental favourites often turn out to be the dullest laggards in the next bull market.

At MILARS, we only choose leaders.

The next leaders, which are chosen by MILARS usually consist of quality earnings and growth profile. In essence, these companies are expanding. Either by gaining market shares from old/unorganised players or by launching new products/services. These companies may not be blue chips or even large caps. But at times these smaller leaders go on to become big names.

A

- Acceleration in Earnings

It is rightly said that profit is the lifeblood of a business. Business earnings have a direct impact on the prices of their stocks. As an investor, what matters most is the earnings of your shares in the company ie the EPS. Accelerating earnings attracts investments from institutional investo₹It also denotes expansion which is an ideal feature of quality stocks.

MILARS emphasises on quality in investments & hence focuses on companies with explosive earnings growth showing high price strength.

Recognising real potential & reading between the lines are skills acquired over the years and MILARS Research Analysts constantly screen across the Indian equity markets to spot quality stocks with acceleration in earnings.

R

- Relative Price Strength

Relative price strength [RS] comparison is our proprietary rating tool that rates stocks on the basis of their price performance. We have a percentile stock ranking system where we place stocks in different percentiles [1-99] based on their price performance.

The price of stocks discounts everything. When something in the underlying company is structurally changing, it is always reflected in the price.

MILARS’s Relative Price Strength [RS] comparison is designed to detect when something is up in the company and whether the stock is under accumulation.

Our Research team then actively works on understanding the reasons behind the price changes & determining its sustainability based on various price levels.

S

- Selling Rules

Exiting your stock at the right time is as important as selecting it. Most Investors suffer from not being able to exit their positions at the right time and end up losing a substantial stake of their gains despite their investments reaching new peaks during their holding period.

Similarly, a lot of investors fail to realise that their stocks will have to generate a return of 100% to just reach the break-even price when in fact it dropped by 50%. It is unlikely for a stock, which dropped by 50% to generate such returns in the short term horizon without any substantial change.

Cut your losses short and let your winners run is the golden rule to optimize profits.

At MILARS, we have strict selling rules for both cutting losses and booking profits. We don’t budge from our rules at any point which helps us to stay in the game for a very long time. We maintain discipline by enforcing strict usage of the stop-loss tool which shields the portfolio from the negativity/euphoria that is created in the market which is fuelled by speculation.

Why MILARS®

Emotions In Investment Decisions:

Three key feelings adversely affect the returns: fear, greed, and frustration or impatience. One must always stay calm in investment and business.

MILARS brings logic to investment decisions rather than let emotions take over. Our reliance and disciplined approach towards our six guiding principles enables us to separate emotions from our investment decisions. We strictly believe in pursuing only winners and cutting our losses early so as to maintain ideal investments in our portfolios.

Constant Tracking And Timely Decisions:

Most of the investors fail to track their investments. The fact that most long-term investors adopt a 'Buy and Hold' strategy, only to have their investments soar high up and come back down to the initial levels prove it. What good are unrealized profits if you fail to book them at the right time?

MILARS maintains constant track of the investments and makes timely decisions so that unrealised profits can be booked at high levels and reinvested again at opportune levels, thus enabling our investors to utilize the benefit of compounding effect while reducing the invisible burden of opportunity cost to a great extent.

There is something for everyone!

-

Large Cap Focus:

An investment solution based on the MILARS Strategy that helps you invest in trending Blue chip stocks while countering volatility. Ideal for investors who prioritise stability in their stock investments. -

Emerging Market Leaders:

An investment solution based on the MILARS Strategy that helps you invest in uptrending midcap stocks while striking a balance between volatility and rewards. Ideal for investors seeking growth in their stock investments. -

Little Masters:

An investment solution based on the MILARS Strategy that actively aims to generate high returns from the smallcap segment. Ideal for investors seeking high growth returns from their stock investments.

Get stock recommendations straight in your inbox with our digital and real time setup!

Isn’t it super convenient??!

Get stock recommendations straight in your inbox with our digital and real time setup!

Isn’t it super convenient??!

To assist you on your investment journey, Your allotted Relationship Manager will stay in regular touch!

Stay updated with stockaxis!

All you have to do is check your inbox for regular updates & in-depth Research Reports.

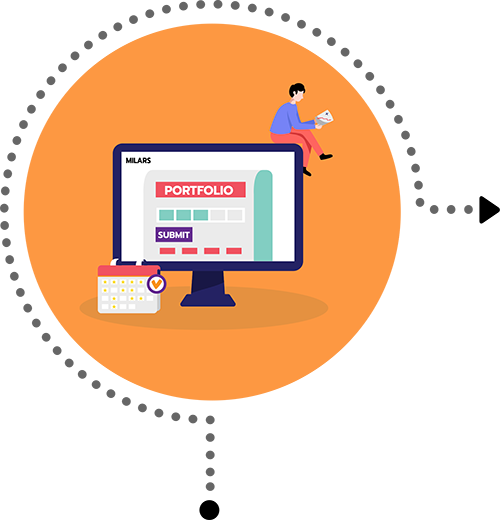

Our process is easy

Get registered on the stockaxis app or website

Subscribe to any MILARS stock universe as per your preference

Get onboard as a premium client with stockaxis

Start Investing with MILARS

Testimonials

“ Portfolios advised by you are wealth creator. I am thankful to you and your supportive staff. ”

“ Good support and service. Excellent support provided. ”

“ It helps to rearrange my stock investment and also help me to recover earlier loss and a great service provided. Thanks. ”

“ Quite impressed by your service ”

“ I am very much satisfied of your services. The Stock selection and timing of stock selection is very much good. ”

“ Services are excellent ”

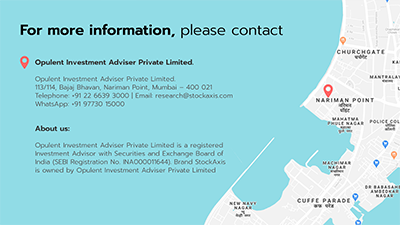

For more information, please contact

Opulent Investment Adviser Private Limited.

Office No.61, Maker Tower E, G D Somani Marg,

Cuffe Parade, Mumbai-400005.

Telephone:+91 97730 15000 | Email: research@stockaxis.com

© Copyright 2018 stockaxis.com, All Rights Reserved.

GSTIN : 27AACCO0257G1ZN.

About us:

The Opulent Investment Advisors Private Limited (“OIAPL”), a Company incorporated under the provisions of the Companies Act, 2013, is one of the prominent research house providing services of equity research, recommendation and advisory services in the financial markets under its brand name “stockaxis”. The OIAPL is registered with SEBI and hold SEBI license as a Research Analyst (registration No INH000007669) and an Investment Adviser (registration No. INA000011644). The OIAPL provides research, recommendation and advisory services for a broad array of investors including NRIs, HNI’s, and thousands of individual investors.

Disclaimers and Disclosures

Opulent Investment Adviser Private Limited (hereinafter referred to as "Opulent") is a SEBI Registered Research Analyst (Registration No. INH000007669) and Investment Adviser (Registration No. INA000011644) registered under the SEBI (Research Analysts) Regulations, 2014 and SEBI (Investment Advisers) Regulations, 2013, respectively providing equity research and advisory services in the Indian equity markets under its brand name "stockaxis". Opulent is a member of the Bombay Stock Exchange (BSE) Associated Members List (BASL) having Membership ID 1092.

Opulent's registered address is Office No.61, Maker Tower E, G D Somani Marg, Cuffe Parade, Mumbai-400005. You can contact us via telephone at +91 97730 15000.

Our Compliance Officer & Grievance Officer is Ms. Ajita Udeshi, and you can contact her via telephone at +91 97730 15000 or through email at compliance@stockaxis.com / care@stockaxis.com

Disclaimer: “Registration granted by SEBI, membership of BSE (RA) and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. The securities quoted on the page above are for illustration only and are not recommendatory.”

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Terms and Conditions

This report is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. The report and information contained herein are strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of Opulent.

The report is based on the facts, figures and information that are considered true, correct, reliable and accurate. The information is obtained from publicly available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. Opulent will not treat recipients as customers by virtue of their receiving this report.