Zomato Limited - IPO Note

Food Services Platform

Zomato Limited - IPO Note

Food Services Platform

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

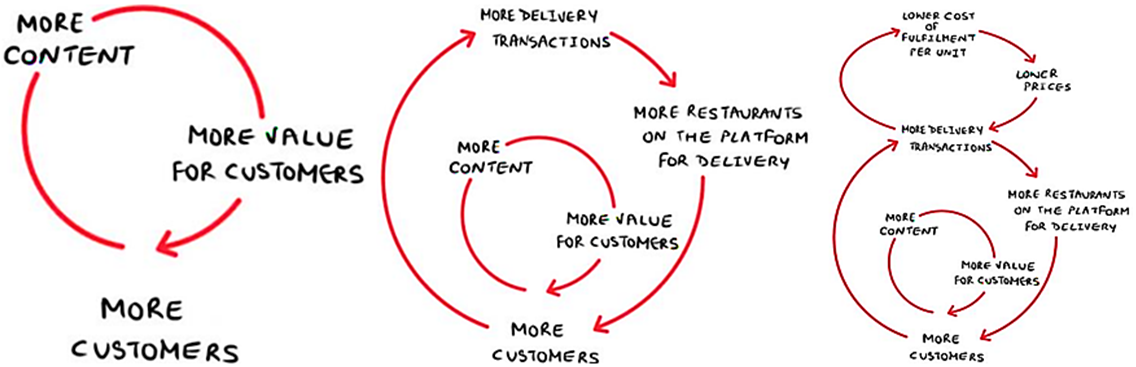

Strong Network Effects

The company has Customer Generated Content (CGC) which includes reviews, ratings,

and images posted by the customers on Zomato’s platform. In FY21, 1.27 crore

customers generated 6.18 crore units of CGC on the platform. This content helps

the company to attract the customer organically; During FY21, 68% of the new customers

were acquired organically. These customers value the content of the listed restaurants

and further add their own reviews and images, which leads to a cycle of more new

customers.

According to the management, more content leads to more customers, who then lead to more content. Furthermore, as the number of consumers increases, so does the number of food orders placed with the restaurants, resulting in additional restaurants becoming available for meal delivery. More restaurants on the platform expand the range of options available to customers, resulting in increased customer numbers. Finally, increasing the number of food delivery orders lowers the delivery cost, which lowers client prices, resulting in even more food delivery orders.

Source: Company RHP

These network effects increase the stickiness and loyalty of both customers and restaurant partners, creating an interlinked virtuous cycle.

Widely Recognized and Strong Brand

Zomato is a well-known and well-remembered brand in India's big and small cities.

Its services comprise both meal delivery and dining out, giving it a competitive

advantage in the minds of consumers. The company's management feels that the

Zomato brand is synonymous with food, and that its customers link it with all things

related to food. Zomato branded apparel, such as t-shirts, jackets, bags, and boxes,

is carried by its delivery partners, further increasing Zomato brand recognition

on the streets.

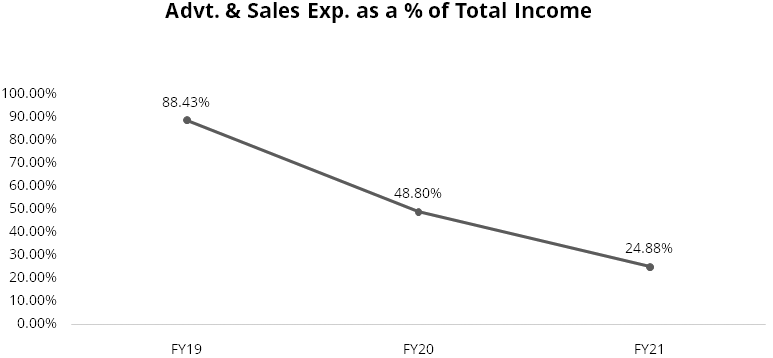

Constant Focus on Unit Economics and Growth

Zomato has made considerable expenditures in marketing and promotions to speed customer

acceptance of meal delivery in India and promote the brand, which has resulted in

the category creation and customers returning to the platform for repeat purchases

on an organic basis. Advertisement and sales promotion expenses per order have decreased

over time as the % of repeat consumers has increased.

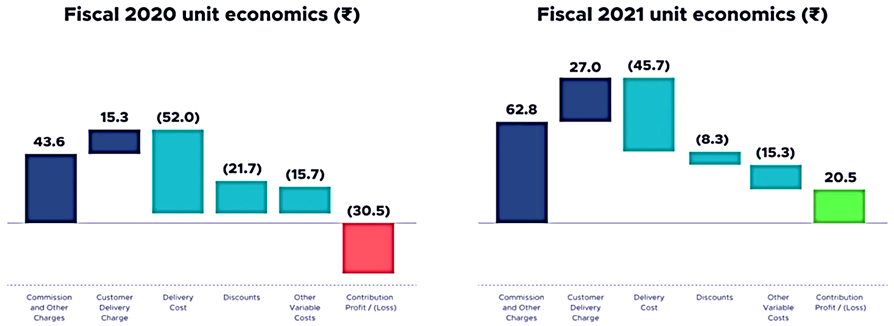

The company has also witnessed an improvement in unit economics in FY21 compared to FY20:

Source: Company RHP

Reasons for the improvement in unit economics in FY21 could be:

- Increase in number of restaurant partners, who for their survival have partnered with Zomato and leverage the digital technology. This increase in restaurant partners resulted in more commission and other charges (Rs. 62.8 in FY21 vs. Rs. 43.6 in FY20),

- More customer delivery charges (Rs. 27 in FY21 vs. Rs. 15.2 in FY20), and

- Lesser delivery cost (Rs. 45.7 in FY21 vs. Rs. 52 in FY20).

Timely Delivery and Quality Service

Zomato's presence in India allows it to serve millions of individuals each month

and interact with them in several different ways. These interactions have repeatedly

demonstrated that fast delivery is one of the most important factors in providing

a positive meal experience to users. Zomato has been working with its partners on

the back end to minimise the average delivery time throughout the years. Zomato's

commitment to customer satisfaction ensures that purchases placed on its platform

are delivered on time. All of this bodes well for Zomato's ability to retain

its loyal client base and receive repeat orders.

Widespread and Efficient Hyperlocal Delivery Network

With 169,802 Active Delivery Partners in March 2021, Zomato maintains one of India's

largest hyperlocal delivery networks. Food delivery is complicated because food

is a perishable product that necessitates cautious handling while maintaining high

levels of hygiene and on-demand service in real time. Machine learning optimises

the matching of orders and delivery partners utilising Zomato's precise and

real-time demand forecasting, fleet optimization, and intelligent dispatch technologies.

Invest in New Products and Technologies

For the benefit of its clients, Zomato will invest in new products, technology,

and services. The management stated that they are actively experimenting in this

field, and that they recently invested USD 100 million in Grofers (Grocery delivery

platform) to buy a minority stake. The company plans to introduce online grocery

through its app which is likely to go live soon. It intends to keep innovating in

order to provide clients with more personalisation and new experiences. Zomato has

already made machine learning a priority and intends to do more so in the future.

Risks

- As of FY21, the company had a restated loss of Rs. 816.43 crores. Given the considerable investments expected to grow the business, it expects costs to rise over time and losses to continue.

- If the company is unable to retain existing restaurant partners, customers, or delivery partners, or add new restaurant partners, delivery partners, or customers to its portfolio in a cost-effective manner, its business could be adversely impacted.

- The business operates in a highly competitive market. Other food delivery firms, such as Swiggy, chain restaurants with their own online ordering platforms, cloud kitchens, restaurants with their own delivery fleets, and companies that provide point of sale solutions and restaurant delivery services compete with it. Further, mobile payment applications that assist meal ordering compete with the company.

- There is no assurance that Zomato will not be forced, through competition, regulation, or other means, to lower delivery charges charged by delivery partners, increase the fees paid to delivery partners for providing services through their platform, further reduce the commissions they charge restaurant partners, or increase marketing and other expenses to attract restaurant partners, customers, or other sources of revenue.

- Currently, the company uses third-party service providers for services and has no control over how these service providers operate their facilities. The service providers’ facilities may be vulnerable to damage or interruption from natural disasters, cybersecurity attacks, terrorist attacks, power outages, and similar events or acts of misconduct.

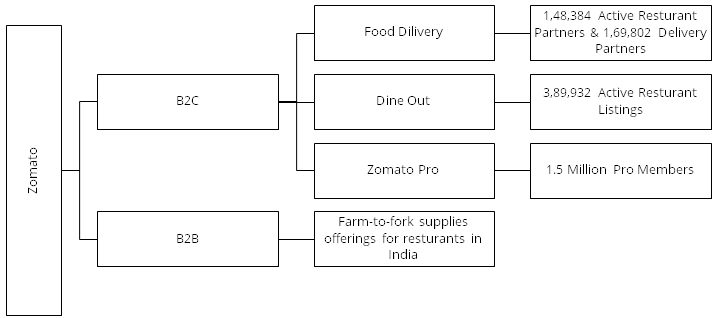

Company Description

Incorporated on January, 2010, Zomato Limited (Zomato) is one of the leading food services platforms in India in terms of value of food sold, as of March, 2021. During FY21, In India, 32.1 million average Monthly Active Users (MAU) visited the company’s platform. The company has a presence in 525 cities across India, with 389,932 active restaurants listings. The company has footprints in 23 countries as of March, 2021, but going forward, given the large market opportunity, the management has decided to focus only on the Indian food market. Zomato's business is based on the premise that, over time, people in the country will eat out more than they will cook at home. They have two key B2C offerings to capitalise on this shift in client behaviour: food delivery and dining-out. Further, Hyperpure is a B2B offering, where the company sources ingredients from farmers, mills, producers, and processors and supplies directly to its restaurant partners. Zomato Pro, a customer reward programme that includes both meal delivery and dining-out, is another important part of its operation.

Key Operating Metrics

| Particulars (Crores) | Unit | FY21 | FY20 | FY19 |

|---|---|---|---|---|

| Average MAU | Cr. | 3.21 | 4.15 | 2.93 |

| Average MATU | Cr. | 0.68 | 1.07 | 0.56 |

| Active Food Delivery Restaurants | Numbers | 1,48,384 | 1,43,089 | 94,286 |

| Gross Order Value (GOV) | Mn | 9,482.97 | 11,220.90 | 5,387.01 |

| YoY Growth | % | -15.49% | 108.30% | |

| Orders | Cr. | 23.89 | 40.31 | 19.10 |

| YoY Growth | % | -40.73% | 111.05% |

Segment-wise Revenue from Operations

| Particulars (Rs. in Crores) | FY21 | FY20 | FY19 | |||

|---|---|---|---|---|---|---|

| Revenue | % | Revenue | % | Revenue | % | |

| Revenue from Services | 1,715.55 | 86.04% | 2,290.81 | 87.95% | 1,281.40 | 97.62% |

| Royalty Income | - | - | - | - | 0.01 | 0.00% |

| Revenue from Sale of Traded Goods | 200.20 | 10.04% | 107.59 | 4.13% | 14.89 | 1.13% |

| Income from Provision of Platform Services | 78.04 | 3.91% | 206.34 | 7.92% | 16.29 | 1.24% |

| Total for Revenue from Operations | 1,993.79 | 100.00% | 2,604.74 | 100.00% | 1,312.59 | 100.00% |

Valuation

Zomato is one of two India-based meal delivery platforms, and as of March 2021, it is the leading platform in terms of food value sold. In addition to focusing on its main business, the corporation is branching out into new areas. The management's recent purchase of a minority share in Grofers is an experiment, and if it succeeds, it might be a new source of revenue in addition to services (food delivery) and traded items (Hyperpure). With 90% of Indians eating home-cooked cuisine, we feel there is opportunity for firms like Zomato to expand their businesses. In the Indian food delivery market, Zomato is also known as a Unicorn. We believe that the valuation at which the firm is planning an IPO is astronomical, and one of the reasons for this could be the investors' enthusiasm for the IPO. At the upper price band of Rs. 76, the issue is valued at 25x of FY21 EV/Sales. We recommend to Subscribe the issue for listing gains as well as for long-term.

Key Information

Use of Proceeds:

The net proceeds are proposed to be utilised for funding organic and inorganic growth

initiatives and for general corporate purpose. The issue includes OFS of Rs. 375

crores by Infoedge (one of the initial & largest existing investors in the company)

Book running lead managers:

Kotak Mahindra Capital Company Limited, Morgan Stanley India Company Private Limited,

Credit Suisse Securities (India) Private Limited, BofA Securities India Limited,

and Citigroup Global Markets India Private Limited

Management:

Kaushik Dutta (Chairman and Independent Director), Deepinder Goyal (Founder, MD,

and CEO), Gunjan Patidar (co-founder and chief technology officer), Gaurav Gupta

(co-founder and head of supply), and Akshant Goyal (CFO)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | FY21 | FY20 | FY19 |

|---|---|---|---|

| Revenue from Operations | 1993.79 | 2604.74 | 1312.59 |

| Revenue Growth (%) | -23.46% | 98.44% | - |

| EBITDA as Stated | -467.17 | -2304.70 | -2243.78 |

| Adj. EBITDA as Stated | -325.11 | -2206.17 | -2143.81 |

| Loss Before Tax | -815.12 | -2385.60 | -1010.51 |

| Net Loss for the Year | -816.43 | -2385.60 | -1010.51 |