Uniparts India Limited - IPO Note

Miscellaneous

Uniparts India Limited - IPO Note

Miscellaneous

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

Uniparts India Limited (UIL) was incorporated on September 26, 1994. UIL is a global manufacturer of engineered systems and solutions. It is one of the leading suppliers of systems and components for the off-highway market in the agriculture and construction, forestry, and mining. Currently, it is present in 25 countries. The company’s product portfolio consists 3-point linkage systems (3PL), precision machined parts (PMP) along with power take off (PTO), fabrications and hydraulic cylinders. They serve some of the largest global companies.

Uniparts had an estimated 16.68% market share of the global 3PL market in FY22 in terms of value and an estimated 5.92% market share in the global PMP market in FY22 in terms of value (source: RHP). They also service aftermarket segment especially for 3PL product range through organized aftermarket retailers and distributors in North America, Europe, South Africa, and Australia. Together 3PL and PMP contribute to more than 90% of UILs revenue.

Geography-wise revenue mix

| Q1 FY23 | FY22 | FY21 | FY20 | |||||

|---|---|---|---|---|---|---|---|---|

| Particulars | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations |

| USA | 169.73 | 48.94% | 575.77 | 46.91% | 434.92 | 48.16% | 518.99 | 57.21% |

| Europe | 79.38 | 22.89% | 310.93 | 25.33% | 210.63 | 23.32% | 165.03 | 18.19% |

| India | 48.96 | 14.12% | 164.69 | 13.42% | 143.33 | 15.87% | 114.60 | 12.63% |

| Japan | 16.53 | 4.77% | 59.95 | 4.88% | 40.83 | 4.52% | 42.08 | 4.64% |

| Asia-Pacific | 8.95 | 2.58% | 27.24 | 2.22% | 16.93 | 1.87% | 16.68 | 1.84% |

| Rest of the world | 10.38 | 2.99% | 38.19 | 3.11% | 22.23 | 2.46% | 15.24 | 1.68% |

| Total | 333.93 | 96.29% | 1176.8 | 95.87% | 868.87 | 96.20% | 872.62 | 96.19% |

Source: Company RHP

Manufacturing Facility:

The company has five manufacturing facilities including the overseas facility.

Capacity utilisation from FY20-Q1 FY23 table

| Q1FY23 | FY22 | FY21 | FY20 | |||||

|---|---|---|---|---|---|---|---|---|

| Manufacturing facility | Production capacity (in tonnes) | Capacity utilization (%) | Production capacity (in Tonnes) | Capacity utilization (%) | Production capacity (in Tonnes) | Capacity utilization (%) | Production capacity (in Tonnes) | Capacity utilization (%) |

| B208, Noida | 2538 | 67.69% | 12357 | 82.38% | 9551 | 63.68% | 8944 | 54.21% |

| GFPL, Noida | 1623 | 77.27% | 7028 | 83.67% | 5045 | 70.07% | 4629 | 70.13% |

| Vishakhapatnam | 2456 | 73.08% | 11046 | 82.19% | 7911 | 58.86% | 8380 | 62.35% |

| Framparts, Ludhiana | 2338 | 90.11% | 10133 | 101.13% | 7698 | 81.03% | 6250 | 69.44% |

| SKG, Ludhiama | 2808 | 74.87% | 11746 | 78.31% | 9602 | 71.13% | 8137 | 67.81% |

| Elride, USA | 559 | 43.84% | 2486 | 48.75% | 2397 | 47% | 3959 | 54.99% |

Source: Company RHP

Understanding Product Offerings

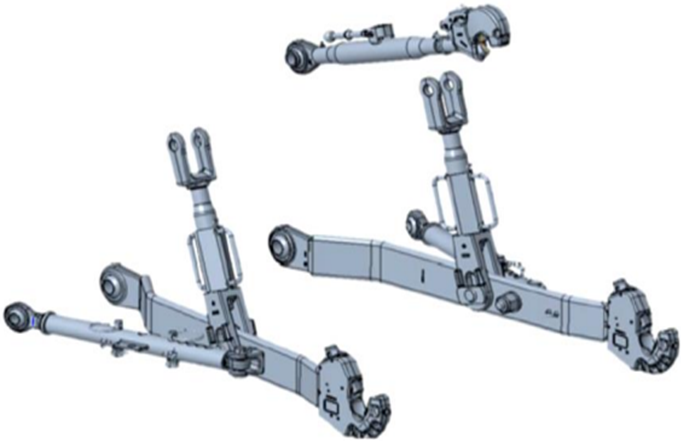

- 3Point Linkage (PL): The 3PL system forms a group of assemblies

allowing an implement like a plough to be attached to the tractor at 3 coupling

points, forming a triangle.

- Precision Machine Parts (PML): PMP is a group of components that

require specific material and manufacturing and undergoes various specifications

and controls. It is used in applications across OHVs (Off-Highway Vehicles), ranging

from engine parts and transmission components to specific parts for joints in agricultural

and construction applications.

- Hydraulic cylinders: Hydraulic cylinders are used as actuators to move mechanized components, by generating linear motion along an axis. Hydraulic cylinders are powered by a fluid, typically oil.

- Power Take Off : PTO is a device used to drive implements such

as rotary tillers, mowers and other equipment requiring a mechanical drive by the

tractor. The PTO transmits power from the tractor to the implement and is used to

distribute the power within the machine.

- Fabrication: The use of fabrications is majorly across Agriculture and construction industry. These parts vary in terms of size as well as design specifications and manufacturing process precision and complexity levels.

Product-wise revenue breakup from FY20-Q1 FY23

| Q1 FY23 | FY22 | FY21 | FY20 | |||||

|---|---|---|---|---|---|---|---|---|

| Particulars | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations |

| 3PL | 199.8 | 57.60% | 683.96 | 55.72% | 506.66 | 56.10% | 427.96 | 47.17% |

| PMP | 122.99 | 35.46% | 447.12 | 36.43% | 339.73 | 37.62% | 432.31 | 47.65% |

| PTO applications | 2.95 | 0.85% | 12.23 | 1.00% | 8.21 | 0.91% | 6.45 | 0.71% |

| Fabrication | 2.71 | 0.79% | 13.00 | 1.06% | 8.41 | 0.93% | 7.72 | 0.85% |

| Hydraulic Cylinders | 0.13 | 0.04% | 0.72 | 0.06% | 0.79 | 0.09% | 0.67 | 0.07% |

| Others | 18.25 | 5.26% | 70.4 | 5.74% | 39.35 | 4.36% | 32.12 | 3.54% |

| Total | 346.83 | 100.00% | 1227.4 | 100.01% | 903.15 | 100.01% | 907.23 | 99.99% |

Source: Company RHP

- Vertically integrated solutions provider

The company is a leading manufacturer of various precision components, where the major products are 3PL & PMP followed by fabrications, PTO and Hydraulic cylinders. The company is fully integrated both forward and backward integration that reduces its dependence on external suppliers.

Over the years the company has transformed from being solely a component manufacturer to solutions provider and further to a systems integrator. They have diversified there product portfolio by including several products such as rear hitch, front hitch, hydraulic lift arms, PTOs and trailer hitch which allow them to offer integrated system solutions to meet customer requirements and move up the value chain. The company often collaborates with their key customers, to understand customers requirement regarding design and various product specifications and customises the product as per the customer’s needs. - Long-term relationships with key global customers, including major original

equipment manufacturers (OEMs):

UIL has strong and long-term relationships with global OEM players in the agriculture and CFM sectors, such as, LS Mtron Limited ,Doosan Bobcat North America (Bobcat), Claas Agricultural Machinery Private Limited (Claas Tractors), Yanmar Global Expert Co. (Yanmar) and Tractors & Farm Equipment Limited (TAFE) Ltd. It serves several organized aftermarket players and large retail store chains in different parts of the world such as Europe and US. players such as Kramp Groep B.V. (Kramp) and Tractor Supply Company (TSC).

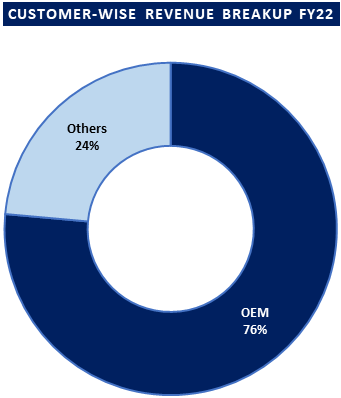

In FY22, the customer base of the company accounted for over 125 customers located across 25 countries globally. Customers such as Bobcat, TAFE and Kramp are associated with the company for over 15 years, while other customers like Yanmar, has a relationship for over 10 years.

The share of OEMs and others in the revenue is~ 76% and 24%respectively.

Source: Stockaxis Research

Rigorous innovation, engineering and design to strengthen product portfolio

The company is a component manufacturer where precision engineering and innovation

in design are the integral parts of the process. Over the years they have made several

design innovations according to the customer specifications and technological changes

adapted by industry to serve diverse set of customers across the globe. This has

aided in expanding there product and customer portfolio. They are also focusing

on opportunities of collaboration and inorganic growth. The company is continuously

working towards increasing the sales of high revenue generating products like 3PL,

which has horsepower of more than 60HP for tractor segment along with other products

like hydraulic cylinders, PTO applications and PMP . UILs biggest strength is they

continuously focus on strengthening there existing portfolio and apply the latest

advancements in that product, to provide best in class quality to their customers.

Revenue breakup (user industry)

| Q1 FY23 | FY22 | FY21 | FY20 | |||||

|---|---|---|---|---|---|---|---|---|

| Particulars | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations |

| Agriculture segment | 244.74 | 70.56% | 865.48 | 70.51% | 630.38 | 69.80% | 544.16 | 59.98% |

| CFM segment | 85.2 | 24.56% | 304.88 | 24.84% | 237.27 | 26.26% | 324.46 | 35.76% |

| Others | 3.98 | 1.15% | 6.42 | 0.52% | 1.22 | 0.13% | 3.98 | 0.43% |

| Total | 333.92 | 96.27% | 1176.78 | 95.87% | 868.87 | 96.19% | 872.60 | 96.17% |

Source: Company RHP

Healthy Financial Position

The company has strong balance sheet with net worth of ₹ 713.93 crore as of June

30, 2022 and have maintained a low debt position. They have efficiently utilized

their resources, which has enabled them to fun there capital expenditures. The revenue

from operations of the company has shown significant growth on account of increased

sales volume in Agriculture segment products. The revenue of the company stood at

Rs 1227 cr in FY22 as against Rs 907 cr in FY20, an increase of 35%.

Strategic business model aids in maintaining leading market presence and cost-effectiveness

into the business:

It has a three layer business model, which makes operations for the customers and

business much efficient and easier. Various channels of delivery helps the company

in smooth and fast operations of the business. Company’s India-led manufacturing

and overseas-led warehousing coupled with direct customer service capabilities have

been a key driver for the growth of their operations. This is evident as company

has implemented ‘manufacturing in India and warehousing in US/Europe is 20%

cheaper than manufacturing in US/Europe’. This strategic approach in the business

has rewarded the company with significant cost-effectiveness. To further improve

profitability UPIL reduced the capacity of its US facility from 7,200 TPA in FY20

to 5,100 TPA in FY21 and increased the sourcing from India. Due to diverse channels

of delivery company enjoys the privilege of charging different margins depending

upon the type of channel. With various channels for supply, the company is able

to fulfil the demand of its OEM (Original equipment manufacturers) globally.

Sales Channel mix

| Q1 FY23 | FY22 | FY21 | FY20 | |||||

|---|---|---|---|---|---|---|---|---|

| Particulars | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations | Revenue (in Cr) | % of Revenue from Operations |

| International sales | 284.96 | 82.16% | 1012.09 | 82.46% | 725.54 | 80.33% | 758.00 | 83.55% |

| Local Deliveries | 86.38 | 24.91% | 296.64 | 24.17% | 254.7 | 28.20% | 294.56 | 32.47% |

| Direct Exports | 105.12 | 30.31% | 389.36 | 31.72% | 242.85 | 26.89% | 206.50 | 22.76% |

| Warehouse sales | 142.24 | 41.06% | 490.78 | 39.98% | 371.31 | 41.11% | 371.54 | 40.95% |

Source: Company RHP

Peer Comparison

| Company name | Total revenue FY22 (Cr) | EBITDA (Cr) FY22 | PAT (Cr) FY22 | EPS-Basic (Rs) FY22 | PE (x) FY22 | RoNW% FY22 | Net Debt/EBITDA FY22 | ROCE (%)FY22 |

|---|---|---|---|---|---|---|---|---|

| Uniparts India Ltd. | 1231.04 | 271.66 | 166.89 | 37.74 | 15.29 | 24.35% | 0.42 | 31.00% |

| Bharat Forge Ltd | 10656.98 | 2363.63 | 1077.06 | 23.23 | 36.73 | 16.25% | 1.29 | 15.84% |

| Ramkrishna Forging Ltd. | 2321.71 | 518.45 | 198.03 | 12.43 | 18.60 | 18.36% | 2.90 | 13.42% |

Note: The PE valuation for Uniparts India is calculated at Upper price band of Rs 577.

Source: Company RHP

Risks

- Capital intensive and competitive industry

The company deals in an capital intensive industry where technological advancements are persistent and heavy capital expenditures are required for expansion of the business. Also it has to keep itself updated with latest technological advancements which bring change in the industry trends. - Concentrated customer base

According to management, it’s top customer (John Deere) accounted for 33% of its total revenue in FY22 & the next 5 customers accounted for another 30-40% of total top line. Hence top 10 customers make up around 75% of revenue clearly showing that the company is dependent on limited number of customers. Any adverse impact on its existing customer base will severely hamper revenue growth of the company.

Valuation

Uniparts India Ltd. is a leading manufacturer of precision components used extensively across agriculture and CFM (Construction, Forestry and Mining) industries along with other industry segments. The company’s financial growth is impressive in past 3 fiscal years in terms of its revenue, PAT and EPS growth with lower levels of debt on its balance sheet.

We believe the company has potential to continue in its strong growth trajectory in future. At upper band IPO price of Rs 577/ share asking valuation is 15.3x of its FY22 earnings which looks reasonabl0065.

We recommend ‘SUBSCRIBE’ rating to the IPO offer.

Key Information

Use of Proceeds:

- The offer is purely an ‘Offer for Sale’ of up to 14,481,942 Equity Shares by the Selling Shareholders and the company intends to garner Rs 836 cr from this issue.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges. Since the offer is an ‘Offer for Sale’ the company will not receive any proceeds from the Offer and all such proceeds (net of any Offer related expenses to be borne by the Selling Shareholders) will go to the Selling Shareholders.

Book running lead managers:

Axis Capital Limited DAM Capital Advisors Limited JM Financial Limited

Management:

Gurdeep Soni (Promoter, Chairman and Managing Director), Paramjit Singh Soni (Promoter,

Executive Director and Vice Chairman) Sudhakar S Kolli (Chief Operating Officer)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars | Q1 FY23 | FY22 | FY21 | FY20 |

|---|---|---|---|---|

| Equity share capital | 44.62 | 44.62 | 44.62 | 44.62 |

| Reserves | 669.31 | 640.62 | 515.52 | 419.55 |

| Revenue from operations | 346.84 | 1227.42 | 903.14 | 907.22 |

| Reveneue Growth (%) | - | 35.91% | -0.45% | - |

| EBITDA | 76.12 | 271.66 | 163.93 | 127.81 |

| EBITDA margin (%) | 21.95% | 22.13% | 18.15% | 14.09% |

| Profit before tax | 65.19 | 229.32 | 118.56 | 74.40 |

| Net profit | 50.52 | 166.89 | 93.15 | 62.64 |

| Net profit margin (%) | 14.56% | 13.60% | 10.31% | 6.90% |

| EPS- Basic | 11.42 | 37.74 | 21.12 | 14.20 |

| EPS- Diluted | 11.19 | 36.98 | 20.64 | 13.88 |

| RONW (%) | 7.08% | 24.35% | 16.63% | 13.50% |

| ROCE (%) | 8.83% | 31.00% | 19.78% | 13.98% |

| Debt/ Equity | 0.16 | 0.18 | 0.22 | 0.57 |