Tracxn Technologies Limited - IPO Note

IT - Software Services

Tracxn Technologies Limited - IPO Note

IT - Software Services

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Leading global player in Private market data and intelligence provider industry

The company has in-house developed platform ‘Tracxn’ which uses algorithms

backed by artificial intelligence to extract extensive data sets which are not readily

available in public domain. The data includes company profile, valuations and financials,

M&A target information, market trends & customer preference related data,

management information, etc. These data sets are helpful for businesses in understanding

customer preferences and increase there sales by analysing trends. For venture capital,

private equity firms these data sets assist in taking best possible investment decisions.

In FY22 and by June, 30 FY22 company has extracted and added information of 1652

and 1275 new entities (approximately) respectively to its platform. It has maintained

a database of 14,00,000 competition maps, over 3,90,000 funding rounds and 1,20,000

acquisition rounds. Company has prepared profiles of over 50,000 investors including

venture capital, private equity firms, and over 22000, completed assessment of companies

that are expected to become unicorns (companies with high valuations), in future.

As of June 30, 2022 company has published over 10,000 reports across diverse sectors.

Key operations and financial performance of the business

| Parameters | June,30, FY22 | FY22 | FY21 | FY20 |

|---|---|---|---|---|

| Operational parameters | ||||

| Customer accounts | 1139 | 1092 | 855 | 642 |

| users | 3271 | 3117 | 2358 | 2075 |

| entities profiled | 1838928 | 1759902 | 1345311 | 937698 |

| Financial parameters | ||||

| Revenue from operations(in Rs Crores) | 18.4 | 63.45 | 43.78 | 37.33 |

| contract price (in Rs Crores) | 18.88 | 69.58 | 51.04 | 40.46 |

Diverse and growing customer base including fortune 500 companies

Company has diverse base of 1092 customer accounts, present in over 50 countries

as of March, 31st 2022. Company’s customer accounts have increased

at a CAGR of 30.42%, from 642 customers in FY 20 to 1092 customers in FY22. Some

of these customer accounts include Fortune 500 companies and there affiliates such

as Unilever Industries Private Limited. The diverse customer base helps the company

to de-risk its dependence on any specific company, sector or industry for its revenue

growth.

The customer base of the company is divided into three broad segments:

Private market investors and investments banks- These customers

majorly comprise of venture capital, private equity firms, individual investors

and investment banks, that rely on company’s platform for making investment

decisions, deal sourcing, etc. Company’s client base under this segment includes-

Accel Management India LLP, Artiman Ventures, growX ventures Fund I, Elevation Capital

Limited and Kae Capital Management Private limited.

Corporates- Under this segment the platform of the company is used for making various strategic business decisions, investment decisions, M&A activity related decisions, for understanding the market and customer demands and for overall growth of the company. Certain client base of the company includes s Unilever Industries Private Limited, Wipro Limited, Lixil Corporation, and Yamaha Motor Solutions India Private Limited.

Others- These includes government agencies, start-ups, incubators, educational institutions, etc. Certain customer base includes Bank of Baroda and Tech City Ventures, UK.

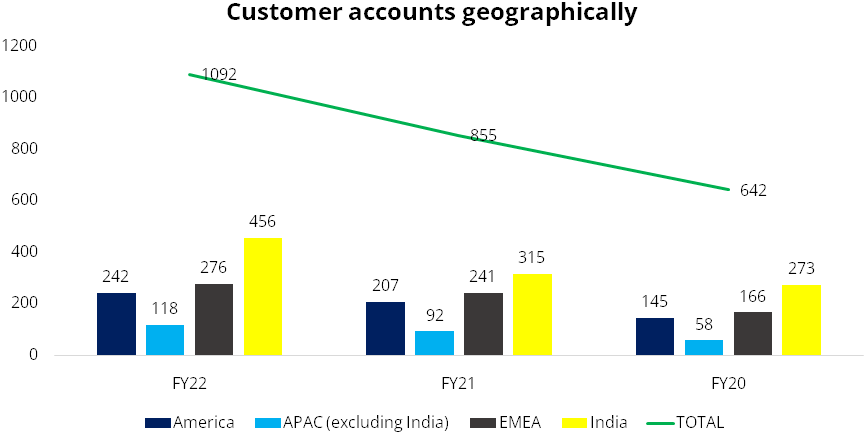

Break-up of Customer Accounts Geographically

| Geography | FY22 | FY21 | FY20 | June 30, 2022 |

|---|---|---|---|---|

| America | 242 | 207 | 145 | 247 |

| APAC (excluding India) | 118 | 92 | 58 | 119 |

| EMEA | 276 | 241 | 166 | 276 |

| India | 456 | 315 | 273 | 497 |

| TOTAL | 1092 | 855 | 642 | 1139 |

As of June 30,2022 23.44% of their customers have been associated with the company for over 3 years. Also, no single country contributes more than 31.60% in the revenues of the company.

Customer Accounts across Categories

| Categories | 30,June 22 | FY22 | FY21 | FY20 |

|---|---|---|---|---|

| Private Market Investors and Investment Banks | 588 | 571 | 456 | 338 |

| Corporations | 312 | 309 | 246 | 191 |

| Others | 239 | 212 | 153 | 113 |

| TOTAL | 1139 | 1092 | 855 | 642 |

Aims to grow additional services on Technology platform developed in-house

Company has its own software platform ‘Tracxn’ which is primarily a

data and market intelligence platform with a vast database of over a million of

entities information, which is readily available by using various in-built tools

and features of the platform. It has 40,000 different business models. In addition

to this there are other tools embedded in this platform such as CRM tool, customer

dashboard builder, tools for sourcing, tracking companies & portfolios , advance

search engines, etc. These advance features add value to customers research by facilitating

availability of extensive data sets, for better decision making. The technology

over this platform is designed in such a way that capitalises use of artificial

intelligence for keeping data accuracy levels high. The Tracxn platforms use cloud

servers that provide backups for data protection & perseverance and ensure minimum

downtime. The platform has very advance technological support which has web-crawling

and data engine which reads 550 million web domains at the back-end. It adds over

2,00,000 entities on a daily basis to the data base.

Focus on expanding business to achieve higher growth levels in upcoming times

Company has received an overwhelming response from venture capital, private equity

firms and investment banking firms. Going forward company’s major focus remains

on increasing the new customer base and successfully continuing with the existing

customer base through advancements in the data extraction tools and quality enhancement

along with price differentiation policies. Marketing channels will enable the company

to increase its client base through corporate events where company can better elucidate

the features and significance of its platform -Tracxn to engage with more corporate

clients. According to company it may enter into agreements for acquiring new businesses

and technologies which the company feel will add value to its existing business

and will help the company to perform better than its present levels.

Strong industry tailwinds will facilitate company’s growth

Over the years number of private companies in the markets globally has grown drastically

and research has become a core department for decision making in itself. Large investments

flow into the market and the users of research and private market data are willing

to go at deeper levels. With growing willingness to invest in private companies

the investments firms are the highest users of this data and will lead the growth

in this industry. As per companies RHP Tracxn technologies stands among top 5 players

of the market globally in private market data industry, which will benefit the company

in long run. India is a growing market and company’s highest number of customer

accounts are associated with this market. Also, the company’s business model

is an asset light model where employee cost is the most expensive part. But, the

amount of remuneration is still lowest in Indian markets therefore it can be estimated

that company will continue to grow maximum clients in this market in coming years.

Experienced Promoters, Board of Directors and senior management team backed by

marquee investors

The promoters of the company have significant experience with software & technology

and have previously worked with venture capital firms Accel Partners and Sequoia

capital which helps them to provide higher efficiency in the business operations.

The shareholders of the company are some of the renowned investment firms –

Ratan Tata, the NRJN family trust, Elevation Capital, Accel partners, Sequoia capital,

Prime Venture Partners, KB Investments, etc . which adds strong support to the business.

Objects of the offer

- The offer is an ‘Offer for Sale’ of the 38,672,208 equity shares of face value of Rs 1 in the price band of Rs75-80/ share. Company intends to garner Rs310 Crores. The bid size is 185 shares and in multiple thereof.

- The company wants to achieve the benefits of listing the Equity shares as it will enhance the brand value and provide liquidity to the existing shareholders. The offer is an offer for sale hence selling shareholders are solely entitled to the entire proceeds from the issue. The company will not receive any proceeds.

Risks

Employee cost expected to grow

Over the three fiscal years company has incurred hefty employee cost. With expansion

of business and appointment of new experienced technological staff this cost is

expected to grow(as clearly mentioned by the company). The growing employee cost

has direct impact on the net results of the business. From past 3 years company

is reportedly making losses and this year Q1 FY23 it has witnessed profit of Rs0.84

crores on net sales of Rs19.08 crores. This severely impacts the profitability of

the business.

| Particulars | 30-Jun-22 | FY22 | FY21 | FY20 |

|---|---|---|---|---|

| No.of Employees | 808 | 798 | 624 | 697 |

| Employee benefit expenses (in Rs Crores) | 16.1 | 58.57 | 53.8 | 51.2 |

| employee benefit expenses as % of total sales (%) | 88.60% | 89.40% | 88% | 84.90% |

Technological advancements and risk of competition

Company operates in a highly technologically advance and competitive industry where

innovations in technology are regular in nature and company has to keep itself ahead

of its competitors if it wants to continue as a key player in the market. This is

expensive and may create adverse variations in client base of companies.

Company Description

Tracxn Technologies was incorporated on August 11, 2012. The company operates under B2B information services market, a leading global market intelligence provider for private company data. As per company RHP it is ranked among top 5 players globally in providing private company data. Company has an ‘Asset Light Business Model’ which operates on ‘Software as a Service-based Platform’ (SaaS)- Tracxn, which has scanned over 550 web domains and profiled more than 14 lakh entities, 1805 feeds categorised industries, sub-sectors, geographies and networks globally. It has 2358 users and 855 user accounts over 50 countries globally. It has launched its platform Tracxn in FY15. This platform uses an in-house developed algorithm which is a combination of ‘Technology’ and ‘Human Analyst’, in the form of artificial intelligence used to extract and analyse the data.

It has a vast data-base which provides information with respect to funding, M&A transactions, valuations, fund rounds, employee count, etc. The company provides detailed industry taxonomy through its strong mechanism where it has, 44 industries mapped into 2,003 sectors, and these sectors are further divided into 49,922 taxonomy layers. The major focus of Tracxn is on ‘Emerging businesses, Industries’, where availability data is restricted. Through its platform it provides Market mapping, which is a visual representation of key sub-sectors, industries, business. These maps are represented with detailed overview of every sector, ratings, exits, top companies and geographies. Detailed reports are also generated for better understanding of the specific sector or industry.

Valuation

The company’s business model is unique with strong support of its in-house developed platform – Tracxn. But given the operational efficiency of the business we conclude that the business is not profitable in nature. Going forward the company aims to expand its business and clearly the employee cost is going to increase than present levels. In such case we do not see the company registering significant profits. However, in long run when the number of customer accounts will grow the company may generate higher levels of revenue and might compensate the employee cost better than present levels. Also, the Company has registered negative EPS and RONW (Return on Net Worth) in past three fiscal years. The price to sales ratio of the company on the basis of FY22 sales stands at 1.26.

Therefore, according to our analysis the company may perform well in long-run, but with lack of profitability in the business at present levels the business is not fit for investment currently.

Thus we recommend ‘AVOID’ for the company.

Key Information

Use of Proceeds:

The offer is an ‘Offer for Sale’ of the 38,672,208 equity shares of

face value of Rs 1 in the price band of Rs75-80/ share. Company intends to garner

Rs310 Crores. The bid size is 185 shares and in multiple thereof.

The company wants to achieve the benefits of listing the Equity shares as it will enhance the brand value and provide liquidity to the existing shareholders. The offer is an offer for sale hence selling shareholders are solely entitled to the entire proceeds from the issue. The company will not receive any proceeds.

Book running lead managers:

IIFL Securities Ltd.

Management:

Neha Singh- Founder, Chairman and managing director of the company, Abhishek Goyal-

Founder, vice chairman and executive director of the company, Ravi Chandra adusumalli-

Non- Executive Director.

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars | Q1 FY23 | FY22 | FY21 | FY20 |

|---|---|---|---|---|

| Equity share capital | 10.03 | 10.03 | 0.11 | 0.11 |

| Reserves | 12.95 | 10.61 | 21.33 | -135.45 |

| Net worth as stated | 22.98 | 20.64 | 22.22 | -135.24 |

| Revenue from operations | 18.40 | 63.45 | 43.78 | 37.33 |

| Revenue Growth (%) | 22.91% | 44.93% | 17.28% | - |

| EBITDA as stated | 0.19 | -6.41 | -17.06 | - |

| EBITDA Margin(%) | 1.01% | -10.10% | -38.97% | -60.12% |

| Profit Before Tax | 0.84 | -4.85 | -5.35 | -54.03 |

| Net Profit after Tax | 0.84 | -4.85 | -5.35 | -54.03 |

| Net Profit (%) | 4.57% | -7.64% | -12.22% | -144.74% |

| EPS- Basic (Rs) | 0.08 | -0.48 | -0.55 | -5.54 |

| EPS- Diluted (Rs) | 0.07 | -0.48 | -1.52 | -5.24 |

| RONW (%) | 3.64 | -23.49% | -24.06% | -39.95% |

| NAV (Rs) | 2.29 | 2.06 | 2.28 | -13.87 |