Tata Technologies Ltd - IPO Note

IT - Software Services

Tata Technologies Ltd - IPO Note

IT - Software Services

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

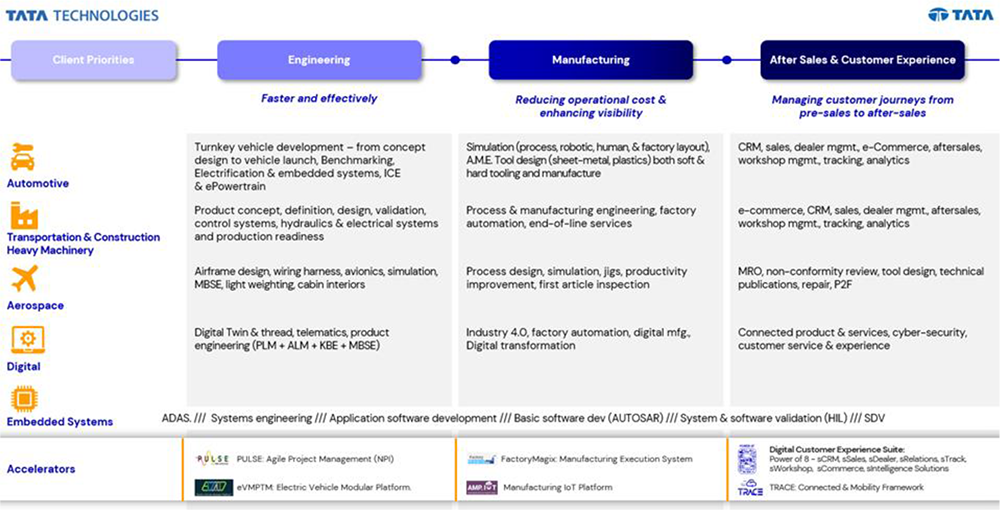

TATA Technologies Limited (TTL) was incorporated on August 22, 1994. Promoted by Tata Motors Ltd (“TML”), Tata Technologies is a leading global engineering services company offering product development and digital solutions including turnkey solutions to global OEMs and their Tier-1 suppliers. The company has deep domain expertise in the automotive industry and leverages this expertise to serve its clients in adjacent industries, such as aerospace and transportation and construction heavy machinery (“TCHM”) The Company’s range of services includes IT Consultancy, SAP implementation, and maintenance, providing networking solutions, CAD/CAM engineering & design consultancy. Services which are provided by the Group include outsourced engineering and designing services and digital transformation services to global manufacturing clients.

Tata Technologies is a pure-play manufacturing focused Engineering Research & Development (“ER&D”) company, primarily focused on the automotive industry and they are currently engaged with 7 out of the Top-10 automotive ER&D spenders and 5 out of the 10 prominent new energy ER&D spenders in 2022.

The company’s business line of segment is categorized into two segments.

Services

The company's primary business line is services, which includes providing outsourced engineering services and digital transformation services to global manufacturing clients helping them conceive, design, develop, and deliver better products.

Technology Solutions

The company complements its service offerings with its product and education business. Through the Products business, they resell third-party software applications, primarily product lifecycle management software, and solutions, and provide value-added services such as consulting, implementation, systems integration, and support.

The company provides engineering services to clients primarily in the automotive vertical, as well as aerospace, TCHM, and our other adjacent verticals. They have participated in new trends in the automotive vertical, especially with electrification and connected vehicles requiring capabilities in domains such as embedded systems and software-defined vehicles. In 2012, they launched eMo: the first full-vehicle EV concept developed by an Indian engineering services firm. Over the years, they have worked with both traditional and new energy vehicle companies on their EV programs successfully completing multiple smaller projects as well as turnkey vehicle development.

Expertise in the automotive industry

The company’s automotive ER&D services span the entire automotive value chain and include concept design and styling, tear down and benchmarking (“TDBM”), vehicle architecture, body engineering, chassis engineering, virtual validation, ePowertrain, electrical and electronics, connected, manufacturing engineering, test and validation, and vehicle launch. In addition to the spectrum of discrete service offerings, they also offer turnkey full vehicle development solutions for traditional internal combustion engine (“ICE”) powered vehicles, plug-in hybrids (“PHEV”) and battery electric vehicles (“BEV”) which have been developed over a period of 10 years.

Differentiated capabilities in new age automotive trends - electric vehicles (“EVs”), connected and autonomous.

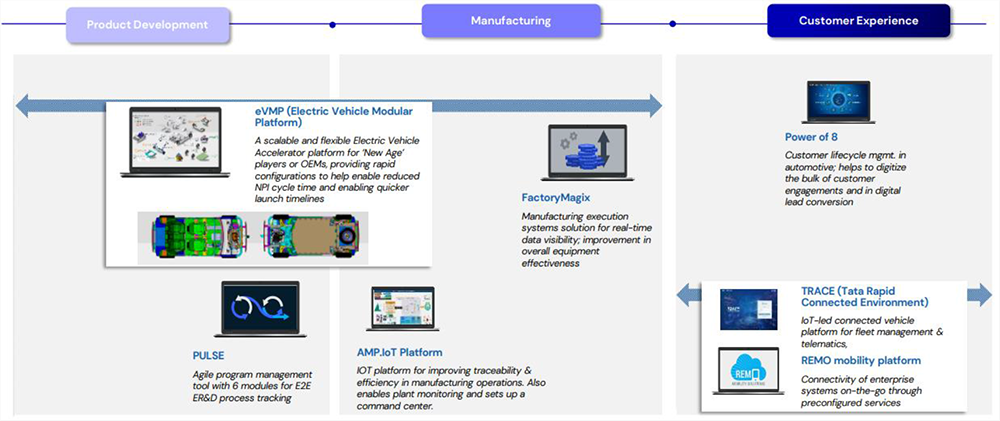

The first step in creating EVs is a compelling vehicle concept and engineering design. Company’s end-to-end solutions for EV development, manufacturing, and after-sales services are designed to help OEMs develop competitive EVs while maintaining a balance between cost, quality, and timelines. Their suite of product engineering solutions including outsourced turnkey EV development, product benchmarking, electric vehicle modular platform (“eVMP”) for accelerating product development timelines, and their light-weighting framework can help OEMs develop products within competitive timelines. Further, their suite of omnichannel after-sales solutions powered by the Power of 8 platforms can help OEMs engage with their EV customers early and manage the entire customer journey effectively. They have a long-standing history of developing EV capabilities since as early as 2010. In 2012, they unveiled an electric vehicle technology demonstrator (“eMO”) at the North American International Automotive Show in Detroit.

Global automotive companies are increasing their research and development (“R&D”) investments across the broader theme of ‘ACES’ technologies – autonomous, connected, electrification, and shared. The shift to alternative propulsion systems specifically electric vehicles has enabled this transformation. Tata Technologies offers a one-stop platform for automotive OEMs to meet new engineering needs across the value chain.

Strong digital capabilities bolstered by proprietary accelerators

The company’s suite of digital services and accelerators is designed to help OEMs and Tier-1 suppliers manage the entire digital product life cycle and engage the customer throughout the product journey. The solutions leverage their deep manufacturing domain knowledge and intimate understanding of clients. Their solutions and accelerators across new product introduction (“NPI”) increase the efficiency of automotive, Tech Mahindra, and aerospace clients in introducing new products to the market. Their range of offerings spans digital product development solutions.

Tata Technologies has built expertise in integration across PLM, ERP, and MES solutions by developing proprietary integration accelerators. They also have experience deploying Industry 4.0 at scale with the ability to identify and deploy emerging technologies, tools, and solutions to transform the manufacturing operations of their clients.

Strong relationships with marquee customers, traditional OEMs, and new energy vehicle companies.

The company has a diversified global presence across Asia Pacific, Europe, and North America and partners with many of the largest manufacturing enterprises in the world. As of September 30, 2023, their clients are comprised of more than 35 traditional automotive OEMs and tier 1 suppliers and more than 12 new energy vehicle companies. Their client portfolio includes Anchor Clients, TML, and JLR, leading traditional OEMs like Airbus, McLaren, Honda, Ford, and Cooper Standard and tier 1 suppliers as well as new energy vehicles companies such as VinFast among others such as Cabin Interiors and Engineering Solutions, ST Engineering Aerospace. Their key accounts are comprised of 7 out of the Top-10 and 12 of the Top20 global automotive ER&D spenders and 5 out of the 10 prominent new energy ER&D spenders globally.

Peer Comparison

| Company Name | Fy23 Revenue from operations (Rs. In cr) | Fy23 Diluted EPS (RS.) | Fy23 ROE (%) | Fy23 ROCE (%) | Fy23 P/E (x) | Fy23 RONW (%) |

|---|---|---|---|---|---|---|

| Tata Technologies Ltd | 4414.17 | 15.37 | 21 | 24 | 32.5 | 20.87 |

| Kpit Technologies | 3365.03 | 13.95 | 25.7 | 30.2 | 108 | 22.91 |

| L&T Technology Services Ltd | 8013.6 | 110.48 | 25 | 32.6 | 42 | 23.54 |

| Tata Elxsi Limited | 3144.7 | 121.26 | 41.1 | 47.7 | 69 | 36.21 |

Risks

Client Concentration Risk: Revenue from top five clients which includes JLR, Tata Motors and VinFast, stands at 57.4% of total revenue and 70.9% of the services segment revenue.

A growing share of the education business may weigh on the margins

The education business operated at lower margins compared with other businesses. It derives ~97% of education revenue in H1FY24 from projects with state governments and public universities.

Forex fluctuations - Exchange rate fluctuations in various currencies could materially and adversely impact its business.

Intense competition - Intense competition in the market for engineering services could affect the pricing and have a material adverse effect on the business, and financial condition.

Valuation

Tata Technologies is a leading global engineering services company that offers product development and digital solutions (including turnkey solutions) to global OEMs and their tier-1 suppliers. The company’s offerings focus on manufacturing-led verticals – Automotive (75% of the revenue), Aerospace, and transportation and construction heavy machinery (TCHM). Its areas of expertise include product engineering and manufacturing engineering in the mechanical domain (such as body engineering), while it is adding capabilities in the software and embedded engineering segments. Tata Tech’s growth trajectory over FY16-23 remains slower than peers’ but has seen improvement. We believe this is captured in valuation.

Considering growing global ER&D spending, robust R&D capabilities, significant improvement in financial performance for the past 3 years, strong domestic demand, deep expertise in the automotive industry, superior return ratios, debt-free balance sheet, established relationship with the marquee customer base, differentiated capabilities in new age automotive trends - electric vehicles (“EVs”), Increased manufacturing focus on education and upskilling and reasonable valuations, we assign a SUBSCRIBE rating for the issue.

The IPO is valued at 32.5 times its Fy23 EPS calculated at the upper price band of Rs.500 which appears reasonable as compared to their peers.

Key Information

Use of Proceeds:

Objects of the Offer

The total issue size is of Rs 3042.51Cr of which the entire amount is an offer for sale and the proceeds will be going to the selling shareholders. The Company will not receive any proceeds from the Offer.

The objects of the Offer are to (i) achieve the benefits of listing the Equity Shares on the Stock Exchanges (ii) carry out the Offer for Sale of up to 60,850,278 Equity Shares by the Selling Shareholders. Further, the Company expects that the proposed listing of its Equity Shares will enhance its visibility and brand image as well as provide a public market for the Equity Shares in India.

Book running lead managers:

JM Financial, Bofa Securities India Ltd, and Citigroup global markets

Management:

Ajoyendra Mukherjee (Chairman & Managing Director), Warren Kevin Harris (Chief Executive Officer & Managing Director), Usha Sangwan (Independent Director), Pathamadai Balachandran Balaji & and Shailesh Chandra (Non- executive Director).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (In Cr) | FY21 | FY22 | FY23 | H1FY24 |

|---|---|---|---|---|

| Revenue from operations | 2380.90 | 3529.58 | 4414.10 | 2526.70 |

| COGS | 579.73 | 1088.34 | 1252.13 | 713.98 |

| Gross Profit | 1801.17 | 2441.24 | 3161.97 | 1812.72 |

| Gross Profit Margin | 75.65% | 69.16% | 71.63% | 71.74% |

| Employee benefit expense | 1216.00 | 1512.60 | 1929.46 | 1131.90 |

| Other Expense | 199.46 | 282.88 | 411.64 | 216.03 |

| EBITDA | 385.71 | 645.76 | 820.87 | 464.79 |

| EBITDA Margin | 16.20 | 18.29% | 18.59% | 18.39% |

| Depreciation and Amortization | 92.20 | 85.71 | 94.55 | 49.74 |

| EBIT | 293.51 | 560.05 | 726.32 | 415.05 |

| EBIT Margin | 12.32% | 15.86% | 16.45% | 16.42% |

| Other Income | 44.82 | 48.80 | 87.75 | 60.72 |

| Finance Cost | 17.65 | 21.89 | 17.98 | 9.47 |

| Profit before Tax | 320.68 | 586.96 | 796.09 | 466.30 |

| Tax Expense | 76.09 | 149.86 | 172.11 | 114.35 |

| Effective Tax Rate | 23.72% | 25.53% | 21.61% | 24.52% |

| PAT | 244.59 | 437.10 | 623.98 | 351.95 |

| PAT Margin | 10.27% | 12.38% | 14.13% | 13.92% |

| EPS(Rs) | 5.89 | 10.77 | 15.38 | 8.67 |