Suryoday Small Finance Bank - IPO Note

Small Finance Bank

Suryoday Small Finance Bank - IPO Note

Small Finance Bank

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

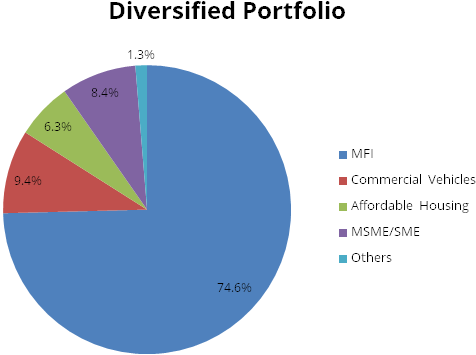

Well Diversified Asset Portfolio

Suryoday has over the years grown secured advances from 5.19% in FY18 to 25.41%

in Q3FY21. The company has been able to diversify its product portfolio and proportion

of net unsecured portfolio has reduced from 94.81% of net advances in FY18 to 74.59%

as on Q3FY21. It has diversified into other products, which broadly include CV loans,

affordable home loans, micro business loans, etc. As of December 31, 2020, commercial

vehicle loans, affordable housing loans, micro business loans, unsecured MSME/SME

loans, secured business loans, financial intermediary group loans and other loans

represented 9.4%, 6.3%, 0.99%, 1.01%, 3.63%, 4.78% and 3.51%, respectively, of the

gross loan portfolio.

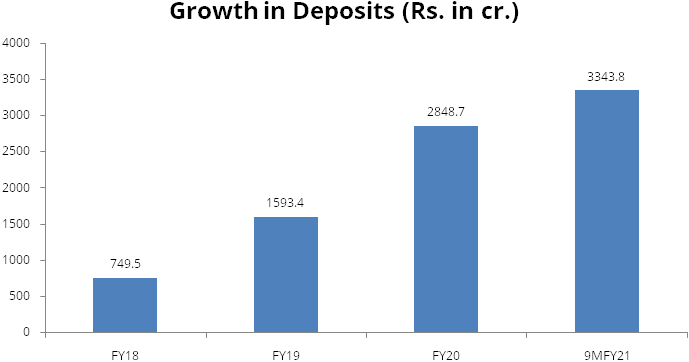

Robust growth in deposits

The deposit base has grown at a CAGR of 94.95% from Rs. 749.5 crore as of March

31, 2018 to Rs. 2848.7 crore as of March 31, 2020 and was Rs. 3343.8 crore as of

December 31, 2020.

As of December 31, 2020, the deposit base represented 69.22% of the overall funding profile.The number of CASA accounts and term deposit accounts have grown from 9,295 and 7,645 as of March 31, 2018, respectively, to 65,676 and 63,399 as of March 31, 2020, respectively and were 3,40,588 and 75,018 as of December 31, 2020, respectively. The bank has been able to leverage the network of business correspondents (BCs) to grow its retail liability portfolio and their expertise to expand into newer geographies.

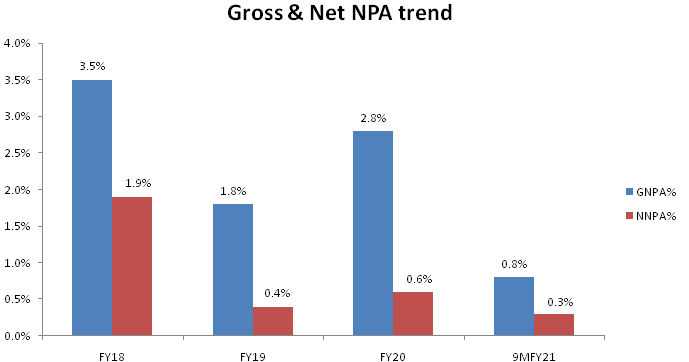

Steady asset quality with strong credit processes and risk management framework

Suryoday has implemented credit management models such as credit history checks

with various bureaus, fraud verification tools, etc, which have enabled them to

maintain a stable portfolio quality. Their effective credit risk management is reflected

in their portfolio quality indicators such as their stable portfolio at risk and

low rates of GNPA and NNPA. As of December 31, 2020, GNPA accounted for 0.8% of

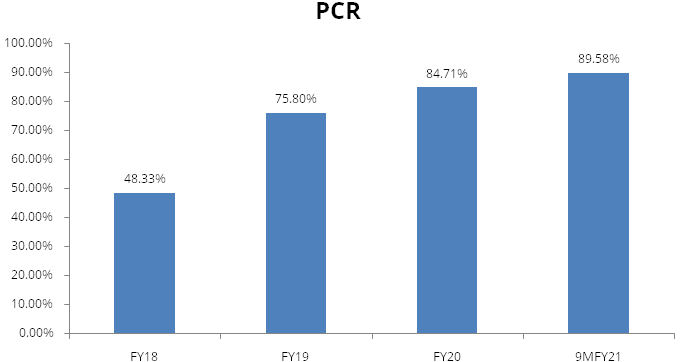

gross advances while NNPAs accounted for 0.3% of net advances. The provision coverage

ratio (PCR) including technical write-offs was 48.33%, 75.80%, 84.71% and 89.58%

in FY18, FY19, FY20 and the nine months ended December 31, 2020, respectively.

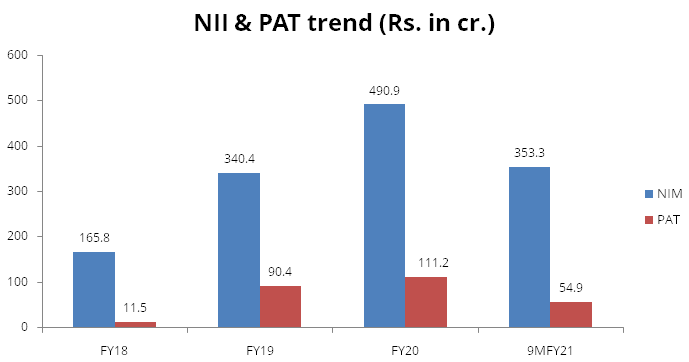

Strong operating performance

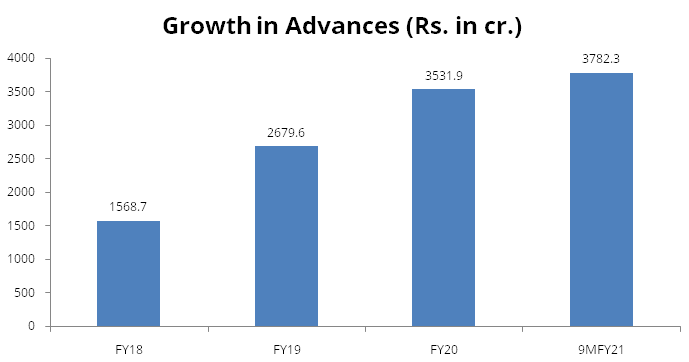

The company’s advances has grown at a CAGR of 47% from Rs. 1568.7 crore as

of March 31, 2018 to Rs. 3531.9 crore as of March 31, 2020 and was Rs. 3782.3 crore

as of December 31, 2020. Net interest income has increased from Rs. 165.8 crore

in FY18 to Rs. 490.9 crore in FY20 and was Rs. 353.2 crore in the nine months ended

December 31, 2020. PAT has increased from Rs. 11.4 crore in FY18 to Rs. 111.1 crore

in FY20 and was Rs. 54.8 crore in the nine months ended December 31, 2020.The company’s

cost-to-income ratio is lowest among SFBs in India. The cost-to-income ratio has

reduced from 64.44% in FY18 to 47.05% in FY20 and was 55.39% in the nine months

ended December 31, 2020.

Well capitalized

Suryoday has strong capital ratios with capital adequacy ratio (CAR) at 41% whereas

minimum requirement is 15%. Suryoday plans to raise Rs. 248 cr. via the IPO mainly

to meet the listing requirement of RBI and secure growth capital. The capital raise

will further improve to already strong capital ratios.Post IPO, the bank’s

CAR should improve to 54% which is highest among peers and promoter stake should

fall to 28%, well below the regulatory requirement.

Industry

Small Finance Bank (SFBs) are allowed to take deposits, which provide them an edge of having lower cost of funds in comparison with NBFCs. SFBs are required to maintain 15% capital adequacy ratio under Basel II norms. The objective of SFB’s is to extend banking services to the underserved and unserved population through savings instruments, and providing credit to small business units, small and marginal farmers, micro and small industries, and unorganized sector.To improve financial inclusion, especially in rural areas, the government is focusing on improving the overall and rural infrastructure for penetration of financial services as well as empowering the development of parallel supporting institutions. This has provided an opportunity for small-finance banks and other financial institutions to cater to the unserved population or act as a channel between the larger financial institutions and other service providers to the underserved customers.

Key regulations for the small finance bank

| Scope of activities |

|

| Prudential norms |

|

| Capital Requirement |

|

| Branch requirement |

|

SFB’s aim to cater to the low-income segment, unlike NBFCs which expand horizontally with special focus product. SFBs are expected to expand vertically and deep which will enable them to have a good range of medium and low value customers and as a result, help in increasing their business.

Rural and microfinance borrowers have low credit penetration and migrate less between credit providers, therefore enabling SFBs to build a loyal customer base. In addition, factors, such as, lack of awareness of financial services, illiteracy and poverty will result in a challenge for SFBs from the demand side. However, the government’s focus on increasing financial literacy and awareness is expected to help overcome this challenge. Although SFBs will fare better in terms of product and service quality due to their focused approach, SFBs is expected to create convenient touchpoints to initiate customers into saving regularly and also invest in human capital to equip their staff into mobilizing deposits.

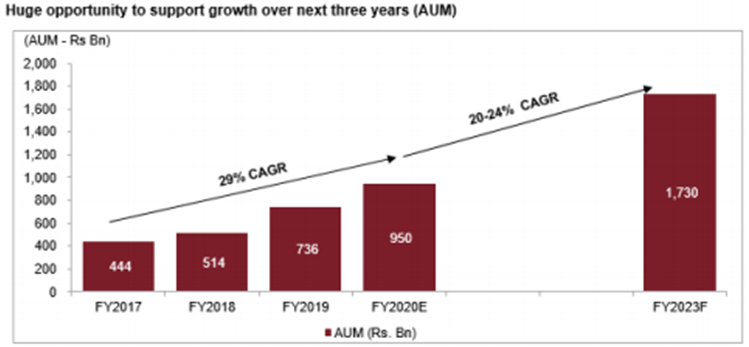

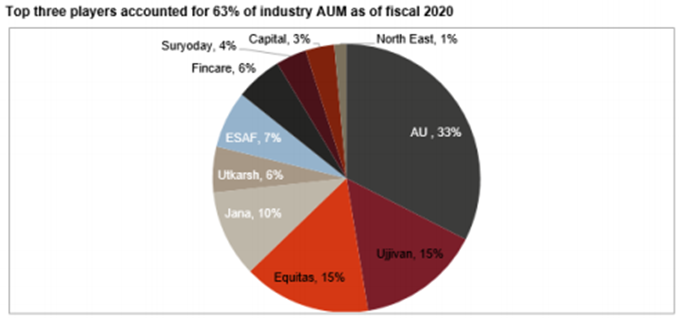

SFBs have grown at a CAGR of 29% from Fiscal 2017 to Fiscal 2020, in terms of assets under management. Top three SFBs accounted for 63% of the total SFB AUM in Fiscal 2020, compared to 55% in Fiscal 2017. These top three SFBs recorded a CAGR of 35% from Fiscal 2017 to Fiscal 2020. Further, it is expected the loan portfolio will grow at a CAGR of approximately 22% in the near term. New loan origination is expected to remain low as SFBs are cautious and selective in disbursals as a result of the pandemic. However, as the economy revives and business operations normalize, growth is likely to recovery from the second half of CY 2021 due to support from rural segment, presence of informal credit channels, geographic diversification, ability to manage local stakeholders, access to low-cost funds, and loan recovery and control on aging NPAs.

Peer comparison

| Particulars | On book AUM FY 20 (Rs Bn) | On book AUM growth (FY 17-20) | Deposit (Rs Bn) | Deposit growth (FY17-20) | Capital Adequacy Ratio | Yield on Advances | NIMs | Cost of Borrowings | Cost to income | GNPA | ROE | ROA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AU SFB | 308.90 | 42.00% | 261.60 | 35.00% | 22.00% | 13.70% | 5.50% | 7.40% | 56.10 | 1.70% | 15.80% | 1.60% |

| Equitas SFB | 146.10 | 27.00% | 107.90 | 30.00% | 23.60% | 19.10% | 9.70% | 8.00% | 66.30 | 2.70% | 9.80% | 1.40% |

| Ujjivan SFB | 141.50 | 30.00% | 107.80 | 46.00% | 28.80% | 21.70% | 10.80% | 8.10% | 67.40 | 1.00% | 14.00% | 2.20% |

| Jana SFB | 112.90 | -4.00% | 96.50 | 130.00% | 19.30% | 22.70% | 9.30% | 9.40% | 80.60 | 2.80% | 3.50% | 0.30% |

| ESAF SFB | 68.10 | 66.00% | 70.20 | 63.00% | 24.00% | 22.30% | 10.60% | 8.70% | 64.90 | 1.50% | 19.20% | 2.30% |

| Utkarah SFB | 66.60 | 60.00% | 52.30 | 38.00% | 22.20% | 20.80% | 9.60% | 8.20% | 57.60 | 0.70% | 19.00% | 2.20% |

| Fincare SFB | 53.40 | 60.00% | 48.50 | 138.00% | 29.30% | 24.90% | 11.80% | 9.50% | 56.00 | 0.90% | 18.30% | 2.50% |

| Suryoday SFB | 37.10 | 64.00% | 28.50 | 79.00% | 29.60% | 22.50% | 10.70% | 8.10% | 47.10 | 2.80% | 11.40% | 2.40% |

| Capital SFB | 33.00 | 34.00% | 44.40 | 21.00% | 19.10% | 11.20% | 4.20% | 6.40% | 75.50 | 2.00% | 7.70% | 0.50% |

Risks

Continuing impact of pandemic may affect business negatively

The outbreak of the Covid-19 pandemic has resulted in muted economic activity due

to lockdown measures taken by the government, which has affected several businesses.

The impact of the pandemic on the company’s business, operations and future

financial performance includes a significant decline in collection efficiencies

as most of collections are cash-based and involve physical presence of employees,

which was not possible due to the nationwide lockdown and travel restrictions that

were imposed. There was a decline in disbursements due to reduced economic activity.

There was a potential significant increase in NPA levels due to deterioration in

credit quality of customers, as the company’s target borrower segment primarily

comprise small traders, individuals with micro-enterprises and others belonging

to the unorganised sector, who were most impacted due to the economic downturn.

The extent to which Covid-19 impacts business and results will depend on future

developments, which are highly uncertain.

Significant concentration in few states

A large number of the company’s banking outlets are in Tamil Nadu, Maharashtra

and Odisha. Consequently, a majority of advances are towards customers in Tamil

Nadu, Maharashtra and Odisha. As of December 31, 2020, 338 out of 554 banking outlets

were located in these three states and advances towards customers in Maharashtra,

Tamil Nadu and Odisha represented 34.76%, 27.43% and 15.11%, respectively, of total

gross advances. In the event of a regional slowdown in economic activity in Tamil

Nadu, Maharashtra or Odisha, or any other developments affecting the ability of

borrowers to repay loans, or that make products in these states less beneficial,

the company may experience an adverse impact on financial condition and results

of operations.

Concentration in deposit

The company is dependent on a limited number of customers for a portion of deposits.

Deposits from 20 largest depositors represented 59.16%, 44.68%, 38.77% and 29.84%

of total deposits as of March 31, 2018, March 31, 2019 and March 31, 2020 and as

of December 31, 2020, respectively. Reduction or loss of such deposits exposes the

bank to an increasing funding risk, which would adversely affect its financial performance.

One of the promoters has encumbered his equity shares with certain systemically

important NBFCs by way of pledge

As of March 9, 2021, 1.12 crore equity shares constituting 11.52% of equity shares

are held by one of the promoters, of which 81.5 lakh equity shares are pledged in

favour of Avendus Finance Pvt Ltd and Kiran Vyapar Ltd while 31.4 lakh equity shares

have been pledged in favour of Placid Ltd, in relation to borrowing arrangements

entered into by Baskar Babu Ramachandran in his personal capacity. Any default under

the agreements pursuant to which these equity shares have been pledged will entitle

the pledgee to enforce the pledge over these equity shares. If this happens, the

aggregate shareholding of the promoters may be diluted.

Company Description

Suryoday Small Finance Bank (Suryoday) is among the leading small finance banks (SFB) in India and has been serving customers in the unbanked, underbanked segments. Prior to the operations as an SFB, it operated as an NBFC– MFI carrying out microfinance operations and operated the joint liability group (JLG)-lending model for providing collateral-free, small ticket-size loans to economically active women belonging to weaker sections. The company started operations as an SFB in January 2017. It has operations across 13 states and union territories. As of December 31, 2020, the customer base was 14.4 lakh. Suryoday SFB operates through 554 banking outlets including 153 Unbanked Rural Centres (URC) and has 4770 employees. The company has set up 661 customer service points (CSP) as additional service or touch points and intends to continue to expand its reach through the customer service point model. The bank’s asset products consist of a) Inclusive finance portfolio (comprising loans to JLG customers) b) Commercial vehicle loans c) Affordable housing loans d) Micro business loans e) Unsecured micro and small enterprise f) Small and medium enterprise loans, secured business loans, financial intermediary group loans and Other various loans.

Valuation

Suryoday SFB has witnessed robust growth in advances along with maintaining asset quality. PostIPO, Suryoday’s CAR will increase to ~54% which will be highestamong peers. Micro finance offers a vast opportunity for business growth. At upper price band of Rs. 305 per share, the stock is available at ~2.4x P/ABV and ~2.2x P/ABV post fresh issue of shares.

However, Bank’s MFI dominant portfolio can pose risk to asset quality and diversification away from MFI will put pressure on margins. On valuation front much larger lister peers like Ujjivan and Equitas are trading at 2.6x and 2.4x ABV which leaves less scope for further upside for Suryoday. Thus we recommend Subscribe for listing gains.

Key Information

Use of Proceeds:

Objective of the issue

Out of total issue size of Rs. 581 crores, offer for sale consist of Rs. 333 crores

and balance Rs. 248 crore of fresh issue will be utilized towards augmenting the

Bank's Tier-1 capital base to meet the Bank's future capital requirements.

Book running lead managers:

Axis Capital, ICICI Securities, IIFL Securities, SBI Capital Markets Limited

Management:

MD & CEO, Baskar Babu Ramachandran, a first generation entrepreneur, has several

years of experience in the financial services sector and has held leadership positions

in companies like HDFC Bank, GE Capital Transportation Financial Services among

others.

Financial Statement

Profit & Loss Statement (Rs. in cr)

| Particulars | FY2018 | FY 2019 | FY 2020 | 9M FY21 |

|---|---|---|---|---|

| Interest Earned | 286.90 | 530.10 | 766.70 | 624.30 |

| Interest Expense | 121.10 | 189.70 | 275.80 | 271.10 |

| NII | 165.80 | 340.40 | 490.90 | 353.30 |

| Other Income | 38.00 | 66.90 | 87.50 | 64.90 |

| Total Income | 203.90 | 407.30 | 578.40 | 418.20 |

| Operating expense | 131.40 | 190.70 | 272.10 | 231.60 |

| Gross Profit | 72.50 | 216.60 | 306.20 | 186.60 |

| Provisions | 61.00 | 126.20 | 195.00 | 131.70 |

| Net Profit | 11.50 | 90.40 | 111.20 | 54.90 |

Balance sheet (Rs. in cr)

| Particulars | FY2018 | FY 2019 | FY 2020 | 9M FY21 |

|---|---|---|---|---|

| Assets | ||||

| Cash balances | 207.20 | 276.40 | 837.60 | 833.20 |

| Investments | 311.30 | 664.40 | 808.20 | 1511.40 |

| Advances | 1568.70 | 2679.60 | 3531.90 | 3782.30 |

| Fixed Assets | 13.50 | 19.00 | 38.70 | 43.40 |

| Other Assets | 55.20 | 121.90 | 148.10 | 180.20 |

| Total | 2156.00 | 3761.20 | 5364.50 | 6350.40 |

| Equity & Liabilities | ||||

| Capital | 67.50 | 81.60 | 86.60 | 89.20 |

| Reserves & Surplus | 471.00 | 798.80 | 979.60 | 1101.80 |

| Networth | 538.50 | 880.40 | 1066.20 | 1191.00 |

| Deposits | 749.50 | 1593.40 | 2848.70 | 3343.80 |

| Borrowings | 717.80 | 1124.20 | 1264.60 | 1487.10 |

| Other Liabilities and provisions | 150.10 | 163.20 | 185.00 | 328.50 |

| Total | 2156.00 | 3761.20 | 5364.50 | 6350.40 |

Key Ratios

| Particulars | FY2018 | FY 2019 | FY 2020 | 9M FY21 |

|---|---|---|---|---|

| No. of shares (crore) | 6.70 | 8.20 | 8.70 | 8.90 |

| BV | 79.80 | 107.90 | 123.10 | 133.50 |

| EPS | 1.80 | 13.40 | 13.40 | 6.20 |

| P/ABV | 3.90 | 2.90 | 2.50 | 2.40 |

| RoA (%) | 0.67 | 3.17 | 2.53 | 1.24 |

| RoE (%) | 2.30 | 14.80 | 11.30 | 6.30 |