Stove Kraft Limited - IPO Note

Consumer Durables - Domestic Appliances

Stove Kraft Limited - IPO Note

Consumer Durables - Domestic Appliances

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Well-recognised Portfolio of Kitchen Solutions Brands with a Diverse Range of

Products

Since its inception in 1999, Stove Kraft has grown from a single brand small LPG

stove manufacturing company to become one of India’s leading manufacturers

of kitchen appliances. It has a presence in 27 states of India and 14 countries

across the world. The existing market presence and strength of the Pigeon brand

has been instrumental in enabling the company to successfully enter into home solutions

vertical with products like LED in 2016. Its tie-up with Stanley Black & Decker

Inc. and The Black and Decker Corporation will enable it to penetrate the premium

segment of the kitchen appliances industry, and contribute meaningfully in the recognition,

demand and growth of its overall brand portfolio. Stove Kraft is engaged in a wide

range of marketing and advertising activities, including in-shop displays, merchandising,

kiosks, live demo stands, social media marketing, which enable it to maintain the

popularity and recall value of their brand portfolio.

Widespread Distribution Network with a Presence Across Multiple Retail Channels

The company’s manufacturing facilities in Bengaluru and Baddi are connected

with 9 strategically located Clearing and forwarding (C&F) agents. Additionally,

it has 651 distributors in more than 27 states and 5 union territories of India.

The C&F agents and distributors are, in turn, connected with a dealer network

comprising of over 45,475 retail outlets, which are driven through a sales force

of 566 personnel.

In addition to independent third-party retail stores, Stove Kraft has also partnered with major Indian retailers for the sale of its products and the products of the company are available in retail chains such as Metro Cash and Carry India Pvt. Ltd. It has also partnered with e-commerce retailers such as Flipkart for the sale of its Pigeon branded products on their portals. The Gilma brand products are sold exclusively through 65 Gilma stores located across 28 cities and towns in 4 states. Internationally, its products are exported to 14 countries. In FY 2016, the company forays into a new line of business, i.e., LED products. The company started trading in LED products and in a span of 36 months.

Strong Manufacturing Capability with Backward Integration.

The company’s Bengaluru facility is a large facility for the manufacturing

of kitchen solutions, which is spread over ~46 acres and five guntas. It is an integrated

facility comprising of 12 manufacturing units, tailored to manufacture pressure

cookers, non-stick cookware, hard anodized cookware, mixer grinders, induction cooktops,

LPG stove, etc. Its manufacturing facilities are backward integrated and have the

ability to manufacture components such as bakelite handles, sheet metal components,

moulded parts, die cast parts, moulds, dies and fixtures in house.

Focus on Quality and Innovation

The quality is a pre-requisite for a positive consumer experience and long-term

brand loyalty. This philosophy has formed the foundation of the expansion and diversification

of company’s product portfolio since its inception. For products which are

sourced from third party OEMs, the company has a dedicated sourcing team and quality

assurance team based out of China, which closely monitors the quality of such products.

Over the years, based on the experience, Stove Kraft has focussed on investing in

experience-based product innovations that are most relevant in creating the best

consumer experience. As of September, 2020, the company has a dedicated in-house

R&D facility, comprising of 13 personnel, and has progressively increased their

investment in R&D in the last few years. To add its efforts in innovation, in

the past, Stove Kraft had also entered into tie ups with foreign companies for technology

enablement and tech knowhow agreements with them from FY 2013 to FY 2015.

Industry

India is expected to rise from the 12th to the 5th largest consumer durables market in the world by 2025 backed by the country’s burgeoning middle-class population, rising disposable incomes, easy access to credit, increasing electrification of rural areas, rising influence of social media and popularity of online sales. Rural India is expected to be the emerging consumer market. There has been a considerable improvement in standard of living of rural population since the last few decades and rural region’s per capita GDP has witnessed CAGR of 6.2% since 2000 (Source: Company RHP).

The market of Indian appliance and consumer electronics (ACE) touched Rs. 2.1 trillion in 2017 and is expected to grow at a CAGR of 9% in 2022. The key large and small cooking appliances category’s current market value is estimated at about ~Rs. 149 billion which is set to reach Rs. 238 billion by end 2022, growing at a CAGR of ~10%.

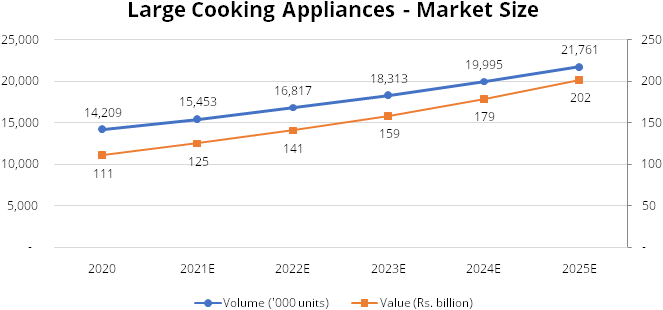

Large cooking appliances include cooker hoods (Kitchen Chimney), cooking hobs and cooktops. Retail sales volume of this category has witnessed a growth of CAGR of 6% from 2015 – 2020. In terms value, the category has grown at CAGR of 9.2% through the same period. Further, it is expected that the category to grow at CAGR 8.7% through 2021 -2025 in volume terms and 12.5% in value terms for the same period (see chart below):

Source: Company RHP, StockAxis Research.

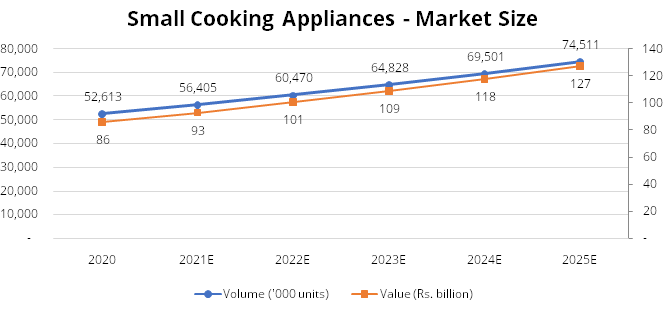

On the other hand, the category of small cooking appliance such as pressure cooker, electric kettle, electric rice cookers, coffee makers, juice extractors, mix grinders, blenders, food processers, etc. In volume terms, this category is expected to reach at a CAGR 7.21% for the period of 2020 – 2025 and in value terms, it is expected to grow at a CAGR of 8.13% during the same period (See chart below):

Source: Company RHP, StockAxis Research.

Snapshot of Growth in Sub-Category of Small Cooking Appliances:

| Sub-Category (Volume '000 units) | 2020 | 2025 | CAGR (2020 - 2025E) |

|---|---|---|---|

| Pressure Cooker | 31,697 | 45,273 | 7.40% |

| Electric Rice Cookers | 2,186 | 2,995 | 6.50% |

| Blenders | 1,229 | 1,713 | 6.90% |

| Food Processors | 2,309 | 3,218 | 6.90% |

| Juice Extractors | 249 | 348 | 6.90% |

| Mixer-Grinder | 13,860 | 19,484 | 7.10% |

| Sub-Category Value (Rs. Mn) | 2020 | 2025 | CAGR (2020 - 2025E) |

|---|---|---|---|

| Pressure Cooker | 17,728 | 27,239 | 9.00% |

| Electric Rice Cookers | 4,421 | 6,140 | 6.80% |

| Blenders | 3,623 | 5,063 | 6.90% |

| Food Processors | 12,283 | 18,257 | 8.30% |

| Juice Extractors | 970 | 1,431 | 8.10% |

| Mixer-Grinder | 44,352 | 64,477 | 7.80% |

Risks

- In 2015, the company filed a suit for seeking perpetual injunction from passing off and infringement of the PIGEON trademark, for the classes registered by the company in 2003 and 2005, in relation to unauthorized sale and manufacture of PIGEON branded products by PAPL, its associate company. Stove Kraft was granted a temporary injunction. Currently, the matter is pending and there can be no assurance that the final judgement of the court will be in favour for the company. Therefore, there is no assurance that the company will be able to protect its trademark in the future.

- There are various legal proceedings, which involves the company, its promoters and director. If these proceedings are determined against the company or its Promoters or its director, may have an adverse effect on its business.

- The BLACK + DECKER brand license agreement contains various provisions such as maintain certain quality standards, get approval from B&D at development stage and to achieve minimum total sales per year. Failure to comply with these provisions could result in adverse consequences including an event of default.

- The manufacturing facility of the company at Bengaluru is situated on the land, which may be subject to regulatory action and litigation.

Company Description

Stove Kraft Limited (Stove Kraft) is a kitchen solution and an emerging home solutions brand. It is one of the leading brands for kitchen appliances in India and dominant players for pressure cookers and a market leader in the sale of free-standing hobs and cooktops. Stove Kraft is engaged in the manufacture and retail of a wide and diverse suite of kitchen solutions under the Pigeon and Gilma brands, and proposes to commence manufacturing of kitchen solutions under the BLACK + DECKER brand, covering the entire range of value, semi-premium and premium kitchen solutions, respectively. The kitchen solutions comprise of cookware and cooking appliances across its brands, and the home solutions comprise various household utilities, including consumer lighting, which not only enables the company to be a one stop shop for kitchen and home solutions, but also offer products at different pricing points to meet diverse customer requirements and aspirations.

Valuation

The company has maintained a good track record of growth over the years through expansion of brand portfolio, distribution network, improved procurement costs and growth in sales. The company has been able to capitalise on its existing logistics, supply chain network and backward integrated manufacturing facilities to utilise its capital efficiently. Over the last few years, the company has added manufacturing and warehousing infrastructure, scaled up its retail franchise operations, added a number of new product categories and entered new customer segments. At the post-issue implied Market Cap to FY20 Sales, the company is valued at 2x of Market Cap/Sales. We recommend SUBSCRIBE on this issue for the listing gains.

Key Information

Use of Proceeds:

The company proposes to utilise the net proceeds from the fresh issue towards repayment/pre-payment, in full or part, of certain borrowings and for the general corporate purposes.

Book running lead managers:

Edelweiss Financial Services Limited and JM Financial Limited.

Management:

Rajendra Gandhi (Promoter and Managing Director), Neha Gandhi (Executive Director),

Rajiv Mehta Nitinbhai (Whole Time Director and CEO), Shashidhar SK (CFO).

Financial Statement

Profit & Loss Statement:- (Standalone)

| Particulars (Rs. Crores) | FY 2018 | FY 2019 | FY 2020 | H1 FY 2021 |

|---|---|---|---|---|

| Net Sales | 523.62 | 640.94 | 669.86 | 328.84 |

| Total Expenditure | 513.65 | 611.12 | 636.07 | 283.77 |

| EBITDA | 9.97 | 29.82 | 33.79 | 45.06 |

| EBITDAM(%) | 1.90% | 4.65% | 5.04% | 13.70% |

| Depreciation | 11.23 | 12.34 | 12.41 | 6.87 |

| EBIT | -1.25 | 17.48 | 21.38 | 38.20 |

| EBITM (%) | -0.24% | 2.73% | 3.19% | 11.62% |

| Interest and Finance | 16.94 | 17.92 | 20.90 | 10.10 |

| Other Income | 5.63 | 1.66 | 3.05 | 0.67 |

| Profit Before Tax | -12.56 | 1.22 | 3.53 | 28.78 |

| Tax | -0.54 | 0.49 | 0.36 | - |

| Profit After Tax | -12.02 | 0.74 | 3.17 | 28.78 |

| PAT Margin (%) | -2.30% | 0.11% | 0.47% | 8.75% |

| Diluted EPS | 6.35 | 0.33 | 1.28 | 11.64 |