Sona BLW Precision Forgings Limited - IPO Note

Precision Forgings

Sona BLW Precision Forgings Limited - IPO Note

Precision Forgings

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

One of the Leading Manufacturers and Suppliers to Global EV Markets

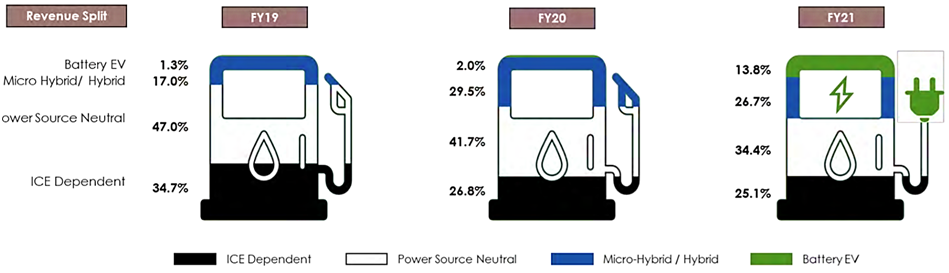

In CY2020, the company’s Battery Electric Vehicle (BEV) sales was 3.3% of

the total global vehicle sales, representing 13.8% of revenues in FY21; the share

to the topline from BEV has increased from 1.3% in FY19 to 13.8% in FY21.

According to the Ricardo Report, among the available propulsion technologies, BEV has been the fastest growing at CAGR of ~46% between CY15 - CY20 and according to the report, the company’s global market share of BEV differential assemblies in CY20 was 8.7%. The report also states that Sona Constar is among a limited number of players, who are well-placed to combine motor and driveline capabilities to offer a compelling value proposition to EV customer base. As at March 2021, the company has been awarded 15 development programs for EV systems and components by 10 different customers, of which active production process has commenced for eight programs and regular production is yet to commence for seven programs.

One of the Leading Global Companies and Gaining Market Share, Diversified Across

Key Automotive Geographies, Products, Vehicle Segments, and Customers

The company has nine manufacturing and assembly facilities, of which six are in

India and one each in China, Mexico, and USA. It also has eight warehouses across

India, USA, Germany, and Belgium. According to the Ricardo Report, the company is

one of the top ten players globally in the differential bevel gear market in CY20

based on overall volumes supplied to PVs, CVs, and tractors. It is also one of the

two largest exporters of starter motors from India and amongst the top ten global

starter motor suppliers in CY20. According to the CRISIL Report, it is the largest

manufacturer of differential gears for PV, CV, and tractor OEMs in India, with an

estimated market share of 55%-60%, 80%-90%, and 75%-85%, respectively.

The company aims to mitigate the impact of cyclical downturns in the automotive industry through their geographic diversification, together with distributed presence in PV, CV, and OHV segments. They are not dependent on a single product, vehicle segment, customer, or geography.

The breakdown of their income from sale of goods across their systems and components:

| Sales of Goods (Rs. in Crores) | FY19 | FY20 | FY21 |

|---|---|---|---|

| % of Sales | % of Sales | % of Sales | |

| Differential Assembly | 4% | 6% | 18% |

| Differential Gears | 41% | 35% | 28% |

| Micro Hybrid Starter Motors | 17% | 29% | 27% |

| Conventional Starter Motors | 34% | 26% | 24% |

| Other Gears | 2% | 3% | 3% |

| Others | 1% | 1% | 1% |

| Total | 100% | 100% | 100% |

Strong Business Development with Customer Centric Approach

As at March, 2021, it has been awarded 58 programs from 27 customers across product

portfolio, from customers in India and overseas, where the start of production was

either during FY21 or a period after FY21. It has long-standing relationships of

15 years and more with 13 of is top 20 customers. Some of its key OEM customers

include Ampere Vehicles, Ashok Leyland, CNH, Daimler, Escorts, Escorts Kubota, Geely,

Jaguar Land Rover, John Deere, Mahindra and Mahindra, Mahindra Electric, Maruti

Suzuki, Renault Nissan, Revolt Intellicorp, TAFE, Volvo Cars and Volvo Eicher. It

also caters to selected leading Tier-I automotive system suppliers such as Carraro,

Dana, Jing-Jin Electric, Linamar and Maschio.

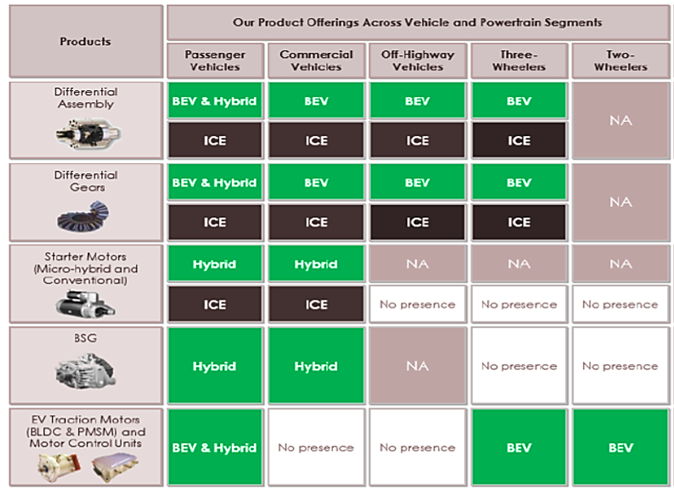

Capturing Market Opportunity in the Growing EV Space

The global trend towards electrification of vehicles continues to expand. Among

the available propulsion technologies, BEV has been the fastest growing at CAGR

of ~46% between CY15 - CY20 and is expected to experience increased market penetration

growing at a CAGR of ~36% between CY20 - CY25. The company’s product offerings

span all types of electrified powertrains. As part of its growth strategy, it is

planning to increase the market share in both the Indian and overseas markets by

catering specifically to EV OEMs, across three product groups: Differential assemblies

and differential gears, 48V BSG motor, and EV traction motors & motor control

units. Sona Comstar expects to benefit from the growing trend towards electrified

drivetrains by further increasing its customer base and expanding their share of

business with existing EV customers.

Continue to Focus on R&D to Develop New and Innovative Systems and Components

The company aims to capture the growth trend in revenue realization per component

with increasing electrification by continuously investing in R&D to develop

and deliver new and innovative systems and components. It has been developing solutions

and alternatives for improving the power density and light weighting of differential

assemblies and EV Traction Motors and motor control units through the R&D efforts.

It has developed in-house capability to develop embedded systems and application

software, along with integration capabilities to offer its customers, a complete

solution. Although the core of the company’s strategy is to continue to achieve

growth organically through investment in their technological capabilities, business

development skills and customer relationships, it continues to evaluate inorganic

growth opportunities such as acquisitions and strategic alliances that may provide

it with complementary technologies that have a similar financial profile.

Risks

- Business is dependent on the performance of the global automotive sector. Any adverse changes in the conditions affecting these markets could impact the business and financial conditions.

- The company derives ~80% of its business from its top ten customers and the loss of such customers or a significant reduction in purchases by such customers could have an adverse impact on its business.

- It competes with several other global automotive component manufacturers and distributors that produce and sell similar products. Also, it is a relatively modest-sized player, compared to global players. Its competitors include manufacturing facilities controlled by OEMs, as well as many other independent domestic and foreign suppliers. Increased competition could impact its business.

- The driveline business is currently operating at 75-80% capacity, while the motor business is operating at 50% capacity. This business will demand a lot of capital in the future, which could affect the company's return ratio.

- It derives ~75% of revenues from exports, thereby exposing it to forex fluctuation risk.

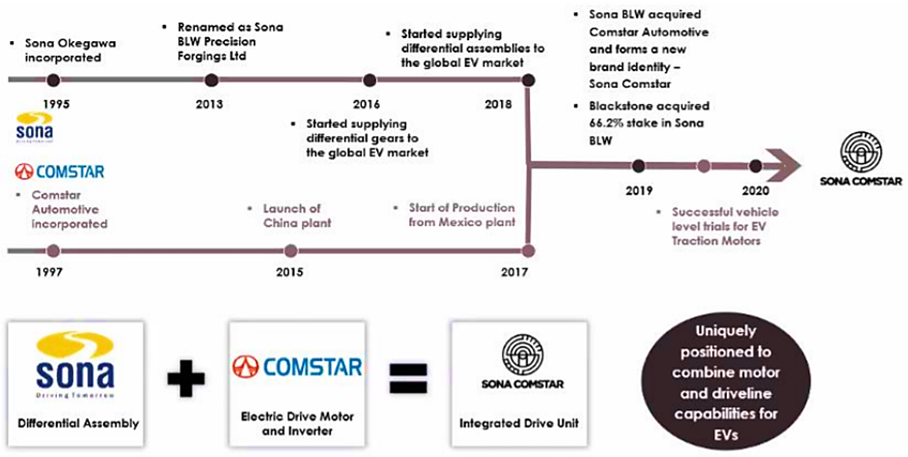

Company Description

Incorporated in the year 1995, Sona BLW Precision Forgings Limited (Sona Comstar) is India’s leading automotive technology companies, designing, manufacturing and supplying highly engineered, mission critical automotive systems and components such as differential assemblies, differential gears, conventional and micro-hybrid starter motors, BSG systems, EV traction motors and motor control units to automotive OEMs across US, Europe, India and China, for both electrified and non-electrified powertrain segments. It has 9 manufacturing and assembly facilities across India, China, Mexico, and the USA, of which 6 are in India. It has been awarded 58 programs from 27 customers across product portfolio, from customers in India and overseas, they have long-standing relationships of 15 years and more with 13 of their top 20 customers.

Income from sale of goods across systems and components, and as a percentage of total sale of goods:

| Sales of Goods (Rs. in Crores) | FY19 | FY20 | FY21 | |||

|---|---|---|---|---|---|---|

| Sales | % of Sales | Sales | % of Sales | Sales | % of Sales | |

| Differential Assembly | 61.10 | 4% | 65.79 | 6% | 261.40 | 18% |

| Differential Gears | 565.79 | 41% | 411.12 | 35% | 414.40 | 28% |

| Micro Hybrid Starter Motors | 232.53 | 17% | 348.04 | 29% | 397.53 | 27% |

| Conventional Starter Motors | 461.33 | 34% | 305.45 | 26% | 354.12 | 24% |

| Other Gears | 31.78 | 2% | 38.73 | 3% | 41.88 | 3% |

| Others | 12.46 | 1% | 11.29 | 1% | 19.60 | 1% |

| Total | 1,364.98 | 100% | 1,180.42 | 100% | 1,488.93 | 100% |

Breakdown of income from sale of goods across powertrain, and as a percentage of total sale of goods:

| Sales of Goods (Rs. in Crores) | FY19 | FY20 | FY21 | |||

|---|---|---|---|---|---|---|

| Sales | % of Sales | Sales | % of Sales | Sales | % of Sales | |

| Battery EV | 17.42 | 1% | 23.359 | 2% | 205.70 | 14% |

| Micro Hybrid / Hybrid | 232.53 | 17% | 348.04 | 29% | 397.53 | 27% |

| Power Source Neutral | 641.46 | 47% | 492.36 | 42% | 512.55 | 34% |

| ICE Dependent | 473.58 | 35% | 316.661 | 27% | 373.15 | 25% |

| Total | 1,364.98 | 100% | 1180.42 | 100% | 1,488.93 | 100% |

Valuation

We believe that the company is operationally sound as it has posted comparatively higher EBITDA (26.8%) and PAT (18.2%) margins compared to top ten auto-component manufacturers in India as of FY20. Its RoCE and RoE stood at 28% and 40% as of FY20, again, higher than top ten auto-component manufacturers in India. It BEV sales was 3.3% of the total global vehicle sales, representing 13.8% of revenues in FY21; among the available propulsion technologies, BEV has been the fastest growing and is expected to experience increased market penetration growing at a CAGR of ~36% between CY20 - CY25. The company expects to benefit from the growing trend towards electrified drivetrains by further increasing its customer base and expanding their share of business with existing EV customers.

Further, it has long-standing relationships of 15 years and more with 13 of its top 20 customers and caters to selected leading Tier-I automotive system suppliers. Taking into consideration its higher amounts of R&D spends and existing customer relations, we believe the company is well equipped to cater to the growing EV powertrain segment. At the upper price band of Rs. 291, the offer is aggressively priced at 77.4x of FY21 earnings. We recommend to subscribe the issue.

Key Information

- Use of Proceeds: The net proceeds from the fresh issue are proposed to be utilised towards repayment and pre-payment of identified borrowings in full availed by the company and general corporate purposes.

- Book running lead managers: Kotak Mahindra Capital Company Limited, Credit Suisse Securities (India) Private Limited, JM Financial Limited, J.P. Morgan India Private Limited, and Nomura Financial Advisory and Securities (India) Private Limited.

- Management: Sanjay Kapur (Chairman and Non-Executive Director), Vivek Vikram Singh (MD and Group CEO), Amit Dixit (Nominee Director), Ganesh Mani (Nominee Director), Sat Mohan Gupta (Director and CEO of Comstar Automotive), Kiran Manohar Deshmukh (Chief Technology Officer), Vadapalli Vikram Verma (CEO of driveline division), and Rohit Nanda (CFO).

Financial Statement

| Particulars (Rs. in Crores) | FY19 | FY20 | FY21 |

|---|---|---|---|

| Equity Share Capital~ | 27.70 | 47.20 | 573.00 |

| Instrument entirely equity in nature | 0.00 | 0.60 | 0.00 |

| Reserves | 146.16 | 1130.20 | 730.90 |

| Net worth as stated | 173.80 | 1177.90 | 1303.90 |

| Long term borrowings | 73.30 | 176.80 | 190.70 |

| Short term borrowings | 38.90 | 84.60 | 114.50 |

| Revenue from Operations | 699.20 | 1037.90 | 1566.30 |

| EBITDA as stated | 200.20 | 242.30 | 441.00 |

| EBITDA (%) as stated | 28.90% | 26.70% | 28.20% |

| Profit Before Tax | 154.80 | 387.01 | 299.97 |

| Net profit | 173.20 | 360.30 | 215.20 |

| Net profit (%) as stated | 24.80% | 34.70% | 13.70% |

| EPS (Rs.) | 5.20 | 23.10 | 22.80 |

| RoNW (%) | 99.50% | 30.60% | 16.50% |

| Average RoE (%) | 35.60% | 35.20% | 36.40% |

| RoCE (%) | 40.30% | 29.00% | 34.80% |