Shriram Properties Limited - IPO Note

Construction - Real Estate

Shriram Properties Limited - IPO Note

Construction - Real Estate

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

One of the Leading Real Estate Development Companies in South India:

The company is among the top five residential real estate companies in South India

in terms of number of units launched between the calendar years 2012 and the third

quarter of 2021 across Tier 1 cities of South India including Bengaluru, Chennai,

and Hyderabad. (Source: Company RHP).

As of September 2021, Bengaluru and Chennai accounted for 91% of the company’s total saleable area in competed projects. In addition, the company has 31.37 msf saleable area under ongoing projects, projects under development, and forthcoming projects in Bengaluru and Chennai

Capabilities in Project Identification and Strong Execution Track Record:

The company has released pre-sales volume of 1.56 msf of saleable area (or 1,260

units) and 3 msf of saleable area (or 2,525 units) in H1FY22 and FY21, respectively.

Its pre-sales volume has grown at a CAGR of 22.6% between the FY17 – FY21.

The company has been able to strengthen its market position amidst consolidating

industry environment since demonetisation and introduction of RERA. The management

believes that its brand recall, track record of quality execution, and deliveries

have been instrumental in its sales and performance. As per the company RHP, its

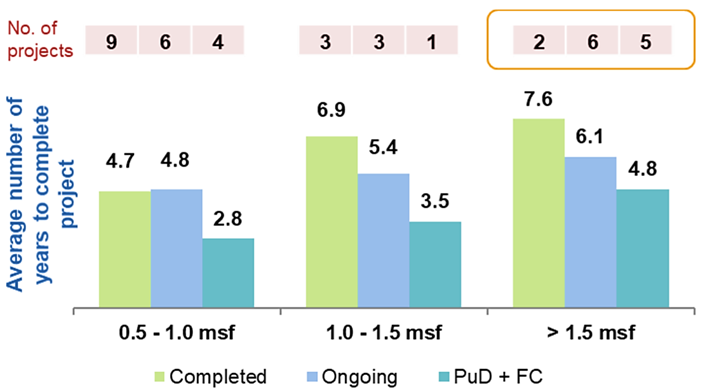

overall execution timeline has improved consistently over the years benefiting from

improvements in project management and control, technology, and automation as well

as strengthened implementation and monitoring.

Source: Company RHP

Established Strategic Relationships:

The company has established relationships with domestic as well as international

financial investors, from whom the company has been able to procure financial investments

for its projects. Investors who have invested in the projects include SUN Apollo

India Real Estate Fund I LLC, Mitsubishi Corp, Amplus Capital Advisors, ASK Real

Estate Special Opportunities Fund, India Realty Excellence Fund II LLP managed by

Motilal Oswal Real Estate Investment Advisors II and Kotak Affordable India Fund.

Some of these investors have made multiple investments in completed and ongoing

projects. The company also has well-established relationships with several lenders,

including public and private sector banks and NBFCs, across its projects.

Scalable and Asset Light Business Model:

The company’s business model relies on its brand strength, project execution,

and management capabilities as well as its established relationships with landowners,

development partners, financial investors, architects, and contractors. Leveraging

these capabilities and relationships, it is transitioning from a real estate development

model to a combination of real estate development and real estate services-based

business model. The management believe that this transition will help

improve margins and profitability as well as return on capital, given low capital-intensive

nature of newer business model. As part of this model, its focus is on DM or joint

development agreements with landowners/developers or JVs, which requires lower upfront

capex compared to direct acquisition of land parcels.

It has grown its DM business, under which it enters into agreements with other developers and landowners and provide turn-key approach to development involving product design, project development, branding, sales and marketing, CRM efforts and thereby handling collection, construction, overall completion, and handover to customers. Its DM portfolio comprises of 11 ongoing projects, 1 project under development and 2 forthcoming projects, representing ~32% of its total saleable area, as of September, 2021. The DM business allows the company to earn fee income (ranging 10% to 16% of total project revenue), based on its brand name and project execution, management, and sales capabilities, while requiring low capital investment.

The management believes that the asset light business model will result in efficient utilisation of capital resulting in lower debt and regular fee income, allowing it to have higher RoCE. It also expects the asset light nature of business model will minimise initial costs.

Could Benefit from Regulatory and Industry Development:

The RERA (Real Estate Regulatory and Development Act) 2016 came into effect in May

2017. The implementation of the RERA has resulted in increased compliance requirements.

These regulations and resultant increase in compliance risks provide a growth opportunity

for larger and well-established real estate developers and create barriers to entry

for smaller real estate developers. Smaller developers having relatively larger

debt exposure are facing liquidity constraints, as post implementation of RERA,

pre-launches and advances from pre-sales cannot be used to cover approvals, preliminary

and preoperative costs. Due to the increased compliance and regulatory risk, home-buyers

also prefer to buy from larger and well-established developers.

To control their risk exposure, lenders and other financial institutions too prefer to offer funding to well-established developers. We believe RERA will lead to large scale consolidation in real estate industry and a rise in the market share of large developers with a long-term presence, strong brand, financial, and execution capabilities.

Develop and Monetise Project in Kolkata:

Shriram Properties owns a land parcel of 314 acres (aggregate development potential

of about 33.54 msf of Saleable Area) at Uttarpara, Kolkata which it intends to use

for development of an integrated township project, ‘Shriram Grand City’.

Additionally, it has entered an agreement for sale for acquiring ~73 acres in the

same location, of which it intends to use ~25 acres of land for development of roads

and associated infrastructure for the proposed integrated township project.

As of September, 2021, the company has obtained approval for development of 26.42 msf of residential area and 7.12 msf of non-residential area in this township. The proposed project comprises of 4.32 msf of ongoing projects and 6 msf of projects under development. In this project ~21.45 msf of saleable area is intended to be in the mid-market and affordable housing category and commercial developments.

The management believes that the company is positioned to capitalise on this opportunity, as the project is proposed to be developed in a phased manner as a mixed-use development comprising of residential, office, commercial, senior citizen homes, schools, recreational, shopping, health, and hospitality facilities. As part of the residential development, the company has financial investor for 2.3 msf of saleable area of affordable housing under the project name “Sunshine One.” The management may consider a variety of strategies to unlock value from undeveloped area in this land parcel, including sale of undeveloped land or grant of development rights to third party developers.

Risks

Risks and Concerns

Geographic Concentration: Shriram Properties’ development

activities are concentrated in a few key cities of Bengaluru, Chennai, Vishakhapatnam,

and Coimbatore, in South India. As of September, 2021, 24 Ongoing Projects, 4 Projects

under Development, and 4 Forthcoming Projects, representing 78% of saleable area

are in South India.

Significant Debt on the Balance Sheet: As of September 2021, the company had a total outstanding borrowing of Rs. 695.1 crores and the debt/equity of the company stood at ~0.9x. However, the debt level is expected to reduce as the company, through current fresh issue aims to reduce the debt.

Corporate Guarantee: The company has provided corporate guarantees in relation to loans (Rs. 727.8 crores) obtained by its subsidiaries and JV and any default by such subsidiaries or JV may result in invocation of the corporate guarantee.

Share Pledge: The company has pledged equity shares of certain subsidiaries in favour of certain lenders to secure loan facilities availed by the company and certain of subsidiaries. Any default will entitle the lenders to enforce the pledge and take ownership of the collateral and/or sell the pledged equity shares.

Litigations Involving Directors: As per the information available in RHP, there are total nine cases (5 civil – Rs. 842.72 crores, 3 Criminal – Rs. 1 crore, and 1 Notices – Rs. crores) amounts to Rs. 844.72 crores.

Not Acquired the Entirety of the Land Required to Develop Certain Forthcoming Projects: The company has not acquired the entirety of the land or rights required to develop Forthcoming Projects, Chandapura and Kannur, which in aggregate represent 7.64 msf or 16% of total saleable area, as of September, 2021. Further, for projects such as Chandapura, Sambhavi, and Kannur, it has not yet received change in land use orders for the entire land of the projects. If it is unable to acquire all the land or rights required, the company may not be able to develop these projects as planned and may incur additional cost or time to rework and change development plans.

Shriram Brand: The company does not own the “Shriram” brand, it has been licensed to it by the Shriram Value Services Limited (SVS) through a brand licensing agreement dated April 29, 2011 and Deed of Novation cum Amendment dated May 24, 2019 to the Branding License Agreement. The company pays a license fee to SVS as a percentage of profit before tax. The branding license agreement is valid until September, 2022 and is renewable every three years, unless otherwise agreed by the parties.

High Competition: The business faces competition from both national and local property developers.

Certain Projects have Not Received OC and CC: Certain of its completed projects have not received an occupancy certificate (OC) or a completion certificate (CC) from relevant authorities. Three completed projects (which were developed more than a decade ago) in Bengaluru have not yet received OC. Further, at the time of completion of certain projects in Tamil Nadu, there was no statutory requirement to obtain a completion certificate and for these projects, the company has relied on property tax receipts of owners, deeds of declaration under the Karnataka Apartment Ownership Act, 1975 or architect certificates to classify these projects as completed.

Company Description

A part of Shriram Group, Shriram Properties is one of the leading residential real estate developers in South India primarily focused on mid-market and affordable. It is also present in mid-market premium and luxury housing categories as well as commercial and office space categories in its core markets. The company commenced operation in Bengaluru in 2000 and have expanded in other cities i.e., Chennai, Coimbatore, and Visakhapatnam. In addition, it is also present in Kolkata, where it is developing a large mixed-use project.

As of September, 2021, it has 29 completed projects, representing 16.76 msf of saleable area, out of which, 24 are in Bengaluru and Chennai (accounting for 91% of saleable area). Further, 84% of total saleable area for completed projects were in the mid-market category and affordable housing category and the balance in the commercial and office space and luxury housing categories. Additionally, plotted developments accounted for 33% of sales volumes during H1FY22.

A of September, 2021, the company has portfolio of 35 projects as ongoing projects, projects under development and forthcoming projects aggregating to 46.72 msf of saleable area. The company has land reserves of ~197.47 acres, with a development potential of ~21.45 msf of saleable area. The below table shows key details of operations as of September, 2021:

| Details | Completed Projects | Ongoing Projects | Project Under Development | Forthcoming Projects | Total |

|---|---|---|---|---|---|

| Number of Projects | |||||

| Owned | 5 | 5 | 3 | 1 | 14 |

| JV & Joint Development | 23 | 10 | 1 | 1 | 35 |

| Development Management | 1 | 11 | 1 | 2 | 15 |

| Total | 29 | 26 | 5 | 4 | 64 |

| Area in msf. | |||||

| Owned | 4.05 | 6.21 | 7.17 | 0.20 | 17.63 |

| JV & Joint Development | 10.68 | 13.67 | 0.25 | 4.31 | 28.91 |

| Development Management | 2.03 | 6.42 | 0.86 | 7.64 | 16.95 |

| Total | 16.76 | 26.30 | 8.28 | 12.15 | 63.49 |

| Number of Projects by Geography | |||||

| Bengaluru | 22 | 18 | 1 | 3 | 44 |

| Chennai | 2 | 4 | 3 | 1 | 10 |

| Kolkata | - | 2 | 1 | - | 3 |

| Others | 5 | 2 | - | - | 7 |

| Total | 29 | 26 | 5 | 4 | 64 |

| Estimated Saleable Area by Geography (msf) | |||||

| Bengaluru | 11.81 | 10.99 | 0.25 | 11.95 | 35.00 |

| Chennai | 3.37 | 5.95 | 2.02 | 0.20 | 11.54 |

| Kolkata | - | 4.32 | 6.00 | - | 10.32 |

| Others | 1.58 | 5.03 | - | - | 6.61 |

| Total | 16.76 | 26.30 | 8.28 | 12.15 | 63.49 |

Source: Company RHP

The map illustrates company’s projects across India, as of September, 2021:

Source: Company RHP

Valuation

Though there is an uptick in demand in residential real estate, we would still advise investors to AVOID the Shriram Properties issue as we believe the valuation (in terms of EV/EBITDA as of FY21) is higher compared to other listed peers such as Brigade Enterprises, Sobha, etc. Though management has indicated that the company will be profitable in FY22, we would still advise waiting for quarterly numbers for more clarity. Further, there are other risks involved in the business such as litigations involving directors, share pledges, no entirety of the land or rights required to develop Forthcoming Projects, Chandapura and Kannur, which in aggregate represent 7.64 msf or 16% of total saleable area, among others.

| FY21 (Rs. in Crores) | Sales | Total Income | Mcap | OPM (%) | NAV | EPS | RoNW(%) | EV/EBITDA (x) |

|---|---|---|---|---|---|---|---|---|

| Shriram Properties | 431.50 | 501.31 | 2,001.56 | 24.15% | 56.44 | -4.60 | NA | 51.49 |

| Brigade Enterprises | 1,949.97 | 2,010.39 | 11428.02 | 24.40% | 111.32 | -2.24 | NA | 21.65 |

| Sobha | 2,109.78 | 2,190.40 | 7969.42 | 32.00% | 255.97 | 6.57 | 2.29% | 9.22 |

| Prestige Estates Projects | 7,264.40 | 7,501.80 | 17770.32 | 26.81% | 166.52 | 36.32 | 23.31% | 6.26 |

Source: Company RHP, Screener, AceEquity

Key Information

Use of Proceeds:

The total issue size is Rs. 600 crores, of which Rs. 250 crores is fresh issue and

balance (Rs. 350 crores) is OFS. The company will utilise the net proceeds from

the fresh issue to repay and/ or pre-pay certain borrowings availed by the company

and its Subsidiaries.

Book running lead managers:

Axis Capital Limited, ICICI Securities Limited, and Nomura Financial Advisory and

Securities (India) Private Limited.

Management:

M Murali (Chairman and MD), Gopalakrishnan J (Executive Director and Group CFO),

K.R Ramesh (Executive Director – Operations), Krishna Veeraraghavan (Director –

Operations & COO, Bangalore), Balasubramanian S (Director – Operations & COO, Chennai),

Ram Shankar Venkataraman (COO, Kolkata), and Balaji R (COO, Vishakhapatnam).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Year End March (Rs. in Crores) | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Net Sales | 330.80 | 650.13 | 571.96 | 431.50 |

| Growth % | 96.53% | 96.53% | -12.02% | -24.56% |

| Expenditure | ||||

| Material Cost | 190.60 | 485.42 | 352.38 | 238.68 |

| Employee Cost | 45.30 | 78.34 | 84.79 | 63.45 |

| Other Expenses | 86.90 | 79.41 | 104.11 | 78.06 |

| EBITDA | 8.00 | 6.97 | 30.69 | 51.32 |

| EBITDA Margin | 2.42% | 1.07% | 5.37% | 11.89% |

| Depreciation & Amortization | 2.30 | 5.25 | 6.40 | 6.58 |

| EBIT | 5.70 | 1.72 | 24.28 | 44.74 |

| EBIT Margin % | 1.72% | 0.26% | 4.25% | 10.37% |

| Other Income | 52.00 | 80.93 | 64.56 | 73.45 |

| Interest & Finance Charges | 85.30 | 113.09 | 128.02 | 129.03 |

| Profit Before Tax - Before Exceptional | -27.60 | -30.44 | -39.17 | -10.83 |

| Profit Before Tax | 320.10 | 91.95 | -40.72 | -12.00 |

| Tax Expense | -29.80 | 34.13 | 4.74 | 22.98 |

| Exceptional Items | 347.70 | 122.39 | -1.55 | -1.17 |

| Net Profit | 349.90 | 57.82 | -45.45 | -34.98 |

| Growth % | -83.48% | -83.48% | -178.61% | -23.04% |

| Net Profit Margin | 105.77% | 8.89% | -7.95% | -8.11% |

| Consolidated Net Profit | 350.40 | 50.30 | -86.11 | -68.29 |

| Growth % | -85.65% | -85.65% | -271.21% | -20.70% |

| Net Profit Margin after MI | 105.93% | 7.74% | -15.06% | -15.83% |

Source: ACE Equity