Senores Pharmaceuticals Ltd. - IPO Note

Pharmaceuticals & Drugs - Global

Senores Pharmaceuticals Ltd. - IPO Note

Pharmaceuticals & Drugs - Global

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

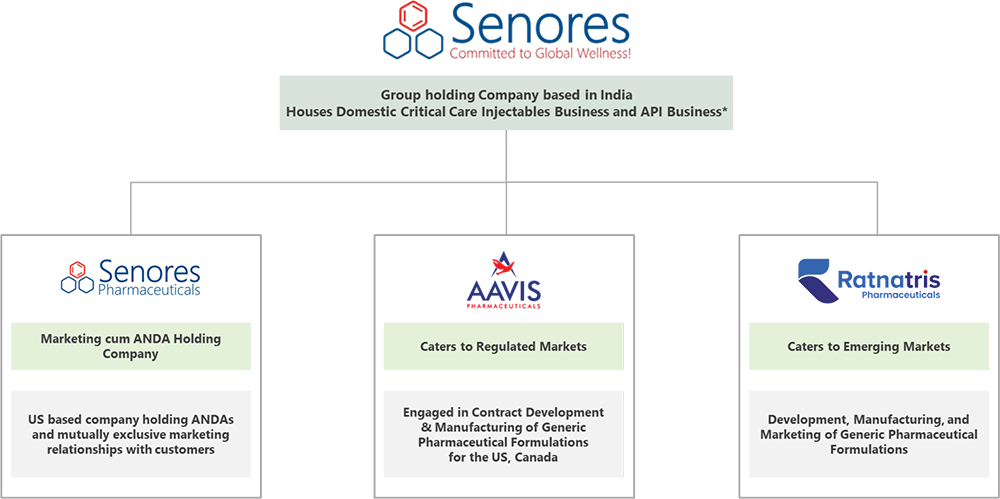

Company Description

Company Profile

Senores Pharmaceuticals is a globally driven pharmaceutical entity specializing

in the development and manufacturing of a wide range of pharmaceutical products

for Regulated Markets such as the US, Canada, and the United Kingdom, with a significant

presence in Emerging Markets across 43 countries. The company focuses on identifying,

developing, and manufacturing specialty, underpenetrated, and complex pharmaceutical

products, establishing itself as a preferred partner for various customers. Leveraging

its research and data analytics, the company strategically identifies molecules

for the Regulated and Emerging Markets. Its diverse product portfolio spans various

therapeutic domains and dosage forms, enabling it to partner with both foreign and

Indian pharmaceutical companies such as Prasco LLC, Lannett Company Inc., Jubilant

Cadista Pharmaceuticals Inc., Alkem Laboratories Limited, Sun Pharmaceuticals Industries

Limited, Dr. Reddy’s Laboratories Inc., and Cipla USA Inc.

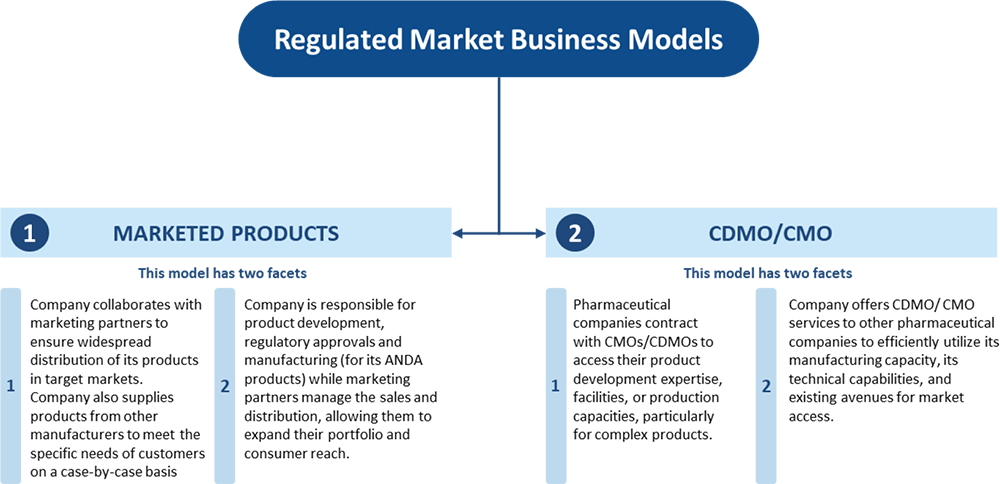

Regulated Markets

The company's primary focus is on the Regulated Markets of the US, Canada, and the United Kingdom, through its subsidiaries, Havix and SPI. Havix operates the US FDA-approved oral solid dosage (OSD) facility in Atlanta, while SPI manages intellectual property for ANDA approvals. Their business model includes marketed products (ANDA products and sourced products) and contract development and manufacturing operations (CDMO/CMO).

ANDA Products

The company’s ANDA products strategy involves identifying, developing, and

commercializing specialty and complex niche products. By analyzing public databases

and conducting internal research, the company identifies mid-market range products

for commercialization in the US, Canada, and the UK. As of September 30, 2024, the

company has received approvals for 19 ANDAs and commercialized 21 products in the

US and Canada markets. Among these are products with Competitive Generic Therapeutic

(CGT) designations, offering exclusivity in the US market for six months after launch,

preventing competitors from releasing generic versions of the same product.

Notable products include Acetaminophen Butalbital Caffeine, where the company commanded a market share of 11.2% in the first 11 months of CY 2023. Similarly, the company has made strides in the Chlorzoxazone segment, with a market share of 60.9% for its 250mg tablet after launching with six months of exclusivity. The company’s strategic identification of CGT for Chlorzoxazone 250mg was a first globally, securing it a dominant market position. Other products include Diclofenac Potassium, Ketorolac, and Mexiletine Hydrochloride, with the company becoming a key player in their respective segments.

The company's focus on low-competition markets and its ability to obtain CGT exclusivity for a significant portion of its approvals (75% of its ANDA approvals from January 2018 to May 2024) underscores its strategic approach. This low-competition environment leads to slower price erosion, helping the company maintain higher market share and profitability, as evidenced by its market share for Chlorzoxazone 250mg.

In summary, the company’s robust research, development capabilities, and focus on complex ANDA products have led to its success in the Regulated Markets, establishing it as a leader in niche pharmaceutical segments with significant growth potential in low-competition therapeutic areas.

The company has established long-term marketing agreements (5-7 years) with major pharmaceutical companies like Alkem Laboratories and Dr. Reddy’s Laboratories in the Regulated Markets. These agreements involve in-licensing fees, transfer pricing, and profit-sharing models. The company's Atlanta Facility, operational since 2018, serves the US, Canada, and the UK, with USFDA approval received in 2019. The facility has been audited four times by the USFDA, with no significant issues in the latest April 2024 inspection. Additionally, it is audited by customers and serves Semi-Regulated Markets like South Africa, Saudi Arabia, and Israel.

Sourced Products

The company also deals in Sourced Products, which are obtained from other manufacturers

or distributors to fulfill specific customer requirements. These products are not

produced in-house but are marketed based on tailored orders for customers.

CDMO

Additionally, the company leverages its Atlanta Facility for Contract Development

and Manufacturing (CDMO/CMO) services in the US, Canada, and the United Kingdom.

The CDMO business model allows the company to form long-term relationships with

customers, offering customized formulation, development, and manufacturing services.

These services include bioavailability, method development, stability testing, and

regulatory support. Customers in this segment include Mint Pharmaceuticals, Solco

Healthcare, and Ambicare Pharmaceuticals. As of September 30, 2024, the company

has entered into CDMO/CMO contracts for over 40 products across multiple regions,

including the US, Canada, UK, South Africa, and Saudi Arabia.

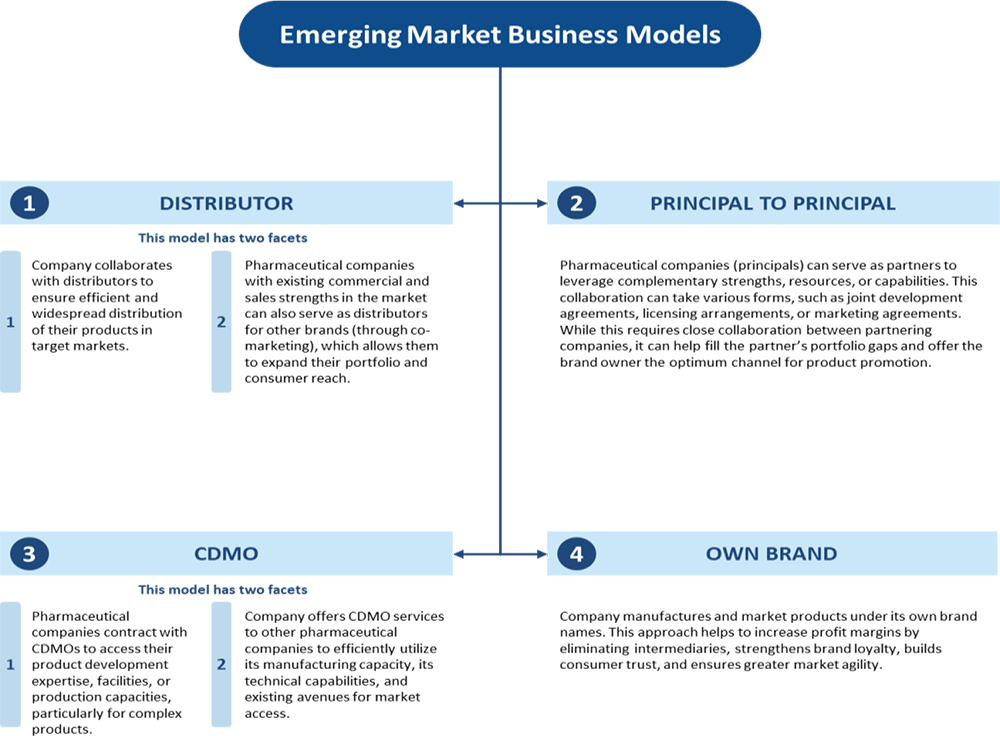

Emerging Markets Business

The company develops and manufactures pharmaceutical products for Emerging Markets through its WHO-GMP approved Chhatral Facility in Gujarat, India. This facility serves countries like the Philippines, Uzbekistan, Tanzania, and Peru. As of September 30, 2024, the company markets products in 43 countries and has obtained product registrations for 205 products, with an additional 406 products filed for registration. The Chhatral Facility has approvals from the regulatory bodies of 10 countries. The company has introduced complex molecules into Emerging Markets, including Apixaban, Tofacitinib, and Sacubitril + Valsartan, based on its successful product identification process used in the Regulated Markets. These products are under patent protection in the US and are not available in some Emerging Market countries. RPPL, a subsidiary acquired on December 14, 2023, now oversees the Emerging Markets Business, and the revenue from this segment began from December 14, 2023.

API Business

The company began its API business with the objective of establishing backward integration

through an API manufacturing facility. Currently, the API business serves the domestic

market and SAARC countries. However, the company has plans to expand its API manufacturing

capabilities to cater to the Regulated Markets and semi-Regulated Markets in the

medium to long term. The company manufactures APIs at its Naroda Facility and is

in the process of establishing a new greenfield unit for API production at Chhatral,

Gujarat. As of September 30, 2024, the company has successfully commercialized 16

APIs, including oncology APIs, demonstrating its capability to produce and supply

a diverse range of active pharmaceutical ingredients.

R&D

The company is R&D-driven, with a differentiated product portfolio across dosage forms targeting markets in the US, Canada, and Emerging Markets. It operates three dedicated R&D facilities in India and the US, with plans to consolidate into one in Ahmedabad. Led by experienced management, including promoters with over 15 years of industry experience, the company employs 54 R&D personnel, including two with doctoral qualifications, to drive innovation in high-growth therapeutic areas.

Competitive Strengths

US FDA-approved facilities for Regulated Markets.

The company manufactures products for the Regulated Markets of the US, Canada, and

the UK through its US FDA-approved OSD facility in Atlanta. This facility has been

audited and approved by the US FDA four times, most recently in April 2024, confirming

its adherence to stringent regulatory standards. It is also DEA-approved for manufacturing-controlled

substances and compliant with the Trade Agreements Act and Buy American Act, qualifying

it for government supply contracts. The facility undergoes regular audits by customers

to ensure continued quality. Additionally, the company provides CDMO services, offering

comprehensive solutions from development to manufacturing, for clients such as Mint

Pharmaceuticals and Solco Healthcare. The Atlanta Facility supports both Regulated

and Semi-Regulated Markets, with plans to expand CDMO partnerships globally. The

US FDA approval provides the company with a competitive advantage, enhancing its

credibility and market access.

Distinct niche product portfolio built in a short span for Regulated Markets

The company's product selection strategy for the Regulated Markets of the US,

Canada, and the UK focuses on developing specialty, niche, and complex products

with market potential in small to mid-sized segments, where competition is limited.

Complex products face less price erosion, ensuring stable pricing and profitability.

The company has 19 FDA-approved ANDAs and 21 commercialized products in these markets.

It follows a data-driven strategy, identifying opportunities through government

sourcing and molecular trends. Four of its FDA-approved products have CGT designation,

offering exclusivity for six months. The company's rapid growth in these markets

is reflected in a CAGR of 1,179.23%, driven by the acquisitions of Havix and RPPL.

Long-term marketing arrangements with pharmaceutical companies in the Regulated

Markets of US, Canada and the United Kingdom

The company has entered long-term marketing agreements, ranging from 5 to 7 years,

with major pharmaceutical companies in the US, Canada, and the UK, such as Lannett

Company Inc. and Dr. Reddy’s Laboratories. These agreements involve in-licensing,

transfer pricing, and product launches through the company’s Atlanta Facility.

The company also maintains established CDMO relationships with partners like Mint

Pharmaceuticals and Solco Healthcare, optimizing production capacity. Focused on

quality, regulatory compliance, and competitive pricing, the company aims to build

long-term partnerships and maintain steady cash flows, strengthening its reputation

in the global market.

Presence in the Emerging Markets with a product portfolio, including specialty

or complex products

The company markets products in 43 countries across Latin America, Africa, CIS,

Southeast Asia, and the Middle East, focusing on value-added and niche products.

These products, often complex and patented in the US, are launched in Emerging Markets

to benefit from lower competition. Manufactured at the Chhatral Facility, which

is WHO-GMP approved, the company produces oral solids, liquids, injectables, and

ORS. As of September 2024, the facility is approved by 10 countries. The company’s

Emerging Markets business generated ₹442.02 million in revenue in Fiscal 2024, representing

20.6% of total revenue. It operates through distributor, P2P, and CDMO models, partnering

with companies like Ajanta Pharma and La Renon Healthcare. Strategic product selection

and local market expertise drive success in these regions.

Strong, in-house R&D

The company identifies niche products through internal research and public databases,

focusing on high-growth areas with limited competition. R&D for formulation,

bioequivalence, and stability studies is conducted at labs in the US and India.

The company is consolidating R&D by setting up a dedicated center in Ahmedabad

and expanding research for CDMO and manufacturing operations.

Peer Comparison

| Particulars (Fy24) | Revenue (Rs. Cr.) | EBITDA Margin % | PAT Margin % | ROCE% | ROE% | P/E (x) |

|---|---|---|---|---|---|---|

| Senores Pharmaceuticals | 215.00 | 20.70% | 15.25% | 11.73% | 23.60% | 57.00 |

| Ajanta Pharma Limited | 4209.00 | 29.50% | 19.80% | 32.22% | 23.47% | 44.00 |

| Alembic Pharmaceuticals | 6229.00 | 15.90% | 9.00% | 13.42% | 13.40% | 34.00 |

| Caplin Point Labratories | 1694.00 | 36.52% | 27.20% | 26.55% | 21.69% | 40.00 |

| Gland Pharma | 5665.00 | 26.54% | 13.64% | 13.63% | 9.26% | 38.00 |

Key Risks & Concerns

Dependence on Third-Party Marketing Partners and Distributors

The company's business relies heavily on third-party marketing partners and

distributors for sales. Loss of partners, financial instability, or reduced demand

can negatively impact operations, cash flow, and financial performance. Although

long-term agreements with partners in regulated markets help stabilize cash flow,

increased competition, pricing pressures, or shifts in market dynamics may affect

future business, posing risks such as reduced partner commitment, territorial violations,

or failure to meet obligations. Termination or non-fulfillment of contracts could

harm business performance.

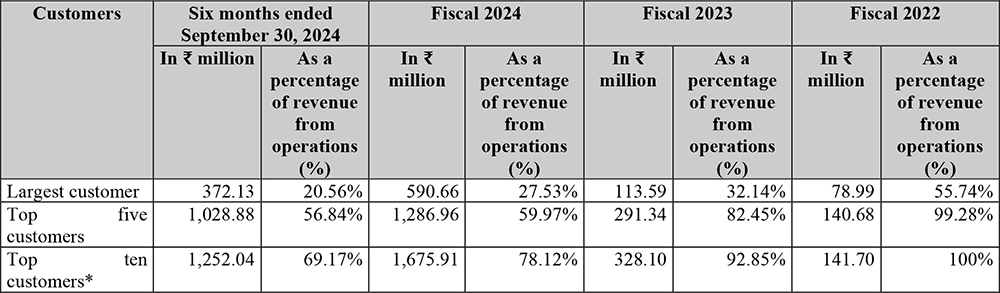

Top customers account for more than 1/5th of total revenue

The table below sets out the revenue contribution and revenue contribution as a

percentage of the total revenue from contracts with customers of our largest customer,

top five customers and top ten customers, for the six months ended September 30,

2023, Fiscal 2024, Fiscal 2023 and Fiscal 2022:

High Exposure to the US Pharma Market

The company derives almost 60% of its total revenues from the United States as of

H1FY25. Any changes in tariffs, duties or restrictions on trade or investment policies

can affect the operations of the business.

Also, any slowdown in the US Pharma market, caused due to inventory build ups can cause significant price and margin pressure on the company.

Any inability or delay in launching new generic pharmaceutical products

Pharmaceutical companies have been using strategies to delay generic drug launches,

such as extending patent protections and promoting authorized generics. Despite

launching 5, 3, and 7 generic products in Fiscal 2024, 2023, and 2022 respectively,

there is no guarantee that these strategies won’t impact future product introductions.

The business may face delays if such initiatives succeed, potentially affecting

operations and financial performance.

Intense Competition in the US Pharmaceutical Market

Senores Pharma is a relatively new company, incorporated in 2017. It is competing

with established Indian and global players in the APIs, CDMO and Generic formulations

space, who have been in this industry for a much longer time and have several long

-term relations with its customers and partners. Also, there is a degree of crowding

for generic CDMO manufacturers in the US.

Outlook and Valuation

Senores Pharmaceuticals Ltd (SPL) is a globally recognized, research-driven pharmaceutical company focused on developing and manufacturing a wide range of specialty, underpenetrated, and complex pharmaceutical products across various therapeutic areas and dosage forms. The company also has a strong presence in the critical care injectables segment. SPL has established itself as a trusted partner for its customers. While primarily operating in the regulated markets of the US, Canada, and the UK, the company has also expanded its reach to 43 countries in emerging markets. As of September 2024, SPL has launched 55 products and successfully commercialized 16 Active Pharmaceutical Ingredients (APIs).

The company's emphasis on intricate generics and specialized formulations establishes it as a dependable entity in high-margin sectors, resulting in robust return ratios, including a return on equity (ROE) of 23.6%. Furthermore, the organization's foray into critical care injectables and strategic acquisitions, such as Havix and RPPL, indicate a commitment to a growth-focused strategy.

We believe Senores can do well, given: (i) a strong foothold in the US Pharma market, (ii) USFDA-approved facilities, and (iii) Presence across developed and emerging markets. (iv) Strategic focus on the CDMO partnerships, (v) Planned capex in niche high-margin products.

The company is valued at FY24 P/E multiple of 57.2x, based on the upper price band on the post-issue capital, which is fairly priced in our view. Although the company’s business model is interesting, the company is in growth phase, it’s ROCE is poor in comparison to Ajanta Pharma. Hence, we recommend aggressive investors to SUBSCRIBE to the issue.

Key Information

Use of Proceeds:

The total issue size is Rs.582.11 cr, which is composed of a free issue of Rs. 500cr

and an Offer for Sale worth Rs. 82.11cr. From the net proceeds of the issue, the

company will utilize Rs. 107cr towards investment in its subsidiary Havix for a

sterile injection facility at Atlanta. Rs 93.7cr towards the repayment of borrowings

of the company and its subsidiaries, Rs. 102.742cr towards funding the working capital

requirements of the company and its subsidiaries, and the rest for general corporate

purposes.

Book running lead managers:

Equirus Capital Private Limited, Ambit Private Limited, Nuvama Wealth Management

Limited

Management:

Swapnil Jatinbhai Shah (Managing Director), Sanjay Shaileshbhai Majmudar (Chairman

and Non-Executive, Non- Independent Director), Hemanshu Nitinchandra Pandya (Non-Executive,

Non-Independent Director), Jitendra Babulal Sanghvi (Non-Executive Director Non-Independent

Director), Chetan Bipinchandra Shah (Whole-Time Director and Chief Operating Officer)

Deval Rajnikant Shah(Whole-Time Director and Chief Financial Officer) , Ashokkumar

Vijaysinh Barot (Non-Executive Director Non-Independent Director), Arpit Deepakkumar

Shah (Non-Executive, Non-Independent Director), Naresh Bansilal Shah , Manjula Devi

Shroff (Non-Executive Independent Director), Kalpit Rajesh Gandhi (Non-Executive

Independent Director), Udayan Dileep Choksi (Non-Executive Independent Director)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (in Rs. Cr) | H1FY25 | FY24 | FY23 | FY22 |

|---|---|---|---|---|

| Revenue from Operations | 181.00 | 215.00 | 35.00 | 14.00 |

| Cost of Goods Sold | 83.00 | 106.00 | 13.00 | 8.00 |

| Gross Profit | 98.00 | 108.00 | 23.00 | 6.00 |

| Gross Profit Margin % | 54.40% | 50.53% | 63.87% | 43.30% |

| Employee Benefit Expenses | 27.00 | 35.00 | 5.00 | 3.00 |

| Other Expenses | 27.00 | 31.00 | 5.00 | 1.00 |

| EBITDA | 45.00 | 42.00 | 13.00 | 2.00 |

| EBITDA Margin % | 24.62% | 19.39% | 35.85% | 13.78% |

| Depreciation | 7.00 | 10.00 | 2.00 | 1.00 |

| EBIT | 37.00 | 32.00 | 11.00 | 1.00 |

| Finance Cost | 10.00 | 9.00 | 2.00 | 1.00 |

| Other Income | 2.00 | 3.00 | 4.00 | 0.00 |

| PBT | 29.00 | 25.00 | 12.00 | 1.00 |

| Taxes | 5.00 | -8.00 | 4.00 | 0.00 |

| PAT | 24.00 | 33.00 | 8.00 | 1.00 |

| PAT Margin % | 13.20% | 15.20% | 23.90% | 7.00% |

| EPS | 7.20 | 12.21 | 6.65 | 1.81 |