Paras Defence And Space Technologies Limited - IPO Note

Defence and Space

Paras Defence And Space Technologies Limited - IPO Note

Defence and Space

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Wide Range of Products and Solutions

As of June 2021, the company has a range of 34 different categories of products

and solutions, with multiple variations in each category. It offers one-stop solution

to all its customers. In the space sector, it has established legacy in the earth

observation domain by supporting government organizations involved in space research

across multiple missions; Since 2018, the company has been a part of most of the

earth observation and space exploration missions which has aided the company to

build a strong foothold in India’s space industry. The R&D and technological

capabilities have helped Paras to diversify its products and solutions.

It has entered into teaming agreements with various German technology companies for unfurlable and deployable antenna, subsystems, subassembly for space applications. As one of the few companies with technology capabilities such as electro-magnetic pulse (EMP) protection solutions, Paras is likely to be an integral stakeholder in most future programmes involving local sourcing of defence and space optics and EMP protection solutions. The company’s diverse products and solutions portfolio enable it to distribute revenue across various verticals and aid in reducing high dependence on a particular product, vertical or customer.

Revenue breakup by type of Products and Services:

| Particulars (Rs. in crores) | FY21 | FY20 | FY19 | |||

|---|---|---|---|---|---|---|

| Revenue | % | Revenue | % | Revenue | % | |

| Heavy Engineering | 37.78 | 26.36% | 64.13 | 43.61% | 60.11 | 38.93% |

| Defence Electronics | 64.93 | 45.30% | 31.81 | 21.63% | 46.86 | 30.35% |

| Defence & Space Optics | 40.62 | 28.34% | 51.1 | 34.75% | 47.42 | 30.71% |

| Total | 143.33 | 100.00% | 147.04 | 100.00% | 154.39 | 100.00% |

One of India’s Few Players in High Precision Optics Manufacturing for Space

& Defence Application

Paras is one of India’s few manufacturers of optics for space & defence

application with an in-house capability of designing, developing, and manufacturing.

It houses equipment and machinery for nano technology, machining, grinding, polishing,

and turning, coupled with testing set up for measuring the performance parameters

of the optical components. With strong experience in working with the Government

space organizations on space missions and being the sole Indian supplier of diffractive

gratings, the company has established itself well in the Indian space market. It

also specialises in large-sized optical mirror and is the only company in India

with the design capabilities for space-optics and opto-mechanical assemblies. This

positions Paras as one of the key participants of value for all exploratory and

observatory missions involving large space telescopes.

Well-Positioned to Benefit from the Government’s “Atmanirbhar

Bharat” and “Make in India” Initiatives

The company’s R&D centre at Nerul is recognised by and registered with

Department of Scientific and Industrial Research (DSIR) and fall within category

of Indigenously Designed Developed and Manufactured (IDDM), the highest category

in the priority of categorisation under Defence Acquisition Procedure.

India is witnessing reforms in defence sector. Recently, Ministry of Defence (MoD) had announced the defence acquisition procedure which focuses on boosting indigenous production and turning India into a global manufacturing hub of weapons and military platforms. This procedure has been aligned with the vision of the Government’s Aatmanirbhar Bharat initiative and to empower Indian defence industry through ‘Make in India’ projects. The MoD has prepared a list of 101 items for which there would be an embargo on the import. Some of the products in the list such as EMP Racks and EMP filters are currently manufactured by the company. This will help the company to increase its foothold as a supplier of these products as well as provide an opportunity to expand existing portfolio with the help of R&D capabilities.

Expansion of Production Capacity

Currently, the company has two manufacturing facilities located at Ambernath and

Nerul. Paras is in the initial stages of augmenting manufacturing facilities by

expanding its production capacity and installing new equipment from the net proceeds

of current proposed issue and from internal accruals. The total estimated cost of

the expansion is up to ~Rs. 48 crores.

| Particulars | Estimated Cots (Rs. in Crores) |

|---|---|

| Building and Civil Work | 9.00 |

| Machinery and Equipment | 37.63 |

| Utilities, Consultancy Fees, and Others | 1.37 |

| Total | 48 |

The management believes the investment will enable the company to cater to the growing demand from its customers, enhance space optics product portfolio, and offer flow formed tubes for space applications, which in turn is expected to result in an increase in revenue and profit.

Further Diversification of Product and Solutions

In order to grow the business, the company intends to further diversify its products

and solutions portfolio through R&D and partnering with overseas technology

companies with specialized technologies in the field of defence and space sector.

Paras has exclusively partnered with ISISpace for manufacturing CubeSats in India

which has allowed it to bring proven technologies to India and serve many applications

in space, such as earth observation, communication, image capture, among others.

It has also partnered with other technology companies for Large Deployable Antennas

for space, Invent, CFRP structures, military winches, etc. which will further broaden

its product portfolio.

The company continue to pursue growth by expanding into opportunistic areas. For instance, Paras Aerospace Private Limited (Subsidiary) aims to offer Unmanned Aerial Vehicle (UAV/Drones) integration solutions and services for a wide range of applications in agriculture, power transmission, oil & gas, mining & construction, etc. Further, Paras Anti-drone Technologies Private Limited (Subsidiary) will design sub modules and will create its own intellectual property and technical know-how in collaboration with the Parent company. Paras Anti-drone Technologies aims to be one of the first indigenous anti-drone technology development company in India and is currently collaborating with leading UAV anti-drone technology firms to further develop its expertise in designing customer-specific modules. The company aims to forward integrate its business offerings and aerospace domain such as drones which will in turn increase business opportunities for the company.

Increasing Reach in International Markets

Paras primarily caters to the requirements of Indian market. It will continue to

focus on its existing markets in Israel and South Korea and intends to provide products

and solutions in the United States and Europe. The company has recently received

orders from the United States and United Arab Emirates for manufacturing IR Lens

and Electro-Mechanical Masts, respectively. One of the company’s customers

has made an application for receiving the DSP-05 license from the Department of

State, USA to enable the export of certain commodities by Paras. The management

believes that obtaining this license by the customer will increase its exports to

the US, which is the biggest optics market in the world.

Risks

- Dependence on Government – The business is largely dependent on contracts from Government of India and associated entities. For FY21, ~51% of the revenue was derived from GoI entities. Further, as of June, 2021, orders from the government was Rs. 130.6 crore compared to order book of ~Rs. 135 crores.

- Customer Concentration – The company derives a significant portion of revenue from limited number of customers. Its revenue from top five customers for the FY21, FY20, and FY19 constituted 59.63%, 72.27% and 58.65%, respectively.

- Significant Working Capital Needs – Paras has significant working capital requirements. If it experiences insufficient cash flows from operations or unable to borrow to meet working capital requirements, it may impact its business operations.

Company Description

Incorporated in June 2009, Paras Defence and Space Technologies (Paras) is India-based company engaged in designing, developing, manufacturing, and testing of wide range of defence and space engineering products and solutions. It has five categories of product offerings viz. defence and space optics, defence electronics, EMP protection, heavy engineering, and niche technologies.

The defence and space optics operations include manufacturing high precision optics such as thermal imaging and space imaging systems. It is the only Indian company with the design capability for space-optics and opto-mechanical assemblies. Its defence electronics operations include providing a wide array of computing and electronic systems, including sub systems for border defence, missiles, tanks, and naval applications. Paras is one of the few companies with specialized technology capabilities such as manufacturing EMP protection. The company is likely to be an integral stakeholder in most of the future sourcing of defence and space optics and electro-magnetic pulse (EMP) protection solutions. Its heavy engineering operations involves providing components for rockets and missiles along with providing mechanical manufacturing support to other verticals.

Paras has two manufacturing facilities located in Nerul and Ambernath. The company is in preliminary stages of augmenting manufacturing facility by expanding production capacity and installing new equipment. Due to its R&D capacitates, the company has been able to diversify its product portfolio. The research activities are focused on creating new products and solutions which are customised.

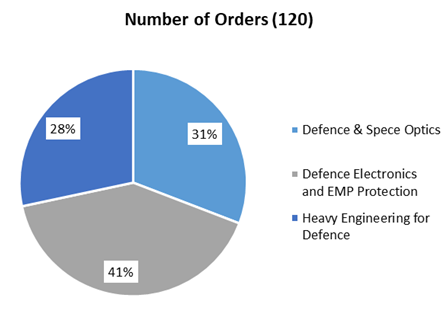

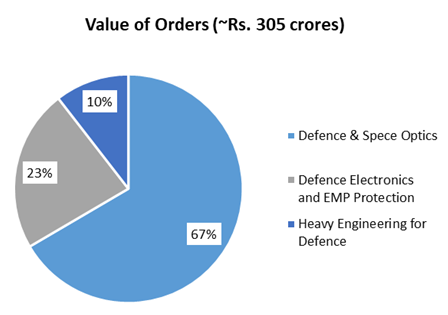

The company derives most of the revenues from the Government arms and associated entities such as defence public sector undertakings and government organizations involved in space research. Its customer base includes Bharat Electronics, Hindustan Aeronautics, Bharat Dynamics, Hindustan Shipyard, Electronic Corporation of India, TCS, Astra-Rafael Comsys, among other and foreign customers include Advanced Mechanical and Optical Systems, Belgium, Tae Young Optics, Green Optics, etc. As of June 2021, the company has order book of ~Rs. 305 crores.

Source: Company RHP

Valuation

Outlook and Valuation

The company is in the business from more than a decade now and enjoys relationships

with various government and private entities. The order book of the company as of

June 2021, is strong at ~Rs. 350 crores and as per the management, this will flow

in books in FY22 and Q1FY23. Further, the management of the company is very positive

on the upcoming orders and could disclose about the details soon. We believe the

company is rightly positioned to reap benefits from the Government’s initiatives

such “Atmanirbhar Bharat” and “Make in India.”

Some of the products in the import embargo list such as EMP Racks and filters are

manufactured by the company which could aid the company in increasing its foothold

as well as provide an opportunity to expand existing portfolio with the help of

R&D capabilities.

The company has been a part of most of the earth observation and space exploration missions which has aided the company to build a strong foothold in India’s space industry. The company is focused on further diversifying its products and solutions in areas such CubeSats, technologies which has applications in space (viz. earth observation, communication, image capture, among others), large deployable antennas, etc. which will further broaden its product portfolio. At the upper price band of Rs. 175, the issue is valued at 33.2x of FY21 earnings. We recommend to Subscribe the issue.

Key Information

Use of Proceeds:

The total issue size is Rs. 170.78 crores, of which Rs. 140.6 crores are fresh issue

and balance (Rs. 30.18 crores) is OFS. The company will utilise the net proceeds

from the fresh issue to purchase machinery & equipment, to fund incremental

working capital requirements, repayment or prepayment of all or a portion of certain

outstanding loan facilities, and general corporate purposes. Details are as follow:

| Objects | Amount (Rs. in Crores) |

|---|---|

| Purchase of Machinery and Equipment | 34.66 |

| Fund Incremental Working Capital Requirements | 60.00 |

| Repayment/Prepayment of all or a Portion of Certain Outstanding loan Facilities | 12.00 |

| General Corporate Purposes | - |

The company has undertaken a Pre-IPO Placement by issuing 2,552,598 equity shares at an average price of Rs. 134.76 per share, aggregating to Rs. 34.40 crores.

Book running lead managers:

Anand Rathi Advisors Limited

Management:

Sharad Shah (Chairman and Non-Executive Director), Munjal Shah (Managing Director),

Shilpa Amit Mahajan (Whole-Time Director), and Harsh Bhansali (Chief Financial Officer).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Year End March (Rs. in Crores) | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Net Sales | 143.09 | 154.40 | 147.04 | 143.33 |

| Expenditure | ||||

| Material Cost | 78.32 | 83.88 | 72.83 | 65.31 |

| Employee Cost | 6.86 | 8.98 | 10.96 | 11.74 |

| Other Expenses | 16.73 | 18.34 | 23.54 | 22.21 |

| EBITDA | 41.17 | 43.20 | 39.71 | 44.07 |

| EBITDA Margin | 28.78% | 27.98% | 27.01% | 30.75% |

| Depreciation & Amortization | 6.68 | 9.41 | 9.71 | 9.65 |

| EBIT | 34.49 | 33.79 | 30.00 | 34.42 |

| EBIT Margin % | 24.11% | 21.89% | 20.40% | 24.01% |

| Other Income | 3.28 | 2.77 | 2.01 | 1.28 |

| Interest & Finance Charges | 7.36 | 9.75 | 10.22 | 13.08 |

| Profit Before Tax - Before Exceptional | 30.41 | 26.81 | 21.79 | 22.61 |

| Profit Before Tax | 30.41 | 26.81 | 21.79 | 22.61 |

| Tax Expense | 5.33 | 7.84 | 2.14 | 6.83 |

| Effective Tax rate | 17.53% | 29.24% | 9.80% | 30.18% |

| Consolidated Net Profit | 25.08 | 18.97 | 19.66 | 15.73 |

| Net Profit Margin after MI | 17.53% | 12.29% | 13.37% | 10.97% |