Nazara Technologies Limited - IPO Note

Mobile Gaming and eSports

Nazara Technologies Limited - IPO Note

Mobile Gaming and eSports

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

Leadership Position in a Diversified and Scalable Business

Nazara has leveraged its capabilities for in-house content creation, game engine

development and propriety technology stack development, ability to deliver positive

Customer Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratios across offerings

and relationships with telecom operators, app stores and other participants in gaming

ecosystems. Its content is developed in India for the global audience, allowing

it to achieve scale.

The company has an operating leverage in gamified early learning on account of captive development of content being undertaken in India, while it generates revenues from North America. As of September 2020, its user base across offerings spanned 58 countries. Its diversified offerings in eSports and sports simulation and geographical reach across India, Middle East, Africa and North America, provide a foundation on which it has been able to scale new products. As the eSports market continues to grow in India, its position in live eSports streaming and on-demand eSports media content could deliver high revenue growth and EBITDA margins. It is well-positioned against single-market local competitors, given its existing presence in multiple markets and insight into differing consumer needs and benefiting from economies of scale.

Portfolio of Intellectual Property and Content Across Regions and Businesses

The company owns and has sustained access to premium IP and local brands across

eSports and mobile games in India. Ownership of IP as a developer and publisher

of mobile games, and as a producer of premium esports content combined with an operator

for eSports organising leagues and an ability to distribute games and exclusive

content distribution leads to significant value creation.

It has well-established and strong relationships with global gaming publishers and platforms including market leaders such as Electronic Sports League (ESL) and Valve Corporation, which allows Nazara to bring to India, online and offline gaming leagues and tournaments with participation from Indian and international teams such as the ESL India Premiership, Airtel India E-Sports Tour, DreamHack India, Dew Arena by ESL, Counter Strike, The Northeast Cup and KO Fight Nights. It also partners with other brands to create multiple gaming event IP in India, such as Mountain Dew Arena, Indian Gaming Show and Asus ROG Masters.

Large Community of Users with Attractive Monetization Opportunities

Nazara’s understanding of behaviour and journey of its key demographics and

users across businesses enable it to attract and retain users. In gamified early

learning, it has been able to scale rapidly and activation and retention remained

range-bound. Its average Monthly Active Users (MAUs) and visits per month for Sportskeeda

increased from 17.79 million and 47.32 million, respectively for FY20 to 38.18 million

and 59.02 million, respectively during 9MFY21. Its average MAUs across sports simulation

games for FY20 were 13.90 million and during 9MFY21 it stood at 13.14 million.

Its geographic outreach has also increased over the last two years with the expansion in North America in FY19. Mobile gamers spent an average of 287 minutes per week across its key freemium mobile games. It relies on the freemium model for monetisation of mobile gaming businesses, allowing users to download and access fully functional apps and content for free. In eSports, including eSports media, revenues are generated through licensing of media rights and brand sponsorships.

Successful Inorganic Growth Through Strategic Acquisitions

Nazara has expanded its portfolio through multiple acquisitions and successfully

integrated these businesses into its operations. In FY18, it acquired Next Wave

to further augment cricket mobile game offerings and through IP-led cricket games,

it now commands the great mindshare in the mobile cricket segment (Source: F&S

Report). It entered eSports through the acquisition of Nodwin Gaming in

FY18, and eSports media through Sportskeeda, by acquiring Absolute Sports in FY20.

Further, its recent strategic investments of Paper Boat Apps, has provided an entry

into gamified early learning. It also acquired Halaplay Technologies in FY19, thereby

entry into skill-based, fantasy gaming. Through strategic acquisitions, it has been

able to increase access to new users and enter new geographies in a cost-effective

manner, achieve a revenue mix and built a network of 54.89 million average MAUs

across all games as at September, 2020.

Launch New IP and Titles Across Content and Games

In the gamified early learning space, the company intends to continually develop

new content to further tap into the large US market and to expand into Spanish,

French and German speaking geographies followed by East Asia, by developing local

and relatable content for each region. It will continue to enrich the product quality

through introduction of learning materials and tools such as positive reinforcements

and rewards, to improve the learning efficiency and experience of subscribers.

In eSports, it will continue to deepen existing relationships with brand and publishing partners and also establish new relationships for more content and event and format IPs, as well as explore synergistic opportunities for content creation through eSports offerings for Sportskeeda. It will continue to work with top game developers to source and localise quality gaming content, invest in new game development tailored to local tastes, as well as continue to invest in eSports IP.

Strong Leadership Team Backed by Marquee Investors

Promoters of the company are highly experienced, with Vikash Mittersain having 40

years of experience in multiple business sectors and Nitish Mittersain, who has

been associated in the promotion of Nazara for 20 years. Manish Agarwal (CEO) has

~20 years of experience in various fields including the gaming space and marketing.

The company also benefits from key personnel from its subsidiaries and associates,

who have significant experience in various verticals within the mobile entertainment

and gaming industry. The company counts well respected funds and individual investors

as its investors, including IIFL, Rakesh Jhunjhunwala and Utpal Sheth.

Industry

With an estimated market size of ~USD 160 billion in 2020, the global gaming industry is one of the largest and fastest growing segments within the media and entertainment sector. Over the last couple of decades, the industry has progressed from arcade style of entertainment to a graphical and social form of entertainment. The Covid-19 pandemic has an accelerated impact on the growth of the gaming industry. Global lockdowns has caused an increase in the engagement within the gaming community as people sought alternative means of entertainment. Estimates suggest that the gaming sector will sustain this healthy growth, with emerging markets expected to play a major role in this growth.

Gaming, a new leader in the Media & Entertainment sector

As music and movies are some of the highly desirable modes of entertainment, a comparison

with gaming would ideally reflect the choice in user preferences. In 2017, the global

gaming industry was nearly twice the sum of the movie and the music industry’s

revenue put together. The subsequent years have also seen a similar trend and in

2020, the gaming industry was valued at USD 157.5 billion while the music and movie

industries had a size of USD 57 billion and USD 39.8 billion. The gaming industry

in India was ~25% of the Indian film industry in 2016, but by 2023, it is expected

to exceed the Bollywood revenues by USD 0.8 billion and reach a value of USD 3.5

billion.

Global Growth Drivers of Gaming Ecosystem

- Increased Penetration of Smartphone Users – Smartphone users form a key component within the gaming ecosystem. The increase in the smartphone penetration is directly correlated with the increase in the number of mobile gamers. As smartphones become cheaper and cost of mobile data decreases, the mobile penetration increases and consequentially more people have access to mobile games.

- Rise in Generation Z (Gen Z) Population – The digitally mature Gen Z population engages in gaming more than the millennial generation or generation X. This generation has access to a wide variety of smartphones and gaming devices, through which they engage in gaming activities. The growth of the Gen Z population between 2015 -2020 correlates with the growth of the gaming industry during the period.

Source: Company RHP

Indian gaming industry is projected to grow over 31.7% YoY due to the growth of digital infrastructure and significant rise in quality and engaging of gaming content. By 2024, the gaming industry in India is set to be valued at USD 3,544 million. India’s online gaming industry has already attracted over USD 350 million in investments from venture capital firms between 2014 – 2020. The rise in online gaming activity propelled by the growth in the number of gamers by almost ten times in the last decade, also led to comparable growth in game developing companies over the same period.

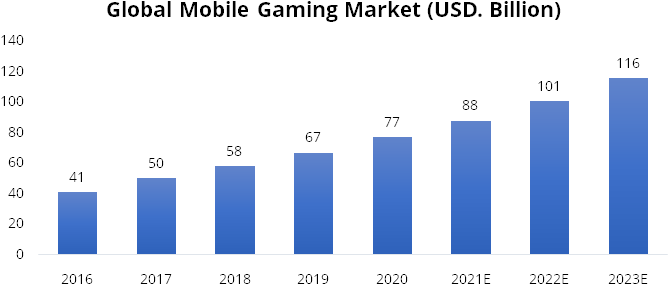

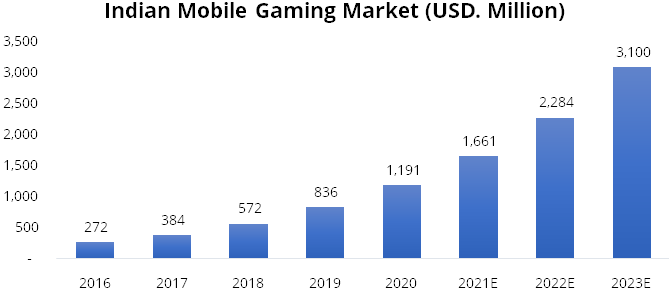

The proliferation of low-cost smartphones, high-speed internet and reduction in data prices are the key drivers for this rapid growth. This mobile gaming segment was valued at USD 272 million in 2016 and is estimated to be about USD 1.2 billion in 2020 growing at a CAGR of 39.6%. Further, the segment is expected to reach a market size of USD 3.1 billion by 2023.

Source: Company RHP

eSports

The global eSports market was valued at USD 521 million in 2016. The recent boost

in the number of eSports viewership and the popularity of eSports tournaments saw

the market rise to USD 1,021 million in 2020. Between 2020 – 2023, the market

is expected to have a growth rate of 16.15% CAGR and is expected to reach a value

of USD 1.6 billion by 2023. The Indian eSports market was valued at USD 70 million

in 2018. The current size of the Indian eSports market is USD 107.8 million and

is expected to grow at a CAGR of 25.1% between 2020 and 2023 and is projected to

reach a market value of USD 208.6 million by the end of that period.

Gamified Early Learning

Gamified early learning tries to bring in the element of fun to learning. It brings

various elements of game play to the learning landscape to make it more entertaining

and engaging. Gamified early learning does not intend to replace teachers, or deter

the classroom education system, but rather works in tandem with the new age digital

techniques to enhance the experience of learning by integrating game elements in

their educational environment.

The market size for the global gamified early learning stood at USD 2.4 billion in 2016 and is expected to grow, at CAGR of 41.8% to reach a market size of USD 27.8 billion by 2023. USA is the largest contributor to this market and had a market size of about a billion dollars in 2016 which is expected to reach USD 12.6 billion by 2023, growing at a rate of 47% CAGR.

Peer comparison

| Name of the Company | Mcap (USD. Billion) | EV/Sales (FY20) |

|---|---|---|

| Nazara Technologies | 0.30 | 9.10 |

| Tencent | 727.00 | 13.40 |

| Bilibili | 26.40 | 26.80 |

| XD Inc. | 2.30 | 5.00 |

| NetEase | 60.90 | 7.10 |

| FriendTimes | 0.60 | 1.80 |

| G-bits | 4.30 | 12.20 |

| Perfect World | 7.90 | 6.20 |

| Sanqi Interactive | 8.90 | 4.20 |

| Average | 9.60 |

Risks

- There is rapid technology change in the mobile games, eSports and gamified early learning businesses. During last few years, VR and AR have grown significantly and gained popularity in games and sports media platforms. Nazara needs to constantly upgrade its technology which requires significant investments in R&D, hardware, software and internet infrastructure.

- A significant portion of its revenues from media rights from the eSports segment is contributed by a single contract, which is currently valid up to March 2021. The contract will need to be renewed or extended upon completion of the current term. Further, game publishers, in future, may or may not want to participate in IP and may ask for consideration to allow their games/brands to be included as part of Nazara’s IP, which could adversely impact its profitability margins.

- Nazara’s telco subscription business is dependent on policies of telecom partners & government regulations on free-to-play games.

- Easy availability of mobile games content across platforms without the involvement of telecom operators and a reduction in payment barriers may all result in a decline of the telco subscription business.

- A substantial portion of international sales and expenses are denominated in foreign currencies, which could fluctuate against the Indian rupee.

Company Description

Nazara Technologies Limited (Nazara) is the leading India-based, diversified gaming and sports media platform with presence in India and globally. It has offerings across interactive gaming, eSports and gamified early learning ecosystems. The company owns some of the most recognizable IP, including WCC & CarromClash in mobile games, Kiddopia in gamified early learning, Nodwin & Sportskeeda in eSports and eSports media, and Halaplay Technologies Halaplay and Qunami in skill-based, fantasy & trivia games. Nazara was among the first entrants in India, in eSports through Nodwin and cricket simulation through Nextwave.

Nazara Technologies – business segments:

Valuation

Nazara Technologies is leading India-based gaming and sports media platform. The company’s diversified offerings, leadership position in eSports and sports simulation and geographic reach across India, Africa, Middle East and North America provides a strong foundation, on which it is able to scale new products. Given Nazara’s market-first position in India across sports simulation and eSports, it is well poised to leverage the opportunity that interactive mobile games, eSports content and gamified early learning apps offer. In the last five years, the company has made various investments in companies such as Paper Boat Apps, Next Wave Multimedia, Nodwin Gaming, Halaplay, amongst others with the total cash considerations of ~Rs. 160 crores and through this, it has been able to access diversified gamers, achieve a revenue mix and built a network of 57.54 million average Monthly Active Users across all games. Further, the company’s intend to increase its geographic coverage of its existing apps such as Kiddopia and WCC franchise across other developed markets could potentially aid its revenue growth. At the upper price band of Rs. 1,101, the issue is valued at 9.1x of EV/Sales of FY20. We recommend to subscribe the issue.

Key Information

Use of Proceeds:

The objects of the Offer are to carry out the Offer for Sale of up to 52,94,392

equity shares by the selling shareholders and achieve the benefits of listing on

the stock exchanges. The company will not receive any proceeds from the offer and

all such proceeds will go to the selling shareholders.

Book running lead managers:

ICICI Securities Limited, IIFL Securities Limited, Jefferies India Private Limited

and Nomura Financial Advisory and Securities (India) Private Limited.

Management:

Vikash Mittersain (Promoter, Chairman and Managing Director), Nitish Mittersain

(Promoter and Joint Managing Director), Manish Agarwal (Chief Executive Officer)

and Rakesh Shah (Chief Financial Officer).

Financial Statement

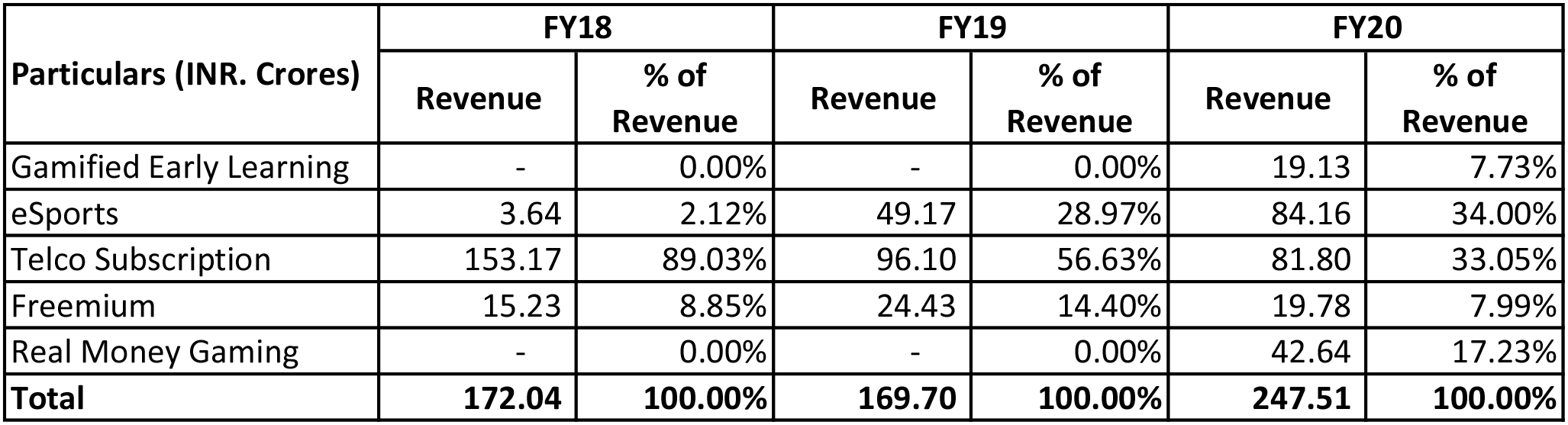

Profit & Loss Statement:- (Consolidated)

| Particulars (INR. Crores) | FY 2018 | FY 2019 | FY 2020 | 9MFY21 |

|---|---|---|---|---|

| Net Revenue from Operations | 172.04 | 169.70 | 247.51 | 200.46 |

| COGS | - | - | - | - |

| Gross Profit | 172.04 | 169.70 | 247.51 | 200.46 |

| Gross Profit Margin (%) | 100.00% | 100.00% | 100.00% | 100.00% |

| Content, event and web serve | 12.14 | 44.30 | 50.69 | 15.20 |

| Advertising and promotion | 42.78 | 27.25 | 132.93 | 119.62 |

| Commission | 3.23 | 3.13 | 7.07 | 22.27 |

| Employee Benefits Expense | 37.20 | 41.38 | 31.87 | 21.85 |

| Other Expenses | 27.98 | 37.29 | 30.48 | 15.41 |

| EBITDA | 48.72 | 16.35 | -5.52 | 6.11 |

| EBITDA Margin (%) | 28.32% | 9.63% | -2.23% | 3.05% |

| Depreciation, Amortization and Impairment Expenses | 8.22 | 19.54 | 26.88 | 18.72 |

| EBIT | 40.50 | -3.20 | -32.40 | -12.62 |

| Finance Cost | 1.83 | 1.38 | 1.24 | 0.51 |

| Other Income | 9.90 | 16.40 | 14.64 | 6.55 |

| Profit/(Loss) before exceptional items, share of net profit/(losses) of investments accounted for using the equity method and tax method (net) | 48.57 | 11.82 | -19.00 | -6.58 |

| Share of loss of Investments accounted using equity method (net) | -0.06 | -0.95 | -1.81 | -1.59 |

| Profit/(Loss) before exceptional items and tax | 48.51 | 10.87 | -20.82 | -8.17 |

| Exceptional Items | -35.72 | - | - | - |

| Profit Before Tax | 12.79 | 10.87 | -20.82 | -8.17 |

| Tax | 11.76 | 4.16 | 5.80 | 1.94 |

| Profit After Tax | 1.02 | 6.71 | -26.62 | -10.11 |

| PAT Margin (%) | 0.59% | 3.96% | -10.75% | -5.04% |

| EPS | 1.05 | 6.39 | -0.77 | -1.78 |