Mrs Bectors Food Specialities Ltd - IPO Note

FMCG

Mrs Bectors Food Specialities Ltd - IPO Note

FMCG

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

One of the leading brands in biscuits and bakery businesses in North India with an ability to establish brands

One of the leading brands in biscuits and bakery businesses in North India with

an ability to establish brands

Mrs. Bectors Food is one of the leading companies in the premium and mid-premium

biscuits segment in North India and sell its products under its flagship brand ‘Mrs.

Bector’s Cremica’. They are among the top 2 Indian biscuit manufacturers

in the premium and mid-premium biscuits segment in Punjab, Himachal Pradesh, Ladakh

and Jammu and Kashmir. In FY 2020, the company had a market share of 4.5% of the

premium and mid-premium biscuits market in North India. Its customers associate

the brand ‘Mrs. Bector’s Cremica’ with high quality premium and

mid-premium biscuits that incorporates quality, taste and value. Its brand recall

is enhanced through its arrangements with certain preferred retail outlets, which

enhance its brand visibility and presence in their shops by displaying its products

prominently in their shelves.

A leading exporter of biscuits

Mrs. Bectors Food is one of the leading exporters of biscuits from India, with ~12%

share of the Indian biscuit export market in CY 2019 and contributes more than 50%

by value of biscuit exports from India to countries such as South Africa and Uganda

and more than 25% by value of biscuit exports from India to Canada. In FY 2020,

the company exported biscuits to 64 countries, across Central and South America,

Europe, North America, East and South Africa, Australasia, the MENA region and Asia

to various retailers, distributors and buying houses such as Monteagle International

(UK) Ltd, Lulu Hypermarket Trading Co, E-Mart Inc., Atlas Global (HK) Ltd, Omni

Trade Services Ltd, Universal Trade Ltd, and World Wide Imports (2008) Ltd.

The company exports various types of cookies such as Danish cookies, choco chip cookies and centre filled cookies, creams, crackers and some glucose biscuits under its flagship brand ‘Mrs. Bector’s Cremica’. The company manufacture a wide range of biscuits for international retail chains under its private labels.

The company has received several quality certifications from including certificate of registration from the U.S.FDA, the BRC food certification, SMETA, Food Safety System certification 22000 and Halal certification for manufacturing biscuits, which helps in the acceptability of its products in developed and quality conscious export markets.

Established presence in retail and institutional bakery business

‘English Oven’ is one of the fastest growing largescale premium bakery

brands in India. The company markets and sells its premium bakery products in savoury

and sweet categories such as breads, buns, pizza bases, and cakes to its retail

customers under its brand ‘English Oven’ which is one of the largest

selling brands in the premium bakery segment in Delhi NCR, Mumbai and Bengaluru.

The company is one of the few bakery companies in India that can handle fresh, chilled

and frozen products and this model enables it to distribute its bakery products

across India. Supply of branded breads and bakery products per day:

| March 31, 2020 | April 01, 2020 - Sep’30, 2020 | April 01, 2019 – Sep’30, 2019 |

|---|---|---|

| 178,564 | 218,674 | 168,022 |

Preferred Supplier to some of the largest QSR Franchises in India

The company is also the largest supplier of buns to reputed QSR chains. It is the

sole supplier of burger buns and pan muffins to Connaught Plaza Restaurants Pvt.

Ltd. since 1995, preferred supplier of burger buns and pan muffins to Hardcastle

Restaurants Pvt. Ltd. for ~13 years. The company has also been one of the main suppliers

of burger buns to Burger King India Ltd since 2014, and to Yum! Restaurants (India)

Pvt. Ltd. since 2013. It has been a preferred and leading supplier of products such

as frozen burger buns, panini, garlic breads to PVR Ltd since the last 10 years.

Over the years, the company has expanded its manufacturing facilities and introduced

stringent quality control processes, which has enabled it to serve other reputed

QSR chains.

Modern and automated production processes with a focus on quality control

Mrs. Bectors Food is a quality-focused company and committed to maintaining stringent

quality standards at all steps of the manufacturing cycle, from procurement of raw

material to dispatch of finished products. Mrs. Bectors Food uses premium quality

raw materials and ingredients in its products. For instance, it has integrated modern

technologies in its manufacturing process such as the ‘Farinograph’,

which allows the company to ensure using consistent quality of wheat during the

manufacturing process.

Wide-spread and established sales and distribution network

The company distributes its biscuits across 23 states in India, through its widespread

network of super stockists and distributors. For the period from April 1, 2020 to

September 30, 2020, the company had a distribution network comprising of 154 super

stockists and 644 distributors supplying to a wide range of customers through 458,000

retail outlets.

Its distribution channels include traditional retail, which it defines as small, privately-owned independent stores, typically at a single location. For the period from April 1, 2020 to September 30, 2020, the company has a network of 4,422 preferred retail outlets. Its distribution network is managed by its in-house sales team of over 403 personnel, as on September 30, 2020.

Most of its products are sold through modern trade channels including Walmart India Pvt. Ltd. The company also directly supplies biscuits to institutional clients like CSDs, Indian Railway Canteens and stores in North India.

The company sells its bakery products for retail customers under its brand the ‘English Oven’ through modern trade, general trade channels and various e-commerce platforms. For the period between April 1, 2020 to September 30, 2020, its bakery products for retail customers were sold through 191 distributors and over 14,000 retail outlets situated in Delhi NCR region, Mumbai, Pune and Bengaluru through direct sales to supermarkets, departmental stores and distributors. Recently, Mrs. Bectors Food also started selling its products through various e-commerce platforms in India, multiplexes such as PVR Ltd, and cloud kitchens such as Rebel Foods Pvt. Ltd.

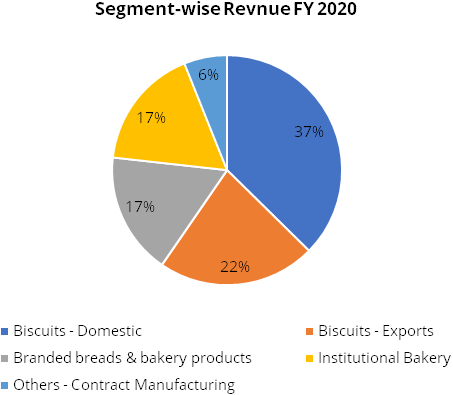

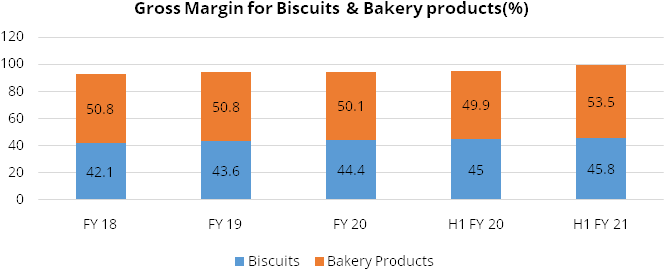

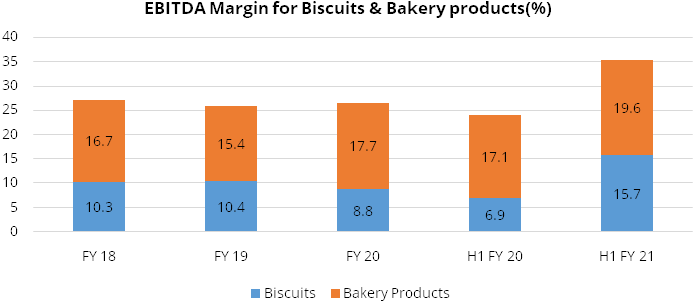

Segment-Wise Performance

Source: Technopak Report, Company RHP and StockAxis Research

Experienced promoter and management team

The experience and leadership of the company’s promoter, Anoop Bector, is

a key factor in its growth and development. Anoop Bector has extensive experience

of over 25 years and industry knowledge and understanding. His experience has helped

the company develop relationships with its vendors for the procurement of raw materials,

institutional customers and dealers and distributors. He also provides strategic

guidance to the company, while also being involved in their day-to-day functioning

of the business. Ishaan Bector, the whole-time director, heads its breads business

and is responsible for overall supervision, development and expansion of the company’s

breads business and has been instrumental in its growth. The breads business has

grown at a CAGR of 29.07% in the last 3 Financial Years under the leadership of

Ishaan Bector.

Key members of its senior management team including Manoj Verma, the national sales director (domestic sales) of the company has over 26 years of experience in sales and marketing. Rajeev Dubey, the director (bread sales) of the company has over 26 years of experience. Asim Bhaumik, the group head of quality, technical, research and development of the company has over 23 years of experience in production and operations, Deep M.S Bajaj, the group senior corporate chief of the company has over 14 years of experience in the hotel industry and Suvir Bector, the vice-president (exports) of the company, who are dedicated to the growth of the business.

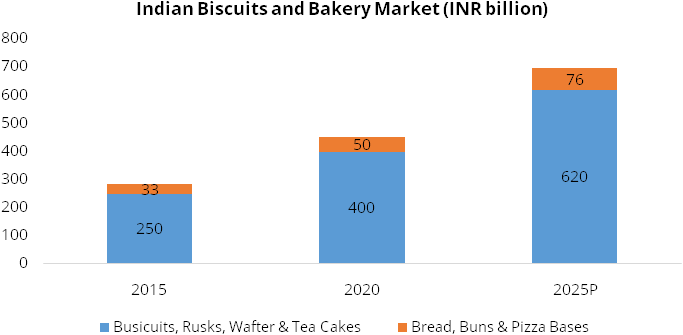

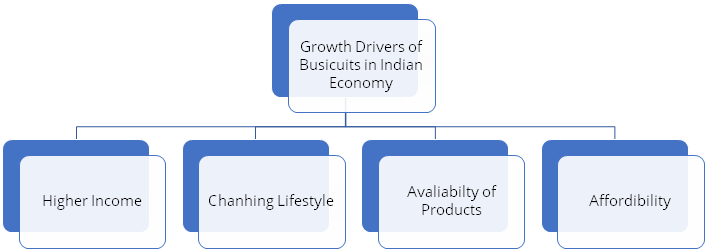

Industry

The Indian biscuits and bakery retail market is valued at Rs. 450 billion and is expected to grow at a CAGR of ~9% over the next five years. Biscuits and other snacking bakery products such as rusks, wafers and tea cakes contribute ~89% to the total market and the balance is contributed by breads including loaves, buns, pizza bases.

Source: Technopak Report, Company RHP and StockAxis Research

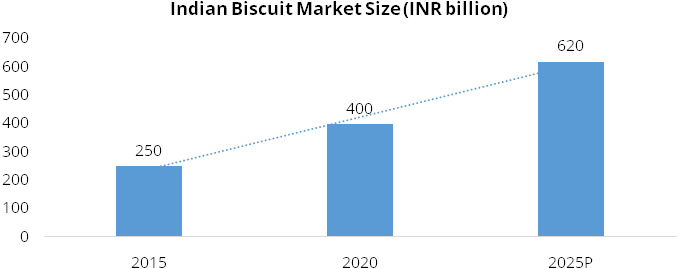

Global biscuit market is estimated to be worth Rs. 7,839 billion in 2020 and is projected to grow at a CAGR of 6% over next five years. Indian biscuit market size is estimated to be Rs. 400 billion in 2020 representing ~5% of the global market. Domestic market is expected to grow at a CAGR of ~9% in the next five years. This growth will increase India’s share in the global market to ~6% by 2025.

Source: Technopak Report, Company RHP and StockAxis Research

Per capita biscuit consumption of biscuits in India has increased by 16% over the last five years. However, it is far behind developed economies like US, UK and other developing Asian economies. Though there is huge headroom for growth in India for biscuit market, it is complex market that requires regional customisation.

Source: Technopak Report, Company RHP and StockAxis Research

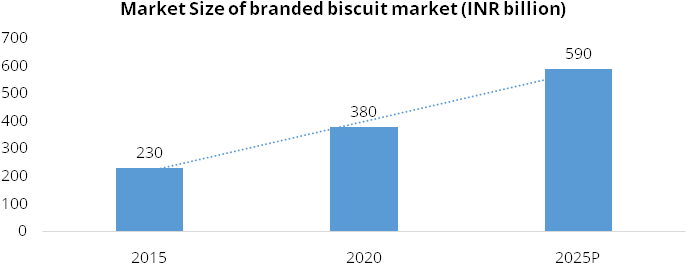

On the basis of price, the biscuit market is classified into Mass, Mid-Premium and Premium segments. Branded mass biscuit has grown at 8.50% CAGR for the last five years and is expected to grow at the CAGR of 7.6% in the next five years, whereas, mid-premium and premium biscuits has grown at CAGR of 12.20% over the last five years. The category has shown growth rate much higher than the mass category. The market for mid-premium and premium biscuits is expected to grow to at a CAGR of 9.50% for the next five years, which is faster than the overall branded biscuit market growing at 9.20%.

Growth rate for branded biscuits in terms of value is greater than the volume over the period of Financial Year 2015 to FY 2020. It is driven by movement of consumers towards mid and premium biscuits. The Indian branded biscuits market is expected to grow at the rate of 9.20% for the next five years.

Source: Technopak Report, Company RHP and StockAxis Research

Source: Technopak Report, Company RHP and StockAxis Research

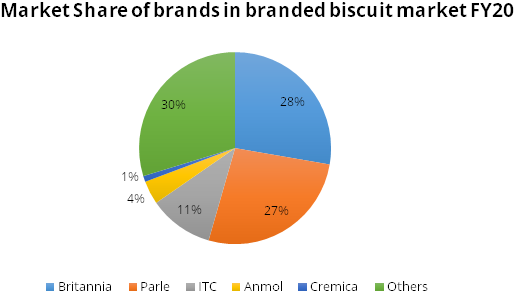

The Indian biscuit market is dominated by leading brands like Britannia, Parle and ITC which constitute 65% of market share. While Parle drives a large portion of its revenues from mass product Parle-G, the company has the largest market share by volume on back of Parle-G brand. Britannia’s revenue is driven by Mid-Premium and Premium products.

Indian biscuit exports have maintained a share of ~2% of total world exports by value since 2017 and 2-3% by volume. India has exported USD 169.00-181.00 million worth of biscuits per annum in Financial Year 2017-19.

The bread and buns retail market in India is valued at Rs. 50 billion in FY 2020 and it is expected to grow at the CAGR of ~9% for the next five years. The growth will be mainly assisted by increase in disposable incomes, change in lifestyle and preferences of the consumers. The demand for breads is concentrated mainly around metros, tier I and larger tier II cities due to higher disposable incomes and changing meal preferences.

The industry is dominated by branded players contributing to about 55% of the total market. Region-wise, North and West are the biggest consumers of bread in the country. The average per capita consumption of bread in developed countries is much higher than India. While the average per capita bread consumption in India is estimated to be ~1.4 kg in 2020, it has immense growth opportunity. Factors such as new product variants, increase in per capita income as well as increase in per consumption will help the growth in the industry.

Comparison with Listed Industry Peers

| Name of the Company | Closing Price as on Dec’14, 2020 | EPS | P/E |

|---|---|---|---|

| Mrs. Bectors Food Specialities Ltd. | 288* | 5.31 | 54.24 |

| Nestle India Limited | 18,591.80 | 204.28 | 91.01 |

| Britannia Industries Limited | 3,776.95 | 58.35 | 64.23 |

| Prataap Snacks Limited | 674.75 | 20.01 | 33.72 |

| DFM Foods Limited | 394.10 | 4.87 | 80.92 |

*Upper band of the issue

Risks

- The company does not have any long-term contracts with its QSR customers and any disruption in its business operations with its QSR customers will adversely affect its business, financial condition, and results of operations.

- If the company fails to anticipate, respond to, and meet the tastes, preferences, or consistent quality requirements of its consumers or accurately predict and successfully adapt to changes in market demand or consumer preference, then there could be a drop in the demand for its products, affect its brand loyalty, and impact its sales.

- The biscuits and bakery products industry is inherently capital intensive and requires significant expenditure. Mrs. Bector’s has incurred indebtedness may incur additional debt in the future, which may expose it to interest rate fluctuations, and restrict its operational flexibility in certain ways.

- The company currently avails of benefits under certain export promotion schemes. Any failure in meeting the obligations under such schemes may adversely affect its business operations and its financial condition.

- Since the company is into exports, it is exposed to foreign currency exchange rate fluctuations, which may impact its results of operations, cash flows, and cause its financial results to fluctuate.

Company Description

Mrs. Bectors Food Specialities Ltd (MBFSL) is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment in North India. The company manufactures and markets a range of biscuits (including cookies, creams, crackers, digestives and glucose) and bakery products in savoury and sweet categories (including breads, buns, pizza bases & cakes) to its retail & institutional clients. The biscuits portfolio is sold under the company’s flagship brand ‘Mrs. Bector’s Cremica’ whereas the bakery products are sold to retail customers under the brand name ‘English Oven.’

All products of the company are manufactured in-house at their 6 manufacturing facilities located in Phillaur and Rajpura, Tahliwal, Greater Noida, Khopoli and Bengaluru. The company supplies its products to retail consumers in 26 states within India, as well as to reputed institutional customers with pan-India presence and to 64 countries across six continents.

Mrs. Bector’s is the largest supplier of buns to reputed QSR brands like Burger King India Limited, Connaught Plaza Restaurants Private Limited, Hardcastle Restaurants Private Limited, and Yum! Restaurants (India) Private Limited. It also manufactures ‘Oreo’ biscuits and ‘Chocobakes’ cookies for Mondelez India Foods Pvt. Ltd.

Valuation

Mrs. Bectors Food is one of the leading biscuit brands in India focused on mid-premium and premium segments across North India with market share of ~4.5%. Its bakery products brand “English Oven” is one of the largest selling brands in Tier-I and II cities with a market share of ~5% in branded bread segment in India. It is also caters to well-known brands such as PVR, Burger King, McDonalds’, in India and has budding exports business. We expect the company to will leverage its strong presence in North India to expand its presence in the other regions of the country. At higher price band of Rs 288, the stock is valued at a PE of 54.24x based on FY20 EPS. We recommend Subscribe to the issue.

Key Information

Use of Proceeds:

The proceeds of the fresh issue will be used for financing the project cost towards

expansion of the Rajpura manufacturing facility by establishing a new production

line for biscuits and general corporate purposes.

Book running lead managers:

SBI Capital Markets Limited, ICICI Securities Limited and IIFL Securities Limited.

Management:

Mr. Anoop Bector (Promoter and Managing Director), Mr. Ishaan Bector (Whole-time

Director), Parveen Goel (Whole-time Director & CFO).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (INR in Crores) | FY 2018 | FY 2019 | FY 2020 | H1 FY 2021 |

|---|---|---|---|---|

| Net Sales | 690.64 | 783.67 | 762.12 | 430.99 |

| Total Expenditure | 605.15 | 687.58 | 669.31 | 358.86 |

| EBITDA | 85.49 | 96.08 | 92.82 | 72.14 |

| EBITDA Margin (%) | 12.40% | 12.30% | 12.20% | 16.70% |

| Depreciation | 28.35 | 35.18 | 41.49 | 22.16 |

| EBIT | 57.14 | 60.90 | 51.33 | 49.97 |

| EBIT Margin (%) | 8.30% | 7.80% | 6.70% | 11.60% |

| Interest and Finance | 6.11 | 12.68 | 15.04 | 5.48 |

| Other Income | 1.79 | 2.36 | 2.85 | 7.56 |

| PBT | 52.84 | 50.66 | 39.18 | 52.14 |

| Tax | 16.95 | 17.51 | 8.78 | 13.26 |

| Reported PAT | 35.89 | 33.15 | 30.40 | 38.88 |

| PAT Margin (%) | 5.20% | 4.20% | 4.00% | 9.00% |

| Diluted EPS | 6.26 | 5.78 | 5.30 | 6.78 |