MTAR Technologies Limited - IPO Note

Precision Engineering

MTAR Technologies Limited - IPO Note

Precision Engineering

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

Precision Engineering Expertise with Complex Product Manufacturing Capability

The company develops and manufactures a wide range of mission critical assemblies

and precision components with close tolerances (5-10 microns), through its precision

machining, assembly, and specialized fabrication facilities, for onward usage by

its customers in the clean energy, nuclear, and space and defence sectors in India,

and abroad. These capabilities are further supported by an extensive and stringent

testing and quality control mechanism undertaken at each stage of the production

process. Towards this end, it uses high precision quality inspection equipment such

as 3D co-ordinate measuring machines, laser measuring, optical alignment instruments,

non-contact measuring, and other such non-destructive testing equipment to ensure

ideal quality, as requested by its customers.

It also has experienced personnel who undertake procedures and inspections such as radiography, ultrasonic, magnetic particle and dye penetrant at its testing facilities. Its capability in measuring and maintaining quality and measurement records at each level of the process is a key enabler. In order to enhance its product offerings, the company has leveraged its adaptability and manufacturing agility by continually investing in manufacturing facilities including in R&D, over the years. Its operations are supplemented by R&D, a critical part of its business capability that is undertaken primarily for the manufacturing processes.

Wide Product Portfolio

As on December 2020, the company’s major product portfolio includes three

kinds of products in the clean energy sector, fourteen kinds of products in the

nuclear sector and six kinds of products in the space and defence sectors. MTAR

strives to understand its customers’ specific business needs and provide products

to meet their requirements and accordingly, its ability to provide quality products

as per the customer specification, and consistent customer servicing standards,

have enabled it to increase its customers’ dependence.

It has also invested in the development of roller screws, which is an import substitute, and is involved in developing the associated technology. Once this development has been completed, the company will be the first manufacturer of roller screws in India, while this product shall be used for a wide variety of applications in the nuclear, space and defence sectors.

Strong, Trusted and Long-Standing Relationships

MTAR Technologies caters to nuclear, space & defence and clean energy sectors

and has strong and long-standing relationships with its clients. In clean energy,

the company is involved in the manufacturing and specialized fabrication of critical

assemblies to customers such as Bloom Energy, Andritz, among others. Globally, Bloom

Energy is one of the largest and the fastest growing player in the hydrogen fuel

cell segment and MTAR has been associated with it for over nine years; MTAR is the

only supplier to Bloom from India as of FY20.

Further, MTAR has played a prominent role in defence sector over past four decades. The company has been supplying hi-Precision machined, fabricated systems to most of the leading programmes of DRDO labs (ADA, GTRE, DRDL), DPSUs (BDL, BEL, HAL) and other defence R&D and Defence public sector Units (DPSUs) establishments of the Indian Defence and international players like ELBIT Israel, Rafael Israel etc. Within the nuclear sector, its long-standing relationship of over 16 years with NPCIL bears testimony to the company’s ability to manufacture and supply specialized products. Within the space sector, it has established relationship with ISRO to whom the company has been supplying a wide variety of mission critical components and critical assemblies for its various missions for over three decades.

Modern Technology at State-Of-The-Art Manufacturing Facilities

The company operates through seven, state-of-the-art manufacturing facilities, including

one export-oriented unit (EOU), situated in Hyderabad, Telangana. The presence of

major defence organizations in Hyderabad not only provides MTAR, an access to the

critical R&D and high-volume projects, but also allows for ease of coordination,

specifically in terms of its collaborative R&D efforts, as well as for subsequent

close monitoring of manufacture and quality control processes, thereby giving it

an advantage over the other players located in other regions. It has consistently

undertaken expansion of manufacturing facilities through internal accruals with

a view to capture increasing demand in the future.

Significant end-to-end capabilities of the manufacturing facilities:

- Manufacturing of precision components with close tolerances to the extent of 5-10 microns supported by a series of high-end machines such as 7 axis Mill-turns, 5 axis vertical machining centres, 4.5 axis machining centres, milling centres, turning centres, grinding centres, tool room machines, deep hole boring and honing machines, among others;

- Assembly and testing capabilities supported by 10,000 class clean rooms with facilities for high as well low temperature, vibration, flow and helium leak tests;

- Specialized fabrication facilities supported by conventional and orbital welding facilities, vacuum brazing, water jet and plasma cutting facilities to meet American Society of Mechanical Engineers standards / American Society for Testing and Materials standards; and

- Surface treatment, heat treatment facilities and special processes facilities.

With in-house expertise, it has also designed and built certain sophisticated special purpose machines instead of importing comparable machines. Additionally, its facilities consist of machining abilities that can manufacture products ranging from few kgs. to several tonnes in weight. The company does not have dedicated production lines to manufacture identified products as a result of which, it has a greater flexibility in terms of utilization of their capacity.

Edge Over Competitors on Account of Technology Competence, High Quality Products

and Strong Customer Relationships

Over the years, the company has established long-term relationships with its customers

which leads to recurrent business engagements with them. MTAR has been playing a

key role in the co-development of quality products for key national programs such

as Chandrayaan and Mangalyaan missions. Additionally, it is engaged in developing

Channel Health Assessment System and the detailed design, engineering, manufacturing

and assembly is under process at one of its manufacturing facilities. It is difficult

to replace MTAR given the steep learning curve and investment in advanced manufacturing

facilities and precision requirements.

Further, given the company’s strong relationship with its international customers, MTAR shall be one of the preferred suppliers in any potential defence offset transaction that such customer may be a part of. The company’s customer retention levels reflect its ability to provide high quality products. The company’s product offerings and high quality along with leadership in key product segments could help in increasing share of business amongst its existing customers as well as increase customer base.

Strong and Diversified Supplier Base for Sourcing of Raw Materials

Over the years, the company has developed a robust supply chain for the sourcing

of a wide variety of specialized raw materials used in the manufacture of mission

critical precision products. The essential raw materials used in its manufacturing

facilities are various kinds of alloys steels and bought out items. While it sources

the materials from third party suppliers depending upon the requirement of a project

that it undertakes, in certain instances, especially involving the critical and

sensitive raw material and bought out items for the manufacture of certain products

are directly procured and supplied by its customers, mostly belonging to the space

and defence sectors. The materials utilized for products catered to the clean energy

and nuclear sectors and other consumables and bought-outs are mostly sourced from

third party suppliers, both domestic and global.

Strong Margins

The company’s net operating revenue has grown at a CAGR of 16.8% between FY18

– FY20. During 9MFY21 the net revenue has grown 16.5% compared to 9MFY20.

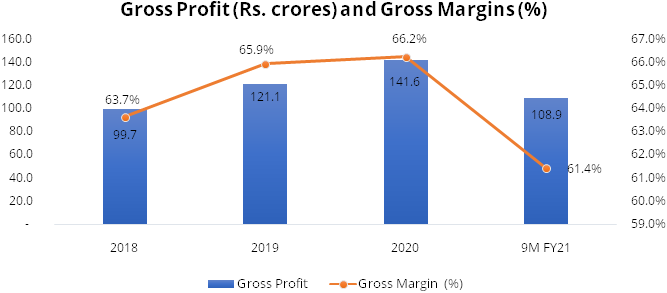

The gross margins of the company have also grown consistently over the years from

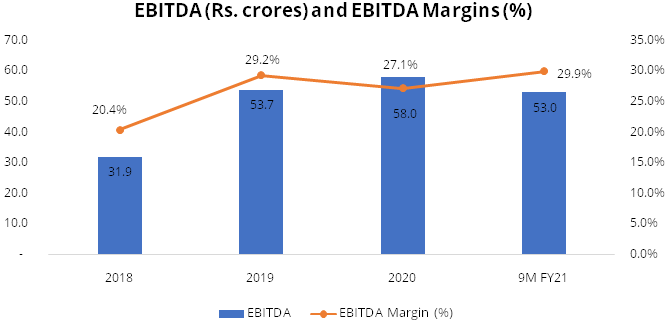

63.7% in FY18 to 66.2% in FY20. The EBITDA of the company has growth at a CAGR of

34.9 during FY18 – FY20 and stands at 27.1% in FY20 and 29.9% during 9MFY21.

The financial position of the company illustrates growth of its operations over

the years as well as effectiveness of the administrative and cost management protocols

implemented by the company.

Growing Order Book

The aggregate order book as on December, 2020 was Rs. 336.2 crores, comprising orders

from clean energy sector, nuclear sector and space & defence sectors amounting

to Rs. 80.2 crores, Rs. 93.2 crores and Rs. 160.6 crores, respectively. Historically,

the order book was Rs. 201.8 crores, Rs. 243.7 crores and Rs. 345.1 crores, as on

March 2018, 2019 and 2020, respectively.

Industry

Precision engineering is a sub-discipline of engineering and is concerned with manufacturing and assembling items that have exceptionally low tolerance and are required to perform consistently over longer repeat cycles. It includes manufacturing and assembly and covers materials, machining and fabrication processes, to produce machinery and equipment of perfect dimension and size. Accuracy and margin of error are extremely important parameters for engineering and production. Any deviation in dimensions can lead to loss of performance or even catastrophic failure of the system. Precision engineering products and components are especially important for critical applications such as aviation, aerospace, space, defence and nuclear power plants, control equipment for process plants, where errors can cause greater damage.

In nuclear sector a failure of small fitting components may led to catastrophic long-term effect, so component tolerance and fit is very critical from safety and operational point of view. Even in space sector, the quantum of investments and length of projects are very large and long, respectively, making it critical to have high quality error-proof products. Otherwise, a small fit error may render years of effort and R&D cost to not achieve the desired output. To avoid such mishaps and error, precision engineering is very critical for strategic sectors such as Defence, nuclear, space, aviation and others.

As per the CRISIL, the precision engineering industry was valued at Rs. 4,098 billion in FY20. The industry mainly caters to automobile components and industrial plant and equipment segments. The industry has clocked a CAGR of 7.1% between FY16 – FY20. Further, the industry will benefit from supportive government policies for manufacturing sector. It will also gain from growth in the machinery and equipment industry and rise in penetration of high technology machinery for manufacturing. Precision engineering is expected to log 6% – 7% CAGR between FY20 and FY25 to reach Rs. 5,550 – Rs. 6,550 billion by FY25. The growth in the industry will be driven by growth in auto-components domestic as well as export demand, and indigenous manufacturing in defence segment.

Defence, aerospace, aviation, power and engineering and capital goods segments are also expected to grow steadily with rise in investments in these sectors. Defence and aerospace segment forms 18% - 20% of the precision engineering market and is valued at Rs. 786 billion in FY20. It is the largest segment after auto components. Engineering and capital goods is the next largest segment with share of 9% - 10% and is valued at Rs. 609 billion in FY20. Within engineering and capital goods, the process plant and industrial segment contributes to 10% - 15%. Space equipment industry is estimated at Rs. 31.2 billion for FY20 contributing to 0.8% of the overall precision engineering market. Demand for precision products from nuclear segment is estimated at Rs. 140 - 175 billion between FY20 – FY25 vs. Rs. 22.5 – 28 billion between FY16 – FY20.

Risks

- The Company depends on Bloom Energy Ltd. and limited number of other customers for significant portion of its revenue. Loss of any such customers would adversely impact the business and financial conditions of the company.

- It significantly depends on orders from NPCIL, ISRO and DRDO. If there is any decline or prioritization of funding by Indian government towards other departments, there would be an adverse impact on the company’s business.

- The company requires working capital to finance the purchase of materials and for manufacture and other related work before payment is received from its customers. The working capital requirements may increase if some contracts do not include advance payments or payment schedules that shift payment towards end of the projects. Additionally, working capital requirements of the company has increased in recent years on account of growing number of projects within a similar timeframe and growth of the business. This continuous increase in working capital requirement could adversely impact the financial conditions and results of operations of the company.

Company Description

MTAR Technologies Limited (MTAR) is a leading precision engineering solutions company engaged in the manufacture of mission critical precision components with close tolerances (5-10 microns), and in critical assemblies, to serve projects of high national importance, through its precision machining, assembly, testing, quality control, and specialized fabrication competencies, some of which have been indigenously developed and manufactured. It primarily serves customers in the clean energy, nuclear and space and defence, sectors. Since inception, the company has strived to grow continually, contributing to the Indian civilian nuclear power programme, Indian space programme, Indian defence and aerospace sector, as well as to the global clean energy sector and the global defence and aerospace sector. Over the years, it has also developed import substitutes such as ball screws and water lubricated bearings that are specialized and used in the sectors the company caters to.

Currently, MTAR operates through 7 manufacturing facilities, including an export-oriented unit. These facilities, each of which is situated in Hyderabad, Telangana, employ advanced equipment to undertake precision machining, assembly, testing and quality control, specialized fabrication, brazing and heat treatment, and other specialized processes, leading to MTAR being a one-stop solutions company for its customers.

Revenue from Operations – Business Segment-wise

| Sectors | March 2018 | March 2019 | March 2020 | 9MFY21 | ||||

|---|---|---|---|---|---|---|---|---|

| Revenue (Cr.) | % of Total | Revenue (Cr.) | % of Total | Revenue (Cr.) | % of Total | Revenue (Cr.) | % of Total | |

| Clean Energy | 78.43 | 49.14% | 112.82 | 61.42% | 137.54 | 64.34% | 87.45 | 49.33% |

| Nuclear | 46.11 | 28.89% | 23.96 | 13.05% | 30.51 | 14.27% | 48.09 | 27.13% |

| Space & Defence | 26.16 | 16.39% | 36.84 | 20.06% | 39.34 | 18.40% | 36.51 | 20.59% |

Valuation

MTAR Technologies has a diversified client base in nuclear, space & defence and clean energy sectors and has trusted and long-standing relationships with its clients. The client base of the company in these industries includes some the most prominent names such as Bloom Energy, NPCIL, ISRO, DRDO, Rafael, etc. Given the steep learning curve and the investment in advanced manufacturing facilities and precision requirements, it would be difficult to replace MTAR. It is also expanding its international presence by acquiring new clients; recently, it has acquired a new international customer operating in the clean energy sector. Further, MTAR is poised to reap benefits from upward trend of nuclear sector in India, increasing indigenization and policy initiatives in the defence sector, and commercialization of Indian space sector. Limited competition for the products which the company manufactures and the expertise it has developed overtime gives it an additional edge. At an upper price band of Rs. 575, the issue is aggressively priced at a P/E of 41.1x of annualised EPS of FY21. We recommend to Subscribe the issue.

Key Information

- Use of Proceeds:

The net proceeds are proposed to be utilised towards funding Repayment/prepayment in full or in part of borrowings, funding working capital requirements and general corporate purposes. - Book running lead managers:

JM Financial Limited and IIFL Securities Limited. - Management:

Venkata Rama Behara (Chairman and Independent Director), Parvat Srinivas Reddy (Managing Director), Mathew Cyriac (Nominee Director) and Sudipto Bhattacharya (CFO).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | 2018 | 2019 | 2020 | 9M FY21 |

|---|---|---|---|---|

| Net Revenue from Operations | 156.62 | 183.67 | 213.77 | 177.27 |

| YoY Growth (%) | 17.27% | 16.39% | 16.49% | |

| COGS | 56.93 | 62.56 | 72.17 | 68.40 |

| Gross Profit | 99.69 | 121.11 | 141.61 | 108.87 |

| Gross Margin (%) | 63.65% | 65.94% | 66.24% | 61.42% |

| Employee Benefits Expense | 44.61 | 43.51 | 51.63 | 37.44 |

| Other Expenses | 23.21 | 23.89 | 32.02 | 18.41 |

| EBITDA | 31.88 | 53.72 | 57.97 | 53.03 |

| EBITDA Margin (%) | 20.35% | 29.25% | 27.12% | 29.91% |

| Depreciation and Amortisation Expense | 11.21 | 11.23 | 12.05 | 9.33 |

| EBIT | 20.67 | 42.48 | 45.92 | 43.70 |

| Finance Cost | 4.46 | 4.46 | 4.75 | 4.83 |

| Other Income | 0.95 | 2.24 | 4.37 | 0.72 |

| Profit Before Exceptional Items and Tax | 17.16 | 40.26 | 45.53 | 39.60 |

| Exceptional Items | - | 1.29 | - | - |

| Profit Before Tax | 17.16 | 41.56 | 45.53 | 39.60 |

| Tax Expenses | 11.73 | 2.36 | 14.22 | 11.53 |

| Profit After Tax | 5.42 | 39.20 | 31.32 | 28.07 |

| PAT Margin (%) | 3.46% | 21.34% | 14.65% | 15.83% |