Life Insurance Corporation of India - IPO Note

Insurance - Life

Life Insurance Corporation of India - IPO Note

Insurance - Life

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths & Strategies

India's largest asset manager with a proven track record:

LIC is the largest asset manager in India as at September 30, 2021, with AUM of

INR 40.1 lakh crore on a standalone basis, which was:

- more than 3.2x the total AUM of all private life insurers in India,

- 15.6x more than the AUM of the second-largest player in the Indian life insurance industry in terms of AUM,

- more than 1.1x the entire Indian mutual fund industry’s AUM and

- 17% of India’s annualised GDP for FY22. As per Crisil report, as at December 31, 2021, LIC’s investments in listed equity represented around 4% of the total market capitalisation of NSE as at that date.

Net profit on sale/redemption of policyholders’ investments was Rs 23897.21 crore, Rs 19387.48 crore, Rs 39809.63 crore and Rs 36462.77 crore in FY19, FY20, FY21 and 9MFY22 on a consolidated basis, respectively. PAT on a consolidated basis increased from Rs 2627.38 crore for FY19 to Rs 2974.14 crore for FY21, representing 6.39% CAGR.

Can benefit from growth opportunities in the Indian life insurance sector:

Under penetration of life insurance in India, are key factors for the multi-decadal

growth in the life insurance industry in India. The GWP(Gross written premium) for

life insurers in India is forecasted to grow at 14-15% CAGR from FY21 to FY26 to

INR 12.4 lakh crore. At this level of premium, life insurance as a proportion of

GDP is projected to reach 3.8% by FY26E, up from 3.2% in FY21. The NBP(New business

premium) of Indian life insurance industry is expected to grow at a CAGR of 18%

from FY21 to FY26 for individual business as compared to a CAGR of 17% for group

business over the same period.

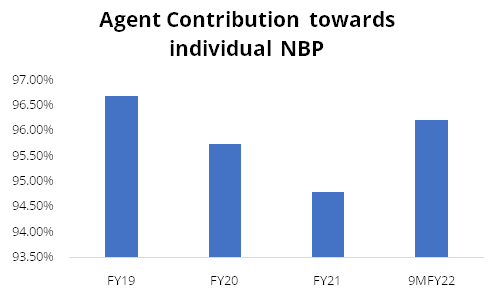

LIC accounts for approximately two-third market share in terms of both GWP and NBP in life insurance industry for FY21, driven by its individual agent network especially in rural areas, wide range of products and a sense of trust created by brand LIC among individuals. GWP on a consolidated basis increased at a CAGR of 9.21% from FY19 to FY21. LIC has a market share of 62.5% and 61.8% compared to 8.5% and 8.8% market share of the second-best player in the market by renewal premium for FY21 and 9MFY22, respectively. NBP on a consolidated basis increased at a CAGR of 13.49% from FY19 to FY21.

Product mix dominated by participating policies:

LIC has a diverse product portfolio that includes individual and group products

in a variety of segments. Their individual product portfolio in India consisted

of 32 individual products (16 participating products and 16 non-participating products)

and seven individual optional rider benefits as of September 30, 2021. Their group

product portfolio in India consisted of 11 group products as of December 31, 2021.

LIC is well placed to serve customers across age brackets with a comprehensive product portfolio, while maintaining a strong connect across age groups. Customers in the age bracket 27 to 40 years old accounted for 42% of individual policies sold in FY21.

Presence across India through an omni-channel distribution network with an unparalleled agency force:

LIC’s omni-channel distribution platform for individual products currently comprises:

- individual agents,

- bancassurance partners,

- alternate channels (corporate agents, brokers and insurance marketing firms),

- digital sales (through a portal on LIC’s website),

- Micro Insurance agents and

- Point of Sales Persons-Life Insurance scheme.

As at December 31, 2021, LIC had the following distribution network for individual products in India:

- 1.33 million individual agents;

- 70 bancassurance partners;

- 215 alternate channel;

- A portal on LIC’s website for digital sales;

- 2,128 active Micro Insurance agents; and

- 4,769 Point of Sales Persons-Life Insurance scheme.

- LIC’s individual policies are primarily distributed by its individual agents. Key metrics for its agent network in India include:

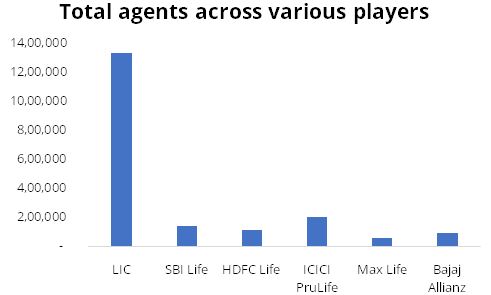

- Largest agent network among life insurance entities in India. As at December 31, 2021, its individual agency force accounted for 55% of the total agent network in India and was 6.8 times the number of individual agents of the second largest life insurer in terms of agent network.

- Industry leading agent network growth in India, with the number of LIC’s agents in India increasing at a CAGR of 7% between March 31, 2019 and March 31, 2021 compared to the next best player’s agency force CAGR of 5% and the average of the private player’s agency force CAGR of 4% during the same period.

- Most productive agent network in the Indian life insurance sector, as evidenced by the fact that for the nine months ended December 31, 2021 and Fiscal 2021, LIC’s agents had an average NBP of Rs. 260,069 and Rs. 412,934 per agent, respectively, compared to the average NBP of Rs. 108,888 and Rs. 124,892 per agent for the median of the top five private players, respectively

- It has the highest Million Dollar Round Table (“MDRT”) members among all the Indian corporates operating in financial services industry, with a total of 721 MDRT members for 2021.

- High longevity of agents - 59.38% of its individual agents in India have acted for LIC for more than five years as at December 31, 2021.

- 81% of LIC’s agents in India recruited in Fiscal 2021 were within the 18 to 40 years old group.

Trusted brand and a customer-centric business model

The brand ‘LIC’ was recognised as the 3rd strongest and 10th most valuable

global insurance brand in 2021, as per the “Insurance 100 2021” report

released by Brand Finance. The brand value of LIC in 2021 was US$8,655 million,

with a Brand Strength Index (BSI) score of 84.1 out of 100, corresponding to AAA-

brand strength rating. The brand ‘LIC’ was also recognised by WPP Kantar

as the 2nd most valuable brand in the report “BrandZ™ Top 75 Most Valuable

Indian Brands” for 2018, 2019 and 2020. The brand ‘LIC’ has won

the Reader’s Digest Trusted Brand Award numerous times and the prestigious

Outlook Money Award Gold Award in Editor’s Choice Category as the “Most

Trusted Brand in Insurance” twice.

The trust in the brand ‘LIC’ is evidenced by the 27.91 crore in force policies under individual business being serviced in India as at December 31, 2021. The trust in the brand ‘LIC’ is further evidenced by the fact that approximately 75% of individual policies sold by LIC in India in the 9 months ended December 31, 2021 were sold to customers who had not purchased any life insurance policies from LIC prior to April 1, 2021.

Industry

Peer comparison

| Particulars (Rs Crore) | LIC | HDFC Life | SBI Life | ICICI Prudential |

|---|---|---|---|---|

| AUM | 3676180.00 | 173839.00 | 229870.00 | 214218.00 |

| Total premium | 403290.00 | 38580.00 | 50250.00 | 35730.00 |

| NBP/Employee | 1.60 | 1.00 | 1.20 | 0.90 |

| Net Profit | 2974.10 | 1360.00 | 1460.00 | 960.20 |

| EV | 95605.00 | 26617.00 | 33390.00 | 29106.00 |

| VNB | 4167.00 | 2185.00 | 2330.00 | 1621.00 |

| VNB Margin (%) | 9.90 | 26.10 | 23.20 | 25.10 |

| Opex Ratio (%) | 8.70 | 11.90 | 4.80 | 7.50 |

| Commission Ratio (%) | 5.50 | 4.40 | 3.50 | 4.20 |

| Total Cost Ratio (%) | 14.20 | 16.30 | 8.30 | 11.70 |

| 13th Month Persistency (%) | 79.00 | 91.70 | 87.90 | 87.10 |

| 61st Month Persistency (%) | 59.00 | 54.40 | 61.60 | 59.80 |

| Solvency Ratio | 1.80 | 2.00 | 2.20 | 2.20 |

| Claims Settlement Ratio (%) | 98.30 | 99.40 | 96.40 | 98.00 |

| Conservation Ratio (%) | 84.50 | 85.90 | 87.50 | 82.00 |

| ROE (%) | 81.70 | 17.60 | 15.20 | 11.70 |

| EPS | 4.70 | 6.74 | 14.55 | 6.66 |

| NAV(Rs.) | 10.30 | 42.75 | 103.99 | 63.51 |

| Market Cap | 600000.00 | 116904.00 | 113725.00 | 75470.00 |

| Embedded Value (Rs. Billion) | 5396.00 | 295.40 | 302.00 | 302.00 |

| Market capitalization to EV | 1.11 | 3.96 | 3.77 | 2.49 |

Risks

Ongoing pandemic may adversely affect all aspects of business

LIC’s and its distribution partners’ ability to distribute products

was adversely affected due to lockdowns. In addition, LIC’s insurance claims

by death increased during pandemic. For FY19, FY20, FY21 and 9MFY22, insurance claims

by death in benefits paid (net) were INR 16963.7 crore, INR 17341.8 crore, INR 23483.3

crore and INR 29310.7 crore, respectively. The extent to which the pandemic will

continue to affect business, financial condition, results of operations in the future

will depend on future developments, which are highly uncertain.

Competition in business is significant

LIC is the only public sector life insurance company in India and primary competitors

are private life insurance companies in India. Private sector insurance companies

have been growing faster than LIC and gaining market share. For FY19, FY20, FY21

and nine months ended December 31, 2021, LIC had a market share of 66.4%, 66.2%,

64.1% and 61.6%, respectively, in terms of total premium in the Indian life insurance

sector. Accordingly, there is no assurance that LIC will not lose further market

share.

Further Losing Market share can be risk:

LIC has lower new policy growth rate as they continue losing market share to private

insurance players, especially in urban areas.

Company Description

LIC has been providing life insurance in India for more than 65 years and is the largest life insurer in India, with a 61.6% market share in terms of premiums (or GWP), a 61.4% market share in terms of New Business Premium (or NBP), a 71.8% market share in terms of number of individual policies issued, a 88.8% market share in terms of number of group policies issued for Fiscal 2021, as well as by the number of individual agents, which comprised 55% of all individual agents in India as at December 31, 2021.

The company offers participating insurance products and non-participating products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products. As of 31 Dec 2021, it has a total AUM of Rs. 40.1 lakh crore. LIC operates through 2048 branches, 113 divisional offices, and 1,559 Satellite Offices. It operates globally in Fiji, Mauritius, Bangladesh, Nepal, Singapore, Sri Lanka, UAE, Bahrain, Qatar, Kuwait, and the United Kingdom.

LIC has a broad, diversified product portfolio covering various segments across individual products and group products.

Its individual products comprise (i) participating insurance products and (ii) non-participating products, which include (a) savings insurance products; (b) term insurance products; (c) health insurance products; (d) annuity and pension products; and (e) unit linked insurance products.

Its individual products include specially designed products for specific segments, such as special products for women and children and Micro Insurance products. In addition, it offers riders that provide additional benefits along with the base product to cover for additional risks, such as accidental disability, death, critical illness and premium waiver on the death of the proposer. Its individual product portfolio in India comprises 32 individual products (16 participating products and 16 non-participating products) and seven individual riders. Its group products comprise (i) group term insurance products, (ii) group savings insurance products; (iii) group savings pension products; and (iv) group annuity products and its corporation’s group product portfolio in India comprises 11 group products.

Valuation

India’s life insurance industry is expected to grow rapidly, owing to a relatively under-penetrated market and expanding awareness, which present a multi-year growth potential. LIC has been providing life insurance in India for over 65 years and is the country’s biggest life insurer, with a significant brand value advantage.

We believe that LIC's distribution advantage, increasing sales mix of direct and corporate channels, and a gradual shift to high margin non-participating products could be potential drivers of LIC's future growth, offsetting lower-than-industry growth rates.

At the upper price band, the stock is priced at 1.11x of its September 2021 Embedded value (Market capital/Embedded value: 6 lakh Crore/5.39 lakh Crore), which is at a significant discount to its listed peers. Currently listed insurance companies trade at Mcap/EV multiple of 2.5x to 3x. We recommend to Subscribe the issue.

Key Information

Use of Proceeds:

The offer comprises Offer for sale of Equity Shares aggregating upto Rs.20,557Cr.

The objects of the Offer are to:

Achieve the benefits of listing the Equity Shares.

To carry out the Offer for Sale by the Selling Shareholder (President of India, acting through the Ministry of Finance, Government of India).

Book running lead managers:

Kotak Mahindra Capital, BofA Securities, Citigroup Global, Goldman Sachs, ICICI

Securities, JM Financial, J.P.Morgan, Nomura Financial, SBI Capital Markets. Axis

Capital Limited

Management:

Mangalam Ramasubramanian Kumar(Whole-time Chairperson ), Pankaj Jain(Government

Nominee Director), Raj Kumar(Managing Director), Debi Prasanna Mohanty(Executive

Director)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| PARTICULARS (INR Cr.) | FY19 | FY20 | FY21 | 9M FY22 |

|---|---|---|---|---|

| Premiums earned - Net | 339971.60 | 382475.50 | 405398.50 | 285341.90 |

| Interest, Dividends & Rent | 200021.00 | 222050.10 | 239565.00 | 189085.00 |

| Profit/ (Loss) on sale/redemption of Investments | 23897.20 | 19387.50 | 39809.60 | 36462.80 |

| Transfer/Gain on revaluation/change in fair value | 1125.30 | 1398.70 | 6145.80 | 705.90 |

| Others income (incl. MTM) | 5794.40 | 20293.60 | 12790.50 | 683.50 |

| Total Revenue | 570809.60 | 645605.50 | 703709.40 | 512279.20 |

| Commission | 20482.60 | 21548.30 | 22358.20 | 15538.10 |

| Operating Expenses related to Insurance Business | 28331.60 | 34425.90 | 35162.20 | 27267.30 |

| Other Expenses | 4832.40 | 19731.70 | 13456.20 | 0.30 |

| GST on Fund Mgt. charges & other charges | 109.80 | 98.30 | 93.20 | 55.70 |

| Provisions | 21157.90 | 35275.80 | 16482.80 | -273.50 |

| Total expenses | 74914.30 | 111080.00 | 87552.60 | 42587.90 |

| 495895.30 | 534525.50 | 616156.90 | 469691.30 | |

| Benefits paid (net) | 252380.80 | 255479.50 | 288489.10 | 234619.90 |

| Interim Bonuses Paid | 1651.40 | 1673.40 | 2229.10 | 2470.00 |

| Change in valuation of policy liabilities | 253585.50 | 296628.40 | 321134.00 | 239357.40 |

| Other Transfers | -9306.30 | -9106.80 | 442.90 | -8398.80 |

| SURPLUS/(DEFICIT) | -2416.10 | -10148.90 | 3861.80 | 1642.80 |

| Add: Share of Profit in Associates | 668.40 | 574.40 | 1163.40 | 2228.10 |

| (Less)/Add: Minority Interest | 2516.20 | 6372.70 | -446.50 | -3.00 |

| TOTAL SURPLUS/(DEFICIT) | 768.50 | -3201.80 | 4578.60 | 3867.90 |