Landmark Cars Limited - IPO Note

Automobiles - Dealers & Distributors

Landmark Cars Limited - IPO Note

Automobiles - Dealers & Distributors

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

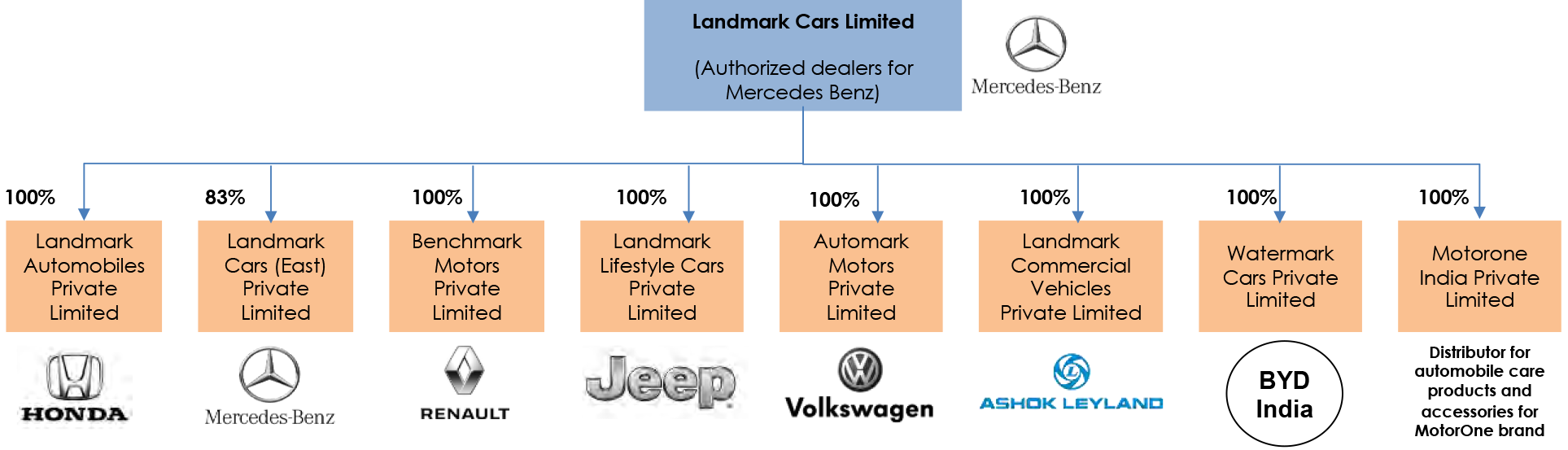

Company Description

Landmark Cars Limited (“Landmark”) was incorporated on February 23, 2006. Landmark is a leading premium automotive retail business in India with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen and Renault. They also cater to the commercial vehicle retail business of Ashok Leyland in India.

They were the number one dealer in India for Mercedes in terms of retail sales for Fiscal 2022, number one dealer in India for Honda and Jeep in terms of wholesale sales for Fiscal 2022 and were the top contributor to Volkswagen retail sales for calendar year 2021. In addition, they were the 3rd largest dealership in India for Renault in terms of wholesale sales contribution for calendar year 2021.

Landmark has a presence across the automotive retail value chain, including sales of new vehicles, after-sales service and repairs, sales of pre-owned passenger vehicles and facilitation of the sales of third party financial and insurance products.

Landmark buy and sell pre-owned passenger vehicles at each of their dealerships. They operate on 2 business models:

- They facilitate the sale of used vehicles through their appointed panel of agents on a commission basis; and

- They take the vehicles on their books for sale after any needed refurbishment

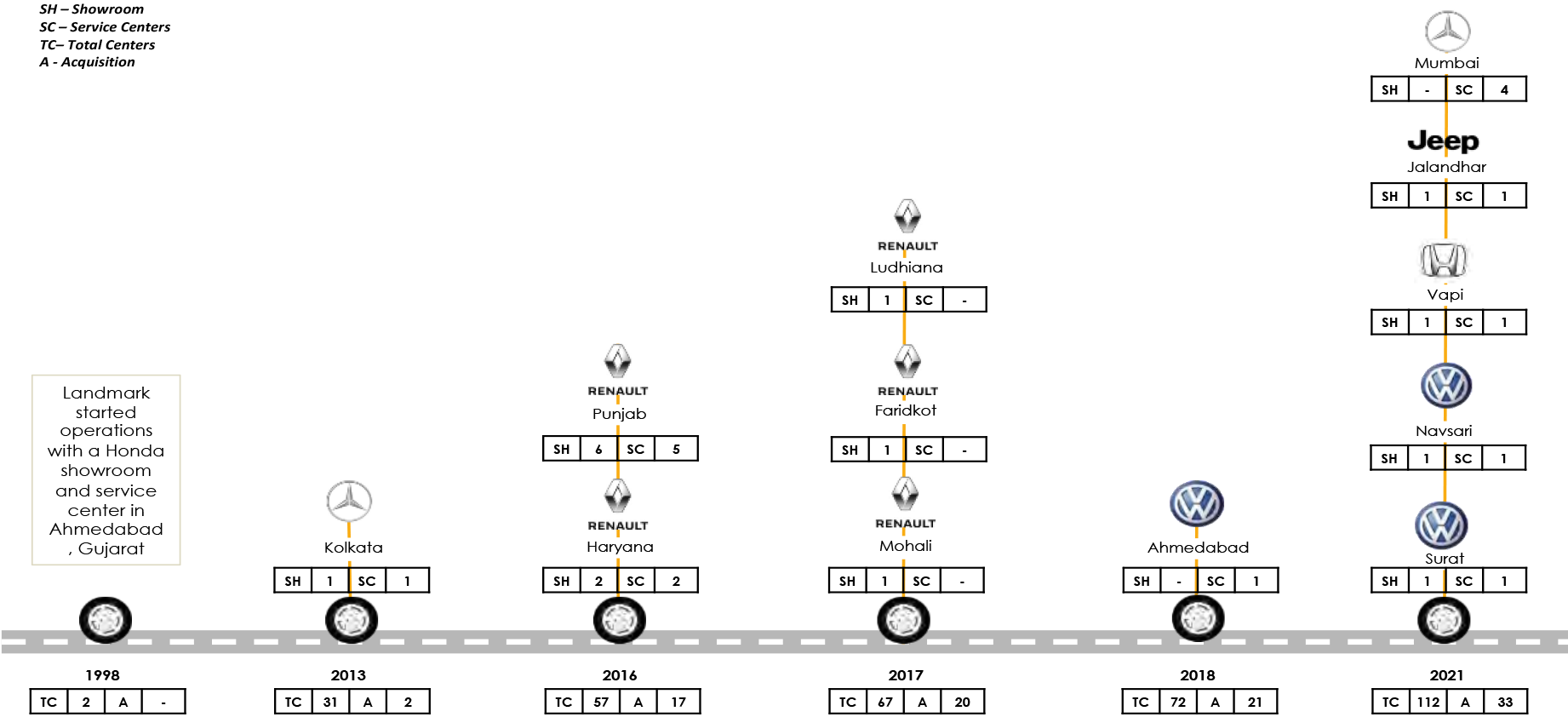

As of June 30, 2022, Landmark has network of 112 outlets in 8 Indian states and union territories, comprised of 59 sales showrooms and outlets and 53 after-sales service outlets.

Company’s vehicle dealership network is spread across 32 cities in 8 states and union territories including Maharashtra, Uttar Pradesh, Gujarat, Haryana, Madhya Pradesh, Punjab, West Bengal and Delhi.

The company operates as an authorized service centre for Mercedes-Benz, Honda, Volkswagen, Jeep, Renault and Ashok Leyland. Landmark Cars also provide after-sales service and repairs through 51 after-sales services and spare outlets, as of September 30, 2021.

Landmark has recently signed a letter of intent with the automaker BYD, a leading player in the global EV market, as a dealer in the National Capital Region (Delhi) and Mumbai in respect of their electric passenger vehicles.

Competitive Strengths

Leading automotive dealership for major OEMs with a strong focus on high growth

segments

Landmark is a leading premium automotive retail business in India with dealerships

for Mercedes-Benz, Honda, Jeep, Volkswagen and Renault. They were the number one

dealer in India for Mercedes-Benz, Honda, and Jeep in terms of wholesale sales for

Fiscal 2022 and were the top contributor to Volkswagen retail sales for calendar

year 2021. They were the 3 rd largest dealership in India for Renault in terms of

wholesale sales contribution for calendar year 2021. In Fiscal 2022, they contributed

15.8% to retail sales of Mercedes-Benz, 5.8% to wholesale sales of Honda, 8.7% to

wholesale sales of Volkswagen, 26.8% to wholesale sales of Jeep and 5.1% to wholesale

sales of Renault.

Company’s longstanding relationships with their OEM partners and their market leadership positions offer them several competitive advantages including:

- Opportunities from the OEMs allowing them to expand business into new cities and geographies;

- sharing infrastructure and manpower across brands to increase margins;

- attracting suitable inorganic dealership acquisition targets (with the support of the OEMs);

- opportunities to expand across business verticals like after-sales service, sales of pre-owned vehicles and sales of financial and insurance products;

- Attracting talented sales and technical personnel;

- executing large scale marketing and advertising campaigns; and

- Centralizing certain backend and support functions all of which leads to economies of scale and margin improvement.

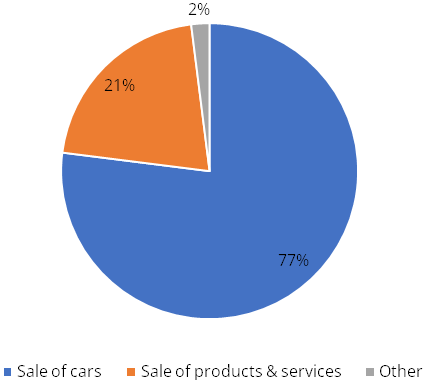

Growing presence in after-sales segment

Landmark operates as authorized service centers and provides after-sales service

and repairs. They also sell spare parts, lubricants, accessories, and other products.

Their after-sales service and spares business provide a stable revenue stream and

contributes to higher-margin revenues at each of their dealerships.

In the 3 months ended June 30, 2022, they earned an average of Rs.21,559 from each vehicle serviced, and they

serviced an average of 14 vehicles for every new vehicle sold in the period.

Revenue Breakup (FY22)

Their OEMs offer manufacturers’ warranties and maintenance programs packaged with vehicle’ sales and, generally, only permit warranty work to be performed at their authorized service centers. This creates a significant barrier to entry for new competitors.

Comprehensive business model capturing entire customer value-chain

Company’s business caters to the entire customer value-chain including retailing

new vehicles, servicing and repairing vehicles, selling spare parts, lubricants

and other products, selling pre-owned passenger vehicles and the distribution of

third party financial and insurance products. They benefited from the synergies

of these complementary businesses as well as increased customer retention from servicing

their customer’s various automotive needs.

Their service centers are also points of sale for spare parts, lubricants, and other products such as accessories as well as value added services such as interior cleaning, polishing and sales of extended warranties. Further, their service centres act as points of renewal for insurance policies and extended warranties from end of manufacturer warranty period onwards.

They also use their service centres to source pre-owned passenger vehicle opportunities for which they have sales teams stationed at their larger service centres.

Robust business processes leveraging technological innovation and digitalization

Landmark has established robust business processes which assist them in reducing

costs and increasing efficiency as well as ensuring faster operationalization of

new facilities. They have established processes for operationalizing new outlets

including purchasing inventory, selecting, and leasing premises and hiring sales

and technical personnel.

The company also has made forays into technology and platforms through their investments in Chatpay Commerce Pvt Ltd (known as “Pitstop”) and Sheerdrive Pvt Ltd (“Sheerdrive”).

Pitstop aims to be a multi-brand car service and repair and provide access to the necessary modern equipment and OES and white labelled spare parts.

Sheerdrive focused on used car transactions at new car dealerships by leveraging its digital SaaS platform that enables digital evaluation and real time used car prices.

Continue strategic acquisitions to expand geographic reach in premium and luxury

brands

Landmark will continue to seek to acquire dealerships to expand its geographic reach

in premium and luxury automotive brands.

The following diagram highlights how company has grown through strategic acquisitions during the periods indicated.

Financial performance for the last 3 years.

Landmark card Limited have reported steady earnings for the past 3 financial years.

Consolidated revenues for FY20 stood at Rs.2218.61 cr. Revenues slipped to Rs.1956

cr in FY21 and then it catapulted to Rs.2977 cr in FY22; registering a stellar growth

of 52% in FY23.

EBITDA witnessed a steady improvement from Rs.73 cr recorded in FY20 to Rs.175 cr in FY22. Company was able to maintain its EBITDA Margin at 6% in FY21 & FY22.

PAT registered a strong growth of 500% to Rs.66 cr in FY22 against Rs.11 cr in FY21.

Key risks

Increased competition: Automobile retailing is a highly competitive business. Increasing competition among automotive dealerships through online and offline marketing and competition from the unauthorized service centers may have an adverse impact on its business, results of operations and financial condition.

Rise in operating costs - Increasing inflation could cause a rise in the costs of rent, wages, and other expenses.

Availability of vehicles from OEMs - Chip shortage, Inflationary environment and supply chain disruptions could materially impact the supplies from the OEMs which in turn may impact company.

Other Risks:

Majority of the issue proceeds is Offer for sale: Out of total issue of Rs.552 cr.

Offer for sale is worth Rs.402 cr which means large majority of issue proceeds will

not accrue to the company. Only Rs.150 cr will be available for the company to use

for its growth.

Contingent Liabilities: Company has certain contingent liabilities and commitments worth Rs.281.94 cr.

Related Party transactions: Company, in the past has entered into, and will continue to enter into, third party transactions, which may potentially involve conflicts of interest with the Shareholders.

Valuation

On valuation front, Landmark cars Limited IPO is valued at 28x FY22E (EPS of Rs.17.88) calculated at the upper band of Rs.506.

Landmark Cars has demonstrated stellar revenue growth of 52.14% in FY22. It is well placed in its target markets no listed competitor. Considering its strategies to gain from entire customer value chain, entering the EV segment, long standing relationships with major OEMs improving financials and growing presence in after sales spare parts & services, the company is well poised to capture growth opportunities & grow its market share in the years to come.

We assign SUBSCRIBE rating to the issue for long term.

Key Information

Use of Proceeds:

Use of Proceeds: The total issue size is Rs. 552 cr, of which Rs.

150 cr is Fresh issue and balance (Rs.402 cr) is Offer for Sale (OFS). The company

will utilize the net proceeds of Rs.120 cr for pre-payment, in full or in part,

of borrowings availed by its subsidiaries and remaining (Rs.30 cr) for general corporate

purposes.

| Particulars | Rs. (in cr) |

|---|---|

| Pre-payment, in full or in part, of borrowings availed by its subsidiaries | 120 |

| General corporate purposes | 30 |

| Total | 150 |

Book running lead managers:

Axis Capital and ICICI Securities

Management:

Sanjay Karsandas Thakker (Promoter, Chairman and Executive director), Aryaman Sanjay

Thakker (Executive Director), Surendra kumar Agrawal (Chief Financial Officer),

Manish Blakishan Chokhani, Gautam Yogendra Trivedi, Sucheta Nilesh Shah and Mahesh

Pansukhlal Sarda (Independent Director).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (in Crores) | FY20 | FY21 | FY22 | Q1FY23 |

|---|---|---|---|---|

| Revenue | 2218.61 | 1956.10 | 2976.52 | 800.00 |

| COGS | 1894.84 | 1647.42 | 2511.74 | 661.73 |

| Gross Profit | 323.77 | 308.68 | 464.78 | 138.27 |

| Gross Margins (%) | 15.00% | 16.00% | 16.00% | 17.00% |

| Employee Benefits Expenses | 136.73 | 107.67 | 153.15 | 44.95 |

| Other expenses | 114.11 | 91.24 | 136.93 | 42.37 |

| EBITDA | 72.93 | 109.77 | 174.70 | 50.95 |

| EBITDA Margin (%) | 3.00% | 6.00% | 6.00% | 6.00% |

| Depreciation and Amortization | 62.95 | 62.47 | 69.79 | 20.83 |

| EBIT | 9.98 | 47.30 | 104.91 | 30.12 |

| Other Income | 10.31 | 10.23 | 12.59 | 1.63 |

| Finance Cost | 44.89 | 37.80 | 35.21 | 12.33 |

| Profit Before Tax | -24.60 | 19.73 | 82.29 | 19.42 |

| Tax Expenses | 4.29 | 8.63 | 16.00 | 1.52 |

| Effective Tax Rate (%) | -17.00% | 44.00% | 19.00% | 8.00% |

| PAT | -28.89 | 11.10 | 66.29 | 18.00 |

| PAT Margin (%) | -1.00% | 1.00% | 2.00% | 2.00% |

| EPS(Rs.) | (-7.84) | 3.09 | 17.88 | 4.86 |