Krishna Institute of Medical Sciences Limited - IPO Note

Hospital & Healthcare Services

Krishna Institute of Medical Sciences Limited - IPO Note

Hospital & Healthcare Services

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Regional Leadership Driven Clinical Excellence and Affordable Healthcare

As per the CRISIL report, KIMS is one of the largest corporate healthcare

groups in AP and Telangana in terms of number of patients treated and treatments

offered. It has 3,064 beds across nine multi-specialty hospitals in these states,

which is 2.2x more beds than the 2nd largest provider in AP and Telangana.

Its leadership in these states is driven by its clinical excellence and affordable

pricing. It delivers clinical excellence through quality healthcare services, supported

by a combination of medical talent, clinical and patient safety protocols and investments

in new medical technology. It has 18.2% share of cardiology treatments in two states.

It also has one of the largest neurosciences programs for epilepsy among private

hospitals in India. KIMS is one of the affordable hospital chains, among the multispecialty

hospital chains compared above, with an ARPP of Rs. 79,526. KIMS has an ARPP almost

41% lower than the average ARPP depicted by players below:

| Company | ARPP ('000) |

|---|---|

| Apollo Hospitals Enterprise Limited | 144 |

| Fortis Healthcare Limited | 141 |

| Healthcare Global Enterprises Limited | 74 |

| Krishna Institute of Medical Sciences Limited | 79 |

| KMC Speciality Hospitals (India) Limited | 63 |

| Max Healthcare Institute Limited | 219 |

| Narayana Health | 93 |

| Shalby Hospitals | 80 |

| Average ARPP | 112 |

Source: Company RHP

Ability to Attract, Train and Retain High Quality Doctors, Consultants, and Medical

Support Staff

KIMS maintains its standard of high-quality healthcare by consistently employing

a diverse pool of talented doctors, nurses, and paramedical professionals. Its multi-disciplinary

approach, combined with affordable cost for treatment, high-volume tertiary care

model, and focus on teaching and research, has helped it to attract and retain quality

doctors and other healthcare professionals. KIMS has taken efforts to create a culture

that nurtures its medical talents and encourage doctors to become stakeholders in

the KIMS hospitals. This culture of empowerment and ownership has encouraged learning

and training in its hospitals, and led to good talent retention and allowed patients

to create long-term relationships with the doctors.

Disciplined Approach to Acquisitions Resulting in Successful Inorganic Growth

KIMS has a successful history of sourcing, executing, and integrating acquisitions.

It has disciplined approach to acquisitions that has enabled it to maintain affordable

pricing model as it has grown in both Tier-I, Tier-II and Tier-III markets. Since

FY17, it has expanded the hospital network primarily through acquisitions of other

hospitals. It seeks to acquire hospitals that can fit into its hospital network

and match its existing hospital profile in terms of specialties, technologies, and

healthcare professionals.

To Strengthen Existing Hospitals and Specialties

KIMS intends to strengthen its existing hospitals by balancing specialty mix and

deepening expertise in select specialties. It has identified cardiac sciences, neurosciences,

gastric sciences, orthopaedics, renal sciences, among others as specialties that

it intends to strengthen and grow. In the area of organ transplantation, it recently

expanded clinical team in Secunderabad to provide heart and lung transplants in

addition to other organ transplant services. Further, it intends to offer organ

transplantation services in more hospitals in the future. It also aims to strengthen

oncology services by adding radiation and surgical services and introducing oncology

services at more hospitals. As demand for healthcare services in AP and Telangana

grows, KIMS will evaluate on increasing the bed capacity of existing hospitals.

It has sufficient capacity across its hospital network to add additional beds through

a mix of brownfield and greenfield projects.

Source: Company RHP

Strategically Grow Presence in Adjacent Markets

KIMS plans to expand its hospital network into markets that are adjacent to its

core markets of AP and Telangana, initially focusing on the following areas:

- Karnataka (Bangalore and greater Karnataka).

- Odisha (Bhubaneswar).

- Tamil Nadu (Chennai).

- Central India (Indore, Aurangabad, Nagpur, and Raipur).

Risks

- It is highly dependent on healthcare professionals, including doctors on a consultancy basis, and the business and financials could get impacted if KIMS is not able to attract and retain such healthcare professionals. The top ten doctors account for 22% of revenue and top 25 doctors account for 36% of revenue out of ~1,100 doctors who work in the organisation.

- The Covid-19 pandemic has affected its regular business operations and may continue to do so, depending on the severity and duration of the pandemic.

- Revenues are highly dependent on hospitals in Hyderabad, Telangana (~65% of revenues). It also significantly dependent on certain specialties for a majority of revenues. Any impact on the revenues from these hospitals or earnings from top specialties, could materially impact its business and financial condition.

- It faces intense competition from other healthcare service providers such as Apollo, Fortis, Healthcare Global, etc.

- Keeping pace with technological changes, new equipment and service introductions, changes in patients' needs and evolving industry standards is a must. Repairs and maintenance of medical equipment is a substantial cost every year ranging from Rs. 20-25 crores.

Company Description

Incorporated in 1973, Krishna Institute of Medical Sciences Limited (KIMS) is multi-disciplinary, integrated healthcare services company. It operates 9 multi-specialty hospitals under the ‘KIMS Hospitals’ brand, with an aggregate bed capacity of 3,064, including over 2,500 operational beds as of March, 2021. Its flagship hospital at Secunderabad is one of the largest private hospitals in India at a single location, with a capacity of 1,000 beds. It offers comprehensive range of healthcare services across over 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopaedics, organ transplantation, renal sciences, and mother & child care. It enjoys a dominant position in AP and Telangana in terms of number of patients treated and treatments offered.

It also conducts medical education programs through its affiliations with state medical boards and universities, for various broad and super specialties at its hospitals at Secunderabad and Kondapur, including for DNB and post-doctoral fellowship programs. As of March, 2021, there were 230 students enrolled in its DNB and postdoctoral fellowship programs. It also offers post-graduate, undergraduate and diploma programs that are affiliated with Kaloji Narayana Rao University of Health Sciences and the Telangana Para Medical Board.

| Particulars (Rs. in Crores) | CAGR (2019 - 2021) | As of and Year ended March | ||

|---|---|---|---|---|

| 2019 | 2020 | 2021 | ||

| Bed Capacity | 4.53% | 2,804 | 3,004 | 3,064 |

| Bed Occupancy Rate (%) | - | 71.83% | 80.49% | 78.60% |

| Inpatient Volume | 2.31% | 1,11,382 | 1,40,676 | 1,16,592 |

| Outpatient Volume | -3.96% | 9,00,043 | 11,37,560 | 8,30,211 |

| Particulars (Rs. in Crores) | Year Ended March | |||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | ||||

| Revenue | % | Revenue | % | Revenue | % | |

| Revenue from Contracts with Customers | 900.80 | 98% | 1,103.71 | 98% | 1,312.21 | 99% |

| Income from Hospital Services | 603.70 | 733.98 | 886.14 | |||

| Income from Pharmacy and Others | 297.10 | 369.73 | 426.07 | |||

| Other Operating Revenue | 17.21 | 2% | 18.94 | 2% | 17.73 | 1% |

| Income from Academic Courses | 5.83 | 6.16 | 6.21 | |||

| Income from Sale of Food & Beverages | 10.51 | 11.58 | 10.57 | |||

| Other Hospital Income | 0.88 | 1.20 | 0.95 | |||

| Total for Revenue from Operations | 918.01 | 100% | 1,122.65 | 100% | 1,329.94 | 100% |

Valuation

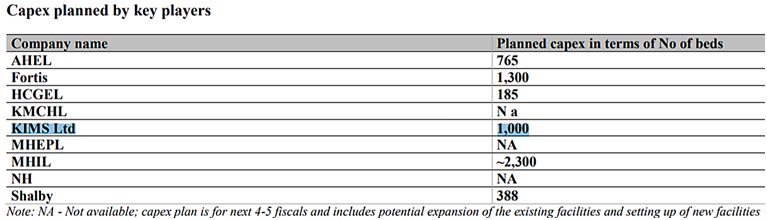

As mentioned in the RHP that in the next 4-5 years, KIMS capex plan is to add 1,000 beds. And the fact that capital cost for opening a hospital can be more than one crore/bed, we believe that this could impact on free cash flows and RoCE going forward. However, based on current strong occupancy rates of ~80%, growth in revenues and margins, and the leadership of Dr. Bhaskara Rao Bollineni, we recommend to subscribe the issue for listing gains. The IPO is valued at ~18x of EV/EBITDA of FY21.

Key Information

Use of Proceeds:

The net proceeds from the fresh issue are proposed to be utilised towards Repayment/pre-payment,

in full or part, of certain borrowings availed by the company and by their subsidiaries

viz. KIMS Hospital Kurnool Pvt. Ltd., Saveera Institute of Medical Science Pvt.

Ltd. and KIMS Hospital Enterprises Pvt. Ltd. and general corporate purposes.

Book running lead managers:

Kotak Mahindra Capital Company Limited, Axis Capital Limited, Credit Suisse Securities

(India) Private Limited, and IIFL Securities Limited

Management:

Dr. Bhaskara Rao Bollineni (Promoter and MD), Anitha Dandamudi (Whole-time Director),

Dr. Abhinay Bollineni (Promoter and Executive Director), and Vikas Maheshwari (CFO)

Financial Statement

| Particulars (Rs. in Crores) | FY19 | FY20 | FY21 |

|---|---|---|---|

| Equity Share Capital | 74.49 | 74.49 | 77.59 |

| Reserves as Stated | 466.17 | 523.64 | 786.14 |

| Net Worth as Stated | 540.66 | 598.13 | 863.73 |

| Revenue from Operations | 918.01 | 1122.65 | 1329.94 |

| Revenue Growth (%) | - | 22.29% | 18.46% |

| EBITDA as Stated | 86.82 | 251.08 | 381.05 |

| Adj. EBITDA as Stated | 173.95 | 251.08 | 381.05 |

| Adj. EBITDA as Stated (%) | 18.83% | 22.24% | 28.43% |

| Profit Before Tax | -15.38 | 140.53 | 279.01 |

| Net Profit/Loss for the Period | -48.81 | 115.07 | 205.48 |

| Net Profit/Loss (%) as Stated | -5.32% | 10.25% | 15.45% |

| Basic EPS | -6.91 | 16.00 | 26.87 |

| RoNW (%) | -8.84% | 19.93% | 23.30% |