Kalyan Jewellers Limited - IPO Note

Retailing

Kalyan Jewellers Limited - IPO Note

Retailing

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

Strong brand equity

Kalyan Jewellers has endeavoured to establish a strong brand in the Indian jewellery

market that their customers associate with trust and transparency. They were among

the pioneers in the Indian jewellery market in (a) educating consumers about the

industry issues; (b) instituting the highest quality standards for their jewellery,

and (c) introducing complete price transparency with their products. Through the

following initiatives, coupled with concurrent customer education and awareness

campaigns, particularly through their “My Kalyan” network, they have

helped strengthen their brand by building customer trust and promoting transparency.

BIS hallmarked jewellery: While selling BIS, hallmarked jewellery is expected to become mandatory in India in 2021, the company is selling only BIS hallmarked jewellery, which is independently verified for purity by government-approved agencies in accordance with BIS norms.

Detailed price tags disaggregating various components: All of their jewellery items are accompanied by a detailed pricing tag disaggregating the various components such as metal weight, stone weight, stone price and making charges to aid transparency to consumers.

Karatmeters to verify purity: Company’s showrooms offer karatmeters to allow customers to verify the purity of their gold jewellery as well as the jewellery they have previously purchased from other sources.

Transparency in gold exchange: In Fiscal 2020 and 9 months ended December 31, 2020, 27.13% and 31.50% of their revenue from operations involved customers exchanging or selling their previously purchased jewellery to them as payment for newly purchased jewellery. They have deployed a transparent process for valuing such exchange of customer gold, including verifying the exchanged gold purity in front of the customer to determine its fair value.

Product certification: With each purchase of jewellery they provide their customers with a “four level product certification” which assures purity, offers lifetime product maintenance, identifies exchange and buy-back terms and provides a detailed product description.

Relevant Staff Training: The company’s sales staff is trained to be forthright with customers and to develop trust with the aim of providing long-term customer satisfaction and winning repeat business rather than focusing on a one-time sale.

We believe the company has created a good brand network in short span of time, but in our view some store are still new (approx. 40% stores are opened in <2 years) and will take its own time to get mature. Hence profitability/per store is still an issue for the company.

One of India’s largest jewellery companies with a pan-India presence

The company is one of the largest jewellery companies in India based on revenue

as of March 31, 2020, according to the Technopak Report. The company has a pan-India

presence with 107 showrooms located across 21 states and union territories in India

and also have 30 showrooms located in the Middle East, as of December 31, 2020.

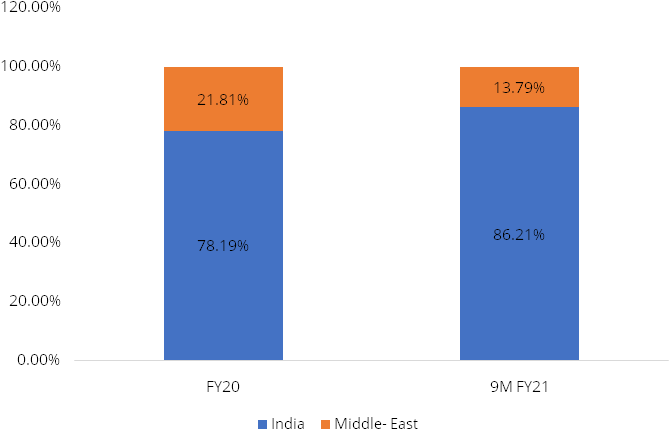

In Fiscal 2020 and in the nine months ended December 31, 2020, 78.19% and 86.21%

of their revenue from operations was from India and 21.81% and 13.79% was from the

Middle East.

Exhibit No 1: Revenue break-up

Source: Company RHP, Stockaxis research

While they started their operations in Kerala, over time the company has been able to successfully expand to become a pan-India jewellery company. As of December 31, 2020, 72 of their 137 showrooms were located outside of South India (South India includes Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Pondicherry and Karnataka). Kalyan Jewellers operations outside of South India contributed 57.69% and 49.92% of their gross profit and 47.81% and 40.40% of their revenue in Fiscal 2020 and in the nine months ended December 31, 2020. In addition, they have a relatively diversified presence across larger and smaller cities, semi-urban and rural regions. For Fiscal 2020 and in the nine months ended December 31, 2020, approximately 51.29% and 53.08% of their revenue in India was generated from sales outside of tier-I cities. Their total showrooms have increased from 77 as of March 31, 2015 to 137 as of December 31, 2020.

Despite of Pan India presence the company generates more than ~50% of revenues from south India. Company has started to enhance its footprint in other states, but we expect the company will face stiff competition from Branded as well as unbranded players in new territories.

Hyperlocal strategy enabling the company to cater to a wide range of geographies

and customer segments

Jewellery consumption patterns in India are highly localised with customer preferences

varying significantly by region, according to the Technopak Report. According to

the same report, this industry characteristic has acted as a significant barrier

for jewellery brands to scale up in India as it demands (a) a nuanced understanding

of local customer needs, (b) region-specific procurement and inventory models, which

require operating at sufficient scale to attract the best artisans, and (c) significant

investments in localised and region-specific marketing campaigns to build awareness

and trust with consumers. They strive to appeal to a broad base of customers via

a multi- faceted hyperlocal strategy by deploying the following initiatives in their

operations:

Localisation of the product portfolio: The company appeal to a wide audience by endeavouring to understand the local market preferences and trends in the geographies in which they operate and offering a range of jewellery products in their showrooms that are tailored to such tastes.

Localisation in brand communication and marketing: The company’s region- specific marketing efforts, including state and city-specific brand campaigns with differential, localised creative content and the use of various relevant brand ambassadors with national, regional and local appeal, is a core element of their brand positioning.

Localisation of the showroom experience for customers: Their localisation strategy is further supported by their policy of hiring personnel for each of their showrooms with local language and cultural knowledge, as well as their practice of designing the showrooms to reflect local tastes and sensibilities.

Localisation through the “My Kalyan” network: Through their strategy of catering to local preferences, combined with their large scale of operations, allows them to cater to a wide range of customers across geographies, age groups, socio-economic status levels and genders as well as across urban, rural and semi-urban markets, all of which greatly widens their appeal and addressability to broad segments of jewellery consumers across India.

We believe that, one of their key competitive strengths is their ability to operate as a hyperlocal jewellery company. They endeavour to cater to their customers’ unique preferences, which often vary significantly by geography and micro market, through their local market expertise and region-specific marketing strategy and advertising campaigns.

Extensive grassroots “My Kalyan” network with strong distribution

capabilities enabling deep customer outreach:

The company grassroots “My Kalyan” customer outreach network is a key

element of their hyperlocal strategy enabling them to be a neighbourhood jeweller

and is focused on marketing and customer engagement across urban, semi-urban and

rural areas in India. According to the Technopak Report, a significant proportion

of India’s gold jewellery demand originates from rural and semi-urban markets

where the penetration of organised jewellery companies has historically been even

lower than that of the overall Indian market. They believe that their network of

“My Kalyan” centres provides them with a marketing tool to help address

the latent demand that exists in some of these markets.

Wide range of product offerings targeted at a diverse set of customers:

Kalyan Jewellers products span jewellery for special occasions, such as weddings,

to daily-wear jewellery, and their product portfolio also caters to a wide range

of price points. The company has launched numerous sub-brands that address specific

customer niches such as:

Ornate wedding jewellery, which they sell through their “Muhurat” brand to their wedding customers;

High-volume, mass market jewellery, which they sell through their “Aishwaryam” brand to their value conscious customers;

Antique and heritage gold jewellery, studded with precious stones jewellery, polki and uncut diamond jewellery that they sell through their “Mudhra”, “Sankalp”, “Nimah” and “Anokhi” brands to the mid-to-high end customers; and

Technology savvy customers, to whom they cater through their online platform. Recognizing early the powerful potential of engaging customers online in an increasingly digitally connected world, they invested and acquired a majority stake in Enovate Lifestyles Pvt. Ltd. and its online platform, www.candere.com. Through this platform, the customers can purchase a wide variety of jewellery under the Candere and Kalyan brands, as well as enroll in their purchase advance schemes.

A description of company’s jewellery sub-brands and their target geographies and themes:

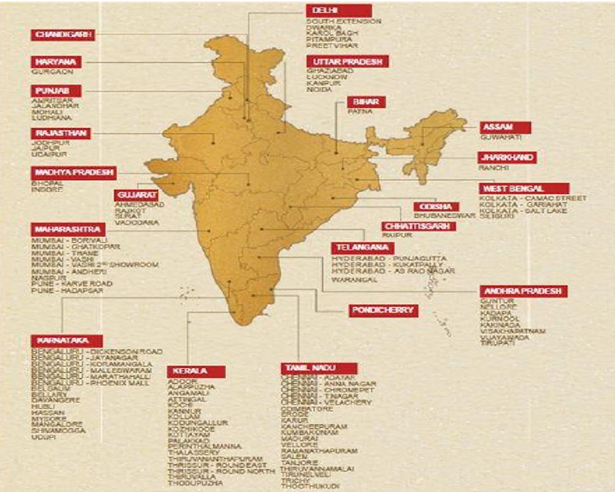

The showroom centre presence across India as of December 31, 2020

Source: Company, RHP

Though company has diversified product portfolio, we believe the company will struggle to cater new customers. Many differentiated products often confuse the new customers and it can adversely affect the business.

Robust and effective internal control processes to support a growing organisation

and showroom network with a pan-India presence

The company has established a robust set of operational and control processes to

manage their business operations and to support their future growth at both the

showroom and corporate level. Given the high value nature of their jewellery, their

inventory management and internal audit procedures are critical to the success of

their business. The company closely track their inventory starting from the initial

procurement of raw materials to its ultimate sale in their showrooms, including

by barcoding each piece of finished goods inventory and conducting daily counts

at their showrooms. These measures are coupled with an integrated enterprise resource

planning, or ERP, system. The ERP system is designed to permit the management to

manage all aspects of their operations, including procurement of raw materials and

semi-finished products, inventory management, sales and finance from a centralised

platform.

Widen product offerings to further increase consumer reach

The company intends to continue to increase their focus on studded jewellery going

forward as these products have wide consumer base and typically have a higher gross

margin profile than their gold jewellery. The company has tailored their showrooms

to offer prominent displays of diamond and other studded jewellery and, in many

cases, have entire floors dedicated to such jewellery. Furthermore, they have launched

a number of sub-brands around their studded jewellery range. Their revenue from

sales of studded jewellery increased from 20.65% of their revenue from operations

in Fiscal 2018 to 23.36% of revenue from operations in Fiscal 2020.

Industry

Indian jewellery market can be separated into two categories plain jewellery which contributes 80% and the rest is studded segment. Indian jewellery & gems market size is Rs 4.5 lakhs Cr, out of which plain jewellery market is estimated at Rs 3.5 lakhs Cr and studded jewellery at Rs 1 lakhs Cr. In India, total official gold import positions at 900 ton/annum while additional 100-150 ton is imported through the unofficial route. There is no regulation on the studded jewellery resulting in higher gross margins (25% +) compared to 5% in gold. In studded segments, jewelers only exchange their own products whereas in plain jewellery segment they exchange other products too, charging a haircut depending on the quality of gold. Most of the jewelers are positive about jewellery demand in India due to its USP as social security. In the recent past the Indian consumers were moving towards the studded jewellery however the local jewelers are facing a trend reversal due to less attractive resale value from their studded jewellery.

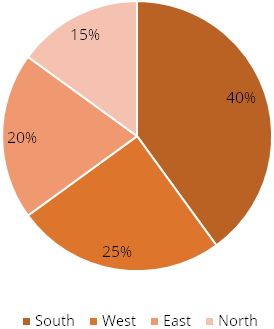

Indian consumers’ jewellery consumption is influenced by multiple factors such as region, income, cultural notions and generally vastly differs across states. Southern states make up 40% of the Indian gold jewellery market while the Eastern states account for 15%. Gross weight of gold worn by a bride in Kerala is more than double the weight of gold worn by a bride in Gujarat signifying that cultural factors scores over per capital income when it comes to regional skews observed in jewellery purchase in India. Customer service expectation also varies from one region to other. Wedding jewellery demand in particular is influenced by local traditions and designs. While the gross weight of an average wedding jewellery purchase is 200 gm in Uttar Pradesh, it is 350 gm in Kerala.

In the southern states of India, consumer purchasing behaviour gravitates towards traditional plain gold Jewellery where margins are typically lower. Consumers in the Northern and Western regions of India are more receptive to studded jewellery and impulse-led lighter-weight jewellery purchases (14k, 18k jewellery) viz-a-vis their southern counterparts. Plain gold jewellery typically has gross margins ranging from 10% to 14%, while diamond-studded jewellery has gross margins ranging from 30% to 35%. Consequently, as the studded ratio (studded jewellery/total revenue) goes up, profitability improves, thereby incentivising the expansion of south focused retailers towards the north, west and east.

Demand heterogeneity is also influenced by seasonality in jewellery purchases witnessed across regions in India. Jewellery demand peaks during the run up to marriage months such as May-June, September-November and January. Agriculture output and monsoon influences gold demand in Tier II and Tier III towns. Rural households invest their proceeds from harvests in gold jewellery during the months of November and December. Demand for gold and silver jewellery goes up during auspicious religious events like Diwali/Dhanteras in October and November and Akshaya Trithiya in April and May.

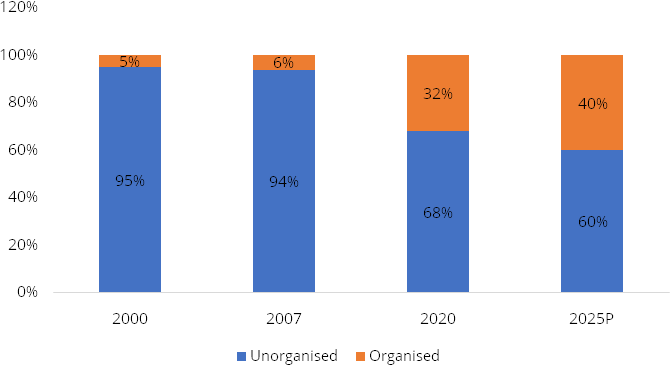

Exhibit No 2: Organised jewellery players are improving its market share

Source: Company RHP, Technopak

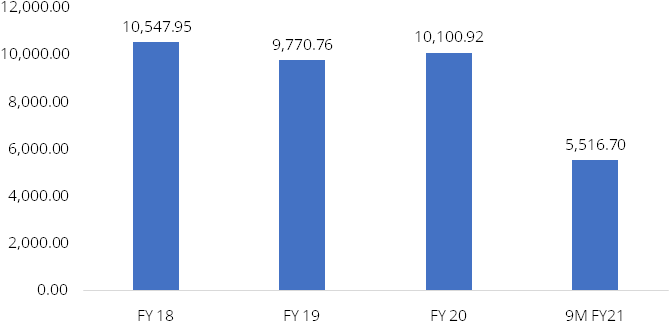

Financial Performance:

On the financial performance front, for the last three fiscals, Kalyan Jewellers

has (on a consolidated basis) posted total income/net profits (loss) of Rs. 10580.02

cr. / Rs. 141.00 cr. (FY18), Rs. 9814.03 cr. / Rs. - (4.86) cr. (FY19) and Rs. 10181.02

cr. / Rs. 142.28 cr. (FY20). For the first nine months of FY21 ended on December

31, 2020, it has incurred a loss of Rs. - (79.95) cr. on a turnover of Rs. 5549.80

cr. Thus, based on 9M-FY21, the issue is having negative P/E.

Exhibit No 3: Revenue trends (In Rs Cr)

Source: Company RHP, Stockaxis research

Exhibit No 4: Financial Snapshot (In Rs Cr)

| Particulars (Rs Cr) | FY 18 | FY 19 | FY 20 | 9M FY20 |

|---|---|---|---|---|

| Revenue from operations | 10,547.95 | 9,770.76 | 10,100.92 | 5,516.70 |

| EBITDA | 1,387.83 | 1,234.29 | 1,432.02 | 796.78 |

| Restated Profit/(Loss) for the year | 141 | -4.86 | 142.28 | -79.95 |

For the last three fiscals, Kalyan Jewellers has (on a consolidated basis) posted an average EPS of Rs. 0.98 and an average RoNW of 4.46%. The issue is priced at a P/BV of 3.97 based on its NAV of Rs. 21.94 per share as of December 31, 2020, and at a P/BV of 3.14 based on post issue NAV of Rs. 27.75 (at the upper price band).

Based on FY20 earnings the issue is priced at a P/E of 63.04 (based on fully diluted equity post issue). But considering its negative earnings for FY21-9M, it is at a negative P/E.

Peer Comparison:

Tanishq (Titan Company Limited) is the leader in the Indian Jewellery market with

3.9% share of the overall jewellery market and 12.5% share of the organized jewellery

market, based on Fiscal 2019.

For the same period, Kalyan Jewellers, also one of the largest jewellery companies in India based on revenues, had 1.8% share of the overall jewellery market and 5.9% share of the organized jewellery market.

Kalyan Jewellers is one of the largest jewellery retailers in India based on revenue as of March 31, 2020.

Retailers in the Indian jewellery Market

Leading organized jewellery retailers have had a diversified growth trajectory till

date. Players like Tanishq (Titan) and Kalyan have expanded well beyond their geographies

of origin to open a large number of stores across multiple different towns and regions

unlike many other organized jewellers that have remained largely focused on certain

cities, states and regions. Store format, price positioning and product offerings

also differ for players.

There are players that are focused on one region, such as Thangamayil, and Khazana in South India, PC Chandra in East India and PN Gadgil in West India, among others. Few multi-regional players such as TBZ, Malabar, Joyalukkas, PC Jeweller and Senco Gold are largely focused in certain regions but have expanded and opened stores in other regions, although to a certain and limited degree.

Furthermore, only a handful, such as Titan and Kalyan have established true pan-India businesses with a diversified footprint across the country.

Approximately 40% of India’s fine jewellery demand originates from five southern states, followed by approximately 25% of the demand from the western states, 20% from northern states and approximately 15% from eastern states. To categorize types of organized jewellery retailers, it is therefore imperative not only to profile them on their stores counts across regions but to map the adequacy of their retail presence in line with the demand distribution of jewellery purchase across the country.

Exhibit No 5: India’s jewellery market

Source: Company RHP, Stockaxis research

Risks

Higher input costs risks: The company manufacture products through a network of contract manufacturers and procure raw materials through suppliers. The ultimate risk of the raw materials lies with the company.

Unable to create brand pull: The company endeavour to open showrooms in optimal locations, however, changing consumer demographics in a particular market or changing lifestyle choices of consumers due to pandemics etc may have an adverse impact on company financials.

Competition risk: The company faces competition from both domestic as well as multinational corporations.

Currency risk: The company is subject to interest rate risk as well as foreign exchange rate risk

Geographic risks: The company generates more than 50% of revenues from South India. As a result, their business is susceptible to regional conditions in South India. An example would be in FY19 the company’s business was affected due to floods in South India.

Company Description

Kalyan Jewellers India Ltd (Kalyan Jewellers) is one of the largest jewellery companies in India based on revenue as of March 31, 2020, according to the Technopak Report. They were established by their founder and one of their Promoters, Mr. T.S. Kalyanaraman, who has over 45 years of retail experience, of which over 25 years is in the jewellery industry. They started their jewellery business in 1993 with a single showroom in Thrissur, Kerala.

Kalyan Jewellers has since expanded to become a pan-India jewellery company, with 107 showrooms located across 21 states and union territories in India, and also have an international presence with 30 showrooms located in the Middle East as of December 31, 2020. All of their showrooms are operated and managed by them. In Fiscal 2020 and in the nine months ended December 31, 2020, the revenue from operations was Rs. 10,100.92 cr and Rs5,516.70 cr, of which 78.19% and 86.21% was from India and 21.81% and 13.79% was from the Middle East. Their total showrooms have increased from 77 as of March 31, 2015 to 137 showrooms as of December 31, 2020, and they intend to continue to open additional showrooms as they expect significant opportunity for further penetration in their existing markets as well as in new markets, primarily in India. The company also sell jewellery through their online platform at www.candere.com.

The company design, manufacture and sell a wide range of gold, studded and other jewellery products across various price points ranging from jewellery for special occasions, such as weddings, which is their highest-selling product category, to daily-wear jewellery. In Fiscal 2020 and in the nine months ended December 31, 2020, 74.77% and 75.88%, respectively, of their revenue from operations was from the sale of gold jewellery, 23.36% and 21.72%, respectively, was from the sale of studded jewellery (which includes diamonds and precious stones), and 1.87% and 2.40%, respectively, was from the sale of other jewellery.

Showroom Network

As of December 31, 2020, the company had 107 showrooms located across 21 states

and union territories in India, which covered a total aggregate area of 4,65,235

sq. ft. as well as 30 showrooms located in the Middle East, which covered a total

aggregate area of 38,056 sq. ft. All of their showrooms are operated and managed

by them.

The showroom centre presence across India as of December 31, 2020

Source: Company RHP, Stockaxis research

Valuation

Kalyan Jewllers Limited is one of the largest jewellery companies in India. It is positioned well in the organised jewellery market. The company faced multiple headwinds in the past such as floods in FY19 and Covid-19 in FY20 . Notwithstanding of strong footprint in South India, the company has poor return ratios, and slower growth rates in terms of revenue and profitability when compared to listed regional player Thangamyil limited. Despite of strong brand equity, Pan India presence, extensive reach and diversified product portfolio the company had a lacklustre financial performance in the past and is not attractive from the point of valuations. At upper price band the company trades at PE of 63.04x while its regional peer Thangamyil trades at PE of 10x and Titan trades at PE of 85x given its superior performance, while on 9M FY21 basis company has suffered losses hence reflects a negative PE. Hence looking at the expensive valuations and lacklustre financial performance we recommend to “Avoid” to the issue.

Key Information

Use of Proceeds:

| Use of Proceeds | (In Rs Cr) |

|---|---|

| Funding working capital required | 600 |

| General corporate purposes | - |

The price band is in the range of Rs.86-87/share. The total issue size is of Rs.1,175 cr (at Rs.87/share). It includes fresh issue of equity shares aggregating upto Rs800 cr and offer for sale (Mr. T.S. Kalyanaraman – The Promoter Selling Shareholder:Rs125 cr and HighDell Investment Ltd – Investor Selling Shareholder:Rs250 cr ) upto Rs375 cr.

Book running lead managers:

Axis Capital Limited, Citigroup Global Markets India Private Limited, ICICI Securities

Limited, SBI Capital Markets Limited and BOB Capital Markets Limited.

Management:

T S Kalyanaraman is one of the Promoter, the Chairman and Managing Director of the

company, T K Seetharam is one of the Promoters and a whole-time Director of the

company, & T K Ramesh is one of the Promoters and a whole-time Director of the company.

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs Cr) | FY 18 | FY 19 | FY 20 | 9M FY20 | 9M FY21 |

|---|---|---|---|---|---|

| Revenue from operations | 10547.95 | 9770.76 | 10100.92 | 7960.20 | 5516.70 |

| Other income | 32.25 | 43.27 | 80.10 | 39.77 | 33.09 |

| Total income | 10580.20 | 9814.03 | 10181.02 | 7999.97 | 5549.80 |

| EXPENSES | |||||

| Cost of sales | 8801.70 | 8198.34 | 8391.77 | 6667.98 | 4518.43 |

| Excise duty on sale of goods | 21.93 | 0.00 | 0.00 | - | 0.00 |

| Employee benefits expense | 368.74 | 381.40 | 357.23 | 268.06 | 234.59 |

| EBITDA | 1387.83 | 1234.29 | 1432.02 | 796.78 | |

| Finance costs | 349.18 | 379.06 | 380.32 | 287.53 | 288.78 |

| Depreciation and amortisation expense | 202.03 | 223.62 | 239.17 | 179.09 | 170.05 |

| Other expenses | 622.83 | 610.68 | 591.66 | 443.45 | 397.08 |

| Total expenses | 10366.41 | 9793.10 | 9960.13 | 7846.12 | 5608.91 |

| Restated Profit/ (loss) before tax | 213.79 | 20.93 | 220.89 | 153.86 | -59.12 |

| Tax expense | |||||

| Current tax | 75.37 | 20.44 | 59.13 | 40.11 | 45.48 |

| Deferred tax | -2.57 | 5.35 | 19.48 | 19.43 | -24.65 |

| Total tax expense | 72.79 | 25.79 | 78.61 | 59.53 | 20.83 |

| Restated Profit/(Loss) for the year | 141.00 | -4.86 | 142.28 | 94.32 | -79.95 |

| Owners of the Company | 142.37 | -3.61 | 143.00 | 94.89 | -80.49 |

| Non controlling interests | -1.38 | -1.26 | -0.72 | -0.56 | 0.54 |