Indigo Paints Limited - IPO Note

Paints

Indigo Paints Limited - IPO Note

Paints

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Consistent Track Record

Indian decorative paint industry has significant entry barriers, which includes

the development of an extensive distribution network through relationships with

dealers, ability to set up tinting machines with dealers, significant marketing

costs and establishment of distinct brand to gain product acceptance. The company’s

differentiated strategic approach in addressing these issues has resulted in its

continued success.

The company’s revenue from operations have grown at a CAGR of 41.9% between FY 2010 - FY 2019, compared to the range of 12.1% to 13.1% recorded by the peer companies in the country. Despite FY 2020 being impacted by overall economic slowdown and Covid-19 pandemic, its revenue from operations have grown by 16.7% YoY, against the range of -8.8% to 4.9% recorded by its peers. The company has achieved this position in a highly competitive Indian decorative paint industry on the back of its multi-pronged approach, which includes introducing differentiated products to create a distinct market in the industry, building brand equity for the primary consumer brand – Indigo, creating an extensive distribution network, and installing tinting machines across the network of dealers.

Differentiated Products

Indigo Paints consistently seeks to launch first-to-market products by identifying

niche product opportunities and introducing products that address these requirements.

It first introduced its metallic emulsions in 2005 and since then has entered new

markets by consistently introducing other differentiated products. It introduced

PU super gloss enamel in 2016 and dirtproof & waterproof exterior laminate in

2017, resulting in a portfolio of seven differentiated products as of September

2020.

As the first company in India to develop certain category-creator products, the company has early-mover advantage in the markets it is present in, which has allowed it to set the pricing terms for these products, resulting in higher margins for these products compared to the rest of its product portfolio. On account of the distinct markets the company caters to, and as only few other companies continue to manufacture these products, it focused its marketing efforts on this portfolio, resulting in increased acceptance and demand, thereby enhancing brand recognition for these products across their network of dealers. Accordingly, revenue generated, i.e., invoicing as per contracted price, from sales of Indigo Differentiated Products represented 28.62% of its total revenue from operations in FY 2020.

Focused Brand-building Initiatives

Indigo Paints has strategically undertaken brand-building initiatives to gain visibility

with prudent use of resources, gradually increasing branding and marketing expenses

consistent with the growth of their business. The advertisement and sales promotion

expenses represented 12.65% of the revenue in FY2020. The advertising and promotion

spend as a percentage of revenue from operations of the top four paint companies

was in the ranges of 3.3% to 5.0% in FY 2020. The media advertising spends of Indigo

Paints in FY2020 is comparable to spends incurred by the major companies, excluding

the market leader.

The focused brand building efforts have helped develop brand equity with limited spend over the years in a market that has historically been dominated by companies that have invested considerable resources on developing their brand over several decades. The company has leveraged its brand recognition and goodwill in the market for its Indigo Differentiated Products, by gradually introducing and gaining visibility for its other product segments. This approach has allowed the company to efficiently manage marketing and advertisement expenses and yet achieve extensive brand recognition within a relatively short period of time.

Extensive Distribution Network

Paint companies are required to spend significant resources to develop their distribution

network to increase the visibility and reach of their products through direct distribution

to dealers. The dealers are typically multi-brand and are located across metros,

large cities, towns as well as rural areas. For a paint company, the market knowledge,

financial resources and time required to develop such a network is significant

Indigo Paints, through the bottom-up approach, has established its distribution network gradually and strategically with prudent use of time, cost and resources. This has helped the company to engage with a larger dealer base across Tier-3, Tier-4 Cities and rural areas which it has subsequently leveraged to expand into larger cities and metros. The company first approached dealers with its Indigo Differentiated Products, being products with greater marketability, to improve penetration of its brand and strengthen the relationship with these dealers. As of March 2020, its distribution network comprised 11,230 active dealers across the country. For efficient service, the company engages with dealers through 34 depots.

Leveraged Brand Equity and Distribution Network to Populate Tinting Machines

In Indian decorative paint industry, Emulsions are the largest and among the fastest

growing product segment. As per F&S Report, the market for emulsions was valued

at Rs. 163.9 billion in FY 2019 and is expected to reach at Rs. 309.5 billion by

Fiscal 2024, growing at a CAGR of 13.60%. Different shades of emulsion paints are

produced through in-shop tinting machines present at dealer outlets. These tinting

machines are unique to each paint manufacturer due to design specifications including

with respect to colorants, emulsion bases, fan-decks or shade cards, and customized

software applications. The machines are a prerequisite for dealers who sell emulsion

paints.

However, stiff resistance for installation of these machines is encountered from dealers due to space constraints. As a result, dealers tend to install tinting machines of only recognized players. Indigo Paints started installing tinting machines in FY2014, which gained momentum from FY2018. During the last 3 years, the company has installed an average of 1,223 tinting machines every year and as of March 2020, it has a total of 4,296 tinting machines across its network of dealers in India.

Strategically Located Manufacturing Facilities with Proximity to Raw Materials

As of September 2020, the company operates three manufacturing facilities, located

in Rajasthan, Kerala and Tamil Nadu. The aggregate estimated installed production

capacity has increased progressively over the years and stands at 101,903 KLPA and

93,118 MTPA as of March, 2020. These manufacturing facilities are strategically

located in proximity to their raw material sources, which reduces inward freight

costs and results in lower cost of raw materials.

The facility in Rajasthan is used to manufacture water-based paints, cement-based paints and putties. For water-based and cement-based paints, the principal raw materials are white cement, minerals including lime, dolomite, calcite and talcum, and acrylic emulsions, which are abundantly available in Rajasthan and in its neighbouring state, Gujarat. In FY 2016, the company has acquired Ji-Build Coatings Pvt. Ltd. and its facilities in Kerala and Tamil Nadu to strengthened its presence in southern India and gained access to solvent-based paints. For water-based paints manufactured at Kerala, the principal raw materials are acrylic emulsions that the company predominantly source from the neighbouring states of Tamil Nadu and Karnataka, minerals are principally imported from Vietnam, and titanium dioxide and china clay that are available within Kerala. For solvent-based paints manufactured at Tamil Nadu, the principal raw materials include alkyd resins which are mainly sourced from manufacturers based in the state and the neighbouring state of Telangana, and turpentine oil that is available from refineries within the state.

Industry

The Indian paint industry has a three-stage setup comprising raw material suppliers, manufacturers and sellers. Most of the raw materials in the paint industry are petroleum based, supplied by petrochemical companies. A few companies adopt contract manufacturing, while bigger companies have their own manufacturing facilities. The larger chemical companies are vertically integrated in both the raw materials and paint production stages while others are pure-play producers of paint and coatings. Most sales are driven through dealer and distributor networks, which sell onwards to local buyers. Hardware stores are usually the retailers in the paint and coating industry, while the other major retailers may have paint and coating segments within their broad range of offerings. Direct sales are a minor component of overall sales.

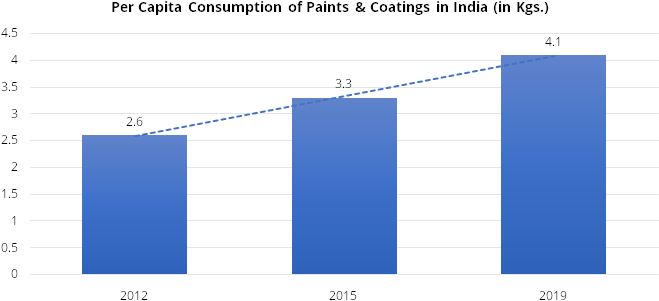

India’s per capita consumption of paints and coatings stands at 4.1 kgs. in 2019 compared to 4.7 kgs. in Asia Pacific and 9.7 kgs. in developed countries of Asia Pacific. India's consumption has increased by a CAGR of 6.8% in the last seven years from 2.6 kgs. in FY 2012 to 4.1 kgs. in FY 2019, compared to the global average consumption of approximately 14 - 15 kgs., the per capita consumption of paints and coatings in India is low, signalling a significant opportunity for market penetration in India.

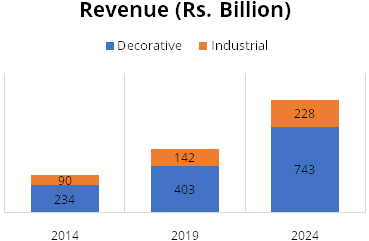

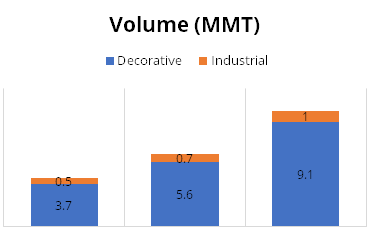

Source: RHP, StockAxis Research

The decorative paint segment constitutes ~74% of the total paint sales, resulting in the paint sector growing at a robust rate even at the time of an industrial slowdown. The industry (Decorative and Industrial Paints) has growing at a CAGR of 11% from 2014 – 2019 and is expected to reach Rs. 971 billion in 2024, registering a growth of ~12% CAGR from 2020 – 2024. In Volume terms, the industry has grown from 4.1 MMT in 2014 to 6.3 MMT in 2019, a growth of 9% CAGR. Further, the industry volumes are expected to reach at 9.4 MMT in 2024, thereby growing a CAGR of 8.3% for the period of 2020 – 2024.

Source: RHP, StockAxis Research

Source: RHP, StockAxis Research

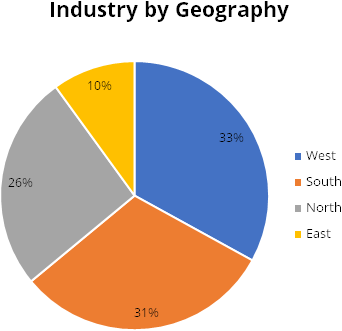

Geographically, the western and southern regions of India account for over 60% of the total demand for paints. For the industry, metros and Tier 1 areas contribute a much lower share in terms of value as compared to the smaller towns and rural areas. For the past few years, the demand from smaller cities and towns has been growing at a faster pace than metro and Tier 1 Cities. The paint companies have been proactively expanding their dealer base in newer geographies, especially Tier 2 – 4 Cities and rural areas, to ensure adequate presence. Most of the bigger players are expanding their capacities and setting-up their plants in the southern regions which is also expected to see a major growth in demand during the forecast period.

Source: RHP, StockAxis Research

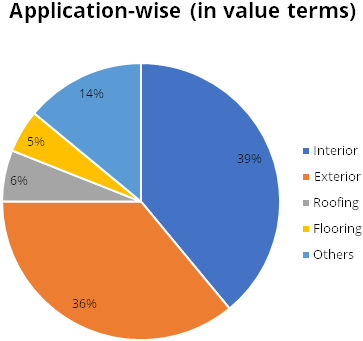

In value terms, Indian decorative paints segment of the industry is expected to growth at a CAGR of ~13% and in volume terms it is expected to grow 10.2% from 2020-2024, driven by a number of factors such as increase in disposable income and numerous housing schemes. The GoI schemes and policies like ‘Housing for All’ will also be a major driver for growth of fresh painting. With more such initiatives targeted for the regional population, the demand from smaller cities and towns is estimated to grow faster.

Within decorative segment, enamels and emulsion paints are the fastest growing sub-segments. Emulsions are the largest sub-segment with increasing popularity among the masses as they are less toxic than most oil-based paints, release a smaller number of VOCs and are devoid of any strong odour. Increasing penetration of emulsions is driven by the varying degrees of shine that manufacturers offer in these paints. The data in the table below is the CAGR growth recorded by the Indian decorative paints industry, segmented based on sub-product type, in terms of value (Rs. billion):

| CAGR | Enamels | Emulsions | Primers | Distempers | Wood Coatings | Putties | Others |

|---|---|---|---|---|---|---|---|

| 2014-19 | 13.6% | 11.4% | 11.8% | 9.9% | 8.6% | 10% | 8.4% |

| 2019-24P | 14.2% | 13.6% | 12.3% | 10.9% | 9.6% | 11.7% | 11% |

Source: RHP, StockAxis Research

The Indian decorative paint industry has been witnessing a gradual shift in preferences from the traditional whitewash to high-quality paints like emulsions and enamel paints, providing stable base for growth of Indian paint industry. In addition, it is creating a strong competitive market, where players are adopting different strategies to tap the growing demand in the market for a larger share. Further, increased focus on education, urbanization, development of the rural market, and introduction of many innovative products such as odour free, and dust and water-resistant paints, are major drivers that are propelling the growth of the paint market in India.

The demand for roofing and flooring paints is also gaining momentum mainly from residential buildings. Roofing coats offer benefits such as thermal insulation and water proofing. Paint companies are now promoting products and the benefits associated with them which has led to increased consumer awareness, and corresponding increase in sales of roofing and flooring paints.

Source: RHP, StockAxis Research

Fresh painting accounts for ~22% of the decorative paint demand. Of this, the share of unorganized players tends to remain high as not all builders provide high quality paints in newly constructed houses. Some builders opt for low-quality distempers with the assumption that buyers will either get interiors done or repaint their houses as per their choice. Accordingly, opting for local paints allows builders to reduce cost of construction. This leads to incremental demand of repainting using better-quality paints. Re-painting represents ~78% of the demand in the decorative segment in India.

In the last decade, the average re-painting cycle has gradually reduced from an interval of 7-8 years in 2010 to 4-5 years in 2019. Earlier the major factor for re-painting the house was the life of paint coat i.e., repainting was done only when paint withered. However, this trend has been changing gradually with some consumers giving more importance to aesthetics, change in looks and appearance of their premises at regular intervals even while the condition of the existing paint is good. These consumer behavioural changes have led to reduction in repainting cycle.

Peer comparison

| Particulars | Asian Paints | Berger Paints | Kansai Nerolac | Akzo Nobel | Indigo Paints |

|---|---|---|---|---|---|

| Revenue CAGR (FY10-19) | 12.80% | 13.10% | 12.10% | 12.50% | 41.90% |

| Revenue Growth FY20 (YoY) | 4.90% | 3.20% | -4.50% | -8.80% | 16.60% |

| Revenue Growth (%) H1FY21 vs H1FY20 | -19.00% | -22.00% | -30.00% | -36.00% | -5.00% |

| EPS (FY20) | 28.20 | 6.77 | 9.67 | 52.13 | 10.61 |

| P/E (x) | 91.77 | 114.62 | 66.70 | 43.60 | 140.43 |

| ROE (%) FY20 | 28.10% | 26.60% | 14.10% | 19.20% | 24.30% |

| ROCE (%) FY20 | 33.10% | 30.00% | 17.50% | 23.90% | 27.50% |

| Tinting Machines (FY20) (in 000s) | 46.00 | 20.00 | 17.00 | 5.50 | 4.30 |

| Tinting Machine CAGR FY18-FY20 | 14.60% | 19.50% | 30.40% | 31.10% | 51.20% |

| Dealer Network FY20 | 70000.00 | 27500.00 | 30000.00 | 15000.00 | 11230.00 |

| Dealer Network CAGR (FY18-FY20) | 14.90% | 17.30% | 10.00% | -4.70% | 10.40% |

| Depots (FY20) | 138.00 | 104.00 | 164.00 | 52.00 | 34.00 |

| Depot Growth CAGR (FY18-FY20) | 3.00% | 1.00% | 2.50% | 6.30% | 3.00% |

| Advt. & Prom. Exp. (% of Sales) FY20 | 4.60% | 4.20% | 5.00% | 3.30% | 12.70% |

Risks

- The company operates in a highly competitive business environment, in which other players have larger business operations, greater financial resources, wider network, access to cheaper cost of capital, etc. The inability of the company to compete and sell at competitive prices may have a material adverse effect on the company’s operations and profitability.

- The company’s ability to grow its business depends on its relationships with its dealers and the community of painters, and any adverse changes in these relationships, or inability of the company to enter into new relationships, could adversely affect its business.

- The business of the company is subject to seasonal variations and cyclicality that could result in fluctuations in its results of operations.

- The company remains susceptible to the risks arising out of raw material price fluctuations and in particular fluctuation of crude oil prices which could result in declining operating margins.

Company Description

Indigo Paints Limited (Indigo Paints) manufactures a complete range of decorative paints including emulsions, enamels, wood coatings, distempers, primers, putties and cement paints. It claims to be the 1st company to manufacture and introduce certain differentiated products in the decorative paint market in India because of which, it has an early mover advantage in the current markets, which has allowed it to realize relatively higher margins for these products compared to the rest of its product portfolio.

As of September 2020, the company has three manufacturing facilities located in Rajasthan, Kerala and Tamil Nadu with an aggregate estimated installed production capacity of 101,903 KLPA for liquid paints and 93,118 MTPA for putties and powder paints. The manufacturing facilities are strategically located in close proximity to raw material sources that reduces inward freight costs. It also intends to expand manufacturing capacities at its Tamil Nadu facility, by adding capacities to manufacture water-based paints. The proposed installed production capacity of the expansion unit is 50,000 KLPA and it is expected to be operational during FY 2023.

In revenue terms, Indigo Paints has achieved the position of 5th largest company in the Indian decorative paint industry on the back of its multi-pronged approach, which includes introducing differentiated products to create a distinct market in the paint industry, building brand equity for its primary consumer brand – Indigo, creating a wide distribution network across 27 states and 7 union territories and installing tinting machines across their network of dealers.

To strategy which the company implements to create demand for its differentiated products is to tap into Tier-3, Tier-4 cities, and rural areas, where brand penetration is easier and dealers have greater ability to influence customer purchase decisions. The company is gradually leveraging this network to engage with dealers in Tier-1, Tier-2 and metros cities. The company engaged Mahendra Singh Dhoni as its brand ambassador to enhance its brand image amongst end-customers. Indigo Paints focuses these branding efforts on its differentiated products and then leverages these efforts to increase distribution and sale of its complete range of decorative paint products.

Valuation

Indigo Paints is the fastest growing amongst the top five players in India and has a consistent track record of sales. The company has posted a strong revenue CAGR of ~42% from FY10-19 compared to 12-13% growth posted by the top four players in the same period. Even in the period of covid-19 pandemic, the company has performed better than its peers in the industry. Further, the company’s focus on differentiated products has given it early-mover advantage resulting into higher margins plus these differentiated products have aided the company to build a strong brand equity which also allows it to push its other decorative paint products. The company’s strategy to increase its presence by tapping its distribution network by adding more dealers (~2,000 – 2,500/year) and tinting machines (1,000 – 1,500/year) will aid its growth further. At higher price band of Rs. 1,490 the issue is value at 140.43x of its FY2020 EPS. We recommend to Subscribe to the issue for listing gains.

Key Information

Use of Proceeds:

The net proceeds are proposed to be utilised towards:

- Funding capital expenditure for expansion of the existing manufacturing facility at Pudukkottai, Tamil Nadu by setting-up an additional unit adjacent to the existing facility.

- Purchase of tinting machines and gyroshakers.

- Repayment/prepayment of all or certain of their borrowings.

- General Corporate Purposes.

Book running lead managers:

Kotak Mahindra Capital Company Limited, Kotak Mahindra Capital Company Limited and

ICICI Securities Limited.

Management:

Hemant Jalan (Managing Director and Chairman), Chetan Bhalchandra Humane (CFO),

Thundiyil Surendra Suresh Babu (COO).

Financial Statement

Profit & Loss Statement:- (Standalone)

| Particulars (Rs. Crores) | FY 2018 | FY 2019 | FY 2020 | H1 FY 2021 |

|---|---|---|---|---|

| Net Sales | 395.07 | 535.63 | 624.79 | 259.42 |

| Total Expenditure | 369.27 | 481.54 | 533.80 | 211.33 |

| EBITDA | 25.80 | 54.09 | 90.99 | 48.09 |

| EBITDAM(%) | 6.53% | 10.10% | 14.56% | 18.54% |

| Depreciation | 9.02 | 17.05 | 19.61 | 11.22 |

| Earnings Before Interest and Tax | 16.78 | 37.04 | 71.38 | 36.87 |

| EBITM (%) | 4.25% | 6.91% | 11.42% | 14.21% |

| Interest | 4.54 | 4.66 | 5.60 | 2.47 |

| Other Income | 1.63 | 1.63 | 1.64 | 0.82 |

| Profit Before Exceptional Items & Tax | 13.87 | 34.02 | 67.43 | 35.23 |

| Exceptional Items | 1.32 | 0.31 | - | - |

| Profit Before Tax | 12.55 | 33.71 | 67.43 | 35.23 |

| Tax | -0.31 | 6.84 | 19.61 | 8.02 |

| Profit After Tax | 12.86 | 26.87 | 47.82 | 27.21 |

| PATM (%) | 3.25% | 5.02% | 7.65% | 10.49% |

| Earnings Per Share | 2.88 | 5.98 | 10.61 | 6.03 |