Indian Railway Finance Corporation - IPO Note

Finance - NBFC

Indian Railway Finance Corporation - IPO Note

Finance - NBFC

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Strategic Role in Financing Growth of Indian Railways

IRFC was incorporated as the dedicated market borrowing arm for the Indian Railways and have played a strategic role in financing its operations. In FY 2020, IRFC financed Rs. 71,392 crores, which is 48.22% of the actual capital outlay of Indian Railways. The cumulative funding made by IRFC to the Rail Sector since its inception to the end of March 2020, is of the order of Rs. 3.39 lakh crores, out of which Rs. 2.33 lakh crore has been funded during the period from FY 2015 to FY 2020, constituting ~69% of its overall contribution. The company owns more than 80% of Indian Railways’ Rolling Stock fleet valued at Rs. 2.28 lakh crores.

As per Centre for Railway Information Systems estimates, in order to achieve a GDP of USD 5 trillion by 2024–25, India needs to spend about USD 4.51 trillion, over these years on infrastructure. And it plans to do so, under its ambitious National Investment Plan (NIP), of which Railways has a sizeable share of around ~13%.

Competitive Cost of Borrowings

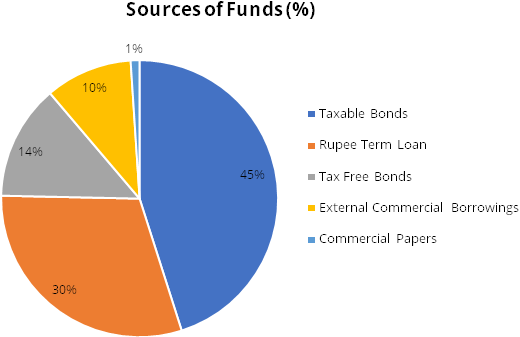

IRFC’s diversified sources of funding, credit ratings and strategic relationship

with the MoR have enabled it to keep cost of borrowing competitive. Since the company

is registered as an NBFC and Infrastructure Finance Company with the RBI, it is

allowed to raise external commercial borrowings of up to USD 750 million or equivalent

per financial year under the automatic route without the prior approval of the RBI,

subject to compliance with parameters and other terms and conditions set out in

the external commercial borrowings policy issued by the RBI. Below chart shows IRFC’s

sources of funds as at September 2020:

In addition to equity infusion by the GoI, IRFC’s medium/long term sources of funding include taxable and tax-free bond issuances, term loans from financial institutions, external commercial borrowings, internal accruals, asset securitization and lease financing. It also has a diverse base of investors from whom it raises funds through issuance of bonds in the domestic and international bonds.

| Domestic Credit Rating (FY 2020) | CRISIL | ICRA | CARE |

|---|---|---|---|

| Long-term | AAA/Stable | AAA/Stable | AAA |

| Short-term | A1+ | A1+ | A1+ |

Further, three international credit rating agencies, Standard & Poor’s, Fitch and Moody’s have awarded “BBB- with Stable Outlook”, “BBB- with Stable Outlook” and “Baa2 with Negative Outlook” ratings respectively to your Company. Besides, the company obtained an issuer specific credit rating of “BBB+ with Stable Outlook” from Japanese Credit Rating Agency.

Low Risk Business Model

The expenses which are incurred by IRFC with respect to any foreign currency hedging

costs and/or losses/gains as well as any hedging costs for interest rate fluctuations

are built into the weighted average cost of borrowing. This enables the company

to earn a margin, as determined by the MoR in consultation with IRFC at the end

of each fiscal, over the life of the lease. Risks relating to damage to rolling

stock assets as a result of natural calamities and accidents are also passed on

to the MoR. Further, the MoR is required to indemnify the company at all times from

and against any loss or seizure of the rolling stock assets under distress, execution

or other legal process.

Liquidity risk of IRFC is also minimized as the MoR is required to cover any funding shortfall required by the company for the redemption of bonds issued on maturity or repay term loan facilities availed by the company. As per the company, the MoR has historically never defaulted in its payment obligations under the Standard Lease Agreement. As in September 2020, IRFC does not have any NPAs. In addition, lease payments to the company by the MoR form part of the annual railway budget in the Union Budget of India.

Cost-Plus Model

The company’s cost-plus based Standard Lease Agreement with the MoR has historically

provided IRFC with a margin over the weighted average cost of borrowing determined

by the MoR in consultation with the company at the end of each fiscal. Typically,

the weighted average cost of borrowing factors in any expenses incurred by IRFC

with respect to any foreign currency hedging costs and/or losses /gains as well

as any hedging costs for interest rate fluctuations. Similarly, IRFC follows the

cost-plus pricing model for financing to other PSUs, which typically provide for

a relatively higher margin. Such financing activity along with the deployment of

net owned funds has allowed IRFC to maintain a net interest margin of:

| Particulars | FY 2018 | FY 2019 | FY 2020 | H1 FY2021 |

|---|---|---|---|---|

| Net Interest Margin | 1.83% | 1.57% | 1.38% | 0.71% |

Strong Asset-Liability Management

In addition to traditional cash flow management techniques, the company manages

its cash flows through an active asset and liability management strategy. Its asset-liability

management model is structured in a manner which ensures that IRFC has minimum asset-liability

mismatches. It borrows on a long-term basis to align with the long-term tenure of

the assets funded by the company. It believes that such an approach of matching

the tenure of advances with borrowings allows it to manage its liquidity better

and meet the growing demands of the Indian Railways. To ensure that it always have

sufficient funds to meet its commitments, IRFC maintains satisfactory levels of

liquidity to ensure availability of funds at any time to meet operational and statutory

requirements.

Further, in the event IRFC do not have sufficient funds to redeem bonds or repay term loans owing to inadequate cash flows during the fiscal year, the MoR is required, under the Standard Lease Agreement to provide for such shortfall, through bullet payments in advance prior to maturity of the relevant bonds or term loans. Such payments are required to be adjusted in the subsequent lease rentals payable under the respective Standard Lease Agreement.

Industry

The Indian Railways is a departmental undertaking of the Government of India, which owns and operates India's rail transport, through the Ministry of Railways. India has the world's third-largest rail network under single management. Indian Railways is among the world’s largest rail network, and its route length network is spread over 1,23,236 kms, with 13,523 passenger trains and 9,146 freight trains, plying 23 million travellers and ~1221 MT of freight in FY 2019.

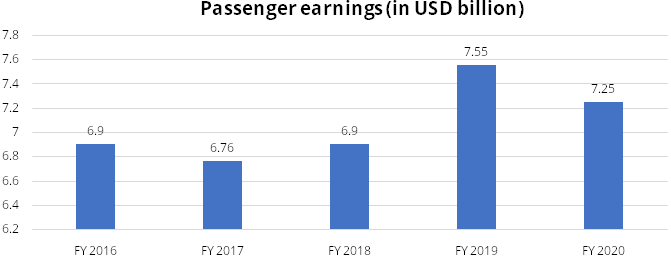

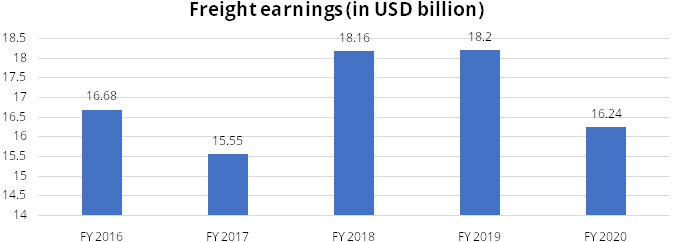

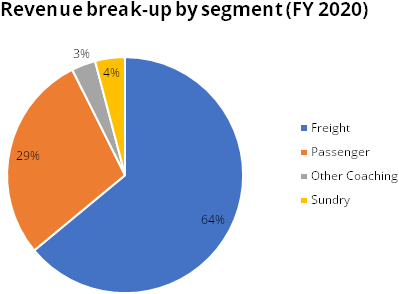

The Indian railways earns its majority (~93%) of revenues from two segments i.e., Passenger and Freight. Revenue from passenger segment has increased at a CAGR of 1.25% to reach USD 7.25 billion in FY20 from USD 6.90 billion in FY16. Freight earnings stood at USD 16.24 billion in FY20. Increased carrying capacity, cost effectiveness, and improved service quality will see Railways incremental share from freight movement.

Source: IBEF, StockAxis Research

Source: IBEF, StockAxis Research

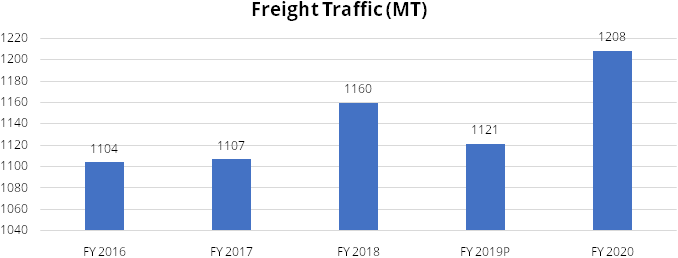

Freight Traffic

The Indian Railways is one of India’s most important source of transportation.

Currently, ~30% of total freight traffic of India moves on rail. Nine commodities

including coal, iron, steel, iron ore, food grains, fertilizers and petroleum products

primarily support freight business for the Indian Railways. Freight accounts for

more than ~2/3rd of India Railway’s revenue. As on FY20, freight

segment accounts for 64% of the total revenues of Indian Railways followed by passenger

segment at 28.6%.

Source: IBEF, StockAxis Research

In the last decade, due to growing industrialisation across the country the Indian Railways has witnessed increased freight traffic. In medium to long term, freight traffic is expected to grow rapidly due to rising investments and participation from private players. The freight business of Indian Railways has increased nearly seven times from 167 MT in 1970-71 to 1,208 MT in 2019-20.

Source: IBEF, StockAxis Research

In order to improve freight traffic, in Fiscal 2018, the MoR implemented several policies such as Liberalising automatic freight rebate scheme in empty flow directions (routes with low freight traffic), Entering into long term tariff contracts with key freight customers, and Introducing double stack dwarf containers as a new delivery model to increase load-ability of trains and attract new traffic under wire.

Passenger Traffic

Train travel remains the preferred choice for long-distance travel for majority

of Indians. The passenger travel is expected to grow further on the back of increasing

population, rising income and growing urbanisation. Increasing incomes in urban

and rural areas have made rail travel affordable to large number of Indians. Improvement

of urban-rural connectivity has been another major contributor to the growth of

Railways. Population residing in urban areas is expected to increase from 461 million

in 2018 to 543 million in 2025F. The percentage of India’s total population

residing in urban areas is expected to increase from 34.03% in 2018 to 37.38% in

2025F (Source: IBEF, Indian Railways Industry Report, October, 2020).

The government is taking various initiatives to encourage people to travel via passenger trains. Fare for premium classes were reduced to compete with airlines, luxury buses and personal transport vehicles. Information Technology is used to make ticket reservation more feasible to passengers along with an airline-style upgradation facility from lower class to higher class. In September 2020, the Indian Railways announced the Clone Train Scheme, wherein it plans to run a clone train with the train of the same number, to help and provide relief to waitlisted passengers over heavy passenger traffic routes.

Infrastructure Development

The positive externalities and the multiplier effect of investment in Infrastructure

for economic growth is a well-acknowledged and established fact. As per CRIS estimates,

India, in its vision to achieve a GDP of USD 5 trillion by 2024–25, needs

to spend USD 4.51 trillion, over these years on infrastructure. And it plans to

do so, under its ambitious National Investment Plan. NIP will enable well-prepared

infrastructure projects that in turn will create jobs, improve ease of living, and

provide equitable access to infrastructure for all, thereby making growth more inclusive.

The total capital expenditure in infrastructure sectors in India during Fiscals

2020 to 2025 is projected at approximately Rs. 111 lakh crores. The annual projected

capital expenditure in Indian Railways is as follows:

| Year | Expenditure (Rs. Crores) |

|---|---|

| 2020 | 133,387 |

| 2021 | 262,465 |

| 2022 | 308,800 |

| 2023 | 273,831 |

| 2024 | 221,209 |

| 2025 | 167,870 |

| Total | 1,367,563 |

Source: RHP, StockAxis Research

Dedicated Freight Corridors (DFC)

Dedicated Freight Corridor Corp. of India Ltd (DFCCIL) is building two freight corridors

– Eastern Freight Corridor from Ludhiana to Dankuni (1,856 kms.) and Western

Freight Corridor from Dadri to Jawaharlal Nehru Port (1,504 kms.) at a total cost

of Rs. 81,000 crores. The projects, when commissioned, are expected to take up more

than 70% of the Indian Railways freight traffic on to their faster, longer and heavier

trains.

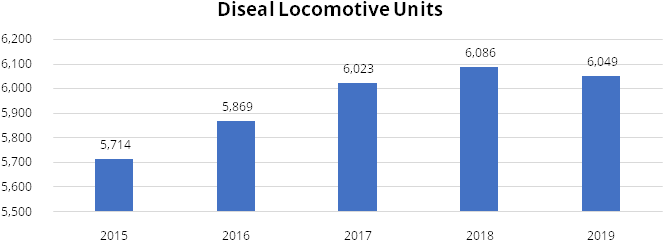

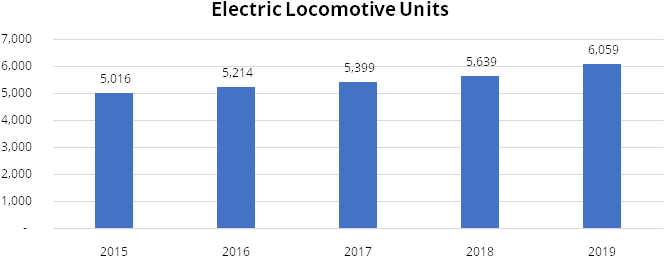

Locomotives, Coaches and Wagons

The Indian Railway’s locomotive fleet has seen significant changes over time.

Initially, led by steam locomotives at the time of independence, the shift in favour

of diesel locomotives has been gradual. Now, electric locomotives are expected to

dominate the future in the Indian Railways.

Source: DRHP, StockAxis Research

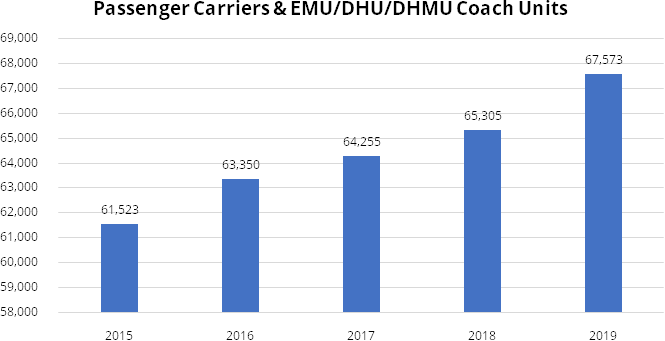

There has been an increase in demand for electric multiple unit (EMU) and diesel electric multiple units (DMU) driven by rising demand from suburban traffic as well as efficiency considerations. Passenger carriers are also expected to be in demand with the increasing passenger usage. It is expected that the demand for coaches shall outstrip supply of coaches.

Source: DRHP, StockAxis Research

Risks

- The company derives a substantial amount of revenue from the Indian Railways and a loss of or reduction in business from the Indian Railways or any direct borrowing by the Indian Railways or introduction of any new avenues of funding by the MoR could have an adverse effect on the operations of the company.

- The company’s business is dependent on the growth of Indian Railways sector. Any changes in initiatives by Government of India to modernise the railways or slowdown in the growth of Indian Railways could impact the operations of the company.

- The company’s ability to operate efficiently is dependent on its ability to maintain diverse sources of funds at a low cost. Any disruption in its funding sources or any inability to raise funds at a low cost could have a material adverse effect on its business.

- The company receives lease rentals which include the value of the Rolling Stock Assets leased to the MoR in the relevant fiscal year, the weighted average cost of borrowing as well as a certain margin, all in accordance with the terms of the Standard Lease Agreement, which the company enters with the MoR for leasing of Rolling Stock Assets subsequent to the end of the relevant fiscal year. There can be no assurance that the margin determined will be favourable to the company. Any adverse determination of the margin will also impact its profitability and results of operation including leverage capacity.

- Mismatch in the tenor of the company’s leases and borrowings may lead to reinvestment and liquidity risk, which may adversely impact its financial condition and results of operations.

Company Description

Incorporated in 1986, Indian Railway Finance Corporation (IRFC) is the dedicated financing arm of the Indian Railways for mobilizing funds from domestic as well as overseas capital markets. The company is engaged into financing the acquisition of rolling stock assets and other items of rolling stock components as enumerated in the Standard Lease Agreement (collectively, Rolling Stock Assets), leasing of railway infrastructure assets and national projects of the Government of India (collectively, Project Assets) and lending to other entities under the Ministry of Railways (MoR), Government of India.

It is a schedule ‘A’ public sector enterprise under the administrative control of the MoR. It is also registered as Systemically Important Non–Deposit taking NBFC and Infrastructure Finance Company with Reserve Bank of India.

The company follows a financial leasing model for financing the Rolling Stock Assets. The period of lease with respect to Rolling Stock Assets is typically 30 years comprising a primary period of 15 years followed by a secondary period of 15 years, unless otherwise revised by mutual consent between IRFC and MoR. In terms of the leasing arrangements, the principal amount pertaining to the leased assets is effectively payable during the primary 15-year lease period, along with the weighted average cost of borrowing and a margin determined by the MoR in consultation with the company at the end of each fiscal. For the second 15-year period, the company charges the Indian Railways a nominal rate which is subject to revision on mutually acceptable terms.

The company owns more than 80% of Indian Railways’ Rolling Stock fleet, comprising 11,332 locomotives, 64,642 passenger coaches, 2,41,082 freight wagons and 85 cranes & track machines, valued at INR 2.28 lakh crore, of which rolling stock assets worth INR 33,544.11 crore were acquired in 2019–20.

The company also follows a leasing model for Project Assets, which typically provide for lease periods of 30 years. As of September 30, 2020, the total AUM, consisted of 55.34% of lease receivables primarily in relation to Rolling Stock Assets, 2.25% of loans to central public sector enterprises entities under the administrative control of MoR (“Other PSU Entities”), and 42.41% of advances against leasing of Project Assets.

Valuation

Although the issue is reasonably priced at P/BV of 1.02x FY 2020. We do not see much upside since the company’s income is capped at spread decided by MoR. Despite any improvements in efficiencies at company’s end (like improvement in cost of funds etc) the benefit will not accrue to the company as all the savings are pass through to the MoR. The only way to increase profitability for company is to increase top line which again is totally dependent on ministry’s decision and ability to spend. We believe even in the long term, this company at best can give returns similar to some debt instruments. In view of low visibility of any significant capital appreciation in near as well as long term & availability of many other options to invest in primary market in current times we recommend AVOID on this issue. In our view investors will be better of giving this issue a pass.

Key Information

Use of Proceeds:

The net proceeds are proposed to be utilised towards augmenting equity capital base

to meet future capital requirements arising out of growth in the business and general

corporate purposes.

Book running lead managers:

DAM Capital Advisors Limited, HSBC Securities and Capital Markets (India) Private

Limited, ICICI Securities Limited and SBI Capital Markets Limited.

Management:

Amitabh Banerjee (Chairman and Managing Director), Shelly Verma (Director of Finance

and CFO).

Financial Statement

Profit & Loss Statement:- (Standalone)

| Particulars (Rs. Crores) | FY 2018 | FY 2019 | FY 2020 | H1 FY2021 |

|---|---|---|---|---|

| Revenue from Operations | 9206.97 | 10987.35 | 13421.02 | 7383.12 |

| Interest Expense | 6637.59 | 8183.06 | 10162.66 | 5440.98 |

| Net Interest Income | 2569.38 | 2804.29 | 3258.36 | 1942.14 |

| Other Income | 0.87 | 0.00 | 0.07 | 1.71 |

| Revenue from Operations | 2570.25 | 2804.29 | 3258.43 | 1943.85 |

| Employee benefits expense | 5.52 | 6.25 | 6.27 | 2.65 |

| Depreciation, amortisation and impairment | 0.35 | 0.42 | 0.46 | 0.23 |

| Other expenses | 32.44 | 14.74 | 57.47 | 54.12 |

| Total Operating Expenses | 38.31 | 21.41 | 64.19 | 57.01 |

| PPOP | 2531.94 | 2782.89 | 3194.24 | 1886.84 |

| Provisions | - | 27.54 | 2.14 | - |

| Exceptional Items | - | - | - | - |

| PBT | 2531.94 | 2755.34 | 3192.10 | 1886.84 |

| Tax | 530.48 | 615.41 | - | - |

| Tax Rate(%) | 20.95% | 22.34% | - | - |

| Profit After Tax | 2001.46 | 2139.93 | 3192.10 | 1886.84 |

| Basic EPS | 3.07 | 3.26 | 3.40 | 1.59 |