India Pesticides Ltd - IPO Note

Pesticides & Agrochemicals

India Pesticides Ltd - IPO Note

Pesticides & Agrochemicals

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Strengths

Wide variety of products with focus on export market

Over the years, the company has diversified their product portfolio and has developed

a niche portfolio of agro-chemical products. The company has grown into a multi-product

manufacturer of formulations, herbicide and fungicide technicals as well as APIs.

This diversification across products and sectors has allowed them to de-risk their

business operations. As of the date, the company has a license to manufacture for

49 agro-chemical technicals and 158 formulations and for APIs, they have obtained

a license for manufacturing 2 drugs for sale. The company’s products are exported

to regulated markets including Australia and other countries located in Europe,

Africa and Asia and have received product registrations either through their customers

or by the company. The company commenced manufacturing of technicals for herbicides

in 2018 that are exported which has led to an increase in their EBITDA margins from

21.6% in FY18 to 29.2% in FY20. The company’s diversified product portfolio

allows for limited dependence on individual products and helps counter seasonal

trends that are, in particular, a challenge for the agriculture industry in India.

Their major customers include multinational corporations, and hence, 56.7% of their

FY21 revenue was generated from exports.

Long-term relationship with key customers

The company has developed strong and long-term relationships with various multinational

corporations that has aided in expanding their product offerings and geographic

reach for their technicals business. These multinational corporations look to collaborate

with active ingredient manufacturers in India, leveraging their cost effective manufacturing

coupled with cheaper labour force and stronger R&D capabilities. The company’s

customer relationships are led primarily by their ability to manufacture complex

Technicals that go off-patent in a cost effective, safe and environmentally conscious

manner as well as their ability to meet stringent quality specifications. They undertake

exports of their products, and either their customers get their products registered

with the relevant regulatory authority or IPL register their products with the respective

regulatory authority directly. Several of their customers have been associated with

the company for over 10 years and certain of their key customers include crop protection

majors, such as, Syngenta Asia Pacific Pte. Ltd. and UPL Ltd.

Extensive distribution network along with strong sourcing capabilities

The company source their primary raw materials from sources within and outside India

and have developed relationships with multiple vendors for their major raw materials

to ensure timely delivery and adequate supply. In FY21, 62% of their raw materials

were sourced locally and this ability to procure raw material domestically enables

them to withstand volatility in raw material prices and ensures continuous supply

for their operations. The company’s vendor selection is based on pre-determined

criteria ensuring all raw materials procured meet stringent regulatory and quality

checks. The company has a dedicated sales team which is focused on direct selling

to customers and leveraging the relationship with them to increase sales of technicals.

For their technicals and formulations segment, they have a Pan-India sales and distribution

presence with a dedicated sales force. As of March 31, 2021, they have a network

of over 20 sales depots consisting of branches, carrying and forwarding agents,

and warehouses spread across 15 states in India and their distribution network comprised

a number of dealers and distribution partners across India.

Strong R&D and product development capabilities

The company has substantial experience in undertaking R&D activities as part

of their manufacturing operations. Their R&D places significant emphasis on

identification of appropriate complex technicals that are suitable for commercialization,

improving their production processes and the quality and purity of their present

products and manufacturing new off-patent products. The company has two well-equipped

R&D laboratories, each of which is registered with the DSIR and their laboratories

are equipped with sophisticated equipment that include gas chromatography, mass

spectrometry and Karl Fischer titrators etc. The company’s R&D efforts

also focus on determining the optimal production process for the technicals and

reduce energy consumption. The company continuously seek to innovate to develop

alternate production processes for their existing technicals and for technicals

that are expected to go off-patent in the near future. As part of these measures,

they undertake pilot studies of new technologies.

Capacity expansion of business and geographies shall boost growth

The company aims to scale up the manufacturing capacities for their existing products

to cater to the growth in demand for the products. They have obtained approval from

the Ministry of Environment, Forest and Climate Change (“MoEF”) to expand

their manufacturing capacity at Sandila to 30,000 MT. In addition, they continually

explore new markets for their existing products. Their expansion and diversification

of their product portfolio would allow them to service new clients, meet existing

demand and consequently, enhance their business prospects. The company intends to

augment their organic growth by pursuing selective acquisitions and strategic alliances

and may consider other acquisition opportunities to selectively expand in their

verticals, provided such opportunities offer the synergies.

Risks

- Business is working capital intensive: If they experience insufficient cash flows from operations or are unable to borrow to meet working capital requirements, it may materially and adversely affect business and results of operations.

- Agro-chemicals business is subject to climatic conditions, the overall area under cultivation and the cropping pattern adopted by the farming community. Seasonal variations and unfavorable local and global weather patterns may have an adverse effect on business, results of operations and financial condition.

- There is a growing consumption of bio-pesticides globally and in India. The use and adoption of bio pesticides by customers may affect competitive position and thereby have an adverse effect on business, results of operations, and financial condition.

Company Description

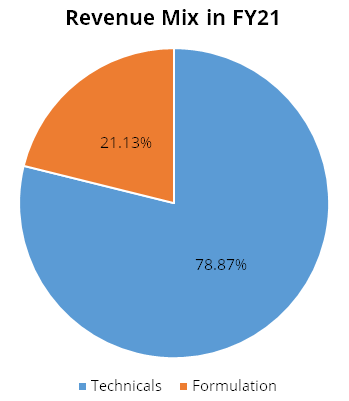

Incorporated in 1984, India Pesticides Ltd. (IPL) is fastest growing agro-chemical companies in India in terms of volume of technicals manufactured. They are the sole Indian manufacturer of five technicals and among the leading manufacturers globally for Captan, Folpet and Thiocarbamate herbicide in terms of production capacity. The company operates in two business verticals: (1) technicals and (2) formulations. In the first vertical, it manufactures generic products, which are used to manufacture fungicides and herbicides as well as Active Pharmaceuticals Ingredients (APIs) with applications in dermatological products. In the second vertical, the company manufactures and sells various formulations i.e. insecticides, fungicide and herbicides and growth regulators which are ready-to-use products. The company currently has 2 manufacturing facilities in Uttar Pradesh, which are spread across over 25 acres. As on FY21, their aggregate installed capacity of their manufacturing facilities for agro-chemical technicals and formulations stood at 19,500 MT and 6,500 MT. While the technicals are majorly exported to more than 25 countries including Australia, Asia, Africa, and European countries, agrochemical formulations are primarily sold to domestic crop protection manufacturers i.e. Sharda cropchem, UPL and Syngentia Asia etc.

Valuation

The company’s growth prospects look promising, considering the i) big opportunities in technicals going off patent ii) capacity expansion iii) strong demand for domestic agrochemical companies in global markets and iv) its established presence in export markets. At the upper price band of Rs 296, the IPO is valued at 24.5x of FY21 earnings, which looks reasonable given the complex chemistries (chlorination, etc.) that the company deals with. Further the company has better return ratios (RoE at ~35% in FY21) compared to peers like PI Industries and Rallis India and has strong relationship with multinational companies which augurs well. Hence, we recommend SUBSCRIBE to the IPO for long term perspective.

Key Information

Use of Proceeds:

The offer comprises of a fresh issue and an offer for sale. Out of the fresh Issue

of Rs 100 crores, Rs 80 crores is proposed to be utilized for working capital requirement

of the company and the balance Rs 20 crores is to be used for general corporate

purposes. The balance Rs 700 crores of the issue would be through offer for sale

by the shareholders and proceeds would go to such selling shareholders.

Book running lead managers:

Axis Capital, JM Financial

Management:

Anand Swarup Agarwal (Chairman and non-executive director): He holds a bachelor’s

degree in law from the University of Lucknow and has over 35 years of experience

in the manufacturing sector. He provides strategic guidance to the company’s business

activities Dheeraj Kumar Jain (Managing Director and Chief Executive Officer): He

holds a bachelor’s degree and a master’s degree in chemical engineering from Osmania

University, Hyderabad India. He joined India Pesticides Limited on December 1, 1995.

He has more than 25 years of experience with the Company and has been responsible

for product development, international business development and project engineering.

Satya Prakash Gupta (Chief Financial Officer): He holds a bachelor’s degree in commerce

from the University of Allahabad. He is an associate member of the Institute of

Cost Accountants of India and an associate of the Institute of Chartered Accountants

of India. He has over 27 years of experience in the field of finance.

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Yr End March (Rs Cr) | FY19 | FY20 | FY21 |

|---|---|---|---|

| Net Sales | 341.00 | 480.00 | 649.00 |

| Material Cost | 187.00 | 253.00 | 310.00 |

| Employee Cost | 13.00 | 16.00 | 23.00 |

| Other Expenses | 75.00 | 117.00 | 133.00 |

| EBITDA | 65.00 | 94.00 | 183.00 |

| EBITDA Margin | 19.00% | 20.00% | 28.00% |

| Depreciation & Amortization | 4.00 | 5.00 | 6.00 |

| EBIT | 61.00 | 89.00 | 177.00 |

| Other Income | 5.00 | 10.00 | 6.00 |

| Interest & Finance Charges | 6.00 | 5.00 | 3.00 |

| Profit Before Tax - Before Exceptional | 61.00 | 94.00 | 180.00 |

| Tax Expense | 17.00 | 23.00 | 46.00 |

| Effective Tax rate | 28.00% | 24.00% | 25.00% |

| Net Profit | 44.00 | 71.00 | 135.00 |

| Net Profit Margin | 13.00% | 15.00% | 21.00% |