India Shelter Finance Corporation Ltd - IPO Note

Finance - Housing

India Shelter Finance Corporation Ltd - IPO Note

Finance - Housing

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

Incorporated on October 26, 1998, India Shelter Finance Corporation Ltd (ISFCL) is retail focused affordable housing finance company with an extensive distribution network comprising 203 branches spread across 15 states with a presence in Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, and Gujarat as of September 30, 2023, and a scalable technology infrastructure across its business operations. The company exhibited 2-year CAGR growth of 41% in terms of AUM (Assets under Management) between FY21-FY23. Its AUM further jumped 43% to Rs 5,181 crores as of September 2023. It covers 94% of the affordable housing finance market in India as of March 31, 2023, in which they have significant presence.

Their target segment is the self-employed customer with a focus on first time home loan takers in the low- and middle-income group in Tier II and Tier III cities in India, and affordable housing loans, i.e., loans with ticket size lower than Rs.2.5 million. This helps in generating relatively high yields on advances. Credit and risk management policies, backed by technology and data analytics throughout its business processes, helps the company to maintain asset quality leading to its GNPA being 1.00% and 2.79% as of September 30, 2023, and September 30, 2022, respectively.The company has been able to maintain average sanction loan to value (LTV) on portfolio low at 50.9% with 55.1% for home loans and 45.3% for LAP.

The company leverages technology and analytics across operations and throughout the customer life cycle from onboarding, underwriting, asset quality monitoring, collections and customer services aiding increased productivity and reduced turnaround times and transaction costs. An end-to-end in-house business sourcing is helping to directly connect with customers, minimize turnaround times, increases customer retention, and mitigate the risk of fraudulent activities.

Investment Arguments

One of the Fastest Growing Assets under Management (AUM) among Housing Finance

Companies in India, High Yields, and Granular, Retail Focused Portfolio

ISFCL primarily finances the purchase and self - construction of residential properties

by first - time home loan takers through home loans and also offer loans against

property. As of September 30, 2023, 70.7% of their customers were first time home

loan takers. As of September 30, 2023, home loans account for 57.6% of their AUM,

while loans against property represent 42.4% of its AUM. According to the CRISIL

Report, they achieved AUM with a growth of 40.8%, among housing finance companies

in India, between FY 2021 and 2023. These growth rates reflect the effectiveness

of its operational model and its ability to underwrite and serve the customers in

the targeted segments in Tier II and Tier III cities in India. It maintains a focus

on serving low and middle - income, salaried and self - employed individuals, catering

to their financial needs.

Extensive and Diversified Phygital Distribution Network with Significant Presence

in Tier II and Tier III cities

With over 13 years of operations as a housing finance company, company’s distribution

network has grown to 203 branches across 15 states in India, as of September 30,

2023. They have a significant presence in the states of Rajasthan, Maharashtra,

Madhya Pradesh, Karnataka, and Gujarat, which, as of March 31, 2023, accounts for

47% of the affordable housing finance market in India. As of September 30, 2023,

they have a branch vintage ranging from five to eight years in 12 states in which

they are present. They have presence in states which cover 94% of the affordable

housing finance market in India, as of March 31, 2023.

The company’s phygital” model of business, which is a blend of physical presence across 15 states through 203 branches and digital interface, enables them in accessing a wider customer base. This model includes “feet-on – streetapproach for physical onboarding of customers through a network of more than 1,500 relationship managers as of September 30, 2023, along with digitization of customer onboarding across loan origination and banking processes.

In - house Origination Model to Ensure Efficient and Seamless Operations across

Various Key Functions

ISFCL maintains a robust in - house infrastructure seeking to ensure seamless operations

and independence across various key functions. During the six months ended September

30, 2023, 98.5% of disbursed loans were originated In - house. To strengthen its

customer connections and build trust, the company has undertaken initiatives such

as prioritizing localized hiring for its branches. This helps leverage the understanding

and relationship that local employees build with customers. Its in-house origination

model further enhances operations by enabling them to conduct all aspects of lending

operations in - house, including sourcing, underwriting, valuation, collections

and customer service, and reduce turnaround times and transaction costs. The chart

below sets forth the company’s in-house loan origination, customer evaluation,

collection, and servicing model.

Technology and Analytics-Driven Company with Scalable Operating Model

India Shelter Finance Corp Ltd is technology and analytics driven affordable housing

finance company and have built a scalable operating model that enables them to expand

its operations and drive growth in revenue. Sales force is a customer relationship

management system, also used as its loan origination system and is integrated with

downstream and upstream applications, including mobile applications, in - house

business rule engine and predictive dialer. Furthermore, as part of its loan origination

process, they capture, process and store data extensively on cloud - based platforms,

thereby -streamlining data management processes and offering customers, a seamless

onboarding experience aligning with its commitment to efficiency and customer centricity.

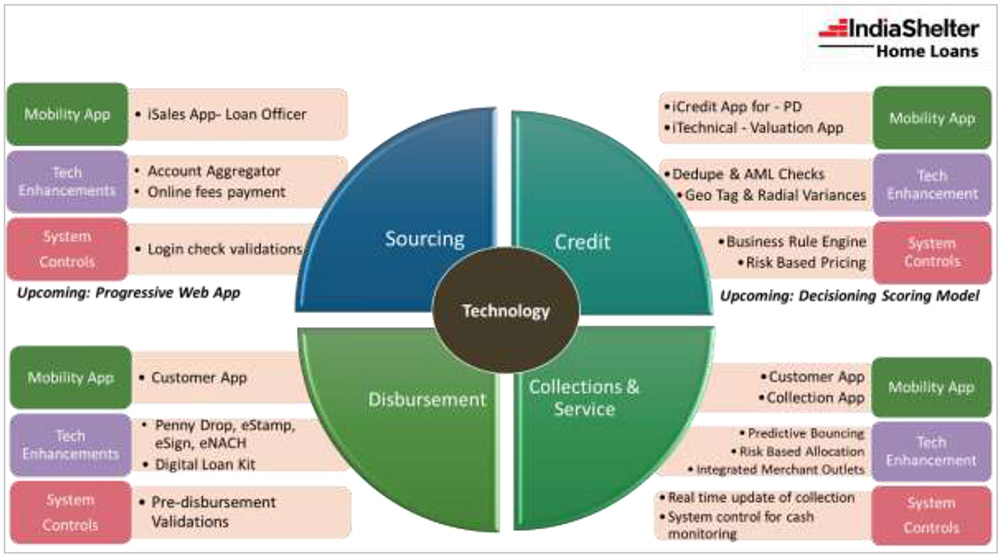

The company have implemented a paperless approach to customer acquisition and onboarding, with tailored mobile solutions that cater to different stages of the lending process. Its iSales application integrates, streamlines, and optimizes its customer acquisition process whereas India Shelter iCredit application facilitates its underwriting process. For collateral evaluation, the company have developed India Shelter iTech application. Furthermore, iCollect plays a vital role in optimizing collection efforts. To ensure customer satisfaction, they have introduced India Shelter iServe, dedicated customer service solution designed to promptly address concerns and queries from its customers. The graphic below sets out an overview of the integration of technology in its operations:

Peer Comparison

| Particulars FY23 (Rs. in cr) | Total Revenue from operations | P/BV ratio | ROA (%) | ROE (%) | GNPA (%) | NNPA (%) |

|---|---|---|---|---|---|---|

| India Shelter Finance Ltd. | 584.53 | 2.4x | 4.10 | 13.40 | 1.13 | 0.85 |

| Aavas Financiers Ltd. | 1608.76 | 3.6x | 3.50 | 14.10 | 0.92 | 0.68 |

| Aptus Value Housing Finance Ltd. | 1093.35 | 4.5x | 7.80 | 16.10 | 1.15 | 0.86 |

| Home First Finance Ltd. | 790.98 | 4.6x | 3.90 | 13.50 | 1.60 | 1.10 |

Key Risks & Concerns

- Risk of non - payment or default by their customers may adversely affect its business, results of operations and financial condition.

- The company’s business is affected by volatility in interest rates for both of its lending and treasury operations, which could cause net interest income to vary and consequently affect its profitability.

- The company may face asset-liability mismatches, which could affect its liquidity and consequently may adversely affect their operations and profitability.

- Focus on first-time home loan takers in Tier II and Tier III cities in India may have higher risk of non- payment or default. As of September 30, 2023, 70.7% of their customers were first-time home loan takers.

- Inability to comply with the financial & other covenants under its debt financing arrangements could adversely affect the business.

Valuation

India Shelter Finance Corporation Ltd (ISFCL) is retail focused affordable housing finance company with a retail – focused portfolio. It has an extensive and diversified distribution network and a strong risk management system. It is a technology-driven company with a scalable operating model. The financial performance of the company has also been stable. The IPO is valued at P/BV of 2.4x FY23 (Book Value – Rs.203.2) calculated at the upper price band of Rs.493 which appears fairly priced.

Citing solid fundamentals, good growth potential, stable asset quality, superior return ratios, robust risk management policies, one of the fastest AUM growth among housing finance companies, scalable operating model, and steady financial performance, we assign a SUBSCRIBE rating to the issue.

Key Information

Use of Proceeds:

The total issue size is Rs. 1200 crores, of which Rs.800 crores is Fresh issue and balance (Rs.400 crores) is Offer for Sale (OFS). The company will utilize the net proceeds from the fresh issue for future capital requirements for onward lending, and the rest for general corporate purposes. Kindly find the bifurcation in the table given below

| Sr.No | Particulars | Amount (Rs.in cr) |

|---|---|---|

| 1 | Fund future capital requirements for onward lending | 640 |

| 2 | General corporate purposes | 160 |

Book running lead managers:

ICICI Securities Ltd, Citigroup Global Market India Private Ltd, Kotak Mahindra

Capital Ltd and Ambit private Ltd

Management:

Rupinder Singh (Managing Director and Chief Executive Officer ), Sudhin Bhagwandas

Choksey (Chairman and Non-executive director), Anup Kumar Gupta, Shailesh Mehta,

Sumir Chadha, (Non-Executive Director), and Rachna Dikshit, Thomson Kadantot Thomas,

Parveen Kumar Gupta, Ajay Narayan Jha (Independent Director)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Income Statement (Rs. in cr) | FY21 | FY22 | FY23 | Q2FY24 |

|---|---|---|---|---|

| Interest Income | 275.00 | 373.00 | 503.00 | 320.00 |

| Fees and commission income | 10.00 | 20.00 | 32.00 | 18.00 |

| Net gain on fair value changes | 3.00 | 5.00 | 6.00 | 6.00 |

| Net gain on derecognition of financial instruments | 29.00 | 50.00 | 44.00 | 42.00 |

| Interest Expended | 105.00 | 148.00 | 210.00 | 140.00 |

| Net Interest Income | 211.00 | 299.00 | 375.00 | 246.00 |

| Other Income | 6.00 | 12.00 | 22.00 | 13.00 |

| Total Income | 323.00 | 459.00 | 606.00 | 399.00 |

| Employee expenses | 62.00 | 101.00 | 135.00 | 84.00 |

| Interest expense | 105.00 | 148.00 | 210.00 | 140.00 |

| Other expenses | 18.00 | 25.00 | 38.00 | 22.00 |

| Provisions | 20.00 | 12.00 | 14.00 | 9.00 |

| Operating Profit | 118.00 | 173.00 | 210.00 | 144.00 |

| Depreciation | 5.00 | 7.00 | 8.00 | 4.00 |

| Profit before tax | 113.00 | 166.00 | 202.00 | 140.00 |

| Tax expenses | 26.00 | 38.00 | 47.00 | 31.00 |

| Profit After Tax | 88.00 | 128.00 | 155.00 | 107.00 |

| EPS (Rs) | 10.00 | 15.00 | 18.00 | 12.00 |