Home First Finance Company India Limited - IPO Note

Finance - Housing

Home First Finance Company India Limited - IPO Note

Finance - Housing

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Technology Driven with Scalable Operating Model

The company is technology-driven affordable housing finance company and has built

a scalable operating model. It is able to digitally capture more than 100 data points

of a customer in addition to credit bureau data, observations of its front-end teams

and feedback from underwriting and management teams and store all this data on a

cloud-services platform. Its integrated customer relationship management and loan

management system provides a holistic view of its customers and ensures connectivity

and uniformity across its branches.

It has also deployed proprietary machine learning customer-scoring models to assist with effective credit underwriting. The company offers mobility solutions through dedicated mobile applications for its customers to enable quick and transparent loan related transactions. Its systems are designed to facilitate a sanction within an average turnaround-time of 48 hours. Its digital service delivery mechanisms and operating model brings uniformity in the operations which results into increases customer satisfaction.

Customer Centric Organizational Commitment

The company is a customer centric organization and has developed strong relationships

with its customers by addressing their key concerns in availing housing finance.

In order to address such concerns, it has set up an easy and customer-friendly process

from the loan application stage to disbursement of the loan. It has set up a paperless

process to onboard customers efficiently and its managers’ conduct home and

workplace visits to ensure minimal disruption to a customer’s daily routine.

The company has a dedicated mobile app for its customers where they can carry out

a number of functions, including accessing their loan statements, prepaying loans

without any prepayment charges and raising service requests.

The company aims to maintain high levels of customer service and has mapped each customer to a dedicated service manager and a relationship manager. It has a centralized repository of all the queries posted by its existing and potential customers and these are mapped to their respective loan accounts. The company endeavours to address a significant majority of customer queries within 24 hours. Its customer centric approach has been a key driver of its growth and helped the company to differentiate from competition and achieve superior net promoter scores.

Deep Penetration in the Largest Housing Finance Markets, with Diversified Sourcing

Channels

As of September 2020, the company has a network of 70 branches covering over 60

districts in 11 states and a union territory in India. The company has successfully

adopted a strategy of contiguous expansion across regions over the years and has

strategically expanded to relevant geographies by evaluating areas with high economic

growth and substantial demand for affordable housing finance, along with industry

portfolio-at-risk levels and socio-economic risk profile. It has demonstrated the

ability to successfully identify new regions to set up branches and grow their market

share in such regions. The table reflects the improvement in the company’s

market share, in terms of origination of home loans in the bucket size o Rs 5,00,000

to Rs. 25,00,000 for the periods indicated:

| Branch Location | Market Share (Q1 FY18) | Market Share (Q4 FY20) |

|---|---|---|

| Jaipur | 0.1% | 2.3% |

| Ahmedabad | 1.7% | 2.7% |

| Surat | 1.7% | 2.5% |

| Indore | 0.2% | 2.3% |

| Nagpur | 0.9% | 2.2% |

| Raipur | 0.3% | 0.8% |

| Hyderabad | 0.2% | 1.1% |

| Bengaluru | 0.2% | 1.9% |

| Chennai | 1.0% | 2.0% |

The company utilises a diverse range of lead sourcing channels such as connectors, architects, contractors, affordable housing developers, in addition to conducting loan camps & micro marketing activities, utilising employee and customer referrals and branch walk-in customers. Connectors are third-parties who provide the company with customer leads on a commission basis paid only when a loan is disbursed and they do not assist in the loan application process. Its connectors are generally individuals such as insurance agents, tax practitioners and local shopkeepers. For FY2020 the company sanctioned 15,591 loans on account of leads generated through 2,553 connectors, respectively.

Centralized, Data Science Backed Underwriting Process

The company serves salaried customers in low and middle-income groups which account

for 73.1% of their Gross Loan Assets, and self-employed customers account for 25%

of the Gross Loan Assets, as of September 30, 2020. The company has employed well-trained

and educated front-end teams to enable it to make right decision on several parameters,

including the size of the loan. The centralized team of underwriters ensures consistency

in implementing their underwriting principles.

Its customer relationship management system is integrated with the loan management system, which is set up on a leading cloud-based customer relationship platform. The technology platforms enable the company to digitally capture over 100 data points of a customer from the inception of the lead. It also has entered into arrangements with third party database service providers to obtain additional information of customers. The integration of such data helps the company to derive a holistic view of its customers, carry out fraud checks and effectively assess the credit worthiness of customers.

All financed properties of the company are geo-tagged and it uses a machine learning backed property price predictor, which has helped the company to reduce turnaround time for approving loans, as well as achieve a higher accuracy in determining the loan-to-value ratio. The robust underwriting and loan approval process has helped it to reduce bounce rates from 14.1% for the Q1 FY18 to 10.5% for Q4 FY20.

Technology Driven Collections System

The company has set up a robust collections management system wherein ~93% of FY20

collections were non-cash based. All its borrowers register for an automated debit

facility and it tracks the status of instalments collected on a real time basis

through a collection module in its system. The company employs a structured collection

process wherein it reminds customers of payment schedules and maintain adequate

balance in their account on the due date, through automated calls and text messages.

It performs predictive analytics to predict the probability of default, which helps

it in obtaining early signals of potential defaults and initiate appropriate action

to mitigate risks.

Well-Diversified and Cost-Effective Financing Profile

The company is able to access borrowings at a competitive cost due to their stable

credit history, superior credit ratings, conservative risk management policies and

strong brand equity. The details of borrowing profile:

| Metric | 2018 | 2019 | 2020 | H1 FY21 |

| Number of Banks Borrowed from | 10 | 14 | 15 | 17 |

| Private Sector | 4 | 7 | 8 | 8 |

| Public Sector | 6 | 7 | 7 | 9 |

| Amount borrowed (Borrowings + Debt securities) (Rs. Cr) | 1,109.88 | 1,925.64 | 2,493.81 | 2,636.58 |

| Private Sector | 214.49 | 444.70 | 753.62 | 751.88 |

| Public Sector | 559.88 | 894.18 | 1,025.68 | 900.32 |

| Other Parties | - | - | 60.14 | 51.47 |

| NHB Loans | 245.50 | 586.70 | 654.37 | 693.45 |

| Debt Securities | - | - | - | 239.46 |

| Average Cost of Borrowings (excluding assignments) | 7.7% | 8.5% | 8.7% | 4.3% |

| Total Equity | 325.22 | 523.14 | 933.64 | 988.2 |

| Debt to Equity ratio | 3.14 | 3.68 | 2.67 | 2.67 |

The company has improved their credit ratings from ‘CARE A-’ as of March 31, 2017 to ‘CARE A+’ as of September 30, 2020 and also currently have an A+ (stable) rating from ICRA Limited.

Industry

Despite the constant focus on the housing segment, housing in India is far from adequate. The GoI, in its Twelfth Five Year Plan has accorded this issue as utmost importance and focused on increasing the amount of housing units available both in the urban as well as the rural sector. As per the estimates of the Twelfth Five Year Plan, the shortage of housing in the urban segment stood at 18.78 million. With increased urbanisation, India is also moving towards higher nuclearization leading to smaller family sizes. This is also reflected in the steady reduction in average household size from 5.5 members per household as of 1991 to 5.3 members in 2001 to 4.8 members.

As of March 2019, the total outstanding retail housing loans in India was Rs. 18.7 trillion, translating into a mortgage-to-GDP ratio of 12.4%. While the ratio has improved over the last few years, it is still lower than several other emerging and developed economies. CRISIL Research analysis indicates the mortgage penetration in India is 9 to 11 years behind other regional emerging markets such as China. Going forward, CRISIL Research expects a steady and gradual increase in mortgage penetration due to various structural drivers, such as a young population, smaller family sizes, increased urbanisation and rising income levels.

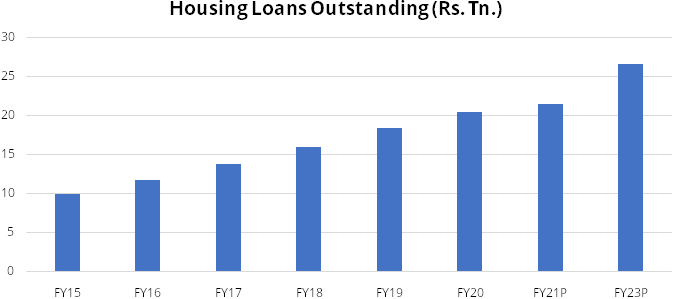

The Indian housing finance market experienced a healthy growth in housing loan outstanding of ~16% over 2015 to 2020 on account of a rise in disposable income, healthy demand and a greater number of players entering the segment. CRISIL Research expects total housing loan outstanding to grow at a CAGR of 5-6% in FY2021 and at 8-9% CAGR over FY2020 - FY2023 (See chart below):

Source: RHP, CRISIL, StockAxis Research

With tightened liquidity post the IL&FS default in September 2018, HFCs have encountered structural challenges in the form of increased refinancing risk and asset-liability mismatch, which slowed down disbursements in FY 2019. HFCs' access to funds from the debt capital markets has also declined considerably, especially for those companies with high negative asset liability management mismatches. Consequently, several players in the industry have been focusing on managing ALM rather than growing their book. Resultantly, overall credit growth in housing loans for HFCs declined 8% YoY in FY 2019. Hence, of the total amount of home loan outstanding of Rs. 18.7 trillion as of March 2019, HFCs accounted for 39% share.

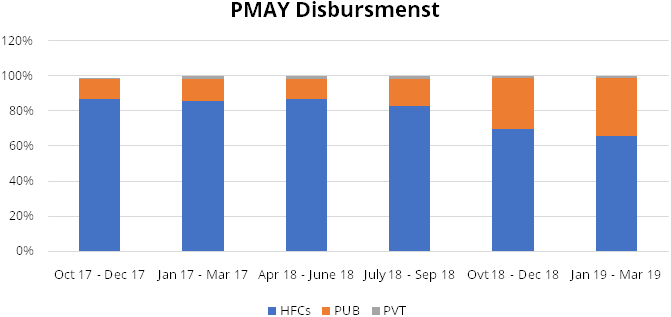

For ensuring housing for all in urban areas, Pradhan Mantri Awas Yojana (PMAY), was launched on June 25, 2015. The mission provides central assistance to implementing agencies through states/union territories and central nodal agencies for providing houses to all eligible families/beneficiaries. As per the publicly available documents, under PMAY, demand reported so far by states/union territories is ~11.2 million. As on October, 2020, the number of houses sanctioned is 10.8 million and the number of houses where construction is completed is 3.7 million, which adds to 33% of the reported demand. To achieve the target, 7.5 million houses still need to be constructed. According to a statement of the Housing and Urban Affairs Minister in June, all the houses will be sanctioned by the first quarter of next year. The construction of houses and delivery of houses is expected to be completed by 2022. The following graph depicts that HFCs account for majority share in overall PMAY disbursement:

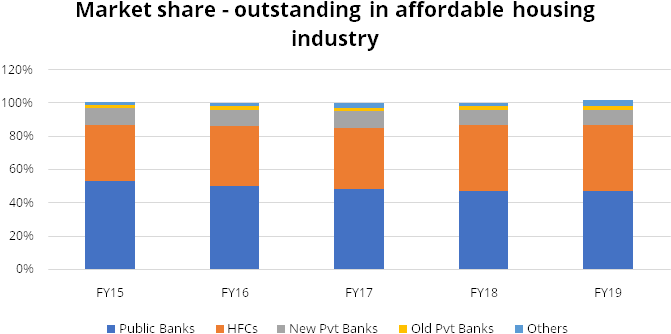

As a result of their faster growth, HFCs have been able to increase their share in the market from 34% in Fiscal 2015 to 39% in Fiscal 2019 in terms of outstanding affordable home loans. Moreover, in terms of disbursement, the share of HFCs have increased from 37% in Fiscal 2015 to 45% in Fiscal 2019. The following graphs set out market share split based on outstanding affordable housing loans:

HFCs have been able to garner this share because of reasons including, strong origination skills and focused approach; creation of niche in catering to particular categories of customers; relatively superior customer service and diverse channels of business sourcing; strong focus on specific geographies; and rapid expansion in branch network and deepening market presence in smaller cities.

On account of their faster growth, HFCs increased their market share from 36% in March 2015 to 39% in March 2019, in terms of credit outstanding. With respect to disbursements, the HFCs were able to garner market share of 41% in FY2019, up from 38% in FY 2015. Smaller HFCs, most of whom have a larger focus on affordable home loans, have outperformed the other player groups, clocking 59% CAGR in loans in this category over the last four years ending FY2019 as against this, the overall market for HFCs in this segment clocked 16% CAGR from FY 2015 - FY2019.

Peer comparison

| Particulars | Home First | Aavas Financers | Aptus Value Housing Finance | Aadhar Housing Finance |

|---|---|---|---|---|

| AUM FY20 (Rs. billion) | 36.00 | 78.00 | 32.00 | 114.00 |

| AUM Growth (CAGR FY15-FY20) | 61.00% | 56.00% | 54.00% | 59.00% |

| AUM Growth (CAGR FY18-FY20) | 63.00% | 38.00% | 50.00% | 20.00% |

| Loans Outstanding FY20 (Rs. billion) | 30.00 | 62.00 | 27.00 | 89.00 |

| Advances Growth YoY | 41.00% | 31.00% | 32.00% | 11.00% |

| Disbursments FY20 (Rs. billion) | 16.00 | 29.00 | 13.00 | 32.00 |

| Disbursment Growth (CAGR FY15-20) | 50.00% | 40.00% | 51.00% | 33.00% |

| RoA (%) | 2.70% | 3.80% | 6.30% | 1.70% |

| RoE (%) | 10.90% | 12.70% | 15.40% | 11.80% |

| Net Interest Margin (%) | 5.40% | 6.40% | 8.20% | 3.90% |

| Yield on Advances | 13.20% | 13.50% | 15.70% | 13.50% |

| Cost of Borrowings | 8.70% | 8.40% | 10.00% | 8.60% |

| GNPA (FY20) | 1.00% | 0.50% | 1.80% | 1.40% |

| NNPA (FY20) | 0.80% | 0.30% | 1.60% | 0.90% |

| No. of Branches (FY20) | 68.00 | 250.00 | 175.00 | 294.00 |

| No.of Employees (FY20) | 696.00 | 4581.00 | 1702.00 | 2097.00 |

Risks

- The company’s ability to raise funds at competitive rates and in a timely manner depends on various factors such as its credit ratings, its risk management policies, regulatory environment, etc. Further any changes in economic and financial conditions or lack of liquidity in the market could adversely affect company’s ability to access funds at competitive rates, which could adversely affect its liquidity and financial conditions.

- The company caters to salaried (75%) and self-employed customers (25%); the latter considered to be higher credit risk customers. Any default in borrowers’ repayment obligations due to micro and macro-economic reasons may adversely affect the business, results of operations and financial condition.

- There is a criminal proceeding against one of the company’s directors, which if determined against him, could harm the reputation of the company. Further, its chairman and independent director has been named in the suit filed accounts list maintained by TransUnion CIBIL Limited.

- The company is affected by volatility in interest rates for both, lending and treasury operations, which could cause its net interest income to vary and consequently affect its profitability.

- The company’s operations are concentrated in the states of Gujarat and Maharashtra and any adverse developments in these regions could have an adverse effect on its business and results of operations.

Company Description

Home First Finance Company India Limited (Home First) is a technology-driven, affordable housing finance company that targets first time home buyers in low and middle-income groups. The company primarily offers housing loans for the purchase or construction of homes, comprising 92% of its gross loan assets as of September 2020. Its gross loan assets have grown from Rs. 1,355.93 crores in FY18 to 3,618.36 in FY20, a growth of CAGR 63.35%. Further, during H1 FY21, its gross loan assets stood at Rs. 3,730.01, a growth of 19.9% YoY.

The company majorly serves salaried and self-employed customers. As on September 2020, salaried loans account for 73.1% and self-employed account for 25% of gross loan assets; the balance was accounted by corporate loans. It also offers other types of loans including loans against property, developer finance loans and loans for purchase of commercial property.

Home first has a network of 70 branches across 60 districts in 11 states and a union territory in India, with a significant presence in urbanized regions in the states of Gujarat, Maharashtra, Karnataka and Tamil Nadu. By adopting a strategy of contiguous expansion across regions, the company has increased its scale of operations and expanded to geographies where there is substantial demand for housing finance. According to the CRISIL Report, the geographies in which the company operates in, accounts for ~79% of the affordable housing finance market in India during the FY19.

It has leveraged technology in various facets of its business such as processing loan applications, managing customer experience and risk management. It offers mobility solutions through dedicated mobile applications for its customers to enable quick and transparent loan related transactions. It has an integrated customer relationship management and loan management system set up on a leading cloud-based customer relationship platform providing the company with a holistic view of all its customers. It utilises proprietary machine learning customer scoring models to assist the company with its centralized credit underwriting process, which has led to consistent and accurate credit evaluation with quick turnaround times.

Valuation

Home First Finance India Limited is an affordable housing finance player focused on digital adoption. Leveraging its digital architecture, it is able to sanction home loans with turnaround time of 48 hours. Disbursements almost quadrupled over FY2017 – FY 2019. However, it was largely stable in FY 2020. Nevertheless, it delivered loan book CAGR of 56% over FY2017 – FY2020. With strong underwriting, the company has experienced healthy asset quality with GNPA ratio of <1%. As a result, its RoA of 2.7% in FY2020 is healthy compared to its peers. However, given its low leverage, it delivered modest RoE of 10.9% in FY2020. At higher price band of Rs. 518, we feel that the issue has a rich valuation of 4.3x of its FY2020 Book Value. We recommend to Subscribe to the issue for listing gains.

Key Information

Use of Proceeds:

The net proceeds are proposed to be utilised towards augmenting its capital base

to meet future capital requirements and for general corporate purpose.

Book running lead managers:

Axis Capital Limited, Credit Suisse Securities (India) Private Limited, ICICI Securities

Limited and Kotak Mahindra Capital Company Limited.

Management:

Manoj Viswanathan (Founder, MD and the CEO), Nutan Gaba Patwari (CFO), Deepak Satwalekar

(Chairman & Independent Director).

Financial Statement

Profit & Loss Statement:- (Standalone)

| Particulars (Rs. Crores) | FY 2018 | FY 2019 | FY 2020 | H1 FY2021 |

|---|---|---|---|---|

| Revenue from Operations | 132.09 | 259.88 | 398.64 | 237.15 |

| Interest Expense | 65.96 | 126.54 | 193.83 | 111.29 |

| Net Interest Income | 66.13 | 133.33 | 204.81 | 125.86 |

| Other Income | 2.15 | 11.05 | 21.02 | 6.04 |

| Revenue from Operations | 68.27 | 144.38 | 225.83 | 131.90 |

| Employee benefits expense | 25.08 | 43.18 | 61.11 | 29.80 |

| Depreciation and Amortisation | 2.46 | 4.58 | 7.24 | 3.90 |

| Other expenses | 13.59 | 24.12 | 33.70 | 11.44 |

| Total Operating Expenses | 41.13 | 71.87 | 102.04 | 45.14 |

| PPOP | 27.14 | 72.51 | 123.79 | 86.77 |

| Provisions | 2.87 | 7.31 | 16.50 | 16.41 |

| Exceptional Items | - | - | - | - |

| PBT | 24.27 | 65.20 | 107.28 | 70.36 |

| Tax | 8.27 | 19.99 | 28.03 | 17.41 |

| Effective Tax Rate (%) | 34.09% | 30.66% | 26.13% | 24.74% |

| Profit After Tax | 16.00 | 45.20 | 79.25 | 52.95 |

| Basic EPS | 3.10 | 7.82 | 10.77 | 6.76 |