Heranba Industries Limited - IPO Note

Pesticides & Agrochemicals

Heranba Industries Limited - IPO Note

Pesticides & Agrochemicals

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

Presence in a Wide Range of Products Across the Entire Value Chain of Synthetic

Pyrethroids

The company manufactures Intermediates, Technicals and Formulations which form part

of the entire value chain of synthetic pyrethroids and other active ingredients

in the agrochemicals business. It is one of the leading domestic producers of synthetic

pyrethroids like cypermethrin, alphacypermethrin, deltamethrin, permethrin, lambda

cyhalothrin, etc. Its capability of manufacturing Intermediates, Technicals and

Formulations and presence in the entire value chain of synthetic pyrethroids provides

it the flexibility to shift between products depending on the demand-supply and

pricing dynamics of the domestic and international agrochemicals industry.

The company’s product pipeline will further expand once it receives necessary approvals from the CIB&RC for 14 Technicals and Formulations to manufacture and sale in India, 7 Technicals and Formulations for the export markets and 172 Technicals and Formulations filed for registration by its International Distribution Partners before regulatory authorities in 41 overseas jurisdictions, excluding Europe.

Product Registrations in the Domestic and International Markets

The company’s International Distribution Partners have obtained registrations

for 371 Technicals and Formulations in 41 countries across Middle East, CIS, Asia,

South East Asia and Africa. Further, as mentioned previously 172 of the company’s

Technicals and Formulations have been filed before the regulatory authorities of

41 countries in various regions across the world, excluding Europe. The company’s

core strength lies in the R&D of active ingredients for creating new formulations

and preparing its dossiers for national and international registrations. Its in-house

registration team is led by qualified personnel who facilitate the registration

process in India with the CIB&RC and its dealers in overseas jurisdictions,

enable the manufacture and export of a range of Technicals and Formulations in the

international markets.

Strong Product Portfolio and Wide Distribution Network

The company manufactures and supplies Technicals to leading domestic and multinational

agrochemical companies operating in and outside India which are used by them for

manufacturing their own products. Its end customers for its Formulations are the

farmers who use its products for crop protection and crop care. It has more than

9,400 dealers/distributors supported by its 21 stock depots spread across 16 states

and 1 union territory in the country in order to meet the demand of its products

from farmers. It participates in various international and domestic agrochemical

exhibitions & industry conferences to market its products. Its sales & marketing

teams travel extensively to maintain and strengthen existing relationships with

customers and to explore new relationships with potential customers. It educates

farmers on the care and protection extended by its products over their crops by

conducting farmer training camps, participating in village level programmes and

district exhibitions to establish a direct relationship with farmer communities

all over India.

Diversified and Stable Customer Base

Various domestic and multinational agrochemical companies operating in and outside

India are customers for the Technicals manufactured by Heranba. As per the company,

these clients include Sumitomo Chemical, Sulphur Mills, Biostadt India, Crystal

Crop Protection, Sharda Cropchem, Meghmani Organics, PI Industries, Agro Life Science

Corporation and Shanghai Agricare Chemical Co. amongst others who use the company’s

products to manufacture their own Formulations and other products.

Industry

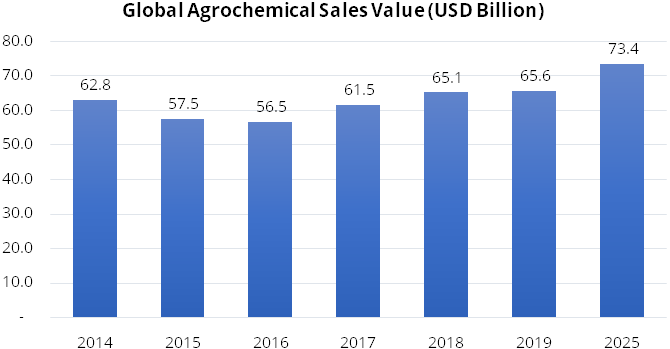

The Global agrochemicals market has registered a CAGR of ~1% during 2014–2019 and reached at USD 65.6 billion in 2019. A significant increase in the global population, the escalating requirement to improve crop yields, and increasing demand for biologically based new products have catalysed the demand for crop protection chemicals over the past few years. Further, the market is expected to reach at USD 73.4 billion in 2025, thereby registering a growth of 1.9% during 2019–2025. Region-wise, Asia Pacific is expected to lead the growth during the forecasted period, followed by North America, Latin America and Middle East and Africa.

Source: Company RHP

The agrochemicals market in India reached a value of USD 2,760 million in 2019, growing at a CAGR of 6.5% during 2014-2019. Factors such as increasing food demand, increasing demand from horticulture and floriculture, off-patent molecules, government support, among others are driving the agrochemical consumption in India. Further, the market is expected to reach at USD 3,798 million by 2025, thereby registering a growth CAGR of 5.5% during 2019 – 2025.

| Market by Product Type | 2019 (USD Million) | 2025 (USD Million) | CAGR 2019 – 2025 |

|---|---|---|---|

| Insecticides | 1,493 | 2,017 | 5.1% |

| Herbicides | 643 | 899 | 5.7% |

| Fungicides | 516 | 727 | 5.9% |

| Others | 108 | 155 | 6.2% |

| Total | 2,760 | 3,798 | 5.5% |

The global Pyrethroids market reached a value of USD 3,235 million in 2019, growing at a CAGR of 4.50% during 2014- 2019. Looking forward, it is expected that the global Pyrethroids market to grow at a CAGR of 6.38% in value terms during 2020-2025, reaching a value of USD 4,068 million by 2025. Pyrethroids serve as a cost-effective alternative to the conventionally used insecticides. Some insecticides are also known for their high potency and extreme efficacy. As a result, there is a growing demand for pyrethroids not only for crop protection but also in areas of public health (Pest management, etc.) and animal health. All these factors are expected to catalyse global pyrethroids market growth further.

In terms of consumption value, the India Pyrethroids market has registered a CAGR of ~7.4% during FY14 - FY19 and reached at USD 110 million in 2019. Further as per the company RHP, the market sales value of Pyrethroids is expected to reach at USD 205 million by 2025, thereby registering a CAGR of 19.6%. Despite the presence of several driving forces, the pyrethroids market faces some challenges. For instance, the rapid photodegradation and high susceptibility to moisture and heat are limiting the effectiveness of pyrethroids in agriculture and other open space applications. Moreover, although pyrethroids offer lower toxicity to human applicators and nontarget mammals and birds, they are highly toxic to invertebrates and fish.

Peer comparison

| Particulars | Heranba Industries | Rallis India | Sumitomo Chemical India | Bharat Rasayan | Punjab Chemicals and Crop Protection |

|---|---|---|---|---|---|

| Sales FY20 (Rs. Crores) | 951.37 | 2251.82 | 2424.75 | 1213.10 | 549.56 |

| Sales CAGR FY18-FY20 (%) | 13.30% | 12.10% | 12.60% | 23.70% | 5.60% |

| Revenue Growth (%) H1FY21 vs H1FY20 | 23.30% | 1.20% | 6.50% | -16.70% | 1.80% |

| Operating Profit Margin FY20 (%) | 13.60% | 11.70% | 13.70% | 19.00% | 7.70% |

| Operating Porfit Margin H1FY21 (%) | 16.10% | 17.70% | 21.80% | 20.50% | 15.10% |

| PAT Margin FY20 (%) | 10.30% | 8.20% | 8.40% | 13.00% | 2.00% |

| PAT Margin H1FY21 (%) | 10.70% | 12.60% | 15.30% | 13.70% | 7.80% |

| EPS (FY20) | 25.03 | 9.50 | 4.10 | 375.33 | 8.74 |

| P/E (x) | 25.05 | 27.25 | 73.15 | 26.06 | 97.48 |

| RoE (%) FY20 | 30.50% | 13.10% | 16.80% | 27.90% | 11.00% |

| RoCE (%) FY20 | 36.80% | 17.40% | 26.10% | 33.70% | 21.20% |

| Debt/Equity (H1FY21) | 0.20 | 0.14 | 0.28 | 0.14 | 0.88 |

Risks

- There are outstanding legal proceedings involving the Company, Promoters and certain Directors which may adversely affect the business, financial condition and results of operations.

- The top ten customers constituted not more than 22.03% and 20.85% of the sales for H1FY21 and FY20, respectively, both in the domestic and the international markets. The top five domestic customers across product categories constituted 9.02% and 8.60% of the total revenue for H1FY21 and FY20, respectively. The top five international customers across product categories constituted 13.04% and 9.60% of the total revenue for H1FY21 and FY20, respectively. Absence of large customers and dependence on smaller customers increases uncertainty of demand which may have an adverse impact on the business operations and financial performance.

- The Company has not entered into long-term agreements with its customers for purchasing the products nor for the supply of raw materials with suppliers. It is subject to uncertainties in demand and there is no assurance that these customers and suppliers will continue to purchase its products or sell raw materials to it or that they will not scale down their orders. This could impact the business and financial performance of the company.

- Raw materials constitute a significant percentage of the company’s total expenses. Any increase in prices and any decrease in the supply could adversely affect the company’s business

- The issue is mostly an Offer for Sale. ~90% (Rs. 565.24 crores) of the issue proceeds goes to promoters and the balance proceeds (~Rs. 60 crores) is to be used to fund the working capital requirements and general corporate purpose of the company.

Company Description

Heranba Industries Limited (Heranba) is a crop protection chemical manufacturer, exporter and marketing company based in Vapi, Gujarat. It manufactures Intermediates, Technicals and Formulations. It is one of the leading domestic producers of synthetic pyrethroids like cypermethrin, alphacypermethrin, deltamethrin, permethrin, lambda cyhalothrin, etc. The company’s range of pesticides includes insecticides, herbicides, fungicides and public health products for pest control and its business verticals include:

- Domestic Institutional sales of Technicals: manufacturing and selling of Technicals in bulk to domestic companies.

- Technicals Exports: Exports of Technicals in bulk to customers outside India.

- Branded Formulations: Manufacturing and selling of Formulations under its own brands through its own distribution network in India.

- Formulations Exports: Export of Formulations in bulk and customer specified packaging outside India; and

- Public Health: Manufacturing and selling of general insect control chemicals by participating in public health tenders issued by governmental authorities and selling to pest management companies.

The Company holds registrations for 18 Technicals for manufacture and sale in India, 103 Technicals & Formulations for manufacture and sale in the export markets and 169 Formulations registered for manufacturing and sale in India. Further, the company has filed an application for registration of 14 Technicals & Formulations for manufacture & sale in India as well as 7 Technicals and Formulations to manufacture for the export markets with the CIB&RC and are in the process of evaluation.

Heranba has in-house R&D team for product development and improvisation which is well supported by its product registration team. Its R&D facilities at Unit I and II are recognized by the Department of Scientific and Industrial Research, Ministry of Science & Technology, Government of India. Its new R&D facility at Unit III, Sarigam has become operational from October, 2020.

Valuation

Heranba has a leading position in pyrethroids segment and has a wide range of products across entire value chain. It holds registrations for numerous technicals and formulations for domestic and international markets and this pipeline could expand further once it receives necessary approvals from the CIB&RC. The company’s revenues are almost equally contributed from domestic and exports. Though, the exports have been affected during H1FY21 on account of covid-19 pandemic, the revenues have seen an uptick of ~23% compared to H1FY20 as the decrease in exports has been offset by the increase in sales of technicals and formulation in the domestic market. Further, as the restrictions related to the covid-19 pandemic to be gradually lifted, the exports of the company could improve. It has a strong balance sheet with nil long-term borrowing as of September 2020. It has a high return on equity of 30.5%. At the higher price band of Rs. 627, the company is reasonably valued at 25x of FY20 earnings compared to its listed peers. We recommend to subscribe to the issue.

Key Information

Use of Proceeds:

The net proceeds are proposed to be utilised towards funding working capital requirements

and general corporate purposes.

Book running lead managers:

Emkay Global Financial Services Limited and Batlivala & Karani Securities India

Private Limited.

Management:

Sadashiv K. Shetty (Promoter, Chairman and Executive Director), Raghuram K. Shetty

(Promoter and Managing Director), Sujata S Shetty (Whole-time Director), Vanita

R. Shetty (Whole-time Director), Raunak R Shetty (Whole-time Director) and Maheshwar

V. Godbole (CFO).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | FY 2018 | FY 2019 | FY 2020 | H1FY21 |

|---|---|---|---|---|

| Revenue from Operations | 741.25 | 1004.44 | 951.37 | 618.34 |

| COGS | 503.75 | 697.76 | 637.43 | 419.44 |

| Gross Profit | 237.50 | 306.69 | 313.94 | 198.90 |

| Gross Profit Margin (%) | 32.04% | 30.53% | 33.00% | 32.17% |

| Employee Benefits Expense | 33.21 | 38.01 | 46.47 | 22.86 |

| Other Expenses | 116.48 | 137.27 | 138.13 | 76.77 |

| EBITDA | 87.81 | 131.41 | 129.35 | 99.28 |

| EBITDA Margin (%) | 11.85% | 13.08% | 13.60% | 16.06% |

| Depreciation | 5.01 | 5.95 | 8.20 | 6.60 |

| EBIT | 82.80 | 125.46 | 121.15 | 92.67 |

| Finance cost | 11.81 | 10.73 | 8.84 | 3.46 |

| Other Income | 5.32 | 7.39 | 16.53 | 0.87 |

| Profit Before Tax | 76.31 | 122.12 | 128.84 | 90.08 |

| Tax expenses | 29.43 | 46.72 | 31.09 | 23.77 |

| Effective Tax Rate | 38.57% | 38.25% | 24.13% | 26.39% |

| Profit After Tax | 46.88 | 75.41 | 97.75 | 66.31 |

| PAT Margin (%) | 6.32% | 7.51% | 10.27% | 10.72% |

| EPS | 12.00 | 19.31 | 25.03 | 16.98 |