Harsha Engineers International Limited - IPO Note

Bearings

Harsha Engineers International Limited - IPO Note

Bearings

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key strengths and strategies

Comprehensive solution provider offering a diversified suite of precision engineering

products across geographies and end-user industries:

HEIL is the largest manufacturer of precision bearing cages, in terms of revenue

in organized sector in India and among the leading manufacturers of precision bearing

cages in the world. Within its diversified product portfolio, company manufactures

bearing cages (including cylindrical roller cages, spherical roller cages, deep

grove cages, angular contact cages, thrust roller cages and taper roller cages),

complex and specialised precision stamped components, welded assemblies and brass

castings and bushings. Company have been successful in improving its current processes

of manufacturing and new product development for different types of bearing cages

mainly due to its designing and tooling development and technological capabilities.

Since its inception, they have manufactured more than 7,500 types of products in

the automotive and industrial segments. HEIL have recently expanded its product

portfolio to introduce sand-casting, value-added stamping components, bronze bushings

etc. to cater to more end user industries such as wind, mining and shipping sectors.

Accordingly, it has insulated itself to a large degree against fluctuation in demand

for a specific product because of the wide range of products offered to diverse

end user application.

Consistent track record of growth and financial performance

Company’s focus on operational and functional excellence has contributed to

strong track record of healthy financial performance. Company has demonstrated steady

growth on the topline from FY20-22 at Rs. 1321.48 crores indicating a Revenue CAGR

growth of 14%. On the operational front as well, company has shown an EBITDA CAGR

growth of 25% from FY20-22 at Rs.169 crores. PAT clocked a healthy CAGR growth of

61% at Rs.92 crores from FY20-22 reflecting strong growth overall on all parameters.

ROE and ROCE stood at 19% and 25% as of FY22.

| Particulars (Rs. In crores) | FY20 | FY21 | FY22 |

|---|---|---|---|

| Revenue | 885.85 | 873.75 | 1321.48 |

| EBITDA | 86 | 122 | 169 |

| EBITDA Margin | 10% | 14% | 13% |

| Profit After Tax | 22 | 46 | 92 |

| PAT Margin | 2% | 5% | 7% |

| ROE | 6.00% | 11.20% | 19.13% |

| ROCE | 18% | 17.24% | 25.00% |

Established strong relationships with customers across various countries:

HEIL has established strong relationship with their customers who are leading global

bearing manufacturers in the automotive, railways, aviation & aerospace, construction,

mining, agriculture, electrical and electronics, renewables sector. The bearing

cages market globally is concentrated among a few global bearing manufacturers with

Top-6 global bearing manufacturers contributing to 54% of the market share in Fiscal

2022.

As of March 31, 2022, HEIL supply to each of the Top-6 global bearing manufacturers. Their Top-10 customers contributed to 44.70%, 48.24%, and 47.79% of their total revenue from operations for Fiscal 2022, Fiscal 2021 and Fiscal 2020, respectively. The average age of their relationship with their Top-5 customer groups spans more than a decade. Company believes that expertise in area of tooling, automated production facilities, focus on research and development, coupled with technologically advanced, quality consistency on time delivery and cost competitive manufacturing technology processes has resulted in repeat orders from its key customer groups. Robust relationship with its key customers would continue to drive company’s strong operational and financial performance going ahead.

Details of contribution from Top-5 customer groups

| Fiscal 2022 | Fiscal 2021 | Fiscal 2020 | ||||

|---|---|---|---|---|---|---|

| Particulars | Amount (Rs. In crores) | % of Total Revenue | Amount (Rs. In cr) | % of Total Revenue | Amount (Rs. In Cr) | % of Total Revenue |

| Top-5 Customers | 932.35 | 70.55% | 631.57 | 72.28% | 642.63 | 72.54% |

Focus on capex to drive growth

HEIL is likely to deploy Rs.78 crores from the proceeds of this IPO for Funding

capital expenditure requirements towards purchase of machinery and Rs.7.12 crores

towards Infrastructure repairs and renovation of its existing production facilities.

Company’s strong focus on capex to scale the business will be a key revenue

growth driver for HEIL.

Focus on growth by inorganic acquisitions and strategic alliances

HEIL has over the years expanded their business through a combination of organic

growth, acquisitions and strategic alliances with their customers and with other

component manufacturers. They expanded their outreach with the opening of new production

unit in Changshu, China in 2010, acquisition of bearing cage production company

Harsha Precision Bearing Components (China) Co. Ltd in Suzhou, China in 2014 and

setting up of new production unit in Changshu, China, (which was subsequently integrated

into Harsha Precision Bearing Components (China) Co. Ltd in Suzhou) and European

operations in 2016 with the acquisition of their subsidiary Harsha Engineers Europe

SRL (formerly known as M/s Johnson Metal S.A.) located in Romania. Further, in order

to reduce costs and synergize all their operations in India, they have integrated

all their India businesses (engineering and solar EPC business) and operations into

one entity.

They also seek strategic partnerships with their key customer groups for innovation and development of new products and supply them to new geographies. They have recently partnered with a global customer to manufacture their bronze bushings requirements and have significantly grown their business from the client in a span of a couple of years. They intend to further pursue such strategic alliances and inorganic growth opportunities, with a particular focus on technologically innovative acquisitions that may provide better access to technology as a part of their growth strategy to fuel growth for the company.

Increased focus on developing products suited to capture market opportunity in

the growing electric vehicle segment

As the automobile segment is shifting focus to electric vehicles the need for more

silent and lighter bearings, and its components, will be felt, and the demand is

likely to increasingly shift towards precise dimension and dirt free bearing, steel

and polyamide cages as a probable solution at a premium value. Company’s in-house

tool and design capabilities would enable them to manufacture/develop customized

bearings, tap into the growing market and to enhance its share of the business in

this segment.

Industry

Peer comparison

| Particulars (Rs. in Crores) | Sales CAGR (FY20-22) | PAT CAGR (FY20-22) | ROE (%) | ROCE (%) | EPS(Rs) FY22 | PE(x) FY22 |

|---|---|---|---|---|---|---|

| Harsha Engineers Limited | 14.30% | 61.00% | 19.13% | 25.00% | 16.06 | 21.00 |

| Rolex Rings | 4.00% | 31.00% | 29.20% | 31.50% | 55.60 | 35.40 |

Risks

Dependent on third parties for raw materials supplies: Company is heavily reliant on third parties for supply of raw materials and delivery of products.

Contingent Liabilities: Company has certain contingent liabilities and capital commitments (Rs.90 crores), which, if they materialize, may adversely affect its financial conditions.

Foreign Currency exchange rate risk – The Company derives 63% of its revenues in foreign currencies as of FY22 which exposes them to currency rate fluctuations.

No long-term supply agreements with customers – Company do not have firm commitment in the form of long-term supply agreements with its customer groups.

Company Description

Incorporated in 2010, Harsha Engineers International Limited (HEIL) is the largest manufacturer of precision bearing cages, in terms of revenue in organized sector in India and among the leading manufacturers of precision bearing cages in the world. It offers a diversified suite of precision engineering products across geographies and end-user industries which comprises of engineering business and finds application in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors, etc.

The business comprises of two segments:

- Engineering business, under which the company manufactures bearing cages (in brass, steel and polyamide materials), complex and specialised precision stamped components, welded assemblies and brass castings and cages & bronze bushings.

- Solar EPC business, under which the company provides complete comprehensive turnkey solutions to all solar photovoltaic requirements and provides operations and maintenance services in the solar sector.

Company has approximately 50-60% of the market share in the organized segment of the Indian bearing cages market and 6.5% of the market share in the global organized bearing cages market for brass, steel, and polyamide cages in FY 2021.

The company has five manufacturing facilities for engineering business with two manufacturing facilities at Changodar and one at Moraiya, near Ahmedabad and one manufacturing unit each in Changshu, China and Ghimbav Brasov in Romania. Its multinational presence has also allowed the company to diversify its revenue geographically.

Harsha Engineers International Limited has three wholly owned subsidiaries, one in China -Harsha Precision Bearing Components (China) Co. Ltd, one in the United States of America -HASPL Americas Corporationand one in the Netherlands - Harsha Engineers B.V., and a stepdown subsidiary in Romania -Harsha Engineers Europe SRL.

Products Manufactured by the company

Bearing cages

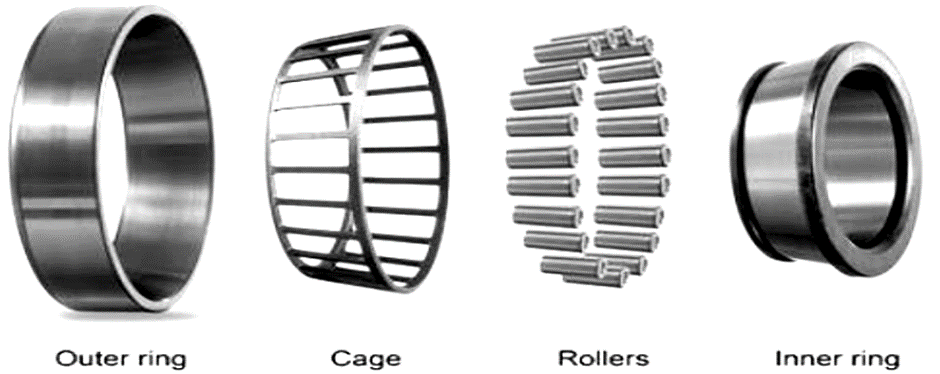

Company manufactures precision bearing cages that forms one of the five components of a bearing: other such components being, the inner ring, outer ring and rolling elements like rollers or balls and cages. Bearing cages are primarily utilized to: (i) separate the rolling elements, reducing the frictional heat generated in the bearing; (ii) keep the rolling elements evenly spaced, optimizing load distribution on the bearing; (iii) guide the rolling elements in the unloaded zone of the bearing; and (iv) retain the rolling elements of separable bearings when one bearing ring is removed during mounting or dismounting

Valuation

The IPO is valued at 20.55 times with earnings of Rs.16.06 (EPS FY22) calculated at the upper price band of Rs 330 per share which appears reasonable.

Citing strong market share in precision bearing cages and being one of the leading players globally in organized bearing cages, having strong clientele with long standing relationship, healthy return ratios, diversified product portfolio, robust balance sheet, sound financial profile, strong earnings visibility and reasonable valuations, we assign a SUBSCRIBE rating to the issue on medium to long term basis.

Key Information

Use of Proceeds:

The total issue size is Rs. 755 crores, of which Rs. 455 crores is Fresh issue and

balance (Rs.300 crores) is Offer for Sale (OFS). The company will utilize the net

proceeds from the fresh issue to repay debt, purchasing machinery, for infrastructure

repairs and renovation of existing facilities and general corporate purposes. Kindly

find the bifurcation in the table given below

| Sr. No. | Particulars | Amount (INR. CR.) |

|---|---|---|

| 1 | Repay/Prepay Certain Borrowings | 270 |

| 2 | Funding capital expenditure requirements towards purchase of machinery. | 77.95 |

| 3 | Infrastructure repairs and renovation of our existing production facilities | 7.12 |

Book running lead managers:

Axis capital, Equirus Capital and JM Financial are the book running lead managers

for the IPO

Management:

Rajendra Shah (Chairman and Whole time Director),Harish Rangwala(Managing Director),

Vishal Rangwala (Chief Executive Officer), Pilak Shah (Chief Operating Officer),

Niharika Vora, Ambar Patel, Kunal Shah, Bhushan Punani and Ramakrishnan Kasinathan(Independent

Directors), Hetal Ukani (Whole time director).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (in Crores) | FY20 | FY21 | FY22 |

|---|---|---|---|

| Revenue | 885.85 | 873.75 | 1321.48 |

| COGS | 458.09 | 414.67 | 739.70 |

| Gross Profit | 427.76 | 459.08 | 581.78 |

| Gross Margins (%) | 48.29% | 53.00% | 44.00% |

| Employee Benefits Expenses | 149.00 | 146.38 | 158.02 |

| Other expenses | 192.73 | 190.80 | 254.73 |

| EBITDA | 86.03 | 121.90 | 169.03 |

| EBITDA Margin (%) | 10.00% | 14.00% | 13.00% |

| Depreciation and Amortization | 35.24 | 34.10 | 35.36 |

| EBIT | 50.79 | 87.80 | 133.67 |

| Other Income | 13.65 | 2.98 | 17.52 |

| Finance Cost | 32.80 | 30.00 | 24.56 |

| Profit Before Tax | 31.64 | 60.78 | 126.63 |

| Tax Expenses | 9.67 | 15.28 | 34.68 |

| Effective Tax Rate (%) | 31.00% | 25.00% | 27.00% |

| PAT | 21.97 | 45.50 | 91.95 |

| PAT Margin (%) | 2.00% | 5.00% | 7.00% |

| EPS(Rs.) | 6.26 | 9.09 | 16.06 |