Happy Forgings Limited - IPO Note

Auto Ancillary

Happy Forgings Limited - IPO Note

Auto Ancillary

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

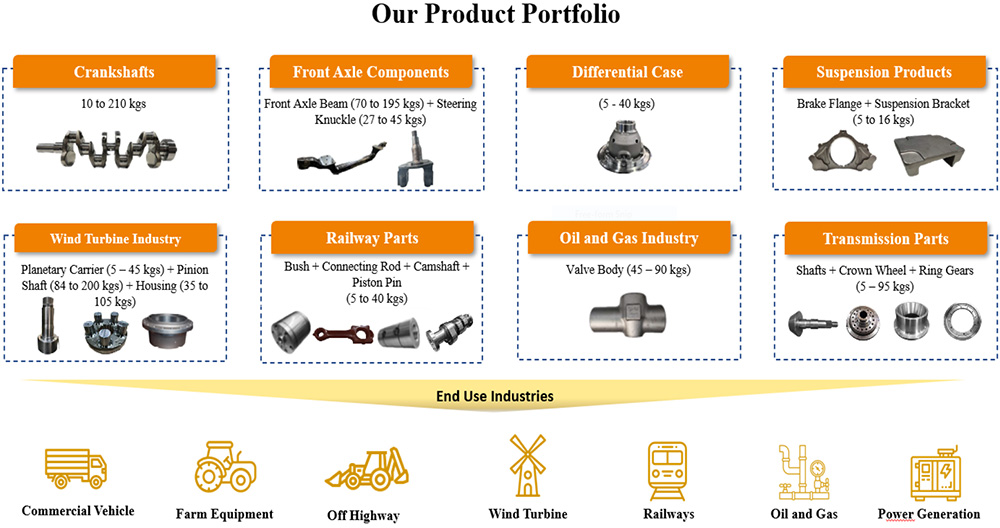

Happy Forgings Limited (HPL) is the fourth largest engineering-led manufacturer of complex and safety-critical, heavy forged, and high precision machined components in India as of FY23 in terms of forging capacity. It has vertically integrated operations engaged in engineering, process design, testing, manufacturing, and supply of components that are margin and value additive. It caters to both Domestic as well as Global original equipment manufacturers (OEMs). It supplies the automotive as well as non-automotive sectors. In the non-automotive sector, it caters to manufacturers of Farm equipment, off-highway vehicles, and manufacturers of industrial equipment and machinery for oil and gas, power generation, railways, and wind turbine Industries.

The company has transitioned from a forging-led business to a machine components manufacturer by focusing on margin-accretive value-added products. Its proportion from the sale of machinery equipment has increased from FY21 to FY23 and as of FY23 automotive sector contributed 43.65% to its total revenue whereas the non-automotive sector contributed 56.35%.

The Company is among the few companies in India with the capability to manufacture and supply high-precision safety critical components to leading OEMs including manufacturers of commercial vehicles, farm equipment, off-highway and industrial equipment, and machinery for oil and gas, power generation, railways, and wind turbine industries.

It manufactures a wide range of heavy forged and machined products such as crankshafts, front axle beams, steering knuckles, differential cases, transmission parts, pinion shafts, suspension products, and valve bodies for a diversified customer base.

HFL is a supplier to each of the top five Indian OEMs by market share in the medium and heavy commercial vehicle industry and four of the top five Indian OEMs in the farm equipment industry by market share as of FY23.

It has three manufacturing facilities of which two are at Kanganwal in Ludhiana, Punjab and one is located at Dugri in Punjab. It has automated certain manufacturing lines by using robots which helps to reduce manpower and further increase efficiency.

Competitive strengths

Fourth largest engineering-led manufacturer of complex safety-critical, and

high-precision machine components

It has 40 years of experience in manufacturing and supplying quality and complex

components. It has emerged as a domestic leader in the crankshaft manufacturing

industry having second largest production capacity for CV and high horse-power industrial

crankshaft. It develops the majority of its revenue from the sale of Machined products

which accounted for 78.66% of the total sale in FY23 whereas the sale of Forged

products contributed 21.34%. The Forging industry has high barriers to entry because

of the lengthy product approval process. From FY23 onwards, the company started

focusing on manufacturing machined products and as a result, it was named as the

highest revenue contributor among its peers.

Diversified business model, well positioned for advancement in alternative engine

technology

It is present in the automotive as well as non-automotive sectors. In the non-automotive

sector, it manufactures and supplies precision components to OEMs of farm equipment,

off-highway vehicles, and industrial machinery and equipment for oil and gas, power

generation. For the FY23 within the automotive sector, CV contributed 43.65%. The

non-automotive sector's contribution to the total sale was 56.35% of which farm

equipment contributed 36.79% the highest among the sector followed by off-highway

vehicles which accounted for 15.86%. it has a diversified customer base from different

sectors, as of FY23 customers from the Farm equipment and industrial sectors are

24 each.

Established partnerships with clients across various industries

It has a diversified customer base, and its focus on quality, providing customized

solutions and timely delivery of products has helped the company to maintain long-term

relationships. As of FY23, 19 customers were there with them for more than 10 years,

this category of customers contributed 75.98% to the total revenue whereas 8 customers

were there for more than 5 years but less than 10 years. The company has been successful

in increasing its wallet share by offering additional products to its existing customers.

In commercial vehicles, it supplies to SML ISUZU, Mahindra Rise, etc. For the Farm

equipment sector, it supplies to Escorts Kubota Limited, Yanmar and Sonalika, etc.

In the Off-Highway Vehicles, its customers are Dana, JCB India Limited, and Hendrickson.

Strong track record of building capabilities and infrastructure with a focus

on capital efficiency

The company operates three manufacturing facilities, of which one facility is completely

dedicated to forging operations and the other two facilities are functional with

both forging and machining capabilities. Its manufacturing facilities are strategically

located so that it enables cost and logistical advantages. Its upgraded manufacturing

facilities, infrastructure, and equipment have helped it to manufacture diverse

products, reduce its operating costs, and increase efficiency. It is the second

company in India to have installed 14,000-tonne press machinery. The investment

in press machinery which includes some features of automation has helped the company

to increase the production speed, reduce cycle time, and improve productivity.

Foray into lightweight forging and machining with the introduction of aluminium

components

By leveraging its existing capabilities, the Company intends to diversify its product

portfolio by entering into the market of lightweight forging and machined components.

In particular, they aim to introduce aluminum forging and machined components to

cater to the growing demand for lightweight materials in various industries such

as automotive, aerospace, and defence. They believe that this will potentially open

up new opportunities for their business and help them stay competitive in the market.

Further, they may pursue opportunities in the manufacturing of aluminium components

for electric vehicles in the passenger vehicle market. With their existing forging

machinery and certain additional investments in processes, they may explore manufacturing

steering arms, knuckles, suspension parts, and powertrain components specifically

tailored for the electric vehicle market.

Increasing wallet share and acquiring new business by leveraging existing OEM

relationships and adding new customers

The Company is focused on leveraging long-standing relations with its existing OEMs

and adding new customers to increase their wallet share across their products. They

intend to target new business from global customers who were earlier importing from

China and Europe, as well as new business from the global counterparts of their

existing customers. Apart from catering to automotive demand from these countries,

they plan to cater to the demand for products that have applications in industries

such as defence, oil and gas, power generation, and wind turbine in the export market.

They further endeavor to ensure that new business opportunities are margin accretive,

by expanding their capabilities by adding new solutions for heavy transmission gear

cutting in machining and foraying into heavy forgings up to one tonne, thereby expanding

their range of forgings from 250 kilograms to one tonne.

Peer Comparison

| Company Name | Revenue from Operations (Rs. cr.) | EPS (x) | P/E (x) | ROCE (%) | ROE (%) | EBITDA Margin (%) |

|---|---|---|---|---|---|---|

| Happy Forgings Limited | 1197 | 23 | 36 | 24 | 21 | 28 |

| Bharat Forge Limited | 12910 | 11 | 103 | 8 | 7 | 14 |

| Craftsman Automation Limited | 3183 | 118 | 44 | 21 | 20 | 22 |

| Ramkrishna Forgings Limited | 3193 | 16 | 49 | 19 | 21 | 22 |

| Sona BLW Precision Forgings Limited | 2655 | 7 | 86 | 22 | 18 | 26 |

Key Risks & Concerns

Customer Concentration Risk

In FY23 top 10 customers contributed 70 % to the total revenue. Loss of all or a

substantial portion of sales to any of its top 10 customers could hurt the operations.

Even though it has a long-lasting relationship of more than 10 years with its top

10 customers, the risk is still inherent in the business.

Supply Side Mismatch Risk

The company requires steel for manufacturing complex and high-precision heavy forged

machine equipment for that it relies on a few suppliers. It does not have a definitive

agreement with its suppliers. A delay in supply by its suppliers might extend the

production schedule and can adversely affect its output.

Sectoral Cyclicality

It caters to the automotive and non-automotive sector, so it is exposed to fluctuation

in sales due to the performance of these industries. A decrease in demand in the

sales of vehicles due to consumer demand, trends, and economic conditions might

affect the revenue for the company.

Reliance on Power & Fuel

Any disruption in the supply of power and fuel from sources can increase the production

cost and adversely affect the business.

Outlook and Valuation

We like Happy Forgings' diversified business model, lean balance sheet, and strong returns ratios. Strong leadership position in the heavy forged and high precision machined components, marquee relationship with leading OEMs, inorganic growth opportunities, strong industry tailwinds, expanding capacities, strong product portfolio, increasing demand, integrated manufacturing operations, unique positioning in the competitive market and healthy growth outlook makes it compelling bet. The IPO is valued at 36.44x its FY23 EPS (Rs.23.32), which appears attractive, and hence we recommend a subscribe rating for the issue.

Key Information

Use of Proceeds:

The total issue size is Rs. 1009 Crores, of which Rs.400 Crores is Fresh Issue and

the balance Rs. 609 Crores is Offer for sale. The company will utilize net issues

from the proceeding for the purchase of equipment, plant, and machinery and payment

of outstanding debt.

| Particulars | igures (In Crores) |

|---|---|

| Purchase of Equipment. Plant and machinery | 171.13 |

| Repayment of Outstanding Debt | 152.8 |

| General Corporate Purpose | 76.0 |

Book running lead managers:

JM Financial Limited, Axis Capital, Equirus Capital Private Limited, and Motilal

Oswal Investment Advisors Limited are the Book Running Lead Manager for the IPO.

Management:

Paritosh Kumar (Chairman and Managing Director), Ashish Garg (Managing Director),

Pankaj Kumar Goyal (Chief Financial Officer), Megha Garg (Managing Director), Narinder

Singh Juneja (Chief Executive Officer), Prakash Bagla (Nominee Director), Satish

Sekhri, Vikas Giya, Ravindra Pisharody, Rajeswari Karthigeyan, Atul Behari Lall

(Independent Director).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars | FY 21 | FY 22 | FY 23 | Q2 FY24 |

|---|---|---|---|---|

| Revenue | 585 | 860 | 1197 | 673 |

| COGS | 252 | 388 | 551 | 295 |

| Gross Profit | 333 | 472 | 645 | 378 |

| Gross Profit Margin | 57% | 55% | 54% | 56% |

| Employee Benefit Expense | 49 | 69 | 88 | 54 |

| Other Expense | 126 | 172 | 217 | 128 |

| EBITDA | 159 | 231 | 341 | 195 |

| EBITDA Margin | 27% | 27% | 28% | 29% |

| Depreciation & Amortization | 36 | 38 | 54 | 32 |

| EBIT | 123 | 193 | 287 | 164 |

| Interest | 12 | 7 | 12 | 7 |

| Other Income | 6 | 6 | 6 | 3 |

| Share of Profit from JV | 0 | 0.05 | 0.05 | 0 |

| PBT | 117 | 192 | 280 | 159 |

| Tax | 31 | 50 | 71 | 40 |

| PAT | 86 | 142 | 209 | 119 |

| PAT Margin | 15% | 17% | 17% | 18% |

| EPS | 9.66 | 15.90 | 23.32 | 13.33 |