Glenmark Life Sciences Limited - IPO Note

Pharmaceuticals & Drugs - API

Glenmark Life Sciences Limited - IPO Note

Pharmaceuticals & Drugs - API

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Leadership in Select, High-Value, Non-Commoditized APIs in Chronic Therapeutics

GLS is the leading developer and manufacturer of select, high-value, non-commoditized

APIs in chronic therapeutic areas, including CVS, CNS and pain management and diabetes

and continue to branch into other APIs. Its API portfolio comprises niche and technically

complex molecules. As of March, 2021, it sold APIs in India and exported to Europe,

North America, Latin America, Japan, and RoW. It works towards developing 8-10 molecules

each year, which include both, high-value, and high-volume APIs. As of May, 2021,

it had filed 403 DMFs and CEPs across various major markets (the US, Europe, Japan,

Russia, Brazil, South Korea, Taiwan, Canada, China, and Australia). As of March,

2021, GLS had a portfolio of 120 molecules globally.

Strong Relationships with Leading Global Generic Companies

Over the years, the company has established strong relationships with leading global

generic pharma companies that has aided GLS in expanding product offerings and geographic

reach. As of March, 2021, 16 of the 20 largest generic companies globally were GLS’

customers. The company has been able to maintain high customer loyalty with a high

rate of repeat customers. For FY21, FY20 and FY19, ~69% of GLS’ customers

were period-on-period repeat customers. It has a history with many customers, including

Glenmark, Teva Pharmaceutical, Torrent Pharma, Aurobindo Pharma, Krka and other

global leaders in generic pharma and biosimilars. The term of relationship with

seven largest customers averages 5-15 years and ~41% of its customers for the FY21

were also the customers in FY20 and FY19.

Quality-Focused Compliant Manufacturing

Since 2015, GLS’ facilities have been subject to 38 inspections and audits

by regulators including the USFDA, PMDA, COFEPRIS, Health Canada, MFDS (Korea),

EDQM, other European regulatory agencies and CDSCO conducted on a periodic basis.

It has not received any warning letters or import alerts from such regulatory authorities.

Its facilities have also been subject to 432 inspections and audits by its customers

during this period.

Expand the Geographic Focus, API Portfolio and Scope of Operations

GLS intends to expand the size and scope of its business by diversifying the customer

base in existing markets and increasing market coverage, geographically. It intends

to expand presence in countries/regions that are adopting more stringent regulatory

framework and moving towards becoming well-regulated markets (viz. South Korea,

Taiwan, Russia, Brazil, Mexico, and Saudi Arabia). It also intends to create new

opportunities in RoW markets by using manufacturing in the least developed countries

through local partnerships.

The company expects revenue contribution from newly-commercialised products to increase over the next five years and narrow the proportion of revenue attributable to sales of its existing top products. Additionally, GLS sees the complex API business as a key growth opportunity and intends to leverage its expertise to expand its existing technology platforms to manufacture and grow complex API portfolio in oncology, peptides, and iron compounds. The company intends to pursue acquisition possibilities that will strengthen its market position, improve technical capabilities, add new products to existing or new therapeutic areas, and expand sales, customers, and geographic reach.

Grow CDMO Business

In the last three years, GLS has started working with innovator pharma companies

in CDMO area. In the current portfolio of 120 molecules globally, the company believes

that many molecules offer such opportunities to a new set of customers. Given its

capabilities in process chemistry research, and manufacturing and analytical research

capabilities, the company could attract innovator pharma companies to partner with,

for providing solutions tailored to the needs of innovator and specialty pharma

companies. It seeks to continue to explore opportunities to enhance existing relationships

by undertaking CDM for new molecules across various product segments.

Expand Production Capacities

Currently, the company operates 4 multi-purpose manufacturing facilities with an

aggregate annual total installed capacity of 726.6 KL as of March, 2021. The company

intends to increase API manufacturing capabilities by enhancing existing production

capacities at Ankleshwar facility during the FY22 and Dahej facility during the

FY22 and FY23 by an aggregate annual total installed capacity of 200 KL. The additional

production capacity is expected to help GLS further expand generic API production

and grow oncology product pipeline.

It intends to develop a new manufacturing facility in India from FY22 which is expected to become operational in the Q4FY23. This facility will be a greenfield project with a plan to manufacture both APIs and intermediates and will house several multi-purpose manufacturing blocks with mid-to-high-volume capacity. It will comply with global regulatory standards and will have an aggregate capacity of 800 KL over the next three to four years. The new facility will provide a platform for the growth of CDMO business and add capacity for generic API business. In connection with the capacity expansion, the company also plans to invest in backward integration of key starting materials to become more self-reliant and less dependent on vendors for raw materials.

Industry

Peer comparison

| Particulars (Rs. in Crores) FY21 | Revenue CAGR (FY19 - FY21) | OPM (%) | PAT (%) | RoE (%) | RoCE (%) | EPS | PE (x) |

|---|---|---|---|---|---|---|---|

| Glenmark Life Sciences | 45.83% | 31.35% | 18.65% | 46.71% | 32.69% | 32.61 | 22.08 |

| Divi's Labs | 18.70% | 41.04% | 28.47% | 21.35% | 32.04% | 74.74 | 65.83 |

| Neuland Labs | 18.53% | 15.67% | 8.61% | 10.25% | 12.69% | 62.99 | 32.97 |

| Aarti Drugs | 17.49% | 20.29% | 13.01% | 30.70% | 34.70% | 30.09 | 23.99 |

| Solara Active Pharma Sciences | 7.98% | 23.87% | 13.69% | 13.94% | 16.04% | 61.67 | 28.02 |

Risks

- Customer Concentration – Dependent on a limited number of key customers for a significant portion of revenues. For FY21, its five largest customers accounted for 56% of total revenue and Glenmark Pharma (Parent Company) was largest customer (contributing 41% of the sales as of FY21). It does not have exclusivity arrangements with customers, including key customers.

- Product Concentration - The top ten products accounted for 66% of revenue from the generic API business in FY21. Any unfavourable developments in the sale or use of products in these categories could have an adverse impact on revenues.

- Raw Material Risk – The company sources the raw material from third-party vendors. Significant portion of RM is sourced from China (40%) and India (60%) as of FY21.For FY21, three largest suppliers accounted for 40% of total purchases. Any interruptions in supply of RM, increase in prices, inability to find alternate sources could impact the operations.

- Competition – APIs are inherently commoditised with no significant barrier to entry. It competes with various domestic as well as international players.

Company Description

Incorporated on June, 2011, Glenmark Life Sciences Ltd. (GLS) is a wholly-owned subsidiary of Glenmark Pharmaceuticals Ltd. GLS is the business of developing and manufacturing Active Pharmaceutical Ingredients (APIs) in chronic therapeutic areas, including cardiovascular (CVS), central nervous system (CNS), pain management, and diabetes. It also manufactures and sells APIs for gastro-intestinal disorders, anti-infectives, and other therapeutic areas. Other than APIs, the company is providing contract development and manufacturing operations (CDMO) services to multinational and specialty pharmaceutical companies.

As of March, 2021, GLS had a portfolio of 120 molecules globally and sold APIs in India and exported to countries in Europe, North America, Latin America, Japan, and ROW. As of May, 2021, it had filed 403 DMFs and Certificates of suitability to the monographs of the European Pharmacopoeia across various major markets. As of March, 2021, 16 of the 20 largest generic companies globally were its customers. GLS has a history with many of its key customers, including Glenmark, Teva Pharmaceutical, Torrent Pharma, Aurobindo Pharma, Krka, and another global leaders.

GLS currently operates four multi-purpose manufacturing facilities located at Ankleshwar and Dahej (Gujarat) and Mohol and Kurkumbh (Maharashtra) with an aggregate annual installed capacity of 726.6 KL as of March, 2021. Since 2015, the facilities have been subject to 38 inspections and audits by regulators (USFDA, PMDA, COFEPRIS, Health Canada, MFDS, EDQM, other European regulatory agencies) and the company have not received any warning letters or import alerts from such regulatory authorities. As of May, 2021 GLS owned or co-owned 39 granted patents and had 41 pending patent applications in several countries and six pending provisional applications in India.

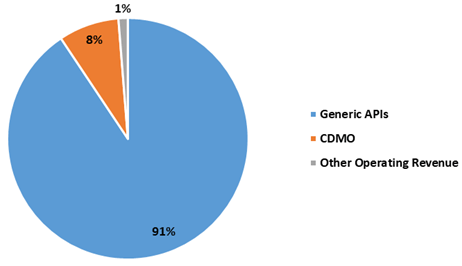

The chart below sets out revenue split of Generic APIs and CDMO for FY21:

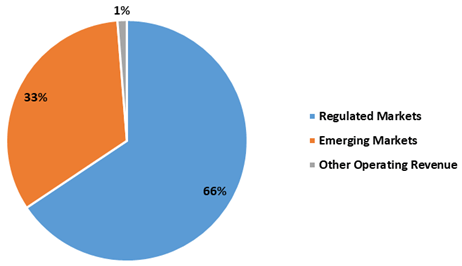

The chart below sets out revenue split from operations for FY21 between regulated markets and emerging markets:

Company’s API product portfolio spans across therapeutic areas including CVS, CNS, pain management, diabetes, and others.

| Product Area | No. of Products | Key Products |

|---|---|---|

| CVS | 21 | Olmesartan, Amiodarone, Telmisartan, Perindopril, Rosuvastatin and Cilostazol. |

| CNS | 27 | Oxcarbazepine, Zonisamide, Topiramate, Bupropion, Ropinirole, Riluzole and Lacosamide. |

| Diabetes | 9 | Glimepiride, Teneligliptin, Vildagliptin and Linagliptin. |

| Pain Management | 2 | Etoricoxib and Lornoxicam |

| Other APIs | - | Atovaquone, Voriconazole, Mirabegron, Desloratadine, Esomeprazole Magnesium, Adapalene and Fluconazole. |

Source: RHP

Details of Revenue from API Business

| Particulars (Rs. in Crores) | FY21 | FY20 | FY19 | |||

|---|---|---|---|---|---|---|

| Revenue | % | Revenue | % | Revenue | % | |

| CVS | 776.32 | 45.44% | 668.16 | 51.64% | 543.85 | 43.07% |

| CNS | 167.72 | 9.82% | 127.98 | 9.89% | 121.95 | 9.66% |

| Diabetes | 61.87 | 3.62% | 57.14 | 4.42% | 79.50 | 6.30% |

| Pain Management | 70.57 | 4.13% | 72.70 | 5.62% | 68.50 | 5.42% |

| Other APIs | 631.94 | 36.99% | 367.88 | 28.43% | 448.93 | 35.55% |

| Total | 1,708.42 | 100.00% | 1,293.86 | 100.00% | 1,262.73 | 100.00% |

Valuation

The company is a leading developer and manufacturer of select, high-value, non-commoditised APIs in chronic therapies and works with 16 of the 20 largest generic companies globally. The company has a clean regulatory track record as there are no warning letters/import alerts received by the company from regulatory authorities till date, ensuring high-quality, which is critical to brand and maintaining long-term relationships. On financial front, the company has performed well with improving operating margins. The company intends to reduce product concentration with planned capex in FY22. The new greenfield manufacturing facility in India which is expected to become operational in the Q4FY23 will provide a platform for the growth of CDMO business and add capacity for generic API business. At the upper price band of Rs. 720, the issue is priced at 22.1x of FY21 earnings. We recommend to Subscribe the issue.

Key Information

Use of Proceeds:

The company will utilise the net proceeds from the fresh issue towards payment of

outstanding purchase consideration to the promoter for the spin-off of the API business,

funding capital expenditure requirements, and general corporate purposes.

Book running lead managers:

Kotak Mahindra Capital Company Limited, BofA Securities India Limited, Goldman Sachs

(India) Securities Private Limited, DAM Capital Advisors Limited, BOB Capital Markets

Limited, and SBI Capital Markets Limited.

Management:

Glenn Saldanha (Chairman and non-executive director), Yasir Rawjee (MD and CEO),

Bhavesh Pujara (Senior VP and CFO), Vinod Naik (Group VP and head of the technical

operation), and Palle V R Acharyulu (Group VP of the R&D department)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Year End March (Rs. in Crores) | 2019 | 2020 | 2021 |

|---|---|---|---|

| Net Sales | 886.42 | 1537.31 | 1885.17 |

| Growth % | 73.43% | 22.63% | |

| Expenditure | |||

| Material Cost | 331.97 | 690.46 | 905.50 |

| Employee Cost | 106.28 | 142.28 | 149.13 |

| Other Expenses | 200.99 | 232.62 | 239.46 |

| EBITDA | 247.18 | 471.96 | 591.07 |

| EBITDA Margin | 27.88% | 30.70% | 31.35% |

| Depreciation & Amortization | 19.26 | 29.37 | 33.39 |

| EBIT | 227.91 | 442.59 | 557.68 |

| EBIT Margin % | 25.71% | 28.79% | 29.58% |

| Other Income | 0.99 | 11.99 | 0.81 |

| Interest & Finance Charges | 0.61 | 33.52 | 87.55 |

| Profit Before Tax - Before Exceptional | 228.30 | 421.07 | 470.94 |

| Profit Before Tax | 228.30 | 421.07 | 470.94 |

| Tax Expense | 32.71 | 107.97 | 119.36 |

| Effective Tax rate | 14.33% | 25.64% | 25.35% |

| Exceptional Items | - | - | - |

| Net Profit | 195.59 | 313.10 | 351.58 |

| Net Profit Margin | 22.07% | 20.37% | 18.65% |

| Consolidated Net Profit | 195.59 | 313.10 | 351.58 |

| Net Profit Margin after MI | 22.07% | 20.37% | 18.65% |